Guide to Fine Hotels + Resorts by American Express

Key takeaways

- American Express Fine Hotels + Resorts is a luxury travel portal exclusively for premium Amex cardholders, offering access to over 2,600 luxury properties worldwide.

- Cardholders with eligible American Express cards can receive exclusive benefits and perks when booking through Fine Hotels + Resorts.

- These benefits include room upgrades, daily breakfast for two, early check-in and late check-out and complimentary credits at select properties.

American Express makes it simple to find unique luxury hotels all around the world through its curated travel site, Fine Hotels + Resorts (FHR).

Although this collection of properties is only available to select American Express cardholders, Fine Hotels + Resorts perks can be easy to overlook, given all the other travel-related benefits that come with premium Amex travel credit cards.

Booking your next hotel stay through Amex Fine Hotels + Resorts will add several great benefits to your stay that are worth learning more about. In this guide, we’ll walk through the details of the Fine Hotels + Resorts program and answer several of the most common questions.

What is American Express Fine Hotels + Resorts?

American Express Fine Hotels + Resorts is a luxury travel portal reserved for premium American Express cardholders, such as those with the American Express Platinum Card® . The program connects eligible members to over 2,600 properties around the world, including a mix of unique independent properties and well-known luxury brands like Fairmont, Four Seasons, Hyatt, IHG and Ritz-Carlton.

Making your hotel booking through American Express Fine Hotels + Resorts allows you to access benefits and perks that aren’t available to the average customer. American Express is very selective with the properties included in the Amex FHR and is equally selective in who has access to the program.

American Express credit cards with Fine Hotels + Resorts Access

If you own one of the following American Express credit cards, you have access to Fine Hotels + Resorts:

-

American Express Platinum Card®

-

The Centurion Card from American Express*

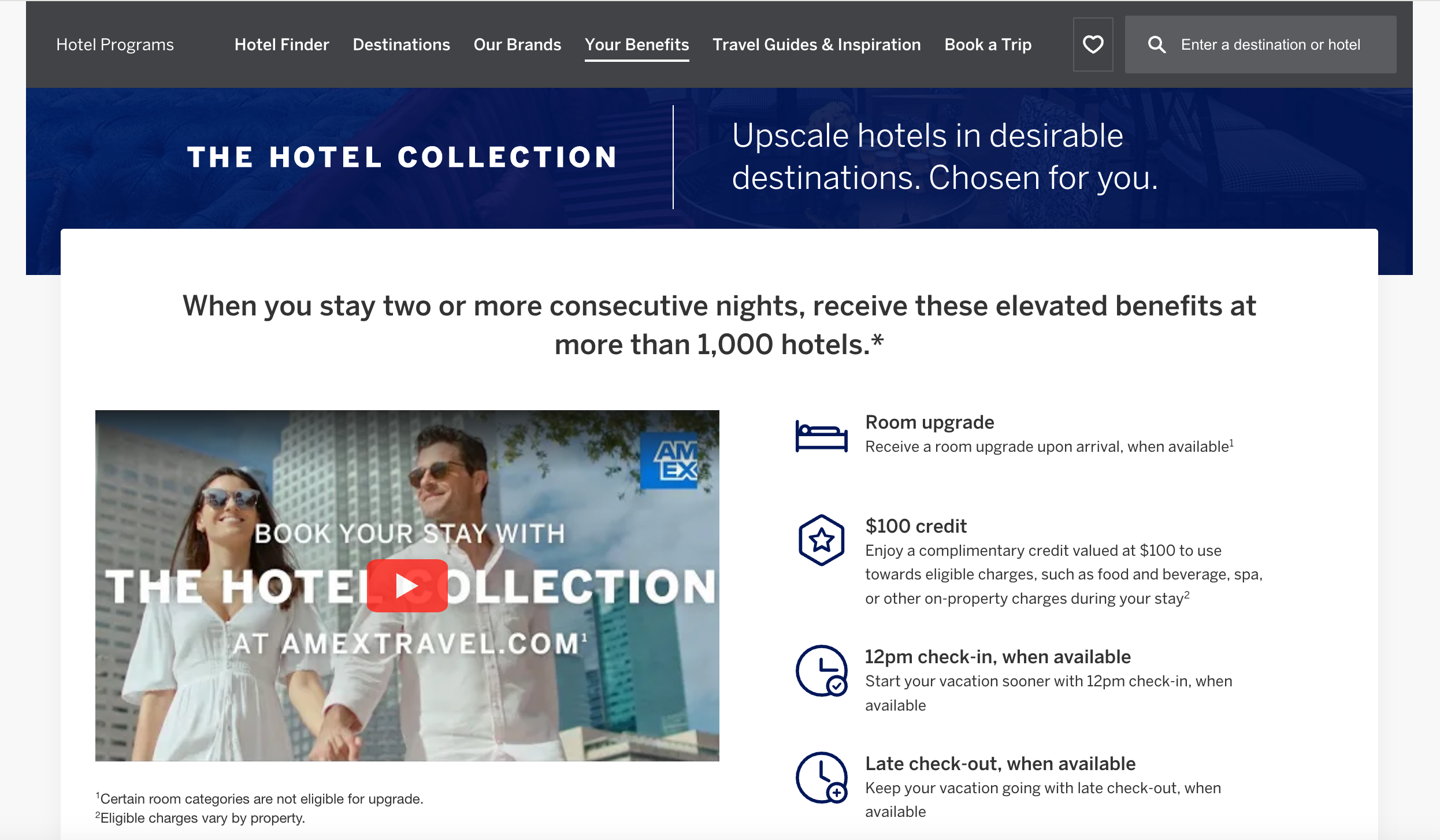

Besides offering access to Fine Hotels + Resorts, the American Express Platinum Card® features up to $600 in annual credits for prepaid hotel bookings at Fine Hotels + Resorts or The Hotel Collection properties when you book through American Express Travel. You’ll need to stay a minimum of two nights in order to utilize this perk.

The Business Platinum Card from American Express offers even greater benefits when it comes to Fine Hotels + Resorts. Cardholders can get up to $600 in statement credits ($300 semi-annual) or complimentary perks for booking with a Fine Hotels + Resorts property, plus up to $100 credit on qualifying hotel purchases (minimum two consecutive night stays with a brand in The Hotel Collection).

American Express Fine Hotels + Resorts benefits

Amex Fine Hotels + Resorts offers some great benefits and perks that can make your stay at one of its luxury properties even more enjoyable. Here’s what you can expect from a Fine Hotels + Resorts stay:

-

Complimentary breakfast for two every day

-

12 p.m. check-in, when available

-

Guaranteed 4 p.m. checkout

-

Free room upgrade at check-in, when available

-

Complimentary Wi-Fi

-

A complimentary credit worth $100 that’s unique to every property

American Express values these perks at $600 on average, giving you plenty of motivation to book your stay through Fine Hotels + Resorts.

Can you use Amex points to book Fine Hotels + Resorts rooms?

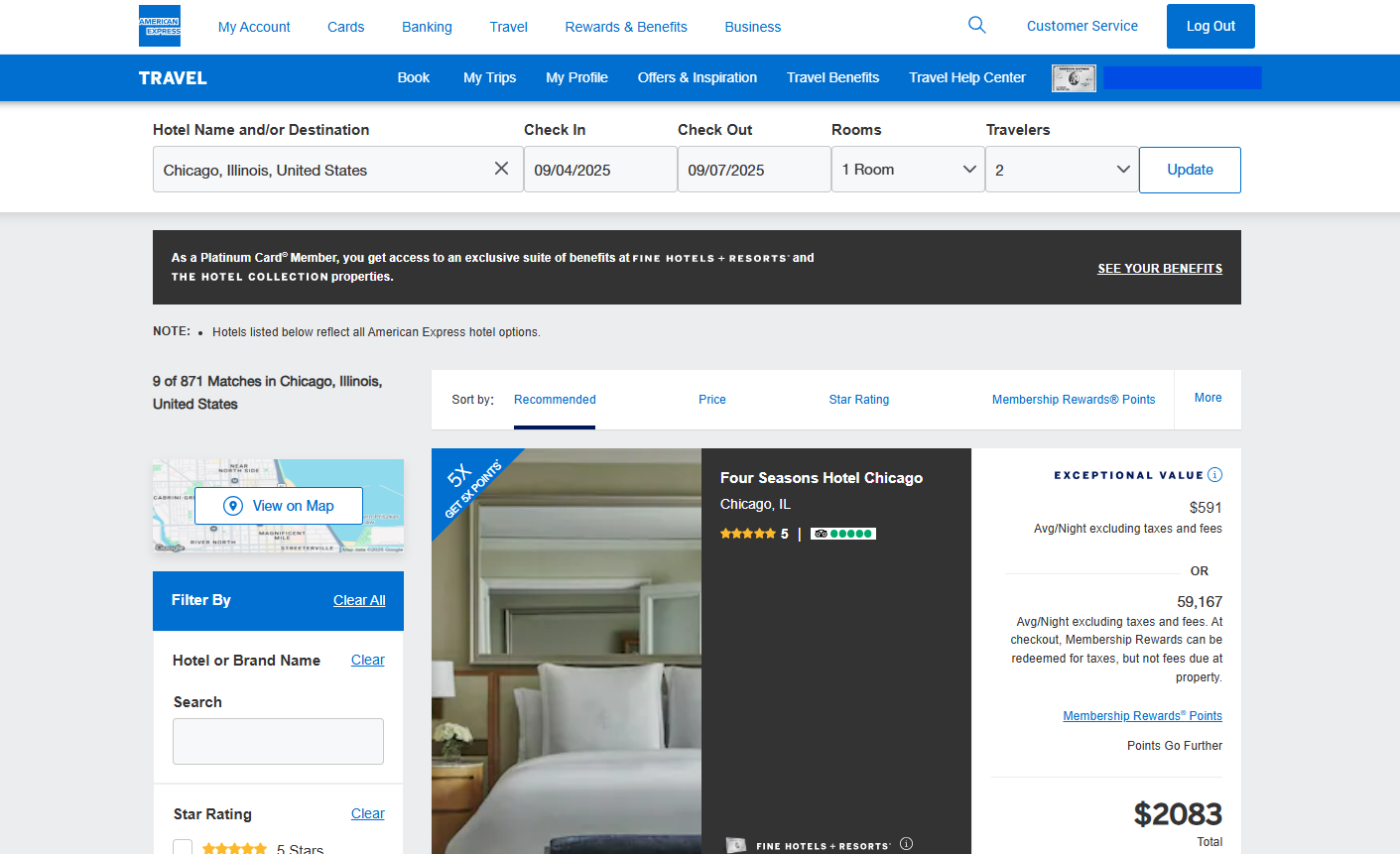

Yes, you can use Amex’s Pay with Points feature to cover some or all of the cost of your stay. Simply make your purchase through American Express Travel using one of the four eligible American Express cards.

The points value will appear as a credit on your statement to cover the cost of your hotel. If you don’t have enough Membership Rewards points to cover the full cost, you’ll simply pay the remaining balance on your next card statement. Membership Rewards points are worth $10 per 1,000 points, and you need at least 5,000 points to begin the redemption process.

Is booking through Amex Fine Hotels + Resorts worth it?

Booking your hotel stay through American Express Fine Hotels + Resorts can be a great opportunity, especially if you value premium travel perks.

Of course, you’ll want to compare prices before you book, especially if you’re considering booking through Fine Hotels + Resorts versus booking directly with the hotel. Keep in mind that the benefits associated with Amex Fine Hotels + Resorts may offset many of the price differences you might find, whether you’re enjoying the complimentary breakfast for two or taking advantage of your late checkout.

Plus, you might be able to use your Membership Rewards points to cover part of your stay — or take advantage of Fine Hotels + Resorts credits offered by the Platinum Card® and Business Platinum cards.

Possible downsides of Amex FHR reservations

While Amex Fine Hotels + Resorts comes with some awesome perks, there are a few downsides to be aware of.

- Higher price tag: As it suggests in the name, this site is geared towards luxury hotels, which means the price tag will be higher than other general travel sites. Still, the additional perks that come with the booking could make the higher price.

- Limited property selection: The American Express Fine Hotels + Resorts selection is expansive and you can book hotels around the world. However, the majority of their selection is limited to the capital cities or popular areas, such as London, New York City and Miami. If you’re looking farther abroad or want to travel to a smaller city, it may be difficult to find a hotel.

- Limited payment options: You have to book a hotel using an eligible card. While this guarantees the use of credits and upgrades, if you wanted to use another card outside of the eligible Amex cards, you wouldn’t be able to use this service.

How to book a reservation on Amex Fine Hotels + Resorts

Booking a reservation through Amex Fine Hotels + Resorts is quite simple and similar to booking hotels on other online travel sites. After logging into your Amex account, you’ll have full access to their booking site and the limited-time deals available.

From there, you enter your destination, dates and the number of rooms you will need for your trip. Sort your options using filters and compare the different hotels before choosing a hotel and the specific room type you would like.

Finally, pay for the room. You can use your points, card, a combination of the two or set up a monthly payment plan through Amex’s Plan it, Pay It program.

Tips for maximizing value when making a Fine Hotels + Resorts reservation

There are a few ways in which you can ge the most out of your bookings. Using these tips won’t only help justify the annual fees of the Amex cards, but also keep you ahead on points and credits:

- Pay with your card: When you use your card to redeem points, the highest possible value is 1 cent per point. However, if you transfer points to airline or hotel partners, you can get up to 2.0 cents per point. Your points will go much farther if you redeem for flights while earning points by paying for your hotel with your card.

- Take advantage of the credits: up to $600 per year ($300 semi-annual) for prepaid Fine Hotels + Resorts® or The Hotel Collection.

- Book multiple stays a year: Instead of one long trip per year, consider spacing out multiple trips per year, even if they’re shorter, to take advantage of limited-time perks, such as free nights, and credits that can use per reservation like the up to $100 credit on qualifying hotel purchases (minimum two consecutive night stays with a brand in The Hotel Collection)

The bottom line

American Express Fine Hotels + Resorts offers some pretty incredible benefits for people who enjoy staying in unique and luxurious properties around the world. If you don’t already have high-level elite status with a hotel, Fine Hotels + Resorts can help you access similar elite-level perks.

While access to Fine Hotels + Resorts probably isn’t at the top of your list of reasons to get the Platinum Card® or Business Platinum card, it makes an excellent — and often overlooked — bonus to pair with the other benefits and rewards that come with American Express credit cards, especially their travel cards. For some people, it might even make the Amex Platinum’s annual fee worth it.

Frequently asked questions about American Express hotels

*The information about The American Express Corporate Platinum Card® and The Centurion Card from American Express has been collected independently by Bankrate. The card details have not been reviewed or approved by the card issuer.

**Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.