The impact of natural disasters on insurance rates in 2024

Homeowners across the U.S. are left footing the bill for damage caused by natural disasters, which are reaching unprecedented levels of financial toll. The NOAA National Centers for Environmental Information (NCEI) recorded 28 separate billion-dollar disasters in 2023, and as of June 2024, there have already been 11. As Americans living along the Gulf of Mexico and the East Coast brace for the most active hurricane season ever predicted, insurance companies are making sweeping changes to policy coverage and premiums. It is more important now than ever to understand how your home insurance covers natural disasters and what steps to take to cover the gaps.

Key takeaways

- The main natural disasters impacting the cost of homeowners insurance are tropical cyclones, wildfires, tornadoes, flooding, earthquakes and severe storms.

- Experts predict that the frequency of extreme weather will cause home insurance costs to continue to rise in 2024 and in future years.

- Typically, standard homeowners insurance policies exclude damage from earthquakes, floods, mudflows, landslides and tsunamis.

- Population growth in severe weather-prone areas and a lack of adequate building codes increase the cost of natural disasters.

2024 Natural disaster-related data and statistics

The average cost of homeowners insurance in the U.S. is $2,230 per year for $300,000 in dwelling coverage as of June 2024. Home insurance premiums vary across the nation and one of the most substantial rating factors determining the cost of insurance is location. Homeowners in high-risk areas may pay more than homeowners in areas at a lower risk from natural disasters, even within the same state. However, other factors impact insurance rates, such as the age and condition of your home, so what you pay could vary dramatically from the average in your area.

The chart below highlights the average cost of home insurance in several states prone to natural disasters, as well as the average cost of home insurance in high-risk cities within those states.

| State | Average annual premium | City at high risk of disaster loss | Average annual premium | Potential natural disaster |

|---|---|---|---|---|

| California | $1,453 | Lake Arrowhead | $1,910 | Earthquakes, wildfires and flooding |

| Florida | $5,533 | Miami | $10,473 | Hurricanes and flooding |

| Georgia | $1,945 | Atlanta | $1,884 | Hurricanes and flooding |

| Illinois | $2,189 | Chicago | $2,702 | Severe storms and flooding |

| Louisiana | $4,274 | Metairie | $6,031 | Hurricanes, tornadoes and flooding |

| Mississippi | $2,820 | Gulfport | $5,433 | Severe storms and hurricanes |

| North Carolina | $2,495 | Greenville | $2,759 | Severe storms, hail and tornadoes |

| Oklahoma | $4,700 | Oklahoma City | $5,476 | Tornadoes, wildfires, ice storms and flooding |

| Pennsylvania | $1,149 | Philadelphia | $1,662 | Severe storms, tornadoes and flooding |

| Tennessee | $2,410 | Arlington | $2,880 | Severe storms and tornadoes |

| Texas | $3,726 | Houston | $4,973 | Fires, tornadoes, flooding and hurricanes |

*Premiums shown are for $300,000 in dwelling coverage.

Billion-dollar disasters

The NCEI divided the most significant natural disasters into 10 categories in its Billion-Dollar Weather and Climate Disasters report. Since 1980, there have been 387 disasters across the nation costing more than $1 billion each. In fact, there isn’t one state that has not been impacted by a billion-dollar weather event. Surprisingly, Hawaii has only had two, and this includes the Lahaina wildfires of 2023. Alaska follows Hawaii as having the next-lowest number of billion-dollar disasters, with eight, and Missouri has 11.

The chart below highlights four of the most common natural disasters in the U.S., which encompass losses from hurricanes and tornadoes. Tropical cyclones, which produce strong winds and heavy rainfall, occur the most often and cause the most damage.

| Event type | Total number of events | Total cost | Average cost per year | Average deaths per year |

|---|---|---|---|---|

| Flood | 44 | $200.2B | $4.6B | 17 |

| Severe storm | 186 | $463.2B | $10.5B | 48 |

| Tropical cyclone | 62 | $1,411.2B | $32.1B | 157 |

| Wildfire | 22 | $145.7B | $3.3B | 12 |

*Source: NCEI

*Costs are CPI-adjusted

Droughts: the forgotten natural disaster

With extreme heat becoming more common, droughts are happening more often and lasting longer. For instance, residents in Fallon, Nevada, have experienced several prolonged drought events amounting to an average duration of 184.5 weeks. Data from the National Integrated Drought Information System showed that in early June 2024, 36.9 percent of the U.S. was experiencing a moderate drought while 8.1 percent of the country was battling droughts categorized as exceptional — the highest drought rating reserved for water emergencies and widespread crop and pasture losses.

It is important for homeowners to consider the effects of extreme heat and droughts, as they can be very damaging to homes and are not covered by homeowners insurance.

Droughts cause the earth beneath your home to dry out and shrink, leading to potential issues with your foundation. An uneven foundation can lead to foundation cracks and leaks, cracks in your interior or exterior walls, misalignment of doors and windows and more — all of which can add up to costly repairs. However, damage resulting from the natural shrinking, expanding and settling of soil is typically excluded from homeowners insurance.

How natural disasters impact your home insurance rate

When homeowners buy insurance, it is a way to transfer the risk of financial loss to an insurance company instead of retaining the risk of loss themselves. In turn, insurance companies share this risk by purchasing reinsurance — insurance for insurance companies. When a catastrophic loss occurs, insurance companies file a claim with reinsurers to cover excess loss without fear of insolvency or impact on long-term profitability. So, if insurance companies have insurance, how do natural disasters impact your home insurance rates?

With climate change increasing the frequency and severity of catastrophic losses, reinsurance companies have drastically increased the rate they charge to insurance companies, which gets passed back down to policyholders. Since insurance is a shared risk pool, you are sharing in the claims and profitability of your insurance company, good or bad. When an insurance company has to pay out for natural disasters in one area, it can impact the insurance rate of all of its policyholders, especially those in states likely to experience more catastrophic losses in the future.

As hurricanes become stronger, the severity and frequency of claims may increase, resulting in higher claim payouts. As a result of these factors, insurance companies are taking steps to mitigate their risk and reduce their exposure by increasing insurance rates and refusing to insure certain homes.— Tasha Carter | Florida’s Insurance Consumer Advocate

Price surge: Catastrophic disasters drive up rebuilding costs

When a catastrophic disaster occurs, it creates a financial ripple effect that impacts the cost of transportation, housing, materials and labor for homeowners and anyone living in the surrounding area. Often, local materials and resources get wiped out by a disaster, so building materials, contractors and other builders are transported to the site. The diversion of people and resources creates a drought of builders and materials in locations not directly impacted by the disaster. The rules of supply and demand kick in, causing steep price hikes for shelter and goods and services, resulting in higher repair and rebuild costs for everyone — not just those with sustained damage.

Does homeowners insurance cover natural disasters?

A homeowners insurance policy provides coverage for specific perils or events. Depending on your state, insurance provider and type of policy, coverage options and deductibles will vary, sometimes greatly. Commonly covered perils related to natural disasters are:

- Fire and smoke: From electrical fires inside your walls to cooking mishaps, insurance will cover most fires. Fires intentionally started are excluded. Homes in areas prone to wildfires may require a separate endorsement and/or have a stand-alone deductible, or have wildfire coverage excluded from the policy.

- Windstorm and hail: Wind or hail damage from tornadoes, derechos, gales and hurricanes are some of the wind events covered by most policies. Homes in areas with frequent tornadoes and hurricanes may have a separate wind and hail deductible, require an additional endorsement, or be excluded from the policy.

- Lightning: Lightning strikes can cause physical damage to your home, electrical surges to your appliances, and fires; all are usually covered by your standard home policy.

- Weight of ice, snow or sleet: Blizzards and snowstorms with high winds can cause snow to accumulate rapidly on the rooftop of your home and other structures. Damage from the weight load is typically covered.

- Volcanic eruption: Volcanoes are not a common concern for most homeowners. However, homes in an area with potentially active volcanoes may have coverage from ash, dust, lava flow, fire and explosions resulting from volcanic eruptions.

Most types of home insurance policies exclude damage from earthquakes, floods, mudflows, landslides and tsunamis. Insurers may also exclude or limit coverage in areas prone to wildfires and high winds (hurricanes and tornadoes). Here are a few key things to understand about home insurance and natural disasters:

- Natural disaster insurance is not a singular type of insurance you can purchase. Instead, it is a term used to describe a collection of insurance coverage on a home policy that provides coverage for natural disasters.

- The terms peril and hazard often need clarification. A peril is an insurance term for something that poses a risk of loss, while a hazard increases the risk of loss. For example, a covered peril in homeowners insurance is fire. Wildfires are natural hazards since they increase the risk of loss from a fire.

How to insure excluded natural disasters

Usually, homes are one of the most significant financial investments people make. Owners living in high-risk areas can still protect their assets by purchasing endorsements to amend their policies or find stand-alone coverage for most perils caused by natural disasters. If adding an earthquake endorsement to an existing policy is not an option, for instance, many insurance companies offer separate earthquake insurance. California homeowners may also find coverage through the California Earthquake Authority (CEA).

Flood insurance is typically purchased separately through a private provider or the National Flood Insurance Program (NFIP). Homeowners needing wind or wildfire coverage may be able to add it through an endorsement or purchase windstorm insurance or wildfire insurance through a state program. Check with your agent to verify that your homeowners policy has the right type of coverage for disasters inherent to the climate in your area.

Drastic rating and policy changes in response to extreme weather

The frequency and expense of natural disasters have caused insurance companies to reevaluate how they underwrite and rate extreme weather. In 2023, the National Association of Insurance Commissioners released its Climate Risk Disclosure Survey results. Several major carriers stated that changes in extreme weather are causing them to increase rates, raise deductibles, exclude some perils from coverage and change their risk modeling. We are just starting to see some of these changes take place.

Bankrate’s proprietary data shows that several home insurers recently changed to a multi-peril rating structure to more accurately capture the risk associated with different perils. In many cases, this change in rating decreased rates for some policyholders but skyrocketed rates for others.

Another example of drastic change is State Farms’ recent decision to reverse the nonrenewals of about 30,000 home policies in California. Instead, these policies will be renewed with the caveat of wildfire coverage now being excluded. Homeowners will need to secure wildfire coverage through the California FAIR Plan.

As extreme weather evolves, homeowners may continue to see changes to their coverage.

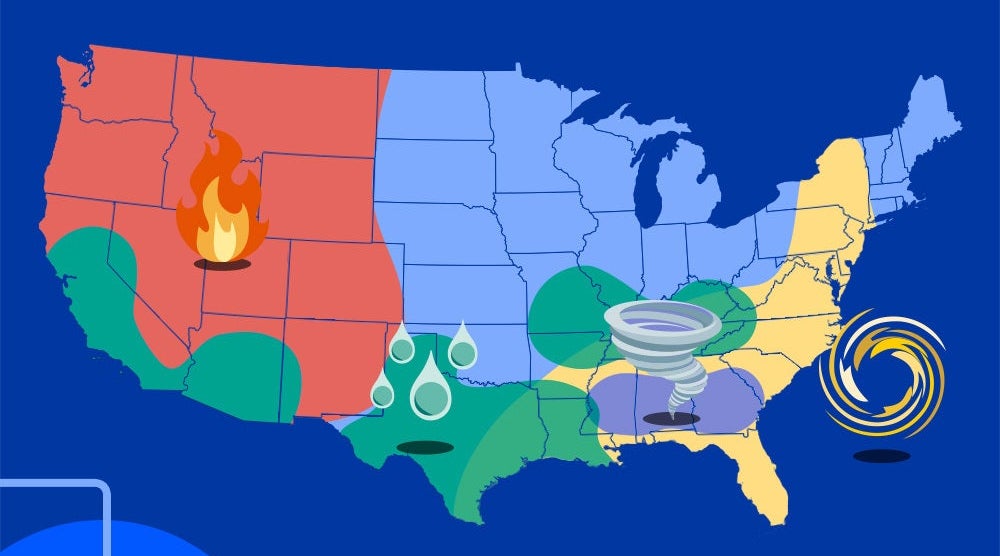

Highest-risk areas for natural disasters

Looking at any natural disaster map will show you that natural disasters can touch any part of the U.S. Extreme weather occurs year-round in one form or another. According to the National Weather Service, winter weather events usually occur between October 15 and April 15. When winter transitions into spring, the fire season starts due to dryer foliage and warmer weather. Fire season lasts from May to August, but depending on the region and preceding winter weather, it can begin as early as February and is at its peak in late summer. Spring and summer months bring tornado and hurricane season, with tornadoes most likely to occur between May and July and hurricanes with flooding from June through the end of November.

Earthquakes and tsunamis are the least predictable of natural disasters. Earthquakes and tsunamis do not have a typical season and both can occur at any time of the year. The United States Geological Survey notes that by examining earthquake record-keeping dating back to 1900, we can expect to have about 16 earthquakes a year. Earthquakes that last longer than 20 seconds are most likely to cause a tsunami. The map below shows which regions in the U.S. are considered at high risk for natural disasters.

States that are most impacted by flood costs

A study published by Nature Climate Change indicates that climate change is increasing the risk of flooding, with population growth being a driving factor. The northeast may see increased flooding and Texas and Florida could experience a 50 percent increase in flood exposure by 2050. The top five states that currently experience the most flooding are:

- Florida

- Texas

- Louisiana

- New Jersey

- California

Flood and wind coverage are the two most sought-after coverage types in hurricane-prone areas. Most homeowners find flood insurance policies through the NFIP, and they may also need windstorm insurance if wind damage is excluded from their standard home coverage. Known as “insurance of last resort,” state-funded insurers such as Louisiana Citizens Property Insurance Corporation and Texas Windstorm Insurance Association provide wind damage coverage — but typically at rates much higher than what is available for homeowners in less-risky areas through the private market.

States that are most impacted by wildfire damage costs

Wildfires can quickly spread from remote forest locations into more populated areas. Humans cause about 85 percent of these devastating wildfires through intentional and unintentional acts. Fire is a common peril covered by homeowners insurance; however, owners who live in wildfire zones may need to purchase a separate policy for wildfire coverage. The top five states that currently experience the most loss from wildfire are:

- California

- Texas

- Colorado

- Arizona

- Idaho

“We need individual homeowners and residents to take actions to keep their homes fire safe so that you have every chance to escape injury or death when a fire occurs”, says Dr. Lori Moore-Merrell, U.S. Fire Administrator. “In communities built near forested areas or in previously forested areas, to minimize the chance of home ignitions, fuels around the home can be removed, reduced or relocated. Homes can also be hardened to prevent ignition from airborne embers by taking action to use ignition-resistant roof coverings, vents, windows and fences. Fire is everyone’s fight.”

Frequently asked questions

-

-

FEMA has 18 natural hazards listed in its National Risk Index. Of those hazards, flooding is the most common disaster in the U.S., costing about $5 billion dollars and causing over 100 fatalities per year. Other common disasters are drought, tornadoes, tropical cyclones, hurricanes (which cause heavy flooding), wildfires and earthquakes.

-

Delaware has had the fewest natural disasters on record since 1953. Delaware experiences four distinct seasons, but none too intense — Nor’easters are Delaware’s most common type of extreme weather. Homeowners in Delaware pay $966 per year on average for $300,000 in dwelling coverage, 57 percent less than the national average for the same coverage level.

-

Currently, Florida has the most expensive home insurance in the nation. Homeowners pay an average of $5,533 annually, or $461 monthly, for $300,000 in dwelling coverage. That’s 148 percent higher than the national average. And keep in mind that this doesn’t include the average cost of Florida flood insurance, which is $953 per year through the NFIP.

-

Even after almost 20 years, Hurricane Katrina remains the most expensive natural disaster in U.S. history, according to the NCEI. While the financial toll was high, costing $192.5 billion (adjusted for inflation), the emotional cost was just as heavy. Impacting Louisiana and Mississippi populations the most, there were 1,833 casualties and millions of people displaced for months and years. Post-Katrina, Louisiana has made $14.5 billion worth of upgrades to the Hurricane & Storm Damage Risk Reduction System (HSDRRS), which has successfully shielded New Orleans from severe hurricane damage since then.

-

California, Florida, Texas, Louisiana and parts of New York can be the most challenging states to find home insurance in right now, with California and Florida typically being the toughest. Increased hurricanes and flooding along the Atlantic and Gulf of Mexico coast pose an increased risk of catastrophic loss and have combined with rampant litigation issues to cause insurance companies to severely limit the location and amount of policies offered in Florida. California, meanwhile, has been experiencing unprecedented wildfires, causing several prominent insurers like Allstate, State Farm and most recently, Farmer’s and AIG to stop writing new property policies for home and commercial buildings.

If you’re having difficulty finding home insurance in your state, consider talking with a licensed insurance agent or contacting your state’s Department of Insurance to learn more about alternatives.

-

Methodology

Bankrate utilizes Quadrant Information Services to analyze June 2024 rates for all ZIP codes and carriers in all 50 states and Washington, D.C. Quoted rates are based on married male and female homeowners with a clean claim history, good credit and the following coverage limits:

- Coverage A, Dwelling: $300,000

- Coverage B, Other Structures: $30,000

- Coverage C, Personal Property: $150,000

- Coverage D, Loss of Use: $60,000

- Coverage E, Liability: $500,000

- Coverage F, Medical Payments: $1,000

The homeowners also have a $1,000 deductible, a $500 hail deductible and a 2 percent hurricane deductible (or the next closest deductible amounts that are available) where separate deductibles apply.

These are sample rates and should be used for comparative purposes only. Your quotes will differ.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

Does car insurance cover hurricane damage?

Home insurance ‘crisis’: First Florida, now California — is my state next?

Home insurance isn’t just more expensive, it’s also harder to get in 2025