Chase Sapphire Preferred® Card review: The best travel rewards card for less than $100

Snapshot

4.9

Bottom line

The Chase Sapphire Preferred is an excellent entry point into the world of travel rewards since it offers impressive value, multiple redemption options and premium benefits for a modest $95 annual fee.

BEST STARTER TRAVEL CARD

on Chase's secure site

See Rates & FeesIntro offer

75,000 bonus points

Rewards rate

1x - 5x

Annual fee

$95

Regular APR

19.24% - 27.49% Variable

4.9

Bankrate score

Rewards value

APR

Rewards flexibility

Features

Reward Details

Card Details

Remove a card to add another to compare

Remove a card to add another to compare

The future of rate shopping

We’re building something new to make rate shopping smarter and simpler. Join the waitlist to get early access.

Limited spots available

The future of rate shopping

We’re building something new to make rate shopping smarter and simpler. Join the waitlist to get early access.

Limited spots available

You’re on the list!

You're all set! We'll be in touch soon with personalized options just for you.

Chase Sapphire Preferred® Card overview

The Chase Sapphire Preferred Card is one of the best travel credit cards on the market and a fan favorite among Bankrate staff. It has a relatively low $95 annual fee, a generous rewards program, annual credits and anniversary bonus points. I picked up this card in October 2022, and it’s been my main rewards-earner since.

Although it lacks some of the robust perks found in more premium travel cards, that’s OK with me. I don’t travel enough to need airport lounge access, and many of the credits these cards offer are ones I'd have to really work to use.

Chase Sapphire Preferred video review: Our writer's hot take

Check out how Bankrate credit card expert Ana Staples uses the Chase Sapphire Preferred to book her trips and why she thinks it can be a great "go-to" travel card.

-

Rewards

- 5X points on travel purchased through Chase Travel℠ (excluding hotel purchases that qualify for the $50 annual hotel credit)

- 5X total points on Lyft rides (2X on general travel and 3X-point bonus, offer ends Sept. 30, 2027)

- 5X total points on Peloton equipment and accessory purchases over $150 (maximum of 25,000 total points; offer ends Dec. 31, 2027)

- 3X points on dining (including eligible delivery services), select streaming services and online grocery purchases (excluding Walmart, Target and wholesale clubs)

- 2X points on other travel

- 1X points on other purchases

- Rewards value: 1 cent per point when redeemed through Chase Travel℠ or around 2.0 cents on average through the right transfer partner (based on Bankrate's estimated valuations)

Expert Appraisal: Exceptional

See our expert analysis -

Welcome offer

- Earn 75,000 bonus points after you spend $5,000 on purchases in the first three months from account opening

Expert Appraisal: Good

See our expert analysis -

Rates and fees

- $95 annual fee

- Foreign transaction fee: $0

- No intro APR on purchases or balance transfers

- Regular APR: 19.24% - 27.49% Variable

- Balance transfer fee: 5 percent of the amount each transfer (minimum $5)

- Cash advance fee: 5 percent of the amount each transaction (minimum $10)

- Late/returned payment fee: Up to $40

Expert Appraisal: Typical

See our expert analysis -

Other cardholder perks

- 10 percent anniversary bonus points based on your total purchases the previous year

- Up to $50 in annual statement credits toward hotel stays through the Chase Travel portal

- Comprehensive travel insurance, including trip cancellation/interruption insurance, trip delay reimbursement and baggage delay insurance

- Complimentary, limited-time credits and/or other partner perks with Lyft, DoorDash and Peloton

- Purchase and extended warranty protection

- Potential access to alternative payment plans with a fixed monthly fee

Expert Appraisal: Good

See our expert analysis

Chase Sapphire Preferred pros and cons

Pros

-

You can combine points from other Ultimate Rewards cards to enhance their overall value.

-

This card packs strong redemption value through its transfer partners and statement credits.

-

This card features benefits commonly found on higher-tier travel cards, including an anniversary bonus and robust travel protections.

Cons

-

You can earn higher bonus rates in some everyday categories with other cards.

-

The card comes with a $95 annual fee.

-

This card doesn’t offer introductory APRs on purchases or balance transfers, unlike some no-annual-fee rivals.

First-year value vs. ongoing value

I can’t stress enough how much this card is worth the annual fee.

If you're looking for a new travel card and need a nudge, the Sapphire Preferred card’s welcome offer will definitely sweeten the deal for the first year. But its value can extend into the second year and beyond, assuming you fully utilize the card's perks. Here's how much you can earn if you spend $22,500 annually, with $6,000 of that being spent in the card's 5X categories, 8,000 being spent in the card's 3X categories and $8,500 being spent on miscellaneous purchases.

| Cost & benefits | First-year value | Ongoing value |

| Welcome offer | $750 (75,000 bonus points after spending $5,000 in the first three months, worth 1 cent when redeemed through Chase Travel) | – |

| Yearly rewards | $625 (points worth 1 cent when redeemed through Chase Travel) | $625 (points worth 1 cent when redeemed through Chase Travel) |

| Perks of monetary value |

|

|

| Annual fee | -$95 | -$95 |

| Value | $1,358 | $580 |

Why you might want the Chase Sapphire Preferred

The Sapphire Preferred is hard to beat if you’re looking for a cost-effective travel card. Its travel perks, annual credits and bonus points are impressive for a card in its class and can easily justify the annual fee. Perhaps even more appealing is the diverse selection of bonus categories and redemption options, plus the high travel partner redemption values that can fuel your next trip.

Welcome offer: Solid earnings to kick-start your travels

With the Chase Sapphire Preferred's current welcome offer, new cardholders can earn 75,000 bonus points after spending $5,000 on purchases in the first three months from account opening. According to Bankrate's valuations, those points can be worth around $1,500, based on a value of about 2.0 cents per point on average (when transferred to the right travel partners).

When I got the Sapphire Preferred, I received this standard welcome offer and was able to get plenty out of it — one hotel night in Zurich, Switzerland, a week-long rental car in Poland and three plane tickets in total (one round-trip and two one-way). Could I have waited for a better offer? Maybe, but I really wanted this card for my international trip. However, recent limited-time offers have shown that sometimes waiting can be worth it.

Rewards: Outstanding travel value

The Sapphire Preferred card’s rewards program is a powerhouse, offering impressive rewards rates in more travel-related categories than many competing cards.

When I was looking for my first general travel rewards card, I looked at a few others — mainly from Citi and Capital One — but ultimately settled on the Sapphire Preferred because of its dining and online grocery categories. That’s where I use the card the most. I always pull it out for my Starbucks orders, date nights and weekend lunches to get 3X points.

But where I get the most value in earning rewards is with its online grocery categories — a huge part of my spending. Not only does this include Instacart orders, but also online Kroger, Meijer and Aldi pickup and delivery orders (Walmart, Target and wholesale clubs are excluded). If I don’t have time to hit the grocery store, I can put in a Kroger delivery order and usually have my groceries show up the next day while earning 3X points.

You can also pool points from other Ultimate Rewards and cash back cards, giving the same boost to all your Chase cards. Chase features an impressive list of 1:1 airline and hotel transfer partners, raising the value from 1 cent through the Chase Travel portal to about 2.0 cents per point on average with a high-value transfer partner, according to our most recent valuation. Only a few cards — including the Sapphire Preferred, Chase Sapphire Preferred® Card, and Ink Business Preferred® Credit Card — give you the ability to transfer your points in this way.

More opportunities to earn

You can earn points in a few clever ways if you don’t mind a little legwork. There’s a 10,000-point referral bonus if any friends you refer to the card are approved (up to ten referrals per year), which could be an easy way to earn up to 100,000 more points. Plus, the Chase Offers card-linked program could earn you an extra helping of rewards with various merchants across all categories.

Perks: High-caliber benefits for its card tier

In addition to its stand-out rewards, the Sapphire Preferred’s benefits include perks that provide excellent value for its annual fee. For example, its stellar travel insurance matches the coverage offered by premium travel cards with higher annual fees.

But the most valuable perks are its recurring bonuses.

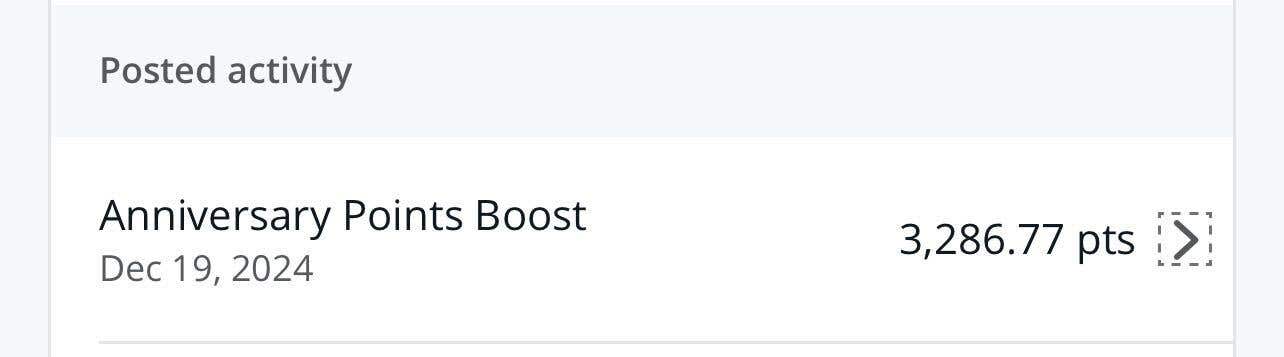

You’ll get up to $50 in statement credits each year for hotel stays you purchase through Chase Travel. You’ll also get a 10 percent anniversary point bonus. For example, I spent around $32,000 on my card in 2024, earning me an extra 3,286 points.

Image provided by Courtney Mihocik; individual anniversary point bonuses will vary.

Why you might want a different travel card

The Sapphire Preferred is an excellent travel rewards card, but it may not be right for you if you’re wary of annual fees or looking for a balance transfer offer.

Rates and fees: Annual fee may discourage newcomers

The Sapphire Preferred has a $95 annual fee, which may appear intimidating if you only travel occasionally and are looking for your first travel card. However, this price tag is low compared to the perks and rewards the card offers. Before picking up the Sapphire Preferred, I already held a co-branded airline card with a $99 annual fee, so it was easier for me to stomach $95 — especially when I considered the card's point values and perks.

The annual account anniversary bonus points and credits can potentially offset the annual fee alone, but the fee also isn’t too difficult to offset through your standard rewards spending. Keep in mind that this level of rewards and perks value can be difficult to find among no-annual-fee travel cards. No-annual-fee competitors also typically have lower rewards rates than the Preferred card and no yearly credits or notable travel perks.

The card's other rates and fees are typical for travel cards — there are no foreign transaction fees to worry about while you’re abroad, and the ongoing APR is only slightly higher than the average current credit card interest rate.

Why Bankrate staff love the Chase Sapphire Preferred

The Chase Sapphire Preferred is a favorite among Bankrate staff. Here’s why:

Bankrate staff insights

Best cards to pair with the Chase Sapphire Preferred

The Chase trifecta is your best pairing option because of the cards’ complementary rewards categories and the ability to pool your earned rewards into one account.

Just keep Chase’s 5/24 rule in mind as you search for cards to pair with the Sapphire Preferred: You may not be eligible to open a Chase credit card if you’ve already opened five or more credit cards (no matter the issuer) in the past 24 months.

Alternative picks

If you’re looking for a travel card that goes beyond mid-tier perks, consider one of these luxury cards: