Debit Cards

Debit and prepaid debit cards provide convenient and secure payment options for consumers, allowing easy access to funds without the risk of accruing debt.

Explore debit card basics

Use your debit card wisely

Daily ATM withdrawal limits

It's important to know how much you can withdraw from your bank's ATMs in a given day to help you better handle financial emergencies that require cash.

Available account balance vs. current balance

Understand the differences between the two balances you may see when looking at your bank account.

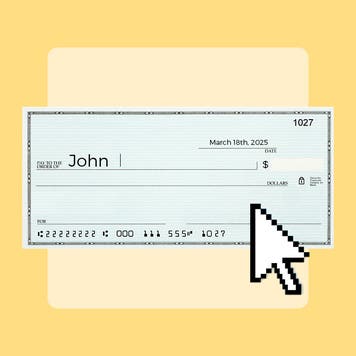

Checking account and ATM fee study

Maintaining a checking account with a debit card can come at a high cost. Learn how rising ATM fees and other banking fees are impacting consumers.

Experts in all things banking

Our expert reporters and editors bring the news and analysis you need—backed by data and firsthand experience.

About Bankrate

Bankrate Financial Analyst

Principal U.S. Economy Reporter

Senior Economic Analyst

Latest articles