How to calculate your home equity — and how much you can tap

Key takeaways

- Knowing how to calculate home equity gives homeowners a way to understand their home’s worth — and potentially liquidate it for their needs or wants.

- To calculate your home equity, take your home’s appraised value and subtract your mortgage balance: the difference is essentially your equity stake.

- Equity can be accessed with options like a home equity loan, home equity line of credit or cash-out refinance. Bear in mind that you can’t borrow against all of your equity — lenders require that a certain percentage remain untouched.

Your home equity — the amount of your house that you own outright — can be a valuable resource. You can use your equity to renovate some rooms, pay off credit cards, cover college tuition, start your own business or almost anything else.

Before you can use this source of wealth, though, you need to know how much you have. This figure, along with your loan-to-value (LTV) ratio, determines the likelihood of being approved for a home equity loan or home equity line of credit (HELOC), and how much money you could be eligible for.

Here’s how to calculate the equity in your home and how much of it you can tap. And to what extent you can, and can’t, control the worth of your ownership stake.

Key terms to know when calculating equity

- Home equity

-

Your equity is basically the difference between your home’s value and the amount you owe on your mortgage (and any other loans against the home).

- Loan-to-value ratio (LTV)

-

Your LTV or loan-to-value ratio is the size of your mortgage vis-à-vis your home’s worth. Expressed as a percentage, it’s computed by dividing the principal balance of your mortgage by your home’s appraised value. Lenders consider it when approving you for a mortgage or other financing that uses the home for collateral.

- Combined loan-to-value ratio (CLTV)

-

Lenders calculate your CLTV or combined loan-to-value ratio when you apply for a second mortgage. It represents the total debt against the home: both the original mortgage and the size of the new home equity loan or line of credit.

Calculating home equity is relatively simple math, and if you have accurate figures on hand, all you have to do is plug them into a home equity calculator. But you can determine your level of equity on your own, as well. Here’s how.

How to calculate the equity in your home

Step 1: Estimate your home’s value

Calculating equity starts with identifying the property’s market value. You can find out how much your home is worth using a number of methods.

Online home price estimators are an easy (and free) way to gauge your home’s worth. These popular online tools rely on algorithms and public records to generate estimates. Keep in mind, though, that the results really are estimates, not necessarily the value a lender will assess if you decide to apply for financing.

When you input your address in an online estimator, the dollar amount you’ll get is an estimate of the property’s fair market value, which might not be the same as the home’s appraised value. Home equity lenders rely on a home’s appraised value — based on a professional appraiser’s assessment — to determine your equity level and how much you can borrow. The fair market value of your home simply refers to what a homebuyer would likely pay for the property today, given the current real estate market.

If you don’t want to pay hundreds of dollars for a professional appraisal just yet, using a home price estimator is a good first step in calculating your home’s value, and your equity. But don’t be surprised if the lender’s appraiser comes up with a significantly different sum.

Step 2: Find out what you owe

The next number you’ll need is the outstanding balance on your mortgage, which can be found on your most recent statement. You could also check your lender or servicer’s online dashboard, assuming it has one, or call directly for this information. Be sure to check for any unpaid fees or penalties.

Step 3: Take the difference to determine your equity

Once you have your home’s value and your mortgage balance, you’re almost finished. From here, all you need to figure out how to calculate equity is some simple subtraction. Your home equity equals the current value of your home minus your current mortgage debt.

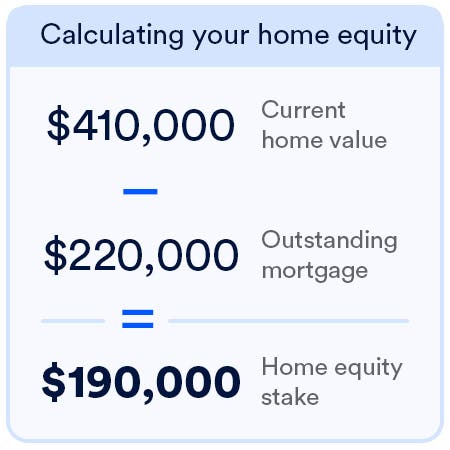

Assume your home’s current value is $410,000, and you have a $220,000 balance remaining on your mortgage. Subtract the $220,000 outstanding balance from the $410,000 value. Your calculation would look like this:

In this case, your home equity would be $190,000 — a 46 percent stake.

How much equity can you borrow?

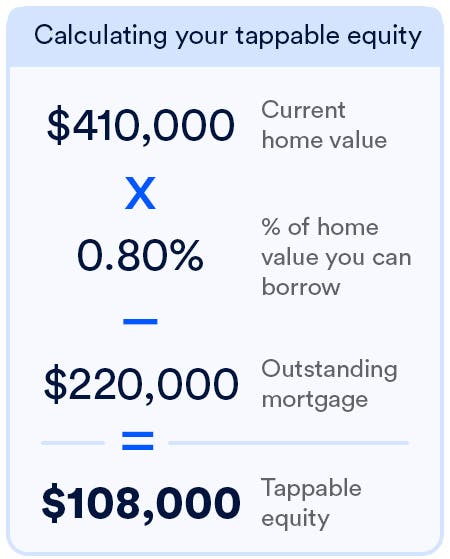

OK, you now know how to determine equity in your home. But the number you’ve arrived at doesn’t equal the sum you can pull out. That’s because you can’t borrow the full amount of your home equity. Many lenders allow you to borrow only up to 80 percent of your home’s value.

Calculating the equity you can access is fairly easy. Using our example above, that’s 0.8 x $410,000, or $328,000. Subtract $220,000 (what you still owe on your mortgage), and you’d have $108,000 of tappable equity.

Calculating LTV and CLTV ratios

Now that you know how to calculate how much home equity you have, you can explore borrowing against it. However, when you approach a lender about this option, they won’t be looking solely at your equity stake.

Specifically, the lender will also look at your LTV ratio, or the size of your loan divided by your home’s value, expressed as a percentage. You can do the math with Bankrate’s LTV calculator. Or, use this equation (we’ll employ the same numbers from our example above):

$220,000 [outstanding mortgage] / $410,000 [home value] = 0.5365, or 53.65%

So far, so good. Unfortunately, with home equity-backed loans or lines of credit, it doesn’t stop there. For this sort of financing, lenders look not just at the LTV, but your combined LTV (CLTV) ratio.

For example, if you wanted a $30,000 home equity loan, your CLTV would come to 60.97 percent (your $220,000 mortgage plus your $30,000 loan divided by your home’s $410,00 value).

The higher the LTV ratio, the more risk for the lender. And the higher an interest rate they’re likely to charge you.

In other words, knowing how to determine equity in a home isn’t enough to determine how much money you can borrow. You also want to look at the CLTV you’d have, using your primary mortgage plus the new loan.

How to access your home equity

Once you know how to calculate equity and how much you can borrow, you’ll need to choose the type of financing. The options include:

- A home equity loan (HE Loan) allows you to borrow a lump sum of money upfront and repay it in equal installments at a fixed interest rate. It could be ideal if you know how much you need and prefer a predictable monthly payment and stable interest rate.

- A HELOC (home equity line of credit) is more flexible. You can borrow up to a set limit during the draw period, which usually lasts 10 years. As with a credit card, you borrow only what you need when you need it.and you are only charged interest, at a variable rate, on what you actually withdraw. Once the draw period ends, your line of credit converts to a loan that’s repayable over a set period, usually up to 20 years.

-

A cash-out refinance lets you replace your existing mortgage with a larger one: You receive the difference between the two balances in a lump-sum payment. You then make monthly payments on this new mortgage, just as you did on your original one, that are amortized over a set number of years.

In terms of interest rates, HE Loans and HELOCs are usually less expensive than personal loans and credit cards. Cash-out refis tend to run a few percentage points lower than home equity loans.

Keep in mind: Home equity loans and HELOCs aren’t free. These loans come with some closing costs, similar to taking out a traditional mortgage. These costs can include fees for loan origination, an appraisal, a credit report and title searches.

How home prices affect your home equity

You can control one piece of the home equity calculation: your mortgage balance. As you make monthly payments, that balance goes down and your equity goes up.

The other big piece of the puzzle in calculating equity falls less squarely into your hands, however. It relates to your local residential real estate scene. When prices for homes in your area rise or fall, it directly impacts your home equity.

Let’s go back to our example above. Say you paid $410,000 for your house when you bought it, but its market value has since increased to $440,000. That’s an additional $30,000 in your home equity stake. Home-value increases accrue to your side of the ledger, not your lender’s, because your mortgage balance is set when you close on your home. It’ll go down as you make payments, of course, but the size of the debt doesn’t fluctuate with changes in property values.

In Q2 2025, mortgage-holding homeowners held an average $213,000 in tappable home equity (how much they can borrow while still maintaining at least a 20 percent stake in their house), according to ICE Mortgage Technology’s August Mortgage Monitor.

The opposite could also be true, though. If selling prices decreased in your neighborhood and your home’s value dropped to $390,000, that would give you $20,000 less in equity.

Fortunately, changes in your local housing market aren’t the only way to move the needle on your home’s value. You can make strategic renovations to make your home worth more.

Just keep in mind that the return on investment there isn’t guaranteed. If you invest $15,000 in improvements but a decline in the local real estate market causes your home to drop by $20,000, for example, it would cancel out any equity gains for you.

Frequently asked questions

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.