Merchant category codes: How to earn more cash back

Key takeaways

- While credit card issuers use merchant category codes (MCCs) to classify businesses, you may be able to leverage them to maximize your card’s rewards.

- Knowing the MCCs of stores you frequent can help you find which stores will reward you the most for your purchases.

- Retailers can have different MCCs than others in the same chain — a potential “loophole” to earning points or miles on purchases that typically don’t earn many rewards.

Digging into the inner workings of your credit card rewards might sound intimidating, but the extra elbow grease is worth it. For instance, exploring your card terms will reveal that you earn cash back at certain locations based on the business’s merchant category code — or MCC.

This hidden knowledge can help you understand what makes your rewards program tick. It can also be the deciding factor between choosing a cash back credit card that you know you’ll be able to maximize or not. Read on to learn the ins and outs of MCCs — and how you can use this knowledge to earn maximum rewards with your rewards credit card.

What is a merchant category code?

Merchant category codes are four-digit numbers that credit card networks — like Visa, Mastercard, American Express and Discover — use to classify businesses in order to track consumer spending. They collect this information to protect you from fraud, assign rewards and gather marketing data to fine-tune their products.

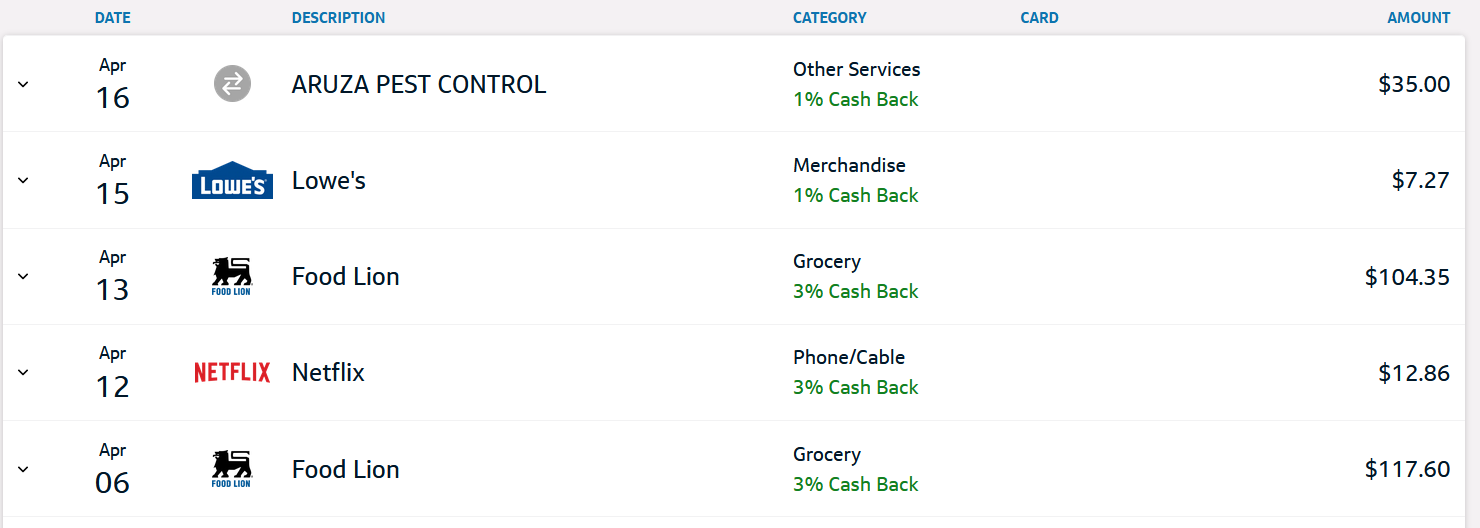

Here’s how you may see these categories appear in your credit card account:

On the flip side, you can also use this information to your benefit by performing a simple MCC code lookup. By analyzing your network’s merchant category code list prior to shopping, you can determine how to earn the most rewards according to your card’s bonus categories.

Keep in mind: Each network has its own specific merchant category code list and definitions for which purchases or retailers qualify. For example, Discover’s MCCs are slightly different than the MCC codes for Visa.

How to find a merchant category code

Now that you know what an MCC code is, let’s talk about how to spot them. Finding a business’s merchant category code can be tricky depending on your network, but here are the two major ones:

However, American Express and Discover don’t make their code lists publicly available. In that case, your card issuer may provide a list of its network’s MCCs either online or by request.

If you don’t have a store’s exact MCC, it might take some trial and error to nail down which stores near you offer the best rewards. Try using your card to make a small purchase at the store you want to shop, then check your next statement to see how much you earned in rewards. This can help you determine how your credit card will code purchases from that store before you commit to spending a lot of money that won’t be coded to qualify for your card’s bonus categories.

Why didn’t I earn rewards on a purchase at a certain store?

Not earning elevated rewards on a purchase that you thought qualified in a bonus category typically boils down to one of two things:

- Your rewards card’s bonus category definition

- Your network’s MCC classification

Some credit cards offer broader definitions for their bonus categories. For instance, the Chase Freedom Flex®* occasionally offers online shopping rewards at specific retailers — such as Amazon.com, Walmart and PayPal purchases — based on its quarterly cash back calendar. Meanwhile, the Bank of America® Customized Cash Rewards credit card has an in-depth online shopping category that covers a broad array of merchants — from major retailers to specialty merchants like Etsy.com.

Another reason you may have missed out on bonus rewards is that the credit card MCC didn’t correlate with the issuer’s bonus category. For example, standard Walmart locations are typically listed as MCC 5310 — or discount stores — while Walmart Supercenters are usually listed under Visa’s MCC 5411 — grocery stores and supermarkets. Depending on the MCC credit card listing, bonus category descriptions can reduce rewards on these purchases.

These annoying MCC differences develop because the store’s merchant category code is determined by the primary products it sells. Since Walmart doesn’t primarily sell supermarket produce, its MCC reflects that.

Why might a store’s MCC not match its actual business type?

Determining a store’s MCC can be tricky if the store or retailer sells certain items but identifies differently. For example, say you go to a nice movie theater (MCC 7832) that has a restaurant within. You buy dinner and a beverage with your American Express® Gold Card, hoping to earn 4X points on your restaurant purchase. You may be surprised later to read your credit card statement and find that the bonus category didn’t go through — not because you used your card wrong, but because the transaction was processed as a movie theater purchase, rather than a restaurant purchase.

Just because a merchant sells a certain type of product does not inherently mean their merchant code will reflect the same thing. Also, be mindful of businesses undergoing any big changes — they may not have updated their MCCs yet if they’ve recently rebranded.

When reviewing my rewards earnings one month, I was surprised to see that my Audible.com purchases had not earned 5 percent back with my Prime Visa card, even though Audible is an Amazon company. I was only missing out on about $10 in cash back for the year, but I was curious to see why this was the case. I reached out to Chase, which confirmed that Audible purchases did not qualify for bonus points. Though they didn’t explain further, support was thoughtful enough to credit me 65 points as a one-time courtesy, without me even asking.— Nouri Zarrugh, credit cards editor at Bankrate

Earning cash back with merchant category codes

Maximizing your cash back or other rewards begins with knowing the MCCs of the merchants you shop with most frequently. To help you get started, we’ve collected a list of the most common bonus categories and compared them to the Visa and Mastercard merchant category codes. Keep in mind that some merchant brands have their own MCCs, especially when it comes to travel chains.

| Cash back category | Visa MCC | Mastercard MCC |

|---|---|---|

| Groceries/U.S. supermarkets | 5411: Grocery stores and supermarkets | 5411: Grocery stores and supermarkets |

| Wholesale clubs | 5300: Wholesale clubs | 5300: Wholesale clubs |

| Superstores/Big box stores (Walmart, Target, etc.) | 5310: Discount stores | 5310: Discount stores |

| Gas stations |

5541: Service stations (with or without ancillary services) 5542: Automated fuel dispensers |

5541: Service stations (with or without ancillary services) 5542: Automated fuel dispensers |

| Restaurants/dining |

5812: Eating places and restaurants 5813: Drinking places (alcoholic beverages) — bars, taverns, nightclubs, cocktail lounges and discotheques 5814: Fast food restaurants |

5812: Eating places, restaurants 5813: Bars, cocktail lounges, discotheques, nightclubs and taverns — drinking places (alcoholic beverages) 5814: Fast food restaurants |

| Entertainment |

Very broad, but here are a few popular examples: 7832: Motion picture theaters 7922: Ticket agencies and theatrical producers (except motion pictures) 7991: Tourist attractions and exhibits |

Very broad, but here are a few popular examples: 7832: Motion picture theaters 7922: Theatrical producers (except motion pictures), ticket agencies 7991: Tourist attractions and exhibits |

| Department stores | 5311: Department stores | 5311: Department stores |

| Online shopping | 5815 to 5818: Digital goods (including digital media, games, applications and “large digital goods merchants”) | These can vary depending on the merchant, but digital goods range from 5815 to 5818 |

| Drug stores | 5912: Drug stores and pharmacies | 5912: Drug stores and pharmacies |

| Home improvement |

5712: Furniture, home furnishings and equipment stores (except appliances) 5713 to 5714, 5718 to 5719 and 5722: Includes floor covering stores, drapery/upholstery stores, fireplace stores, household appliance stores and miscellaneous home furnishing specialty stores |

5712: Equipment, furniture and home furnishings stores (except appliances) 5713 to 5714, 5718 to 5719 and 5722: Includes floor covering stores, drapery/upholstery stores, fireplace stores, household appliance stores and miscellaneous home furnishing specialty stores |

| Travel |

Very broad, but here are a few popular examples: 3000 to 3308: Individual airline MCCs 4511: Airlines and air carriers (not elsewhere classified) 4582: Airports, flying fields and airport terminals 3351 to 3441: Car rental agencies 3501 to 3839: Lodging — hotels, motels, resorts 7011: Lodging — hotels, motels, resorts and central reservation services (not elsewhere classified) 4111: Local and suburban commuter passenger transportation, including ferries 4121: Taxicabs and limousines 4131: Bus lines 4784: Tolls and bridge fees 4112: Passenger railways 4411: Steamship and cruise lines 4722: Travel agencies and tour operators |

Very broad, but here are a few popular examples: 3000 to 3350: Airlines and air carriers 4511: Air Carriers, airlines (not elsewhere classified) 4582: Airports, airport terminals, flying fields 3351 to 3500: Car rental agencies 3501 to 3999: Lodging — hotels, motels, resorts 7011: Lodging — hotels, motels and resorts (not elsewhere classified) 4111: Transportation — suburban and local commuter passenger, including ferries 4121: Limousines and taxicabs 4131: Bus lines 4784: Bridge and road fees, tolls 4112: Passenger railways 4411: Cruise lines 4722: Travel agencies and tour operators |

Keep in mind: In the end, it is at the discretion of your card issuer which MCCs they will lump into your bonus category. Not all cards with a travel bonus will consider passenger railways, for instance.

How to maximize your rewards with merchant category codes

Now that you have a general understanding of bonus category codes, here are a few strategies to align your spending and maximize your rewards card’s categories:

The bottom line

Sifting through your credit card’s MCC classifications might sound overwhelming, but these valuable specifications can be worth their weight in rewards opportunities.

Once you understand your favorite stores’ MCCs, you can optimize your shopping list for boosted rewards on purchases that normally wouldn’t earn anything more than the base rewards rate. With a little elbow grease and creativity, you’ll be laughing all the way to the bank.

Frequently asked questions about merchant category codes

*Information about the Chase Freedom Flex® has been collected independently by Bankrate. The card details have not been reviewed or approved by the card issuer.

The Bank of America content in this post was last updated on July 24, 2025.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.