How to maximize your rewards with Chase Offers

Key takeaways

- Chase Offers provides certain Chase cardholders with opportunities to earn cash back at select merchants.

- Offers are personalized to both individual customers and each Chase card in your wallet.

- Any cash back earned through Chase Offers comes on top of the rewards you normally earn for using your card.

- Consider stacking your rewards even higher by adding offers to your card, then making purchases through a shopping portal that also offers cash back or discounts.

Chase Offers is a program that lets you “double dip” on rewards and discounts when you shop with participating retailers and pay with an eligible Chase credit or debit card. The key to maximizing this program is knowing it exists in the first place, and then taking steps to add Chase Offers you want to use to your account ahead of time.

Why should you use Chase Offers? Doing so is free and requires very little effort. Plus, Chase credit cards are already some of the most popular rewards cards available today. Several Chase cards earn Chase Ultimate Rewards points, which are some of the most flexible points out there. Chase also offers popular cash back credit cards, co-branded hotel and airline cards and credit card options for small business owners and entrepreneurs.

If you hope to use Chase Offers to maximize the rewards you earn on your favorite Chase credit card, read on to learn more.

What is Chase Offers?

Chase Offers works similarly to American Express’ Amex Offers feature. When you hold certain Chase cards, you’ll have access to an array of Chase Offers “deals” that you can apply to your account if you want.

There are a few key reasons Chase credit card offers are worth pursuing. First, these offers are free and preloaded within your online account management page or the Chase mobile app. In addition, the statement credits you earn with Chase Offers are given on top of any rewards you earn just by paying with your Chase credit card. To be clear, Chase Offers come back to you as statement credits, while your card will still earn rewards separately.

How does Chase Offers work?

Chase Offers are typically advertised as a percentage back on purchases with select merchants or a specific amount of cash back. There’s typically either a maximum amount you can earn, a specific spending requirement or both.

Keep in mind Chase Offers change all the time, and the one you like may appear once, only to disappear later. Here are a few recent examples of Chase Offers we have seen:

- 10 percent back at Sleep Number ($500 maximum statement credit)

- 5 percent back on Southwest Airlines purchases ($50 minimum purchase, $40 cash back maximum)

- $25 back at LensDirect when you spend $130 or more

- 10 percent back at Penn Station ($4 back maximum)

- 10 percent back at Vera Bradley

- 10 percent back at Great Wolf Lodge ($100 minimum purchase, $48 back maximum)

- 5 percent back at Ulta ($5 back maximum)

Limitations to keep in mind

While Chase Offers is free and easy to use, you should know the fine print and limitations.

Expiration dates

First, you’ll notice that Chase Offers all have an expiration date, and sometimes the date is only a few weeks (or a few days) from when the offer shows up in your account. For this reason, you should go ahead and add any Chase Offers you like to your card. There’s no penalty for letting an offer expire without using it, so you might as well.

You should receive the statement credit for an offer as long as you make the transaction before the expiration date and meet any other terms, even if the transaction posts to your account after the offer expires.

Chase Offers are highly variable

Also, keep in mind that Chase Offers are tailored to each customer, so your friend may have access to better (or worse) offers than you do. They could have totally different offers altogether or Chase Offers from the same retailers but in different amounts.

Chase Offers are chosen for you based on how you use your card, so if you use your card regularly, you should receive offers that are useful to your lifestyle and spending habits. Conversely, if you recently opened your card or rarely use it, you may not have many relevant offers available.

They are card-specific offers, and must be activated beforehand.

In order to get credit for an offer, you must activate the offer in your account before making the purchase. Because of this, it’s a good idea to check your offers page regularly to ensure you don’t miss out on rewards for purchases you’re already planning to make.

Since offers are tied to specific cards, you’ll also have to use the correct card to make the purchase. For example, if you have a Chase Freedom Unlimited® and a Chase Sapphire Preferred® Card and see an offer that’s only available on your Freedom Unlimited, you won’t earn the offer if you use your Sapphire Preferred for the purchase.

This can be inconvenient if the card with the offer is not the card that would earn the most credit card rewards on the purchase.

Cash back comes with limits

Finally, don’t get too excited when you see offers that say 10 percent back or 20 percent back — at least not until you read the fine print. A lot of offers that advertise a percentage back have a limit on the amount of cash back you can earn. The limits can be small, sometimes less than $10. However, any cash back on a purchase you were already planning to make is better than nothing.

Some offers can only be used once, while others can be used multiple times until you reach the cash back limit. Check the terms and conditions of the specific offer for details.

Only available in the U.S.

Currently, Chase Offers are only available in the U.S. To see offers in your account, you must have a U.S. address listed as your primary residence or place of business.

Which credit cards have Chase Offers?

Chase Offers are available on many Chase consumer and business credit cards, as well as debit cards. Offers can and do vary from card to card and person to person. Also, note that your Chase Offer won’t affect your regular rewards rate. Regardless of whether you apply a Chase Offer to your card or not, you’ll still earn the exact amount of cash back or other rewards you normally do from that card.

Here are a few popular Chase credit cards that let you apply Chase Offers:

|

Card |

Rewards |

Welcome bonus |

Annual fee |

|

75,000 bonus points after spending $5,000 on purchases in the first 3 months from account opening |

$95 |

|

|

125,000 bonus points after spending $6,000 on purchases in the first 3 months from account opening |

$795 |

|

|

$200 cash bonus after spending $500 in the first 3 months from account opening |

$0 |

|

|

$200 cash bonus after spending $500 in the first 3 months from account opening |

$0 |

|

|

$350 bonus cash back when you spend $3,000 on purchases in the first 3 months; additional $400 in bonus cash back when you spend $6,000 on purchases in the first 6 months |

$0 |

|

|

100,000 bonus points after spending $8,000 on purchases in the first 3 months from account opening |

$95 |

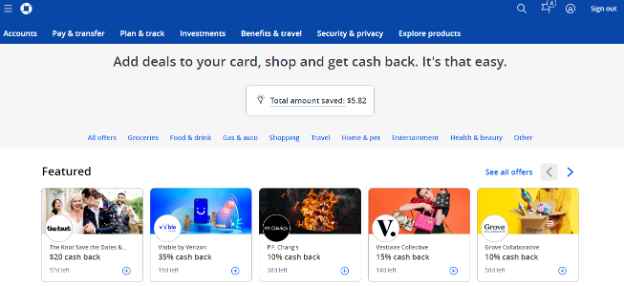

How to add Chase Offers to your card

You can find Chase Offers when you log in to your account at Chase.com or through the Chase mobile app. Generally speaking, they’ll be found on the right side of your screen next to the details for each of your credit card accounts.

In the app, you can navigate to Chase Offers through the Benefits and Travel tab.

To see your offers, all you have to do is click on the “Chase Offers” section. From there, you’ll be taken to a separate page with all the Chase Offers you’re eligible for.

At this point, you can simply click on any Chase Offers you think you could use. When you do, the Chase Offer will be automatically applied to your account. If you make an eligible purchase within the time period your Chase Offer is valid, the cash back will be automatically credited to your account. If not, your Chase Offer will expire and fall off your account.

Maximize spending with Chase Offers

Since Chase Offers are given out on top of the rewards you earn with your Chase credit card, you should take advantage if you can. After all, you only need to check your account every once in a while and click on the offers you want to use. If you happen to use them, then the cash back will be automatically applied to your account with no work on your part.

Here are some additional ways to maximize your Chase Offers:

Earn more through the Chase shopping portal

Chase’s shopping portal is another tool that helps you earn points on eligible purchases, and you can use this portal in conjunction with Chase Offers. Like Chase Offers, Shop Through Chase helps you earn additional points or cash back on top of the rewards you earn with your credit card. However, Shop Through Chase can only be used for online purchases.

Let’s say you have a Chase Offer in your account from Shutterfly, but at the same time, Chase is offering bonus points in its portal for purchases from the same place. In that case, you could add the Chase Offer to your credit card account, click through the Chase portal to shop at Shutterfly and triple dip — rewards earned with your credit card, bonus rewards through the Chase portal and cash back from the Chase Offer you applied to your card.

Use other cash back portals

You can also score additional rewards by using other cash back portals to earn rewards at stores that show up in your Chase Offers. Some of the top shopping portals may include offers from merchants that align with Chase Offers from time to time, allowing you to stack your rewards even higher. Check out our list of the best cash back apps to find other shopping portals that may work for you.

While you can use Chase Offers in conjunction with a shopping portal, you can’t get rewards from two shopping portals — such as Shop Through Chase and Rakuten — on the same purchase.

Align Chase Offers with credit card bonus categories

Finally, you should take extra care to line up Chase Offers with the bonus categories your credit card offers, such as travel or dining. For example, if you have restaurant or travel deals available on a card like the Chase Sapphire Preferred, you should make use of them to earn a statement credit through Chase Offers while also earning 3X points on dining and 2X points on general travel purchases through the card’s own rewards.

If you have multiple Chase cards, an offer may not always appear on the card with the highest rewards rate for the relevant spend category. For example, if you receive an offer for cash back at Walgreens on your Chase Sapphire Preferred, you may have to decide whether you value the cash back from the offer over the additional points from using a card that earns higher rewards on drugstore purchases (such as the Chase Freedom Unlimited).

The bottom line

Make sure to check the Chase Offers in your account frequently so you can maximize them when offers for your favorite restaurants and retailers come along. Failing to do so means you’re leaving “free money” on the table.

If you own additional credit cards outside of Chase, read up on other credit card special offers and limited-time promotions that may apply to you.

*The information about the Chase Freedom Flex has been collected independently by Bankrate. The card details have not been reviewed or approved by the issuer.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.