Guide to the Marriott Bonvoy rewards program

Key takeaways

- The Marriott Bonvoy program makes it easy to earn points through paid hotel stays, spending on co-branded credit cards and other qualifying activities.

- Program members can use their points for award nights at more than 8,900 properties worldwide and for other types of travel.

- Earning elite status with Marriott Bonvoy helps members enjoy premium perks like welcome gifts and room upgrades.

The Marriott hotel brand was founded in 1927 and has since expanded to become one of the largest hotel chains in the world. You can stay at more than 8,900 Marriott properties in 141 countries and territories globally. Because of the program’s wide reach, your experience with Marriott could include some time at a luxury St. Regis or Ritz-Carlton property or a few simple stays at a Springhill Suites or a Residence Inn.

Marriott also allows frequent hotel guests to earn points for free hotel stays while enjoying elite status benefits through its loyalty program, called Marriott Bonvoy. Here’s everything you need to know about the Marriott Bonvoy program, redeeming Marriott rewards and how to get the most out of your Marriott leisure or business travel.

Marriott Bonvoy rewards program overview

Marriott Bonvoy is the loyalty program for all the available Marriott hotel brands, like Springhill Suites, J.W. Marriott, W Hotels and more. This program is free to join, and becoming a member lets you save on regular hotel rates, earn points for each dollar you spend with Marriott properties and potentially enjoy elite status benefits like room upgrades or free breakfast.

While you’ll get more benefits when you climb the elite status ranks with the Marriott Bonvoy program, you should also know that you’ll get some perks just for joining. For example, all members get complimentary in-room Wi-Fi access, exclusive member rates and mobile check-in services.

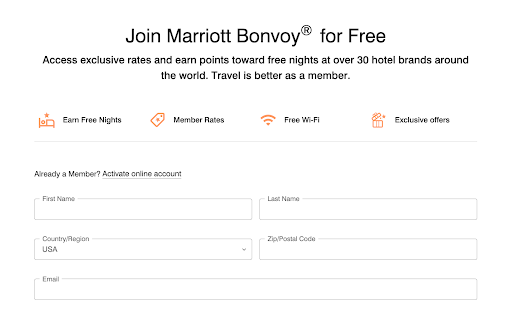

How to sign up for Marriott Bonvoy

Joining the Marriott Bonvoy program is free and easy. Simply go to the Marriott Bonvoy website and follow the prompts to join.

You’ll need to provide basic information like your name, email address, location and password to create your account. At that point, you’ll get a Marriott Bonvoy loyalty number and the option to build out your profile with more personal information.

How to earn Marriott Bonvoy points

There are many ways to earn Marriott Bonvoy points, and not all of them require stays in Marriott hotels. For example, you can also earn points through:

- Spending with a Marriott credit card

- Flying with Marriott airline partners

- Marriott Bonvoy’s Eat Around Town dining program

- Cruise bookings via Cruise with Points

- Car rentals booked through Hertz

- Qualifying Marriott Bonvoy events

While all the additional ways to earn Marriott Bonvoy points can help grow your rewards balance, the best ways to earn Marriott points are through hotel stays and spending on co-branded Marriott credit cards. First, you should know that Marriott Bonvoy members earn a minimum of 10 points per $1 spent at most Marriott Bonvoy properties, and that elite members in the program earn anywhere from 10 percent to 75 percent bonus points.

Marriott Bonvoy credit cards also let users earn points without paying for hotel stays. These points come in the form of welcome bonuses for meeting a minimum spending threshold and points for each dollar in purchases charged to an eligible card.

How to redeem Marriott Bonvoy points

You can use your Marriott Bonvoy points in many ways beyond free hotel nights. For example, you can redeem your points for gift cards, travel (including flights, cruises, car rentals and more) and exclusive Marriott Bonvoy experiences. Alternatively, you can share your points with other Marriott Bonvoy members or donate your points to charity.

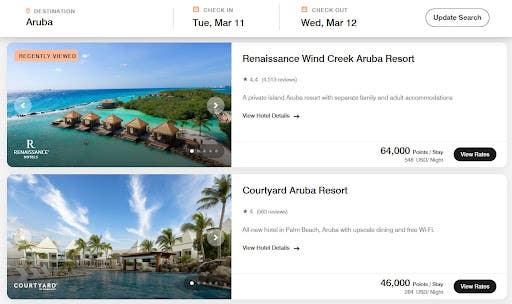

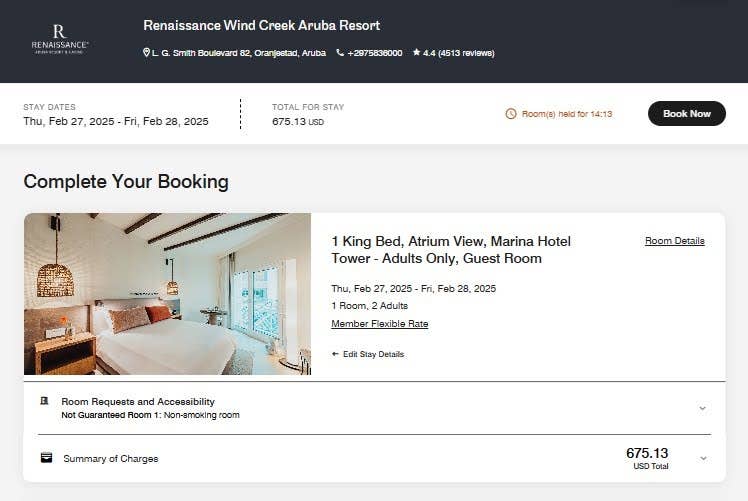

Award nights are always the best way to redeem Marriott Bonvoy points, and you can find some great deals despite the program’s use of dynamic pricing for awards. For example, we found rates for stays at the Renaissance Wind Creek Aruba Resort on the Caribbean island of Aruba for 64,000 points per night or the Courtyard Aruba Resort for 46,000 points per night.

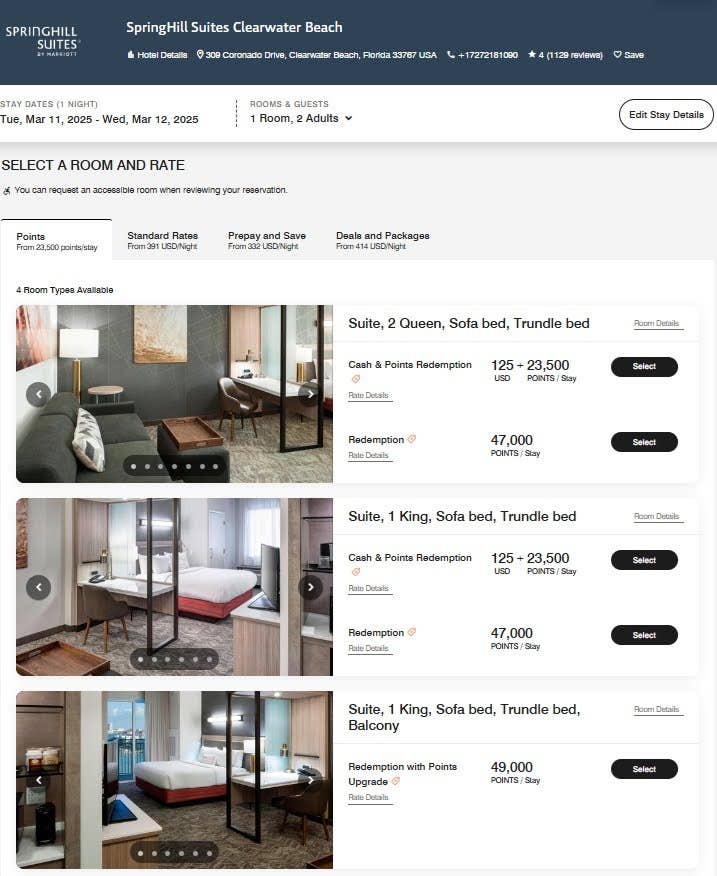

If you don’t have enough points for a redemption, Marriott Bonvoy also allows you to pay with a combination of points and cash at eligible properties. However, not all properties will offer this redemption, at least not on all dates.

If there is an option to use cash and points through Marriott Bonvoy, you can find it by clicking on the hotel you want to stay with after a search. For example, we found cash and point redemption options at the Springhill Suites Clearwater Beach for dates in March 2025. Members who want to pay with rewards and cash could redeem 47,000 points per night or 23,500 points with a $125 cash copay.

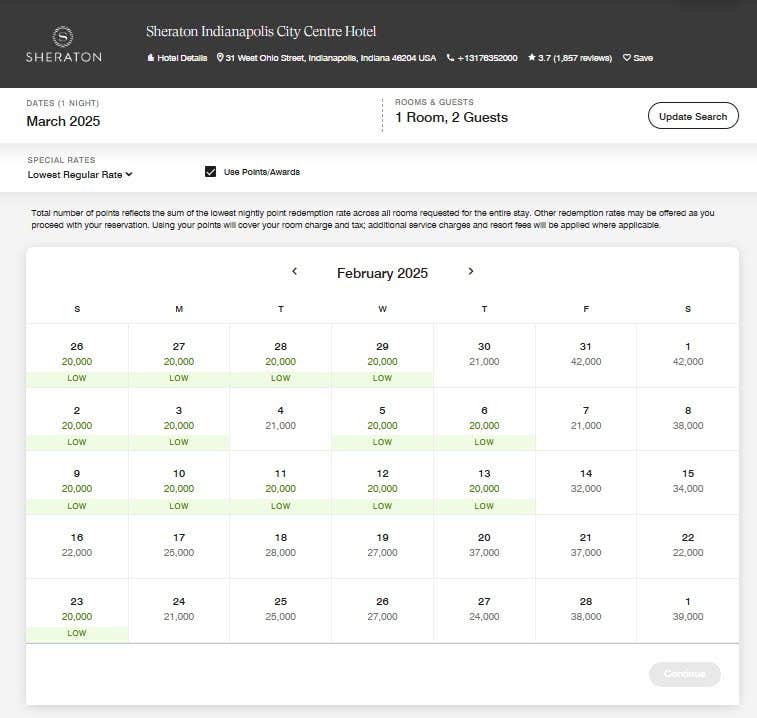

Marriott Bonvoy also offers a PointSavers redemption that lets members book award nights at discounted rates. However, rates and availability for this program vary, and you’ll typically have to travel on off-peak dates to qualify.

You can typically find these offers using “flexible dates” when searching for a destination for award stays. This will bring up a chart that shows you the best dates in any month to book a stay with discounted rates.

Here’s an example of a search we did at the Sheraton Indianapolis City Centre Hotel:

How much are Marriott Bonvoy points worth?

According to our valuations, Marriott Bonvoy points are worth approximately 0.7 cents each. This makes them more valuable than points in several other hotel loyalty programs, although some hotel loyalty points are worth a lot more.

That said, some ways to get more value for your rewards include booking off-peak travel dates to get lower rewards rates and taking advantage of Marriott’s “Stay for 5, Pay for 4” promotion. This promotion lets you book five award nights for the price of four, thus getting 20 percent off a five-night award stay.

If you wanted to book the Renaissance Wind Creek Aruba Resort on the Caribbean island of Aruba for 64,000 points per night, you would typically need to redeem 320,000 Marriott Bonvoy points for a five-night stay. However, this promotion require you spend 256,000 points instead.

No matter the redemption you’re after, you should strive to book award nights for the best point value possible. Note that you can figure out the value of points you’re paying for an award night with this simple equation:

Formula

So, if you booked a room at the Renaissance Wind Creek Aruba Resort for 64,000 points per night, the cash rate is $597 for our research dates. However, when you add in taxes and fees, the nightly cost comes out to $675.13.

With this calculation, the per-point value is slightly more than 1 cent per point ($675 ÷ 64,000 points = 0.0105).

Also, note how the value of Marriott Bonvoy points compares to the average value of points from other hotel loyalty programs, all offering their suites of travel credit cards. These values are highlighted below.

| Hotel program | Bankrate point value |

| Marriott Bonvoy | 0.7 cents |

| Best Western Rewards | 0.6 cents |

| Hilton Honors | 0.6 cents |

| IHG One Rewards | 0.7 cents |

| Radisson Rewards Americas | 0.4 cents |

| World of Hyatt | 2.3 cents |

| Wyndham Rewards | 0.9 cents |

Marriott Bonvoy elite status

The Marriott Bonvoy program has six membership levels and five levels of elite status you can pursue, each with an increasing number of perks you can enjoy when you get there. When it comes to hotel stays, basic members earn 10X Marriott Bonvoy points for each dollar they spend. However, elite members earn more bonus points based on the tier of status they have achieved. Generally speaking, you’ll climb the elite status ladder with Marriott Bonvoy the more nights you accrue with the hotel brand.

The following table explains the most important benefits you’ll get with each level of elite status with Marriott, as well as the activity you’ll need to get there:

| Status level | Member | Silver Elite | Gold Elite | Platinum Elite | Titanium Elite | Ambassador Elite |

| Required stays | 0-9 nights per year | 10-24 nights per year | 25-49 nights per year | 50-74 nights per year | 75-99 nights per year | 100 nights per year + $20,000 in spending |

| Bonus points | N/A | 10% | 25% | 50% | 75% | 75% |

| Complimentary in-room Wi-Fi | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Exclusive member rates | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Mobile check-in and services | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Ultimate Reservation Guarantee | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Late checkout (based on availability) | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Dedicated Elite Support | ✓ | ✓ | ||||

| Points, breakfast offering or amenity (varies by brand) | Points only | ✓ | ✓ | ✓ | ||

| Enhanced room upgrade (based on availability) | ✓ | ✓ | ✓ | ✓ | ||

| Lounge access | ✓ | ✓ | ✓ | |||

| Annual Choice Benefit (terms apply) | ✓ | ✓ | ✓ | |||

| 48-hour guarantee | ✓ | ✓ | ||||

| Ambassador service | ✓ | |||||

| Your24™ | ✓ |

Find the best Marriott card for you

Discover the best features of Marriott's co-branded cards and determine which one fits your travel needs.

Compare nowThe bottom line

Joining Marriott Bonvoy is a no-brainer since it’s free and immediately comes with some basic benefits. You should also know that earning this program’s points is not difficult. Not only will you earn 10X points spent at Marriott hotels as a basic loyalty program member, but you can earn more bonus points as an elite member or through spending with a Marriott credit card.

With so many ways to earn Marriott Bonvoy points, you could get a free hotel stay (or vacation) in less time than you think.

The information about the Marriott Bonvoy Bold® Credit Card, Marriott Bonvoy Boundless® Credit Card and Marriott Bonvoy Bountiful™ credit card has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.