How to use the American Express travel portal

Key takeaways

- The American Express travel portal (AmexTravel.com) lets individuals book airfare, hotel stays, cruises and more with cash or points.

- In order to book travel with rewards through this portal, you need an American Express credit card that earns Amex Membership Rewards points.

- While booking through the portal can make sense, there are scenarios where you can save points by transferring them to Amex airline and hotel partners instead.

The most popular travel credit cards allow you to redeem your points in more than one way, including the option to use points for booking travel through a portal.

American Express allows you to book travel through its own portal, found at AmexTravel.com. To book travel using points, you need a credit card that earns points in the American Express Membership Rewards program. That said, anyone can book through this portal and pay with another form of payment.

Let’s break down how to use the travel portal and what makes it a good choice for Amex cardholders.

How to use the Amex travel portal to book flights and hotels

Using the Amex Travel Portal to book flights, hotels, cruises and other travel is a lot like using any other travel booking site. AmexTravel.com is designed to make it easy to search for travel and compare multiple flight and hotel options in one place.

Besides flights, hotels and cruises, you can also use the Amex Travel portal to book rental cars and vacation packages. All you have to do is head to AmexTravel.com and enter basic details about the travel you want to book. From there, you’ll be presented with a selection of options you can choose from.

Paying with cash vs. points

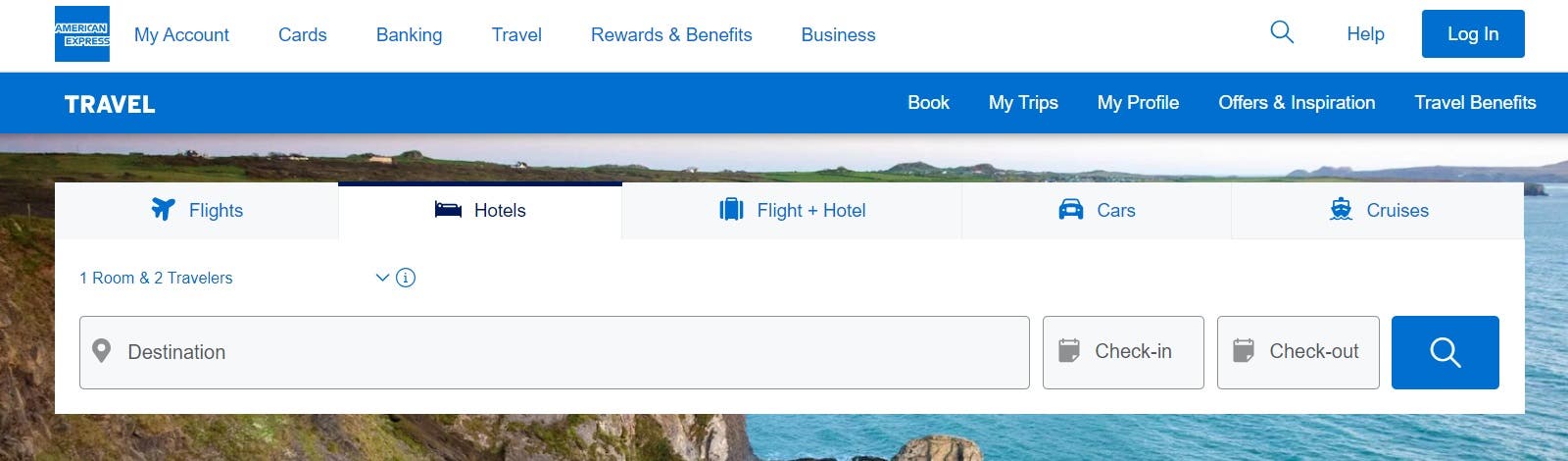

When using the Amex Travel portal to pay for hotels, flights and other bookings, you have the option to pay with points, cash or both.

To pay fully or partially with points, simply visit the American Express website and log in to your account. Once you find the travel option you want and are ready to book, you can choose either “Use only points” or to “Use points + card.” You can also pay for travel with only your credit card as payment or use the Amex “Plan it” feature for your booking.

Once you book and choose how you want to pay, your credit card will be charged the full dollar amount of your booking. A credit for any points you used, however, will be applied to your account within 48 hours, per American Express.

Bankrate’s take: You’ll need at least 5,000 Membership Rewards points to pay with points. This rule makes it a little more difficult to use up any leftover points from previous bookings.

When it comes to booking flights, there are a few interesting details to note. If you have an Amex card that offers access to Centurion Lounges or Delta Sky Clubs, for example, you’ll see a note showing qualification for lounge access on flights that apply. You can use Amex points to book a business- or first-class flight or to upgrade your existing flight.

You also have the option to transfer your American Express Membership Rewards points to Amex airline and hotel partners.

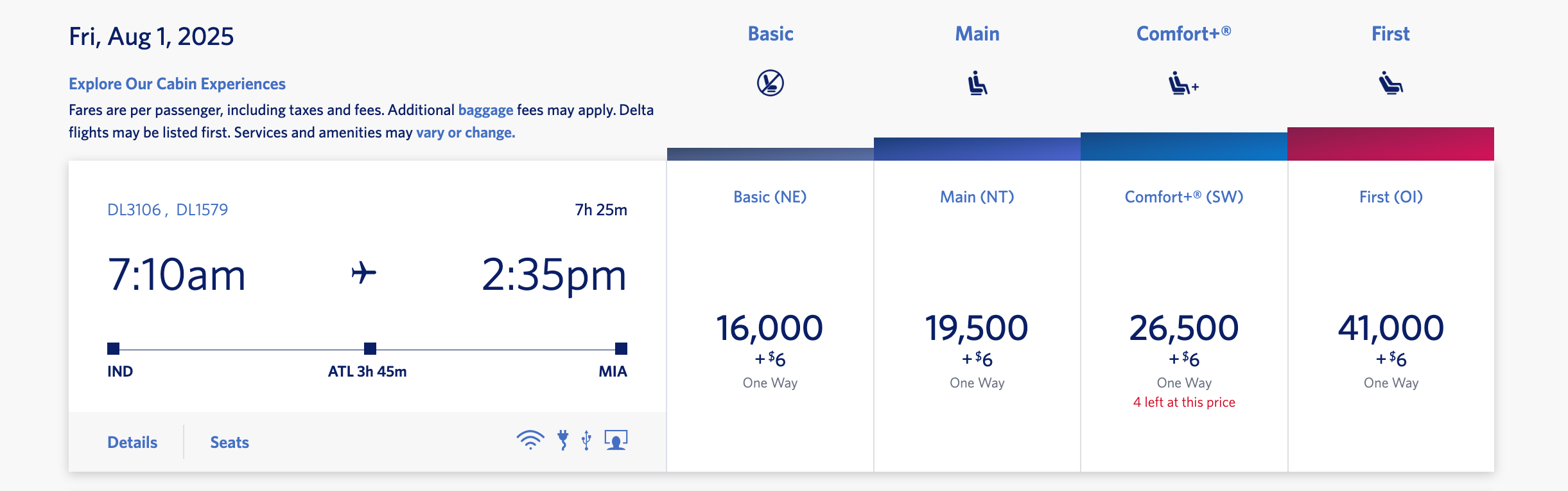

Paying with the Pay It® Plan It® feature

American Express cardholders can also pay for airline tickets with Pay It® Plan It®. The Amex Pay It Plan It plan allows you to pay for major purchases over time through a convenient payment plan. The monthly payment plan allows you to potentially avoid interest charges while paying down your balance.

At checkout, cardholders are presented with up to three different plans to pay for any flight purchase of $100 or more. Note that the installment payment plan doesn’t have any interest associated with it, but there is a fixed monthly fee based on the card’s APR.

Booking flights through Amex Travel

Before you book flights through AmexTravel.com with your points, find out if you could get a better deal by transferring your rewards to an Amex airline partner instead. You can easily find this out by comparing award flights with your favorite airline to what the cost would be for airfare through AmexTravel.com.

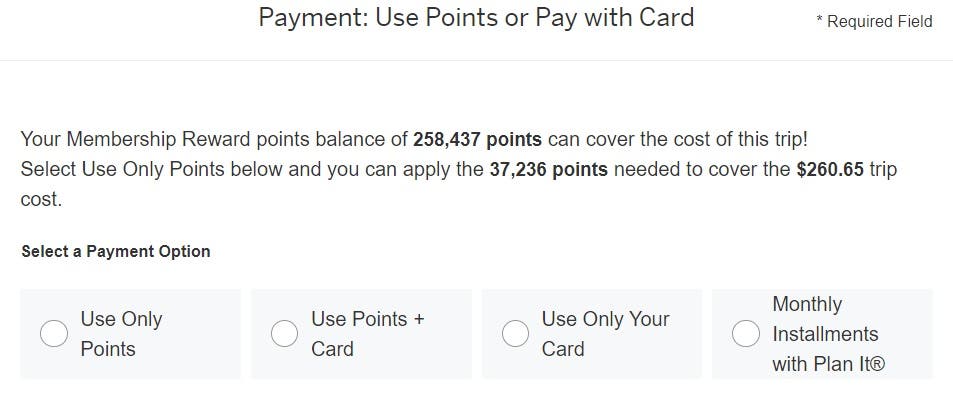

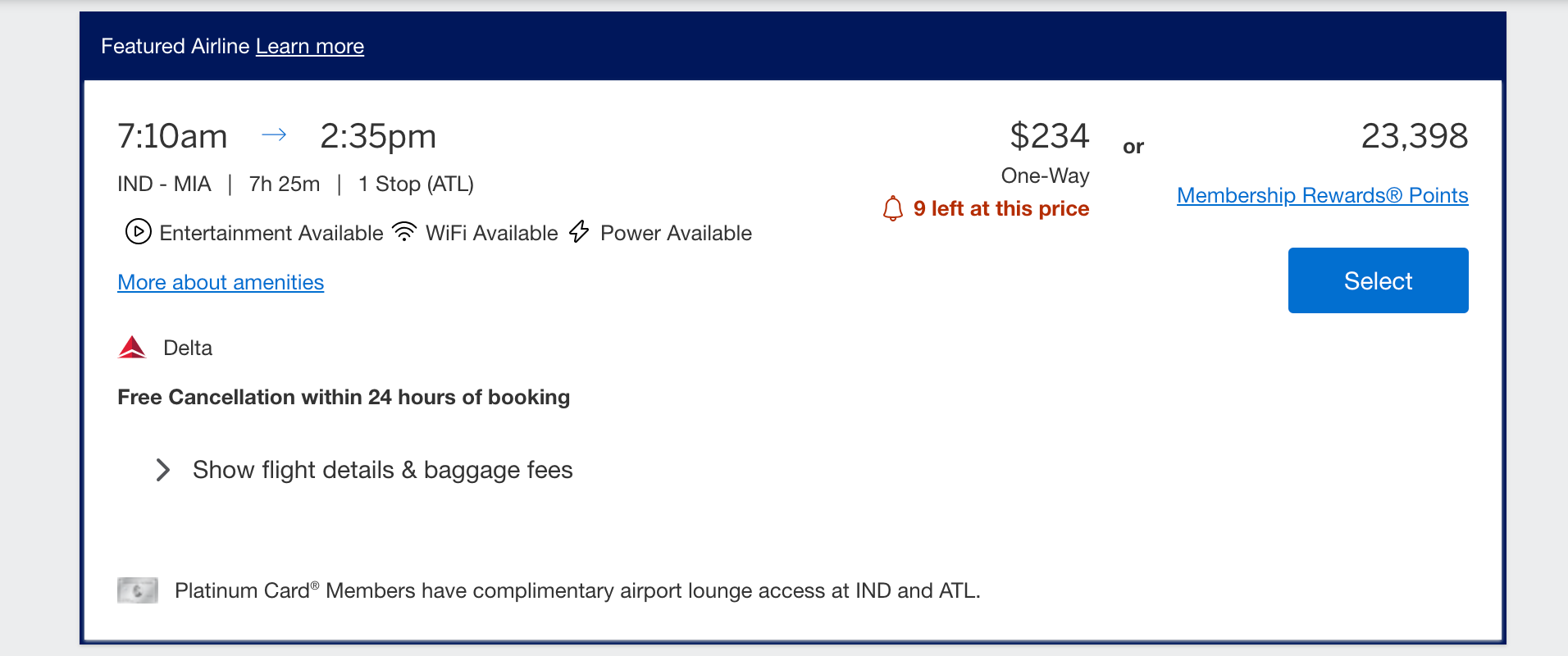

Here’s an example of how this could work. Let’s say you want to fly from Indianapolis to Miami on Delta Air Lines on a specific travel date in August of 2025. In that case, you could easily see how many miles you would need on the Delta website by searching for the travel you want and clicking on the button that says “Shop with Miles.”

As you can see, the flight in question starts at 16,000 miles plus $6 in basic economy and 19,500 miles plus $6 in main cabin economy through the Delta website.

When you compare this cost to what you would pay for the same flight through AmexTravel.com, it’s easy to see where transferring your Amex points to Delta makes more sense. For the same flight on the same travel date, AmexTravel.com wants 23,398 miles.

In the meantime, Amex lets you transfer points to Delta Air Lines at a ratio of 1,000:1,000 in increments of 1,000. This means you would transfer as little as 14,000 Amex points to your Delta SkyMiles account (as a Delta card customer) and make this booking.

This is just one example of how transferring your Amex points to a partner can make more sense than booking a flight through AmexTravel.com. That said, you’ll want to run the numbers for each booking you make before deciding, as there may be scenarios where booking through Amex is a considerably better deal — and you won’t know unless you do the research upfront.

Booking hotels through Amex Travel

Using the Amex Travel portal to book a hotel or resort stay works similarly, requiring you to enter your travel information to identify properties in the destinations you plan to visit. Once again, you can pay for your booking with points, cash or a combination of the two. You’ll need to have at least 5,000 Membership Rewards points in your account in order to pay with points.

Again, you’ll want to compare your options when deciding whether to book hotels with hotel loyalty points or directly through Amex. That’s because, in addition to the many frequent flyer programs Amex partners with, the program lets you transfer Amex points to the Choice Privileges program, Hilton Honors and Marriott Bonvoy.

Booking through the International Airline Program

The business and personal Platinum cards let you access a newer Amex program for frequent flyers known as the International Airline Program. This program was created to increase access to lower fares on 24 participating airlines, but it’s only good for international premium class tickets.

To search for fares that qualify, log in to your personal or business Platinum account. From there, use AmexTravel.com to search for First Class, Business Class or Premium Economy for an international destination. At that point, you may see some flight options that show an International Airline Program banner.

Booking through the Amex Fine Hotels and Resorts program

Note that select premium American Express credit cards, like The Business Platinum Card® from American Express and American Express Platinum Card®, let you access an additional hotel program known as American Express Fine Hotels and Resorts.

This program lets cardholders book stays at over 2,600 luxury hotels in the world with added benefits worth up to $550 per stay. Amex Fine Hotels and Resorts perks can include:

- Daily breakfast for two people

- 4 p.m. late checkout

- Complimentary internet access

- Noon check-in, based on availability

- Room upgrades based on availability

- Unique resort amenity worth up to $100

The Amex Fine Hotels and Resorts program is available only for eligible premium cardholders. Using this program also typically means going without elite hotel benefits or points for paid stays and terms apply.

What are the benefits of booking through the Amex Travel portal?

AmexTravel.com is a third-party booking site that works similarly to competitors like Expedia.com and Orbitz.com. You can use it to compare prices for airfare, hotels and more across the web, just like you would with any other booking site.

But there are more benefits to using this portal if you’re an American Express cardholder.

Is booking through AmexTravel.com worth it?

Only you can decide which travel booking option works best for your needs. Regardless of the value of rewards earned, some travelers like being able to book directly through a portal that offers multiple options.

AmexTravel.com also gives customers the benefit of booking any travel available on the portal without having to find award space on a flight or search for available award nights in high-demand hotels. American Express Membership Rewards points, however, are usually worth more if you transfer them to Amex transfer partners, particularly airlines.

Either way, it is wise to compare all your options before booking travel through AmexTravel.com. See if a transfer partner might let you book the flights you want for fewer miles, but don’t be afraid to use AmexTravel.com if you don’t want to deal with award availability or if you find a better deal.

The bottom line

Whether it’s for flights, hotels, car rentals or vacation packages, the American Express travel portal offers a convenient platform for booking all aspects of travel. It’s simple and rewarding to plan and manage travel arrangements with its extensive travel options and exclusive benefits.

Ultimately, it’s a go-to option for cardholders looking to maximize the travel benefits of Amex reward cards, streamline their trip planning and enhance their travel experiences.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like