What is a homeowners insurance peril and how does it work?

Key takeaways

- Homeowners insurance perils are unpredictable events that cause damage to your property.

- Home insurance typically covers 16 named perils.

- Commonly excluded perils from home insurance policies include earthquakes, floods, sinkholes, certain types of water damage, wear and tear and intentional damage.

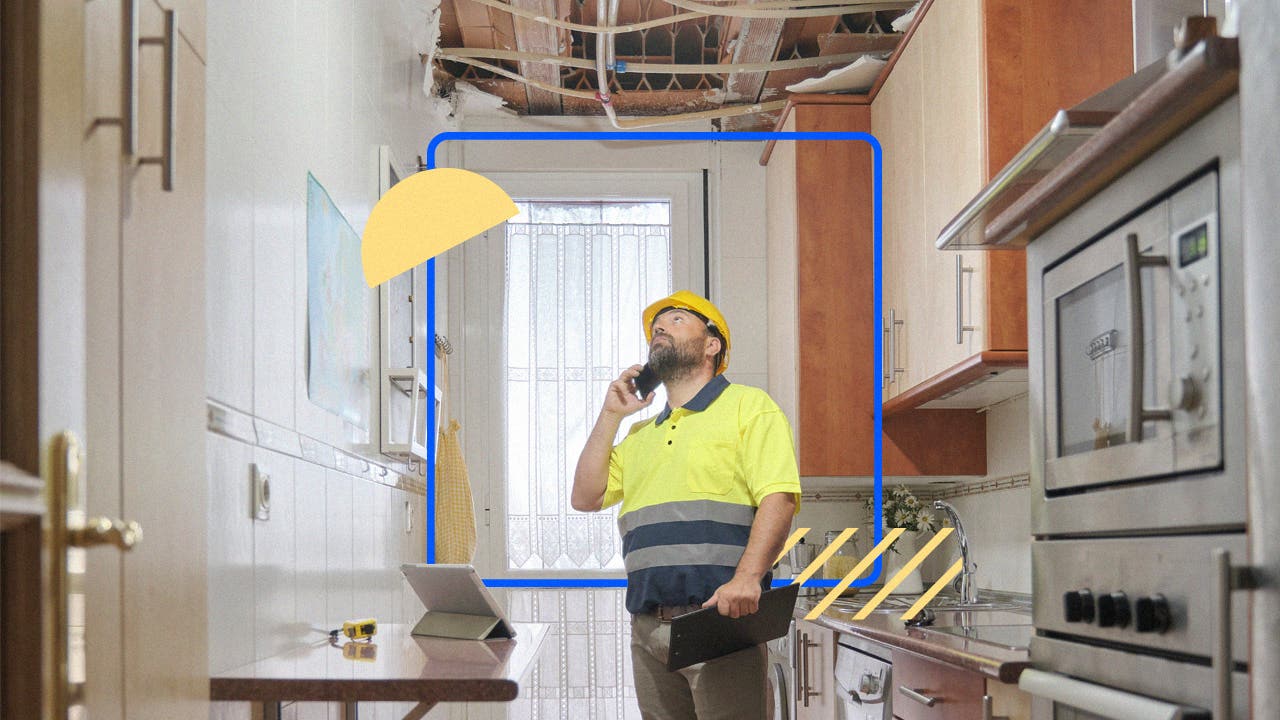

If you’re shopping around for a home insurance policy, you’ve likely encountered the term “peril.” A peril in insurance refers to an unpredictable event that causes damage to your property, like an accidental kitchen fire, a windstorm or a burst pipe. Your home insurance will typically include a list of perils, but exactly what’s covered and when will depend on the type of home insurance policy you have.

Types of home insurance perils

Simply put, home insurance offers financial protection for unforeseen events. In insurance-speak, these unforeseen, damaging events are called perils. If and when a peril occurs and causes damage to your property, you may file a claim with your home insurance provider to help cover the repairs. A standard homeowners insurance policy lists the following 16 events as named policy perils:

- Fire or lightning

- Vandalism or malicious mischief

- Theft

- Riots

- Smoke and ash

- Volcanic eruptions

- Falling objects

- Power surges

- Damage caused by vehicles

- Damage caused by aircraft

- Weight of snow, ice or sleet

- Hail or windstorms

- Explosions

- Tearing or cracking of a hot water, air conditioning or fire sprinkler system

- Freezing of a heating, plumbing, fire sprinkler or air conditioning system or household appliance

- Accidental water overflow or discharge from a heating, plumbing, fire sprinkler or air conditioning system or household appliance

How policy types cover perils

Different types of home insurance policies cover perils in different ways, depending on how coverage is applied. Your home insurance policy type will determine whether or not your dwelling and personal property are covered on a named or open peril basis.

Here’s a brief rundown:

| Type of home insurance policy | How perils are covered |

|---|---|

| HO-2 | Named perils for dwelling coverage and personal property coverage |

| HO-3 (most common) | Open perils for dwelling coverage and named perils for personal property coverage |

| HO-5 | Open perils for dwelling coverage and personal property coverage |

What does named peril mean in home insurance?

A named perils policy covers losses that are specifically listed in the insurance policy paperwork. This means that you, as the policyholder, are responsible for proving to your insurer that a loss should be covered by your policy by demonstrating that a covered peril caused the damage you want your insurance provider to pay for.

Named peril coverage can apply to your dwelling and personal property coverage, depending on what policy form you have. The most common policy form, HO-3 policies, usually cover personal property losses on a named peril basis.

What does open peril mean in home insurance?

Open peril home insurance — also called “all peril” or “all risk” coverage — means that your property insurer covers any peril not specifically excluded in your policy. With these policy types, rather than you having to prove something should be covered, an insurance company has to prove that the loss is not covered. Open peril policies shift the burden of proof to the insurance company.

HO-3 home insurance policies cover your dwelling and other structures on your property under open perils coverage, and HO-5 policies cover both your home and personal property for open perils. However, the phrase “open peril” can be slightly misleading. Open peril policies don’t cover every single type of loss, and there are policy exclusions to be mindful of.

What are some commonly excluded perils?

Even if you have open peril coverage on your homeowners policy, there are some situations and events not covered. To be covered for certain events and circumstances, you may consider a policy endorsement or a separate supplemental policy. Perils typically excluded by standard property insurance include:

- Earthquakes

- Floods

- Sinkholes

- Certain types of water damage

- Wear and tear

- Intentional damage

The policy you choose affects your cost of homeowners insurance since insurers set premiums based on the level of risk they assume. Speaking with your homeowners insurance agent can clarify how your policy would respond to a covered claim, verify whether you are adequately covered and detail how your premium might be affected if you were to increase your coverage.

What are the differences between peril, risk and hazard?

A peril, risk and hazard are all related but have different meanings when speaking about insurance.

- A peril is the actual event that causes damage and loss.

- A risk is the likelihood of a peril happening.

- A hazard increases the chances of the peril.

Still not sure how to differentiate between these terms? Imagine you have a flood in your basement. The flood itself is the peril. Hazards that can lead to this peril include living in a flood plain or having old pipes. So, having old pipes is a hazard that increases your risk of experiencing a covered peril (flooded basement).

Who is most affected by a home insurance peril?

If you are a homeowner, you will likely be the one most affected by a home insurance peril. After all, you are the one living on the property each day, and a sudden fire or break-in can disrupt you and your family’s daily lives.

Financially, your mortgage lender might also be indirectly impacted by home insurance perils. Unrepaired damage to the structure may impact the property’s market value. For instance, if a windstorm blows through town and rips off a significant amount of roof shingles, a home’s curb appeal and value could take a hit.

Not all kinds of home insurance perils affect all homeowners. Hurricanes mostly occur on the Southeast and East Coasts, while wildfires are a common peril in Western and Southwestern states. Understanding the common perils in your area can help you choose appropriate coverage options. It’s also helpful to know how to read your home insurance policy. That way, you will be able to identify any coverage gaps and purchase additional coverage as needed.

Frequently asked questions

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

What disasters does home insurance cover?

Mortgage insurance vs. homeowners insurance: What’s the difference?

Does homeowners insurance cover fire damage?

What does homeowners insurance cover?