How to redeem Chase points

Key takeaways

- The most valuable redemption options for Chase Ultimate Rewards points include transferring them to travel partners and redeeming them for travel through Chase Travel℠.

- Chase offers unique redemption options like Chase Experiences, Pay Yourself Back and the ability to redeem points for Apple products.

- Redeeming points for cash back, statement credits or gift cards is still a solid option for those who don’t travel often.

If you just started using a Chase rewards credit card, then you likely know the excitement that comes with seeing Chase Ultimate Rewards points building in your account. Earning points or cash back on purchases you’ve made is one of the best parts of owning a top-tier credit card.

But as pretty as they can look in your account, you never want to let your points sit for too long — which happens all too often. Twenty-three percent of rewards cardholders didn’t redeem their rewards at all in the past year, according to Bankrate’s 2024 Credit Card Rewards Survey.

So, what’s the best way to redeem Chase points? If you’re not exactly sure where to start or which redemption options fetch the most value, we’ll offer some tips to help you get the most bang for your buck when it comes to your Chase Ultimate Rewards points.

How can I redeem my Chase points?

-

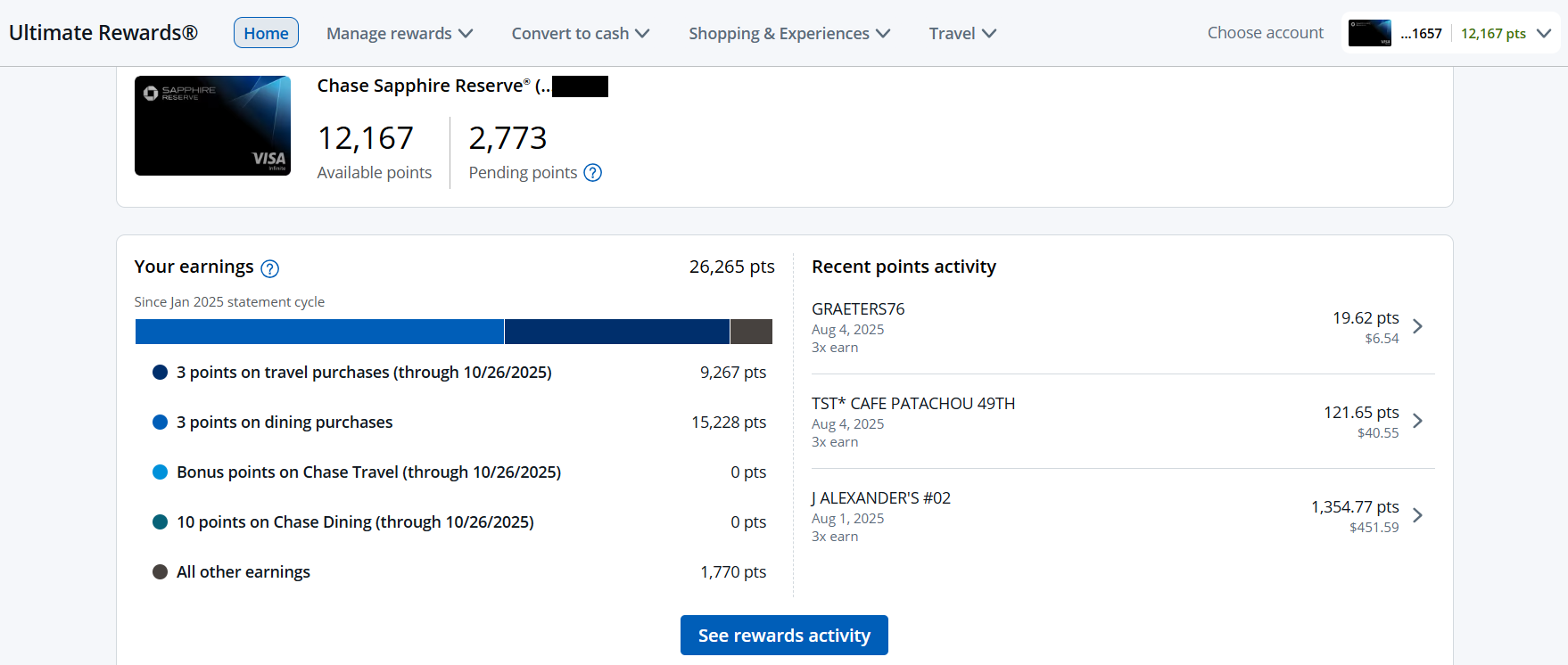

Log in to your Chase account, either on your desktop browser or the Chase mobile app.

-

Navigate to the Ultimate Rewards portal.

-

Once there, you can choose from multiple menu options to redeem points, including cash back, gift cards, Pay Yourself Back and more.

-

Once you choose your redemption option, follow the screen prompts to complete the process of redeeming your points for the selected award.

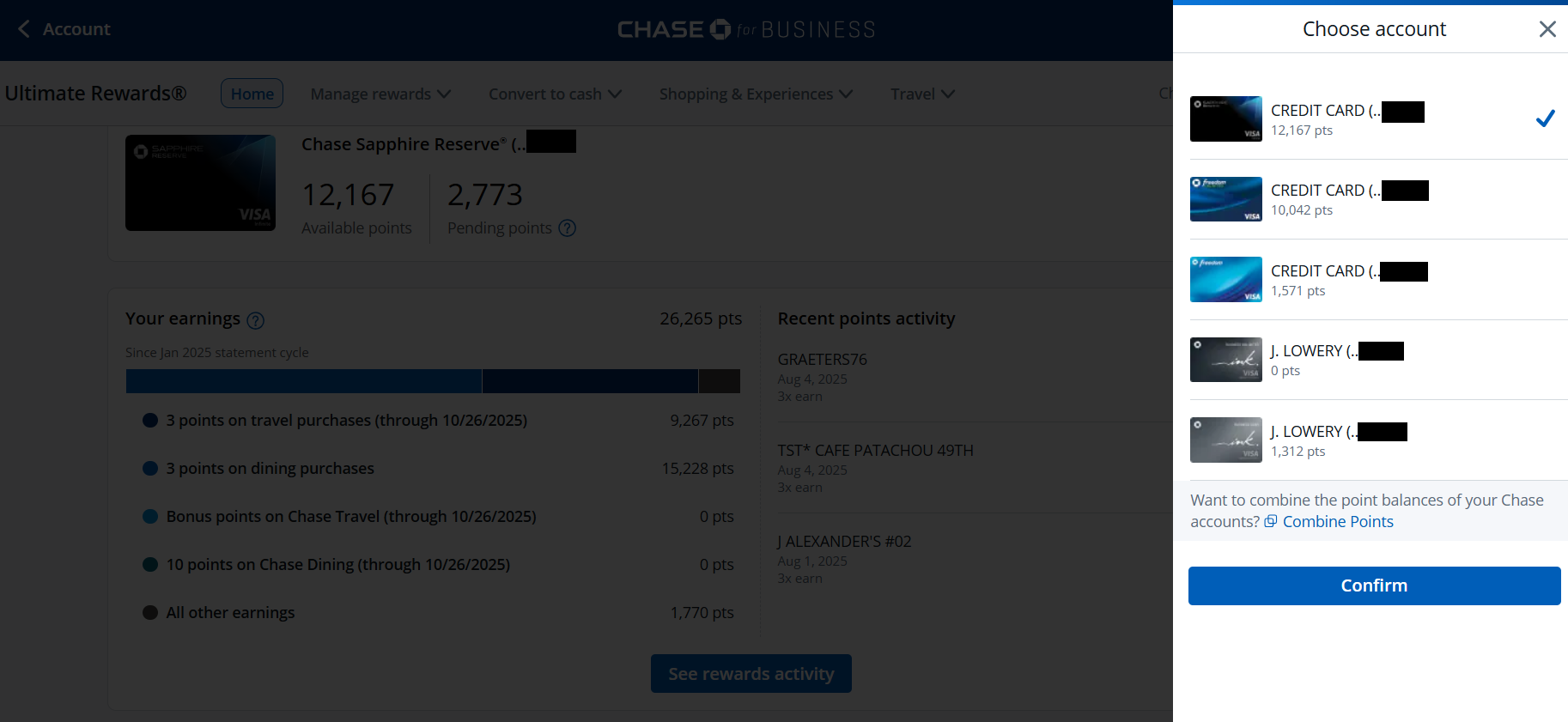

If you have multiple Chase accounts that earn Ultimate Rewards points, choose the card you want to access, and you’ll see how many points are available to redeem.

There’s an option to toggle between your different card accounts and switch cards as needed. If you don’t have enough points for your preferred redemption options, you can transfer points from one card to another within the Ultimate Rewards portal with the “combine points” feature under the “Rewards details” menu.

What are my Chase redemption options?

Once you’re inside the Chase Ultimate Rewards portal, you’ll see various redemption options by using the main menu options and dropdowns at the top of the page. These include:

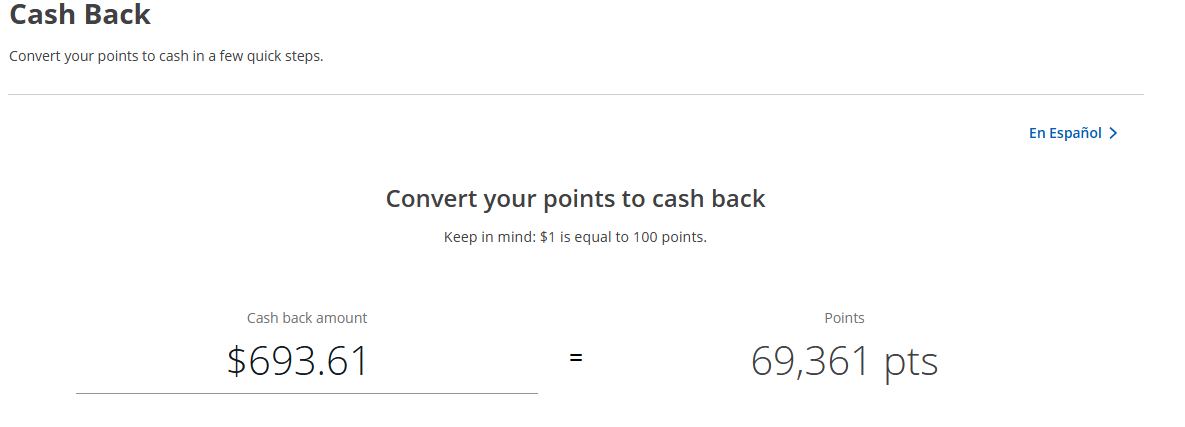

Cash back

Unlike with many travel credit cards, choosing cash back for your Ultimate Rewards redemption doesn’t lower the value of your points. You’ll get 1 cent per point for your rewards, plus the option to deposit your cash into an account of your choice or as statement credit on the card you earned the points with.

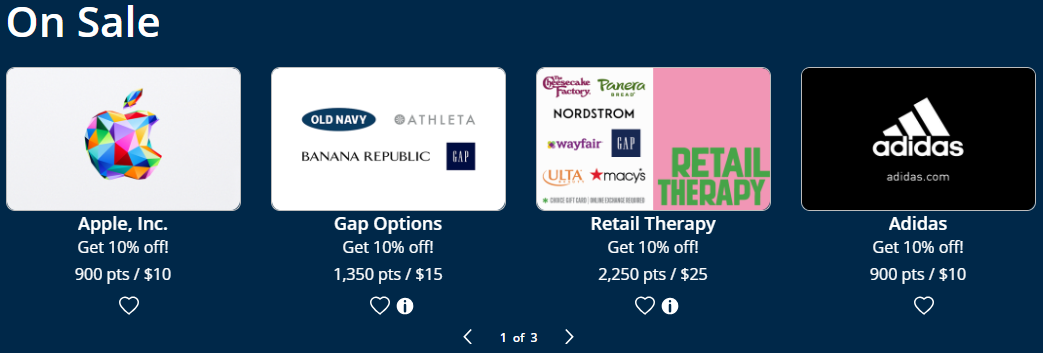

Gift cards

You’ll typically get 1 cent per point for gift cards, but there are special promotions that offer better value from time to time. For example, you might get a $100 gift card for 9,000 points instead of 10,000 points if there’s a 10 percent off sale.

Gift card options also vary and can change over time. Popular options often include Lowe’s, Airbnb, Kohl’s, DoorDash and Ulta.

Travel

One of the most popular redemption options is to book travel accommodations — from hotels to airlines to rental cars — through the Chase Travel℠ portal. That’s because, if you have a credit card in the Sapphire family, you can earn even more.

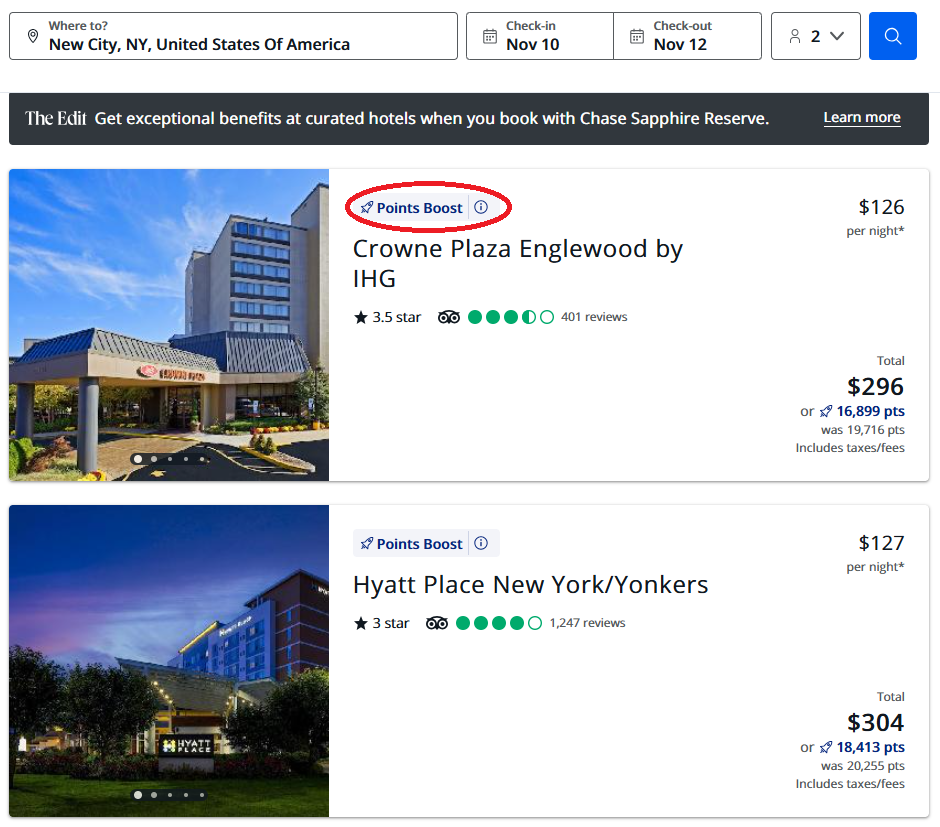

If you have the Chase Sapphire Reserve® or Chase Sapphire Preferred® Card, you can use Points Boost, which allows your points to be worth even more when you redeem through Chase Travel for top-booked hotels and flights with select airlines. Your points are worth up to 2X with the Sapphire Reserve and up to 1.75X with the Preferred card, making this redemption option one of the best on the table.

Bankrate’s take: To know if a flight or hotel option qualifies for Points Boost, look for the blue rocket ship icon next to your search results in the travel portal.

Transfer to travel partners

Arguably the most valuable redemption option is to transfer your points to a Chase travel partner. Points can be transferred to a number of partners at a 1:1 ratio if you have one of the three eligible Chase credit cards:

- Chase Sapphire Preferred® Card

- Chase Sapphire Reserve®

- Ink Business Preferred® Credit Card

Your points are worth about 2.0 cents per point with this redemption option, according to Bankrate’s valuations. This is especially true if you’re booking international airfare or domestic airfare in a premium cabin.

Chase transfer partners include:

Chase Experiences

Want to maximize your Chase points in a fun way? Chase offers Chase Experiences — a platform that gives credit cardholders multiple options to redeem their points for sporting events, concerts, VIP ticket access, preferred seating and more.

Current offerings include:

- VIP experiences at Tampa Bay Lightning games

- Preferred seating options at Atlanta Hawks games

- Exclusive on-site benefits at multiple music festivals

- Discounted tickets to select art events

Pay with Points at Amazon or PayPal

Pay with Points lets you redeem your points for purchases made through Amazon or PayPal at the checkout screen. However, this redemption option is only worth 0.8 cents per point, meaning 100 points equals 80 cents.

This is a nice option to have but not the best way to redeem your points — especially since you can redeem for statement credits at a rate of 1 cent per point instead.

Apple Store

You can also use your points to purchase Apple products like Apple Watches, Airpods, iPhones, iPads, Macs and accessories. “Split Pay” is an option, allowing you to use some of your points while paying for the balance using your credit card. Prices at the Chase Apple Store are comparable to those on the regular Apple website.

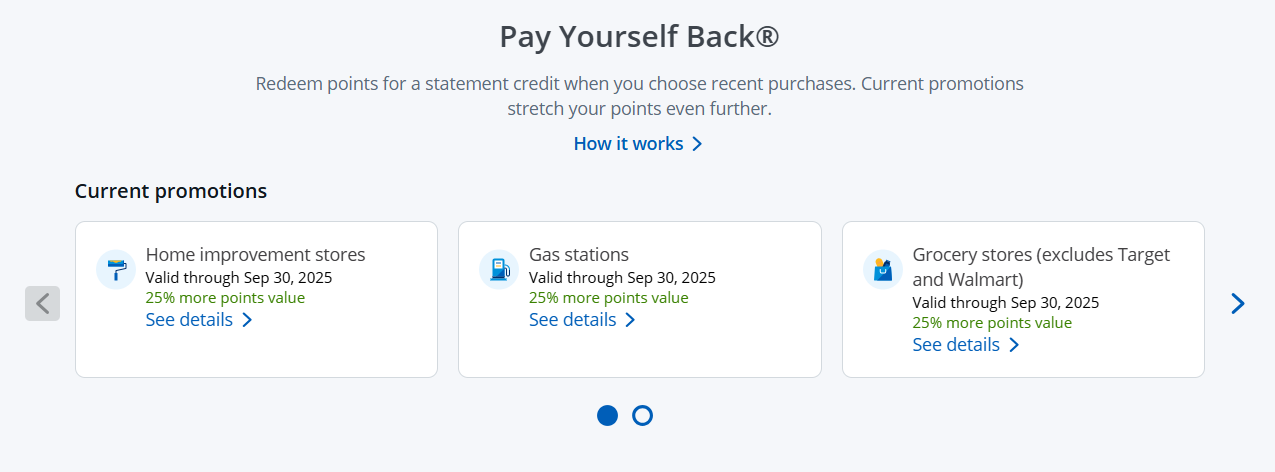

Chase Pay Yourself Back

Chase Pay Yourself Back lets you get more value for rewards when redeeming for statement credits toward eligible spending categories, which can change over time. The main advantage is that your points will be worth more in dollars when used with a Pay Yourself Back promotion than if you redeemed them for a statement credit using the cash back method.

What’s the best way to redeem Chase points?

Generally speaking, redeeming your points for travel through Chase or transferring them to high-value travel partners yields the highest value for your points. However, you’ll want to compare the cost of booking through the Chase portal or transferring points to a partner to know which option requires the lowest total number of points.

That said, if you rarely travel, redeeming your points for cash back, statement credits or gift cards instead might make the most sense. All of these options make using rewards easy, especially since redemptions for statement credits and cash back are simple to do and still net you 1 cent per point.

Redeeming your points at checkout with Amazon or PayPal, on the other hand, fetches the lowest value for your points. However, there may come a time when this particular redemption option makes sense for you, such as during the holiday season or when making a big purchase.

The bottom line

Earning credit card rewards within the Chase Ultimate Rewards program can be an exciting perk to owning one of the best credit cards on the market. These points are especially popular, thanks to their flexible redemption options and high value.

Still, knowing the ins and outs of this program and its available redemption options can help you get the most value out of your rewards. You worked hard to earn your points, so you might as well enjoy them.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.