Chase Ultimate Rewards guide

Key takeaways

- The Chase Ultimate Rewards program is one of the most valuable and flexible credit card rewards programs available.

- You can earn Chase Ultimate Rewards points by spending on an eligible Chase card, spending in Chase’s shopping portal or referring a friend to a Chase credit card.

- You can redeem points in a variety of ways, including for statement credits, cash back, gift cards, travel and more.

- Certain Chase cards help increase the value of your points by allowing 1:1 point transfers to high-value travel partners or by providing you with 25 to 50 percent more value when you redeem points through the Chase Travel portal.

Chase Ultimate Rewards is arguably the most popular and flexible travel rewards program on the planet, and it’s easy to see why. Rewards credit cards that operate within this program let you rack up points for cash back, statement credits, gift cards or travel. You may even be able to turn your Chase Ultimate Rewards points into other rewards currencies using the 1:1 point transfer option, although this option depends on the card you have.

If you’re in the market for a new rewards credit card and you’re curious how a flexible card might work in your favor, you’re in the right place. Keep reading to find out how Ultimate Rewards points work, how you can earn them and the best ways to redeem these rewards for superior value.

What are Chase Ultimate Rewards points?

Ultimate Rewards points are a rewards currency you earn by using any eligible Chase credit card for purchases. The amount of points you earn depends on the type of card you have and the rewards structure for that card.

For instance, some Chase cards offer more points on travel spending, dining, grocery spending and more. Other cards from the issuer offer additional rewards based on rotating bonus categories, which change from quarter to quarter.

Although there are plenty of opportunities to earn points in the Ultimate Rewards ecosystem, cardholders are typically most excited about the variety of redemption options available. These include cash back, statement credits, gift cards, Amazon.com and PayPal purchases and, of course, travel. Travel redemptions are especially attractive with premium travel cards like the Chase Sapphire Reserve®, which can boost your rewards’ value by 50 percent in certain cases.

This guide will help you understand what the Ultimate Rewards program entails and how to get the most out of it.

What are Chase Ultimate Rewards points worth?

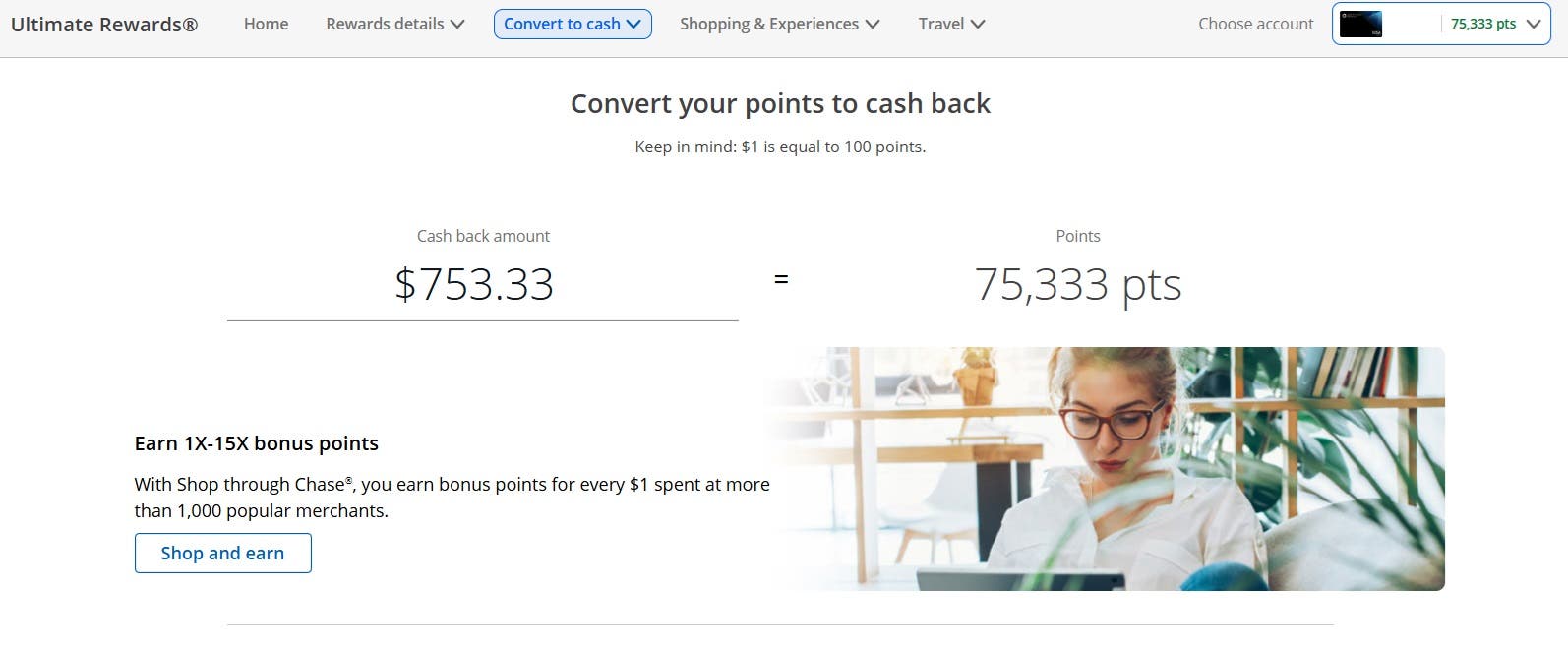

Generally speaking, Chase Ultimate Rewards points are worth 1 cent each when redeemed for gift cards, cash or statement credits.

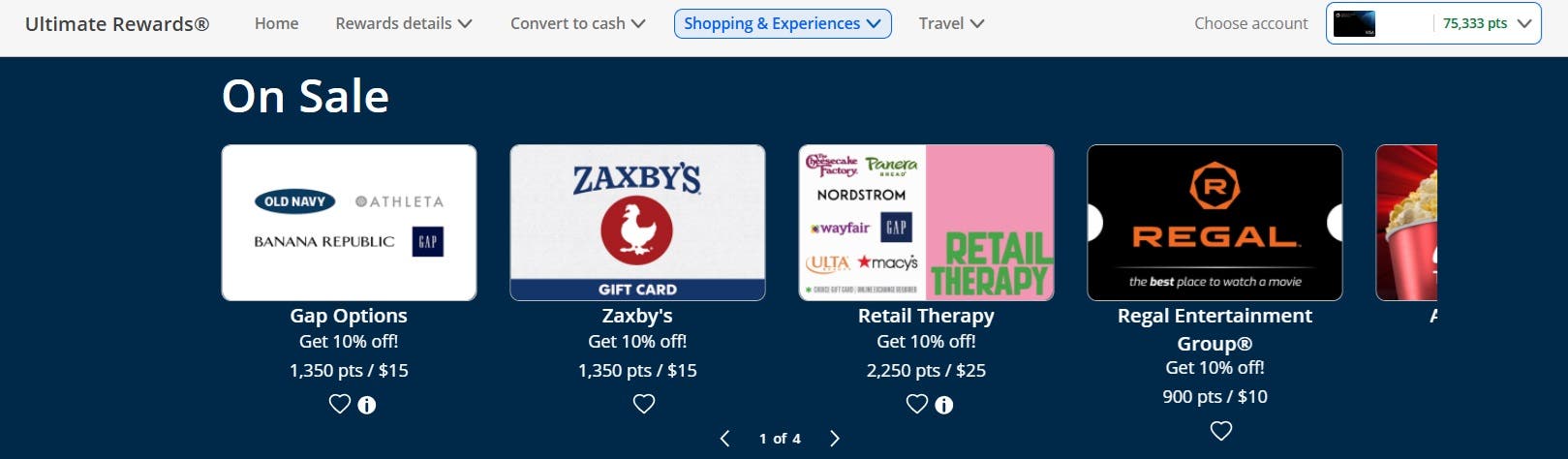

Getting 1 cent per point for cash back or statement credits is a good deal and better than some other rewards credit cards offer, particularly when it comes to travel credit cards. You may also find some ways to get more value for these options, including redemptions for rewards during ongoing gift card “sales” through the Chase Ultimate Rewards portal.

Note that gift cards on sale are typically available for 10 percent fewer points than normal, meaning you could get a $10 gift card for 900 points or a $25 gift card for 2,250 points. These sales change often, so you can check back to see what’s available over time.

There are also some redemption options that can help you get significantly more value for your rewards when using points for travel. For example, the Chase Sapphire Preferred® Card offers 25 percent more value for your points when you redeem them for travel through the Chase Travel portal, and the Chase Sapphire Reserve gives you 50 percent more value with this option. In this case, 100,000 points are worth $1,250 and $1,500 toward travel, respectively.

Also, transferring points to Chase airline and hotel partners gives you another opportunity to get more than 1 cent per point in value. Currently, Chase Ultimate Rewards points are worth around 2.0 cents when redeemed for premium travel redemptions, according to Bankrate’s points and miles valuations. In the end, your true point value will depend on how you redeem your rewards after you transfer them to another program.

How to earn Chase Ultimate Rewards points

Fortunately, there are plenty of ways you can not only earn Ultimate Rewards points but also maximize those earnings with some strategic spending. Here are some ways to optimize your rewards:

Spend on an eligible Chase credit card

The simplest way to earn Ultimate Rewards points is by spending money on your eligible Chase credit card. Make sure you understand the rewards structure of your particular card, and be especially careful to use it for categories where you’ll earn the most.

For instance, you could use your Chase Sapphire Preferred for online grocery shopping to earn 3X points and the Chase Freedom Unlimited® to earn 3X points on drugstore purchases.

Sign up for the Chase trifecta

A credit card trifecta is a card-combining strategy that can help you earn more rewards. The Chase trifecta typically includes a premium consumer travel card, like the Sapphire Preferred, as well as the rotating categories card Chase Freedom Flex®* and the entry-level rewards card Chase Freedom Unlimited®. In some cases, you can swap out one of these cards for a comparable business card.

With this card combination, you could use the Freedom Unlimited for most purchases and transfer your rewards to the Sapphire Preferred to take advantage of any redemption bonuses. Additionally, you could use the Flex card to earn boosted rewards in quarterly rotating categories.

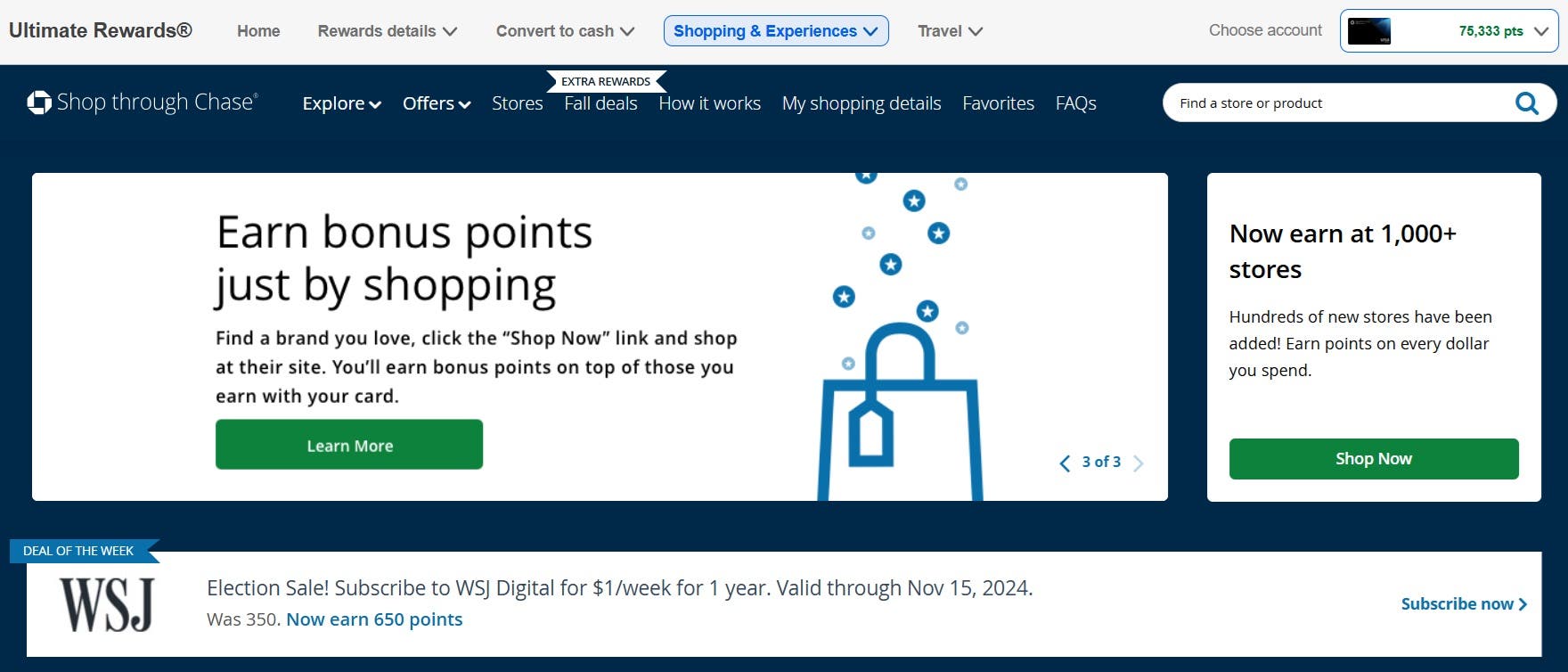

Use Shop through Chase

If you frequently shop online, you should check the Shop through Chase portal for additional opportunities to earn Ultimate Rewards points. Shop through Chase is accessible by logging in to your Chase credit card account and visiting the Ultimate Rewards portal.

Once there, you’ll see plenty of deals with well-known brands and retailers, along with the opportunity to earn additional points per dollar spent. Select a special offer, and you’ll be taken to the retailer’s website, where you can make your purchases and earn your rewards.

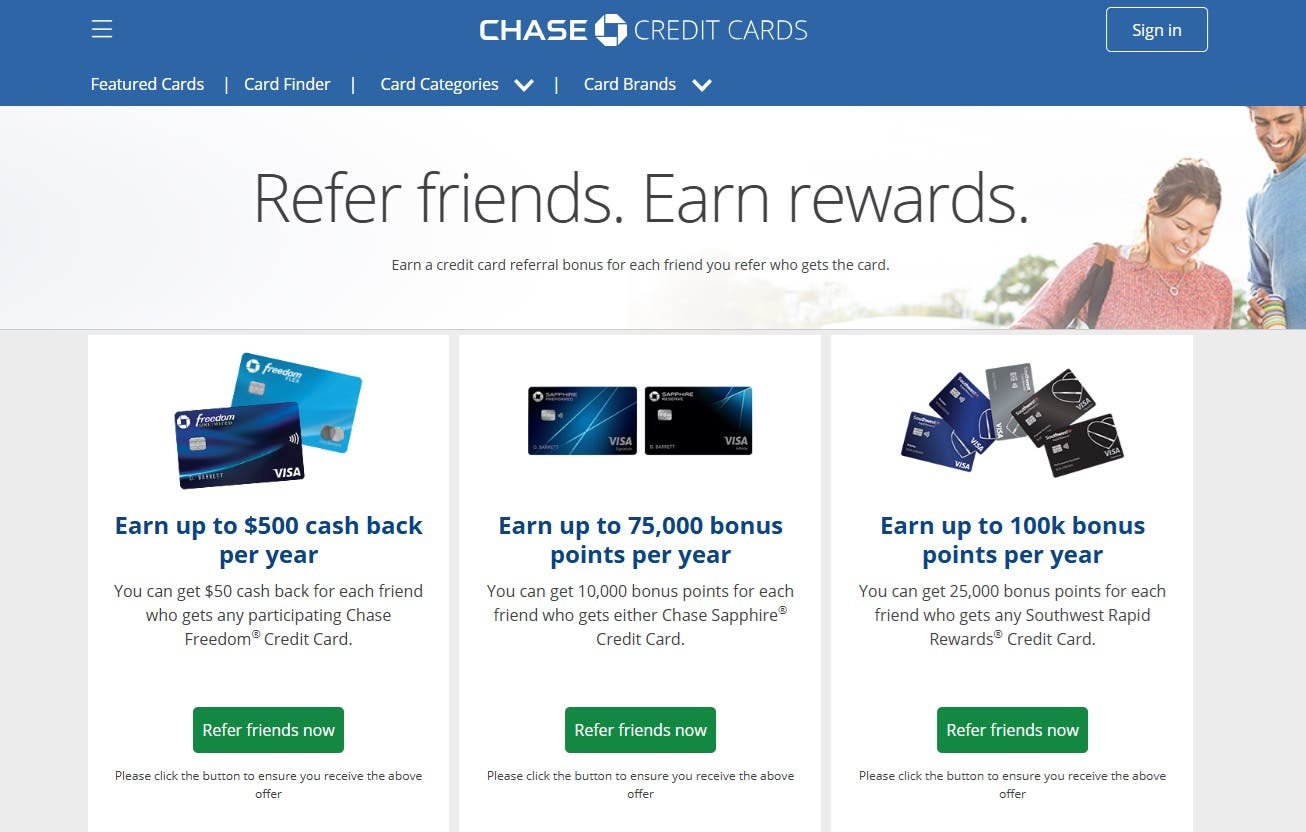

Refer-a-Friend

Chase offers bonuses for friends that use your referral link or code to open a credit card with Chase. These bonuses vary by card, but in many cases, they are doled out in the form of Ultimate Rewards points.

How to redeem Chase Ultimate Rewards points

To redeem your Ultimate Rewards points, log in to your Chase credit card account and access the Ultimate Rewards portal. From there, use the menu to select how you’d like to use your points. Here’s a rundown of your redemption options:

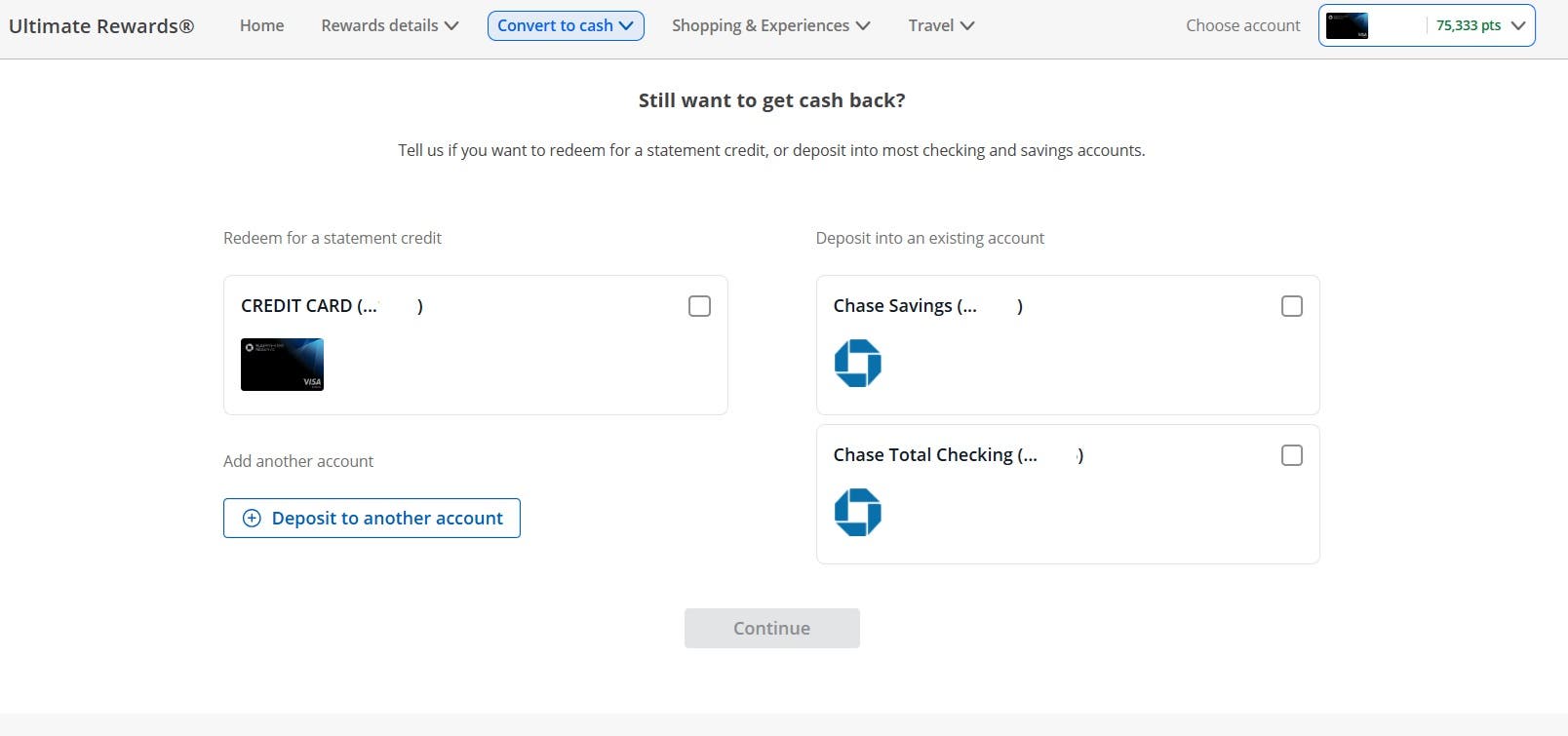

Gift cards, statement credits or cash back

You’ll be able to redeem your points for statement credits or cash back with a value of 1 cent per point. You can also have your rewards transferred to an eligible Chase checking or savings account connected to your credit card account.

Gift card options are also available, generally at 1 cent per point in value. As we mentioned already, Chase sometimes offers special deals on gift cards that can net you more than 1 cent per point in value as we mentioned already — although these offers frequently change.

Amazon and PayPal purchases

You can also redeem rewards for purchases through Amazon.com and PayPal, although you’ll only get .8 cents per point in value when you do. This means 100 points redeemed are only worth 80 cents, and that 1,000 points are worth $8.

In this case, you’ll be much better off redeeming for cash back or statement credits at 1 cent per point and using the funds for purchases on these platforms.

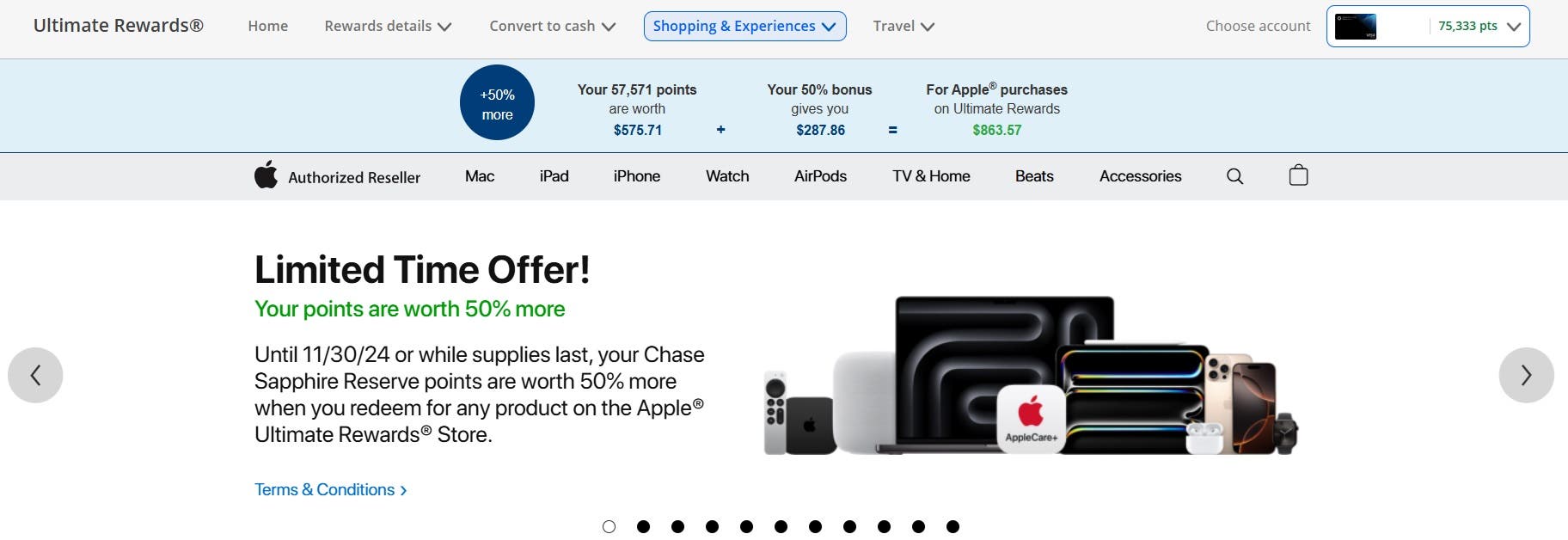

Shop Apple

Redeeming your points for purchases made through Shop Apple can help you save money on big-ticket items and pricey electronics. If you’re in the market for a smartphone or new computer, this could be a good option.

Chase sometimes offers special promotions on merchandise as well, including better redemptions for Apple merchandise based on the card you have.

Travel through the Chase portal

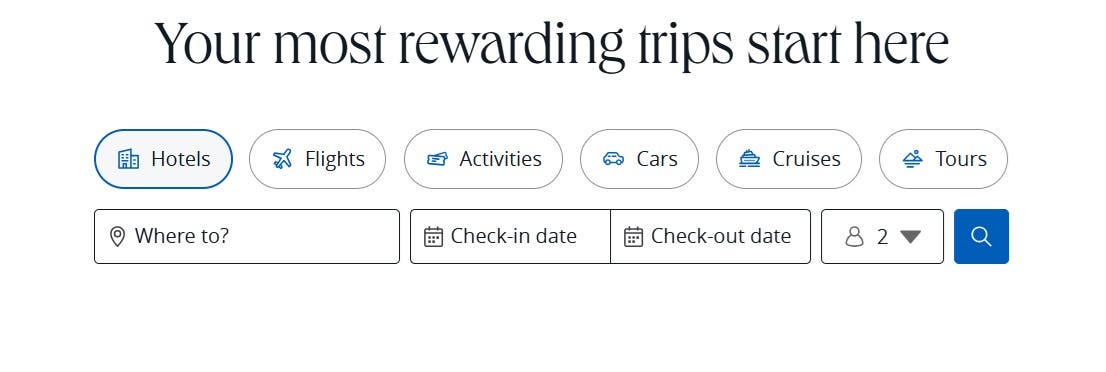

In addition to redeeming for gift cards, merchandise and statement credits or cash back, all Chase Ultimate Rewards-earning cards let you use points to book travel through the Chase Travel portal.

If you want to redeem your points for travel, you can search for available flights, hotels, rental cars, experiences and more through the Chase Travel portal.

Choose your destination and dates to get a list of options, as well as how many points each option requires. If you don’t have enough points, you can make up the difference in cash.

Keep in mind: Sapphire Preferred and Reserve cardholder points are worth 25 percent and 50 percent more, respectively, when redeemed for travel through the portal.

Chase Dining and Experiences

Sapphire-branded Chase cards also let you redeem your rewards for Chase Dining and Experiences options. These redemptions allow you to use points for curated dining experiences, tickets to live events (like concerts and sporting events), home meal kits and more. Redemption values vary, and options frequently change.

Chase Ultimate Rewards partners

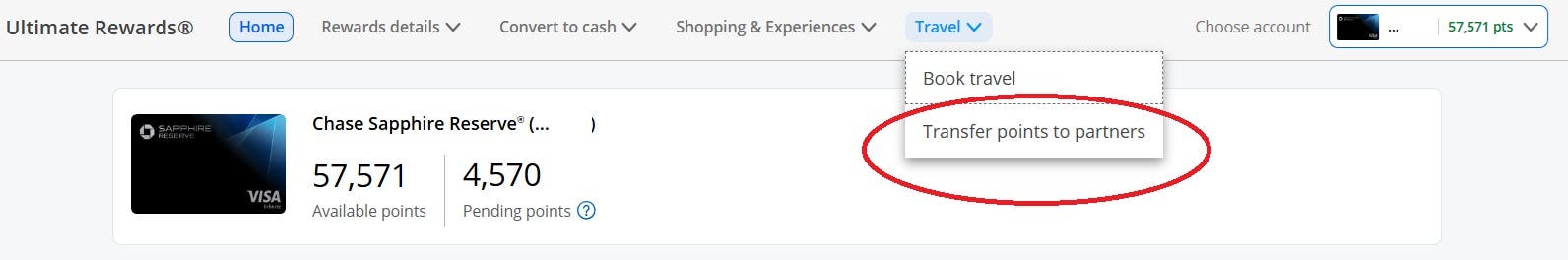

If you have the Sapphire Reserve, Preferred or Ink Business Preferred® Credit Card, you’ll see the option to “transfer to travel partners.”

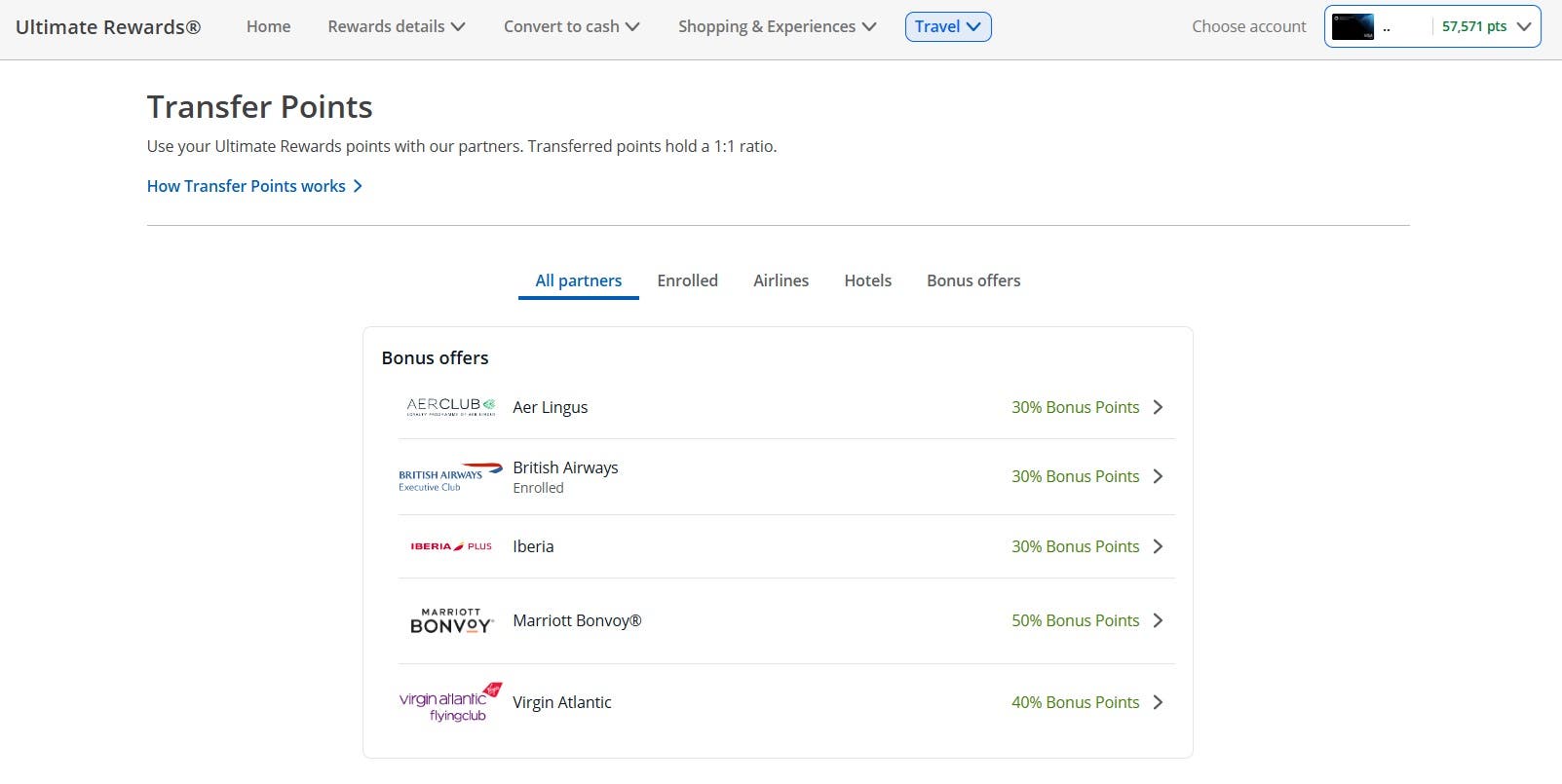

All Chase transfer partners let you transfer points at least at a 1:1 ratio and, in some cases, a little more. This option is likely to net you the best possible value for your rewards.

How to transfer Chase Ultimate Rewards points

If you’d like to transfer your Chase Ultimate Rewards points to hotels or airlines, log in to your Chase credit card account and access the Chase Travel portal. The menu gives you the option to transfer points to travel partners, and from there, you can select your preferred airline or hotel, link your Chase account to your qualifying partner loyalty account and then transfer your points. Points typically transfer at a 1:1 value, so if you’re turning your points into airline miles, 1 point will equal 1 mile.

As noted, however, Chase offers some transfer bonuses from time to time, which can help you get more than one point or mile for each point you transfer from Chase to an airline or hotel loyalty account.

Once you decide on a transfer partner, you’ll be required to transfer Chase Ultimate Rewards points in increments of 1,000. This can sometimes mean you have to transfer more points than you actually need, but it’s still mostly a fair way to make point transfers happen. You shouldn’t wind up wasting too many points when you transfer in increments of 1,000, and you can always transfer more points to use toward another redemption later.

Here’s a list of Chase transfer partners to choose from:

Airline partners

- Aer Lingus AerClub

- Air France / KLM Flying Blue

- Air Canada Aeroplan

- British Airways Executive Club

- Emirates Skywards

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Rapid Rewards

- United Airlines MileagePlus

- Virgin Atlantic Flying Club

Hotel partners

- IHG One Rewards

- Marriott Bonvoy

- World of Hyatt

Chase credit cards that earn Ultimate Rewards points

There are plenty of options in the Chase family that allow people to earn Ultimate Rewards points. Here are some we like, along with the reasons we like them:

Ink Business Preferred® Credit Card

The bottom line

Chase Ultimate Rewards points are a valuable rewards currency that offer a wide range of redemption options. Keep in mind, however, your points may be worth more or less depending on which cards you hold and how you choose to redeem your points.

Before simply redeeming your points for cash back, take some time to explore the Chase Travel portal and all of its reward options and benefits. Once you know which options are available based on the card you have, you’ll be better equipped to make informed choices and get the most out of your Chase Ultimate Rewards.

*The information about the Chase Freedom Flex® and Chase Ink Business Preferred® Credit Card has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Frequently asked questions

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like