How to start traveling with points, miles and credit cards

Key takeaways

- There are various types of travel rewards available, including airline miles and points, hotel points and credit card points.

- To start earning points and miles, you can utilize credit cards, book travel and take advantage of shopping portals.

- When choosing a travel credit card, consider factors like sign-up bonuses, earning potential and travel perks.

If your friends and colleagues are always taking vacations with credit card points and miles, you may be wondering how you can get in the game. Fortunately, getting started with travel rewards is easy to do if you have good credit and you’re willing to do some minimal research and planning. Sure, there are ways to truly elevate your game and become a top-tier expert, but no one starts there and that’s OK.

The most important step in the process is figuring out which travel credit card to sign up for so you can start earning points and miles. From there, you can start dipping your toes into redemption options as well.

But, what are the types of rewards you can choose from? And what’s the best way to use your credit card rewards? In this guide, we’ll help you figure out which steps to take first so you can get started with earning and using travel points and miles.

What are points and miles?

Before you can begin using travel rewards for flights, hotels and other types of travel, it helps to know the difference between points and miles. You should also know that each type of rewards currency has its own average redemption value depending on the airline, hotel or credit card rewards program.

Here’s an overview of the types of travel rewards available:

- Airline miles and points: Airline rewards come in the form of miles or points, and they’re offered through co-branded airline credit cards that are affiliated with a particular airline loyalty program. You can typically redeem airline miles for flights and expenses associated with flying, such as seat upgrades or checked bag fees.

- Hotel points: Hotel points are offered through co-branded hotel credit cards that are affiliated with a particular hotel loyalty program. These points can be redeemed for free (or discounted) award nights within a hotel loyalty program, yet some hotel points have additional redemption options like gift cards or magazine subscriptions.

- Credit card points and miles: Credit card points (or miles) are the type of rewards that fall within a credit card issuer’s rewards program, such as Chase Ultimate Rewards points, Capital One miles and American Express Membership Rewards points. These rewards can be redeemed for statement credits, gift cards, travel through the issuer’s travel portal or transfers to a brand’s airline and hotel partners.

Key tips before you start earning points and miles

There are several key credit card rules to follow, as well as mistakes to avoid, when you first open a rewards credit card. Consider the following advice before you dive into the world of points and miles for travel:

- Pay off your card in full each month. The average credit card interest rate is currently over 20 percent. With that in mind, you won’t “get ahead” with rewards if you carry a balance and pay interest over time.

- Keep an eye on your credit score. You can use credit cards to improve your credit score if you always pay your bill on time and if you consistently keep debt levels in check. Most experts recommend keeping your credit utilization ratio below 30 percent for the best results.

- Be realistic about your points and miles goals. Make sure you look for a credit card and a rewards program that aligns with your current spending and travel habits, along with your travel goals. For instance, if you don’t have a preferred airline or hotel, then a general travel credit card that offers transferable rewards and rewards that don’t expire may help you to better reach your travel goals than an airline or hotel co-branded card.

- Limit how many cards you apply for at once. Don’t go overboard and apply for every travel rewards credit card that catches your eye. If you do, you will likely see damage to your credit score due to too many hard inquiries on your credit reports.

- Pursue sign-up bonuses with care. Most travel rewards credit cards offer a sign-up bonus when you meet a minimum spending requirement within a specified time frame of opening your account. While these bonuses can be helpful, you should only pursue them if you can meet the spending threshold with regular, planned purchases and bills.

How to start earning points and miles

To start earning rewards, consider one or all of the following strategies:

Utilize travel credit cards

While you can earn travel rewards by staying in specific hotels or flying with an airline, travel rewards credit cards offer the best value and most flexible travel rewards currency; plus, they are the fastest path to building a travel rewards bank. That’s because travel credit cards let you earn points or miles for each dollar you spend. This means you can earn travel rewards on everything from your grocery bills to utility payments, gas for your car and more.

Most top travel credit cards also let you earn a big welcome offer in the first few months if you meet a minimum spending requirement and other terms. These welcome offers are typically worth anywhere from several hundred dollars to over $1,000 in travel, and they can provide a great way to reach your initial travel goals quickly. These sign-up bonuses are definitely worth pursuing — as long as you’re mindful about not overspending to earn them — so make sure to factor these offers in as you select a card.

Sign up for loyalty programs

To start earning points and miles, you’ll want to sign up for all the airline and hotel loyalty programs for brands you normally use. Fortunately, travel loyalty programs are free to join and signing up only takes a few minutes online. This means signing up for the Delta SkyMiles program if you frequently fly with Delta, just as you would sign up for the Hilton Honors program if you’re always staying in Hilton hotels.

Once you sign up, you can start earning rewards with your preferred loyalty programs for travel you’re already doing. Then, once you earn enough points or miles, you can unlock different tiers of elite status, which come with even more perks with your favorite brands.

Book travel through a travel portal

Booking travel through your credit card’s travel portal is also smart since it can provide a rewards boost for every dollar you spend. As just one example, the popular Chase Sapphire Reserve® offers 3X points on travel and dining but increases that to 5X points for flights booked through the Chase Travel portal. You can also earn 10X points for hotels and car rentals booked through the portal, which is more than three times what you would earn for booking the same options elsewhere.

Other credit card portals offered through American Express, Capital One and Citi have similar deals when you book paid travel with an eligible travel credit card, so make sure to keep this in mind.

Take advantage of shopping portals

Airline and hotel loyalty programs typically offer shopping portals you can take advantage of, but there are also card issuer portals that can help you earn more rewards. With shopping portals, you can earn extra points or miles by logging in to your account and clicking through a participating retailer’s offer before you make a purchase. While bonus offers vary, you can typically earn an extra 1X to 5X points or miles for each dollar you spend.

The main credit card shopping portals offered directly through issuers or frequent flyer programs include:

- Alaska Airlines Mileage Plan Shopping

- American AAdvantage eShopping portal

- Delta SkyMiles Shopping

- JetBlue TrueBlue Shopping

- Southwest Rapid Rewards Shopping portal

- Shop Through Chase

- United MileagePlus Shopping

Keep in mind: You can also earn American Express Membership Rewards points by shopping through Rakuten. However, there are a few additional steps to take before you can do so, including connecting your accounts.

Don’t skimp on dining programs

A number of hotel and airline loyalty programs also offer dining programs that allow you to earn extra rewards. For the most part, all you have to do to earn points or miles in these programs is sign up, dine at participating restaurants and pay for the meal with a connected credit or debit card. Other stipulations can also apply to earn bonus rewards, including hitting a minimum spending requirement per meal, but the limits tend to be low (at least $25 per meal with some programs).

Airline and hotel dining programs include:

Pay attention to spending category bonuses

Making sure you’re maximizing your credit card’s bonus category rewards is another way to earn more points and miles over time, and without a ton of work. This move is especially important with travel credit cards since they tend to offer a lower rewards rate for regular purchases and more rewards in bonus categories like dining, travel or gas stations.

As an example, the Citi Strata Premier® Card offers more than the standard earning rate on hotels and car rentals booked through Citi Travel, air travel and hotels booked directly, restaurants, supermarkets, gas and EV charging stations. By using this card for purchases in all these categories instead of other forms of payment, you can earn a bigger points haul over time.

How to choose a travel credit card

Before you choose a new credit card, do your homework so you have an understanding of which cards you’re likely to qualify for.

- Know your credit score. Most travel rewards cards require good or excellent credit for approval.

- Understand issuer-specific approval rules. Chase famously follows the 5/24 rule, which states you won’t be approved for a Chase card if you’ve opened five or more cards with any issuer in the past 24 months.

- Consider using Bankrate’s CardMatch™ tool to find a new card. The CardMatch tool can help you discover cards you may be eligible for and potentially avoid an unnecessary hard credit inquiry.

Once you have a good idea of where you stand, it’s time to determine which specific card to apply for. Consider the following:

Popular travel credit cards to consider

While there are numerous travel credit cards that might suit your needs, the chart below highlights some of the most popular options to check out:

| Travel credit card | Best for |

| American Express® Gold Card | Big food spenders |

| Bilt Mastercard® | Earning rewards on rent |

| Capital One Venture Rewards Credit Card | Flexible rewards |

| Capital One Venture X Rewards Credit Card | Premium travel benefits |

| Chase Sapphire Preferred® Card | Access to Chase transfer partners |

| Chase Sapphire Reserve® | Luxury travel perks |

| Citi Strata Premier® Card | Transfers to Citi transfer partners |

| Wells Fargo Autograph® Card | Everyday spending |

| Wells Fargo Autograph Journey℠ Card | Travel purchases |

How to redeem points and miles

Ultimately, how you can use credit card points and miles depends on the travel credit card you sign up for and the rewards currency you earn. Here’s a rundown of the main ways to redeem your rewards:

Maximize points by using travel partners

If you choose a travel credit card with transferable points, make sure you learn about the program’s airline and hotel partners and how they work. You’ll also want to get accustomed to checking award pricing with partners to see if you can get a better deal, as well as the process required to actually transfer points to a partner.

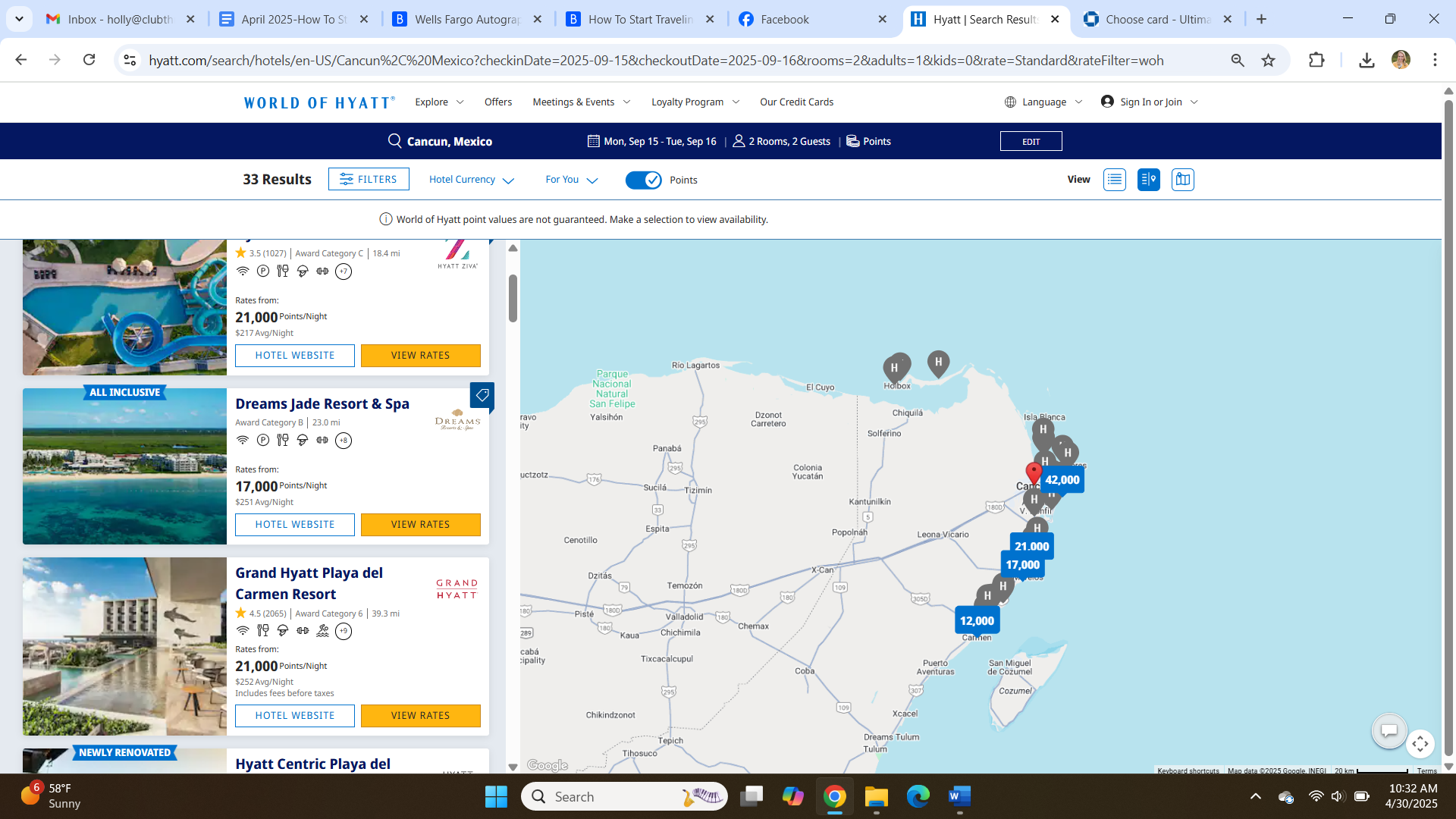

Why does this matter? While there are exceptions, you can often find better award pricing with partners than you’ll pay if you use a travel portal or book with cash. When we searched the World of Hyatt program for a hotel in Cancun, Mexico over dates in September 2025, for example, we found you can book the Dreams Jade Resort & Spa for 17,000 World of Hyatt points or $251 per night. Transferring points to Hyatt in this scenario would get you a point valuation of 1.47 cents per point.

This is a better per-point value than you would get if you booked this same hotel (and found the same price) through Chase Travel and you had the Chase Sapphire Preferred, since this card offers 25 percent more value for points when you redeem for travel through Chase (1.25 cents per point).

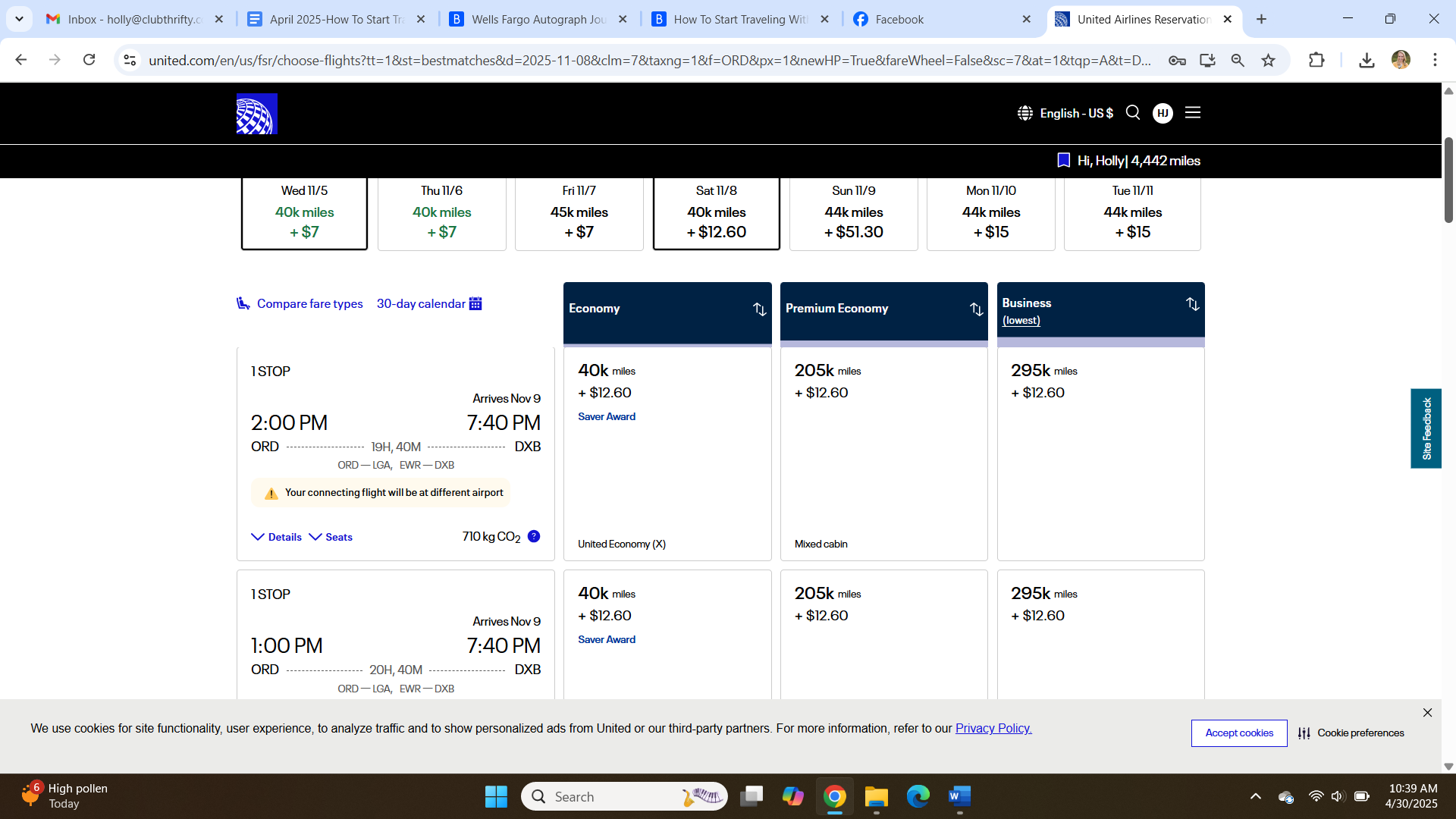

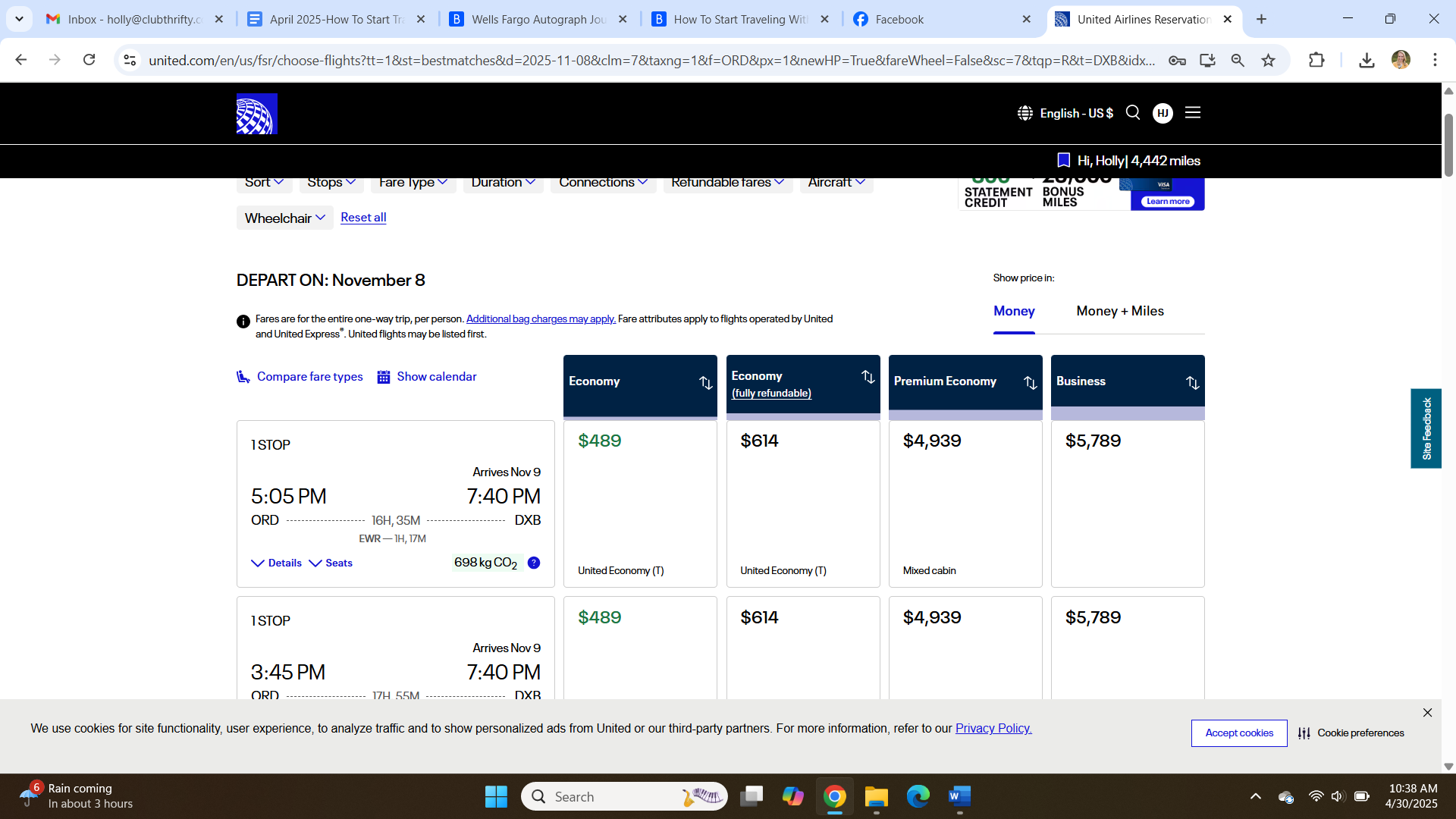

The same potential for a better rewards value also applies with airfare, particularly when it comes to premium seats with specific airline partners. For example, we found one-way award flights in business class with United from Chicago to Dubai for 295,000 miles plus $12.60. However, the same flight would cost $5,789 in cash. This works out to a point value of 1.9 cents per mile.

The bottom line

Taking the leap into the world of travel rewards can be intimidating when you read about complicated redemptions and multi-card strategies. But it doesn’t have to be. Get started with a single card or loyalty program that fits well into your lifestyle, budget and travel goals. You can always expand your plan and add complexity as you get more comfortable with using your rewards.

The key is to understand your own credit history as well as the plans you have for your travel rewards strategy. Saving even a small amount on your next vacation because of your smart use of travel rewards should motivate you to keep learning.

Frequently asked questions about travel credit cards

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.