How to add an authorized user to your Apple Card

Key takeaways

- Apple Card Family allows up to six people to share an Apple Card account and earn their own rewards on purchases in the form of Apple Daily Cash.

- Adding an authorized user requires a formal application and credit check.

- Co-owners have more control over the account, but are equally responsible for making payments.

If you’re new to credit, becoming an authorized user on someone else’s credit card can give you a jump-start on building a great credit score. And if you’re trying to recover from a previous financial mishap, it could be your first step toward rebuilding a damaged credit history.

On the flip side, primary cardholders who add an authorized user to their account may be able to fast-track their way to a sign-up bonus or accelerate their rewards earnings, courtesy of the authorized user’s additional spending.

Different issuers impose different rules when it comes to authorized users, such as how many you’re allowed to add or how much they can spend. You can have up to 10 authorized users on your Citi® Double Cash Card, for instance, and if you hold an American Express consumer card, you can specify a credit limit for each user, something most credit card companies don’t allow.

And in the case of the Apple Card issued by Goldman Sachs, Apple Card Family lets you share your account with as many as five other people, as well as choose their individual credit limits.

Keep reading to learn more about Apple Card Family and how you can opt in.

What is Apple Card Family?

First released in May 2021, Apple Card Family allows up to six people to share a single Apple Card account, as long as everyone belongs to the same Family Sharing group. According to the company, Apple Card Family is “designed to help the Family Sharing group achieve a healthier financial life by making it easy to track spending, all on iPhone and with a single monthly bill.”

Despite the name, participants and co-owners don’t need to be legally related. They simply have to be part of the Family Sharing group, members of which can also share access to other Apple services, including Apple TV+, Apple Music, iTunes, app purchases and an iCloud storage plan.

How does Apple Card Family work (and how do you get access)?

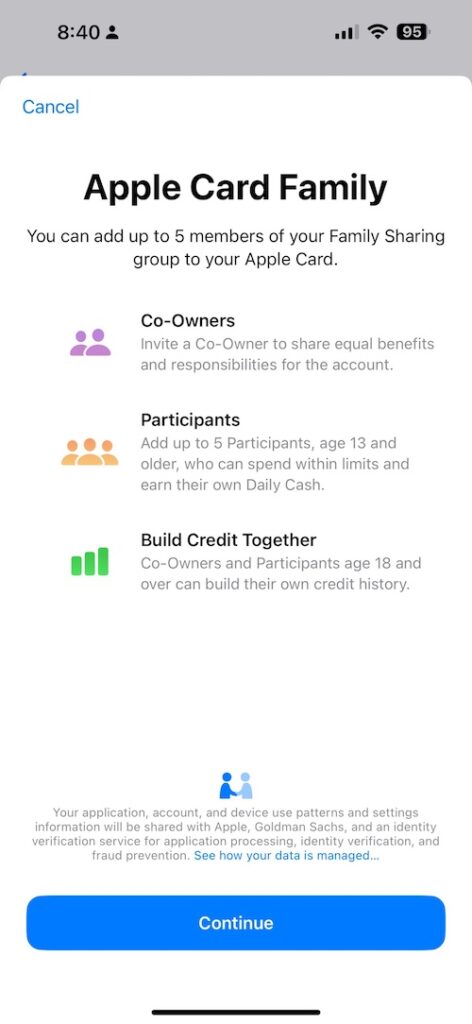

There are two ways Apple Card users can share their account through Apple Card Family:

- Invite up to five people to join the account as a participant, which is similar to an authorized user. Apple Card participants, who must be at least 13 years old, will be able to make purchases but won’t be accountable for paying the bill.

- Designate one person (provided they’re at least 18) as an account co-owner. This lets the original owner and the new co-owner—both of whom will be responsible for keeping the account in good standing—build their credit history together and share the same credit line.

Where Apple Card Family differs from many other authorized-user programs is that everyone on the account, including participants, earns their own unlimited Daily Cash (Apple’s twist on cash back) based on their individual spending. Generally speaking, most issuers only dole out credit card rewards to the primary cardholder.

And two individual cardholders have the option to merge their separate accounts into one joint Apple credit card with a combined credit limit.

How to add an authorized user to your Apple Card

You can add an authorized user to your Apple Card directly in the Wallet app, though the steps differ slightly depending on the device you’re using. Here’s what you need to do:

- On your iPhone, open the Wallet app and locate your Apple Card. (If you’re on an iPad, open the Settings app, tap Wallet & Apple Pay and select your Apple Card.)

- Next, tap the three-dot button in the upper-right corner of your iPhone and select Account Details; iPad users should tap Info.

- Then, tap Add User (on the iPad, tap Share My Card), then tap Continue.

- Select a member of your Family Sharing group if available, or tap Invite People to Family Sharing at the bottom of your screen.

- Tap either Become Co-Owners or Add as Participant, and follow the instructions from there. (You’ll be asked to input either your combined income or a per-transaction spending limit, respectively.)

- Finally, tap Send Invitation and enter your device passcode when prompted.

Your invitee will receive a Wallet notification almost immediately. Invited participants need only tap Accept Apple Card; those who are 18 or older can also supply their Social Security number for credit-reporting purposes, if they choose. Meanwhile, a potential co-owner will have to formally apply for the Apple Card—and undergo a credit check—before they’re able to accept your invitation.

Are there requirements for adding an authorized user to your Apple Card?

The requirements for becoming an Apple Card authorized user are straightforward:

- The primary owner must have an open Apple Card in good standing.

- Participants must be at least 13 years old, while co-owners must be 18 or older and be approved for the Apple Card.

- All prospective authorized users must belong to the same Family Sharing group; if you haven’t already created one, you’ll have to set it up before you can invite anyone to your Apple Card Family.

- Each person must have a compatible iPhone or iPad with the latest version of iOS or iPadOS and the device region set to the United States.

Remember, Apple Card Family caps the number of people on a shared account at six and the number of co-owners at two.

What can an authorized user do on a shared Apple Card?

An authorized user’s card permissions depend on their status as either a participant or co-owner.

Participants

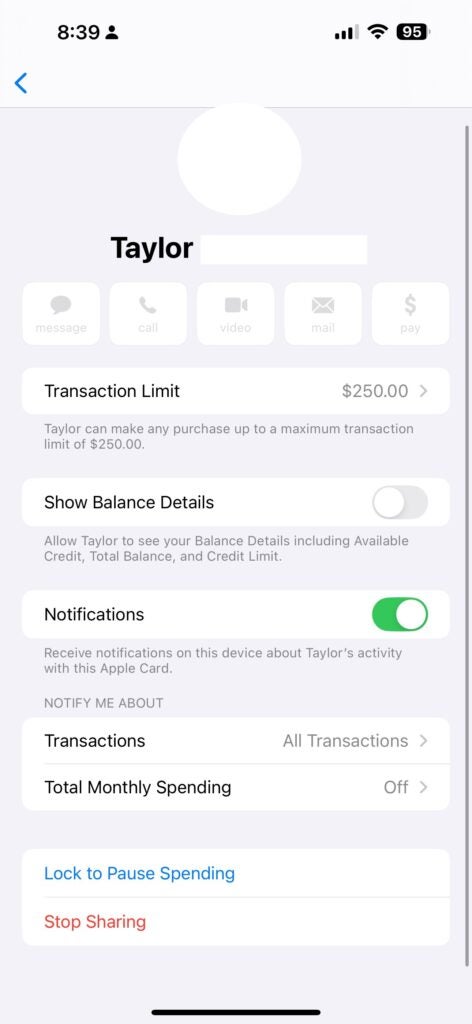

Regardless of their age, Apple Card Family participants aren’t responsible for making payments. They can spend with the card (up to a certain limit designated by a co-owner), as well as earn their own Daily Cash on purchases—which, again, is a rarity among rewards credit cards.

Those 18 and older can choose to have account activity reported to the three credit bureaus in order to establish (or boost) their credit history, while younger participants are meant to use the program to start learning responsible credit habits.

As the primary cardholder, you can set spending limits for participants, monitor their spending, and pause or revoke their access at any time. You can easily manage the details of their account from your Wallet app:

Co-owners

Apple Card Family gives co-owners a lot of control over their account: They can add and remove participants, receive notifications every time they make a purchase, assign spending limits and lock or unlock their cards. They can also request credit-line increases, see every person’s account activity—including their co-owner’s—and even close the card entirely.

Of course, becoming an Apple Card co-owner isn’t without risk: You’re equally responsible for making payments and meeting the terms of the account agreement, which means both of your credit scores may be affected if one of you forgets to pay the bill on time.

The bottom line

As the name suggests (but doesn’t require), Apple Card Family can be a good way for parents to show their kids how to use credit carefully. That said, being willing to take responsibility for everyone’s spending can come back to haunt you if one person runs amok with the card.

Before you extend—or accept—an Apple Card Family invitation, make sure you trust the other members of the group, no matter who they are. You’re putting your own credit score at risk otherwise.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.