Does homeowners insurance cover snow damage?

Key takeaways

- Snow and ice are covered by home insurance in some instances, like if your roof collapses or a tree falls on your home.

- When it comes to roof leaks, it will depend on scenario specifics. Some snow-related roof leaks will be covered, while others may be considered a flood and therefore excluded from your policy.

- Getting a roof inspection, insulating pipes, clearing gutters and trimming your trees can all help stop a snow-related home insurance claim before it happens.

Home insurance covers a limited amount of snow damage. If your roof collapses due to snow and ice buildup, you can typically file a claim with your insurance company. However, damage that occurs over time usually won’t be covered. Home insurance is also unlikely to pay to remove an ice dam; but if the dam creates a roof leak, your policy may help. Here’s what to know about home insurance and snow damage.

When snow damage is covered by homeowners insurance

Snow damage can come in all shapes and sizes, but homeowners insurance can help cover repair costs in some instances. Below are examples of the damage that snow can cause and how a standard homeowners insurance policy usually covers them:

- Roof collapse: Snow and ice buildup can get heavy quickly. If it triggers a roof collapse, that damage will likely be covered by your home insurance policy.

- Damage from ice dams: When snow melts on your roof, it can create an ice dam, which prevents water from running off. If your roof begins leaking because of the ice dam, your home insurance policy may help repair your roof. However, if your personal property is damaged by the leak, your home insurance policy may not cover that.

- Broken tree branches and falling trees: Falling objects like trees, branches and limbs are typically covered by your home insurance policy. However, if the tree is dead or multiple limbs were hanging over your roof before the damage occurred, your claim could be denied.

- Structural damage: Intense snow and hailstorms can break windows, tear shutters and cause other damage to your home’s physical structure. Those repairs would likely be covered under the Coverage A part of your policy, also known as dwelling coverage.

- Frozen pipes: Winter weather and high winds can bring frigid temperatures and frozen pipes. Home insurance covers sudden and accidental water damage, like the result of a burst pipe. However, your insurance company is only likely to approve the claim if your home is kept at a reasonable temperature. Failure to heat your home could be seen as homeowner negligence and result in a denied claim.

When snow damage is not covered by homeowners insurance

Water damage is something of a gray area with home insurance. Importantly, home insurance does not provide financial protection against flooding — and exactly what constitutes a flood can be more complex than you’d think. For instance, in 2024, a Massachusetts court ruled that “standing waters” on roofs, ones that accumulate from heavy rain and snow melt, are not floods. Thus, that damage is covered by your home insurance policy.

However, this may not be the case in every state since home insurance is regulated at the state level, not federally. It’s up to each state to determine which losses are covered and which are excluded. This is why wind is excluded in some Texas counties and why Florida homeowners can choose to opt out of wind insurance.

Speaking with a licensed insurance agent can give you more insight into how your state views snow- and water-related losses. If you’re worried about damage caused by flooding, you may want to consider a flood insurance policy.

Across the board, home insurance won’t cover snow-related damage like:

- Ice dam removal: If an ice dam harms your roof, your home insurance policy might cover some of the resulting damage and offer limited coverage for the removal process. However, if you just want an ice dam cleared off your roof, your policy is unlikely to pay for it.

- Snow removal: Similarly, if you just want your roof cleared, you won’t be able to file a claim for snow removal.

- Homeowner negligence: As a homeowner, it’s on you to stay on top of your home’s maintenance. If your insurance company views any damage as preventable — meaning, it wouldn’t have happened to a well-maintained home — your claim will likely be denied.

Mold is often viewed as a maintenance issue and typically isn’t covered by your policy. However, if the mold sprouted as a result of something covered by your insurance policy, you may have some coverage. For instance, if your roof buckles under the weight of snow and ice buildup, the melt and runoff could get into your attic. In that case, the resulting mold damage could be covered by your home insurance policy. Like water damage, mold can be tricky — if you’re not sure, give your insurance agent a call.

How to prevent snow damage to your home

The best way to avoid filing a snow-related home insurance claim is to prevent the damage in the first place. This is especially true now, when extreme weather has become more destructive — and more than 1 in 4 homeowners say they are unprepared for the potential costs associated with extreme weather, according to Bankrate’s Extreme Weather Survey.

Here’s how you can get your home winter-ready and hopefully avoid snow damage:

| Get your roof inspected | A roof inspection can spot problem areas before they turn into massive leaks. |

| Insulate pipes | This is especially helpful in areas of your home that don’t get heat or are exterior-facing. |

| Keep your gutters clear | Clean gutters can help snow melt off easier and prevent ice dams. |

| Trim your trees | Tree branches can quickly become weighed down by snow and ice. To prevent branches from snapping and causing damage, keep them trimmed back — particularly the ones that hang over your roof. |

| Consider heated cables or snow guards | Heated cables can melt snow before it piles up and becomes an ice dam, and snow guards can help the melted runoff drain safely. |

Learn more: 12 steps to prepare your home for winter

Frequently asked questions

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

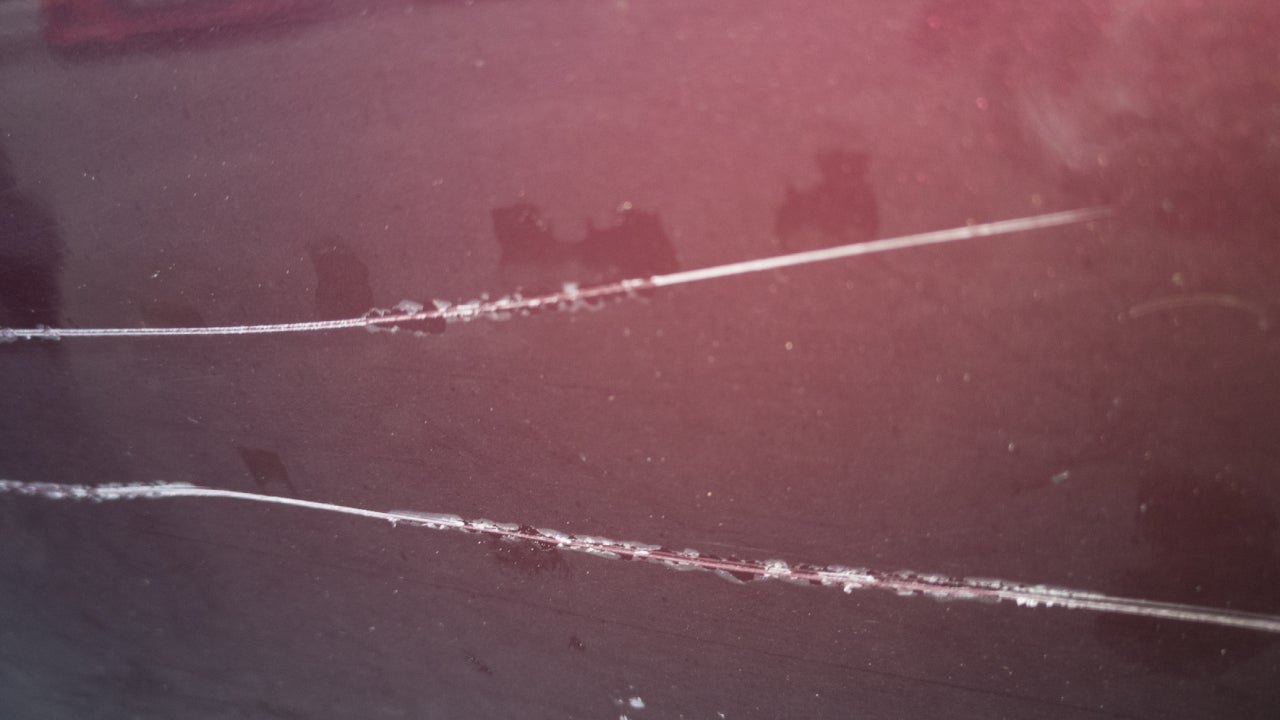

Does car insurance cover keyed cars?

Does homeowners insurance cover septic tanks?

What is contents insurance in homeowners coverage?

Does homeowners insurance cover water damage?