What is a credit card?

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict , this post may contain references to products from our partners. Here's an explanation for . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

Key takeaways

- A credit card is a useful financial tool that allows you access to a line of credit that serves as a loan.

- You can use a credit card to build your credit, which is helpful for meeting future goals like homeownership.

- Debit cards are different from credit cards in that you can only access money you have in the bank, and they offer lower levels of protections than a credit card.

- Use your credit card wisely to avoid overspending and paying interest on balances accrued.

When you need to pay for groceries, cover an emergency car repair or pay your insurance bill, you might simply swipe your debit card to pull money straight from your bank account. But when you don’t have the cash or prefer to earn rewards, there’s another plastic payment card that could help you out — a credit card. This is essentially a loan you can continue using and repaying without applying for another one.

Credit cards are issued by banks and financial institutions with a credit limit,which is the total amount you’re approved to borrow. Whatever you spend on the credit card adds to your balance and could owe interest charges as well.

The interest or annual percentage rate you’re charged can lead to debt if you continuously spend more than you can pay off each month. When used wisely, however, a credit card can be a powerful financial tool and a key part of building credit that helps you achieve future goals — like buying a car or home. You can also use credit cards to earn rewards — such as cash back or points — on purchases and to take advantage of card benefits, like interest-free intro periods or fraud protection.

When choosing a card that’s right for you, it’s helpful to understand what a credit card is and how it works, including what different card-related terms mean. We break down what you need to know about that plastic payment card in your wallet.

How do credit cards actually work?

Simply put, a credit card is a small loan from an issuing bank. While it can be easy to look at credit cards as “free money,” this loan is subject to an APR — otherwise called interest — that’s charged to your balance if you don’t pay off your statement in full at the end of a billing cycle. It’s called “revolving credit” because you’re able to borrow as often as you’d like, up to a predetermined credit card limit, and repay the borrowed amount in installments.

Your credit limit is the maximum amount of money the card issuer will allow you to spend with the card. Issuers usually establish the limit based on your credit score, income, debts and other criteria they look at as part of the credit card application approval process.

When you make a purchase with your credit card, one of four major payment networks — Visa, Mastercard, American Express or Discover — processes your transaction. Their role is to ensure the merchant receives money for the transaction, and that your card issuer bills you for the purchase.

After you purchase goods or services with a credit card, that purchase amount is deducted from your available credit limit. On the other hand, when you make a payment on your credit card account, that payment opens up available credit to use for future purchases.

Important credit card terms

Before applying for a credit card, it’s important to familiarize yourself with common credit card terms.

Key terms

- Interest rate

- Interest is a fee that banks charge on the line of credit they extend to their customers. Interest rates vary depending on the card and credit score of the person applying for the card. Generally, you can avoid interest on purchases by paying off your statement balance by the due date each billing cycle. Interest rates often vary among purchases, balance transfers and cash advances. Additionally, purchases are the only type of transaction that typically includes an interest-free grace period.

- Credit limit

- A credit limit is the spending limit on a credit card. For people with limited or no credit history, your initial credit limit may only be a few hundred dollars. For veteran cardholders, credit limits can be much higher — often into the thousands of dollars.

- Credit score

- A credit score is a rating that allows lenders, including card issuers, to determine your creditworthiness — or the risk they take on by approving you for a loan or credit card. Two popular scoring models, FICO and VantageScore, range from 300 to 850. The factors that determine your credit score include your payment history, length of credit history, credit utilization, new credit inquiries and types of accounts.

- Credit card balance

- A credit card balance is the amount of money you’ve spent on your credit card and owe the issuer at the end of your billing cycle.

- Statement balance

- At the end of each billing cycle your statement lists the total amount of your purchases minus payments or returns plus any remaining balance from the previous month and any accrued interest or fees. The statement balance also helps determine your monthly minimum payment.

- Available credit

- When you swipe your credit card, the purchase is deducted from your overall credit limit. What's left is your available credit or how much of your credit limit is available to spend.

Differences between credit cards and debit cards

To understand credit versus debit, you need to know what credit cards can offer that debit cards can’t.

Let’s start with how a debit card works. When you use a debit card to make a purchase, the cost of the item you’re buying is deducted — or debited — from a linked bank account. Think of it as a cash-equivalent payment tool: Debit cards may be plastic, but every time you pay with a debit card, you’re actually spending cash you’ve already deposited into a bank account.

A credit card is different in that it offers you credit — that is, the ability to buy something now and pay for it later. If you can’t pay off your credit card bill in full at the end of your billing statement, you typically have the option to pay it off over time. Most credit card issuers charge interest on unpaid balances. For some people, however, the flexibility of carrying a balance when needed is worth the extra interest charges.

An important difference between credit and debit cards is how they handle fraud and security. Both types of cards fall under federal fraud law that limits how much you’re responsible for after fraudulent or unauthorized charges, though credit cards are considered a more secure financial tool. Federal law stipulates you aren’t responsible for more than $50 as long as you report the fraudulent credit card charges within 60 days of them appearing on your statement. Going a step further, nearly all major credit cards offer $0 liability protection for a period of time.

Debit cards, on the other hand, come with liability that depends on how quickly you report a lost or stolen card. For example, if it takes more than two business days to report a missing or stolen debit card, you could be on the hook for as much as $500.

This is why many financial experts recommend using credit cards over debit cards — especially when making purchases online, at gas stations or anywhere else that’s a potential fraud risk.

Pros and cons of using credit cards

Credit cards come with a lot of advantages, but there are a few drawbacks to using credit that you should keep in mind.

In most cases, the negative aspects of credit cards can be avoided by practicing responsible credit habits. If you always make your credit card payments on time, for example, you never have to worry about how a late payment can affect your credit score. By keeping your credit card purchases within your budget, you won’t have to worry about going into credit card debt — or getting out of it in the future.

Here’s what to consider when weighing the benefits and drawbacks of credit cards.

| Pros | Cons |

|---|---|

| You can make purchases now and pay them off later. | Making purchases you can’t pay off can lead to credit card debt. |

| You can earn rewards on everyday expenses. | Learning how to maximize your card rewards takes time. |

| You can pay off your balance in full or pay it off over time. | Any balance not paid off in full can accrue interest that generally compounds daily. |

| You can take advantage of money-saving features like 0% intro APR offers on purchases and balance transfers. | If you don’t pay off your balance before a 0% intro APR offer ends, you could get stuck with high interest charges. |

| Credit cards are easy to use and widely accepted. | Certain cards — such as Discover or American Express — might not be accepted as widely by every merchant. |

| Good credit habits help you build a positive credit history and credit score. | Poor credit habits can damage your credit history and lower your credit score. |

| Credit cards can protect against fraud. | A credit card fraud investigation can take up to 90 days to complete. |

Types of credit cards

Each type of credit card has different uses and some offer specific types of rewards. The card you choose will depend on your personal financial situation, goals and how you prefer to be rewarded for your purchases.

| Type of credit card | Primary benefit |

|---|---|

| Secured credit cards | Building credit |

| Student credit card | Lower application approval standards for college students to build credit early and learn to use it responsibly. |

| Store credit cards | Discounts and exclusive offers at a store you frequent. |

| Balance transfer credit cards | Transferring balances from other credit cards to take advantage of low APR or zero APR offers. |

| Travel rewards credit cards | Earning miles or points toward future travel through your spending. |

| Co-branded airline credit cards and hotel credit cards | Exclusive benefits with partnered airlines and hotels like free upgrades, free checked luggage or early check-in. |

| Cash rewards credit cards | Earning a percentage of cash back on your spending to redeem for statement credit, or a cash deposit to your checking account. |

| Points credit cards | Earning points on your purchases to redeem for travel, merchandise or cash. |

How much do credit cards cost?

The costs associated with a credit card depend on how you’re using it and which one you choose.

The important thing to remember is that credit cards aren’t “free money”; they are loan products that can come with significant expense — especially if you don’t have a plan for paying off the balance consistently and completely.

At the most basic level, simply carrying a credit card can be “free” if you have one of the many high-quality no-annual-fee credit cards out there. Other cards charge annual fees that can range into the hundreds of dollars and usually offer perks, benefits and rewards that could make the annual fee worth it for the right consumer.

Beyond the annual fee, there are additional common credit card fees to keep in mind.

Understanding the costs of credit cards

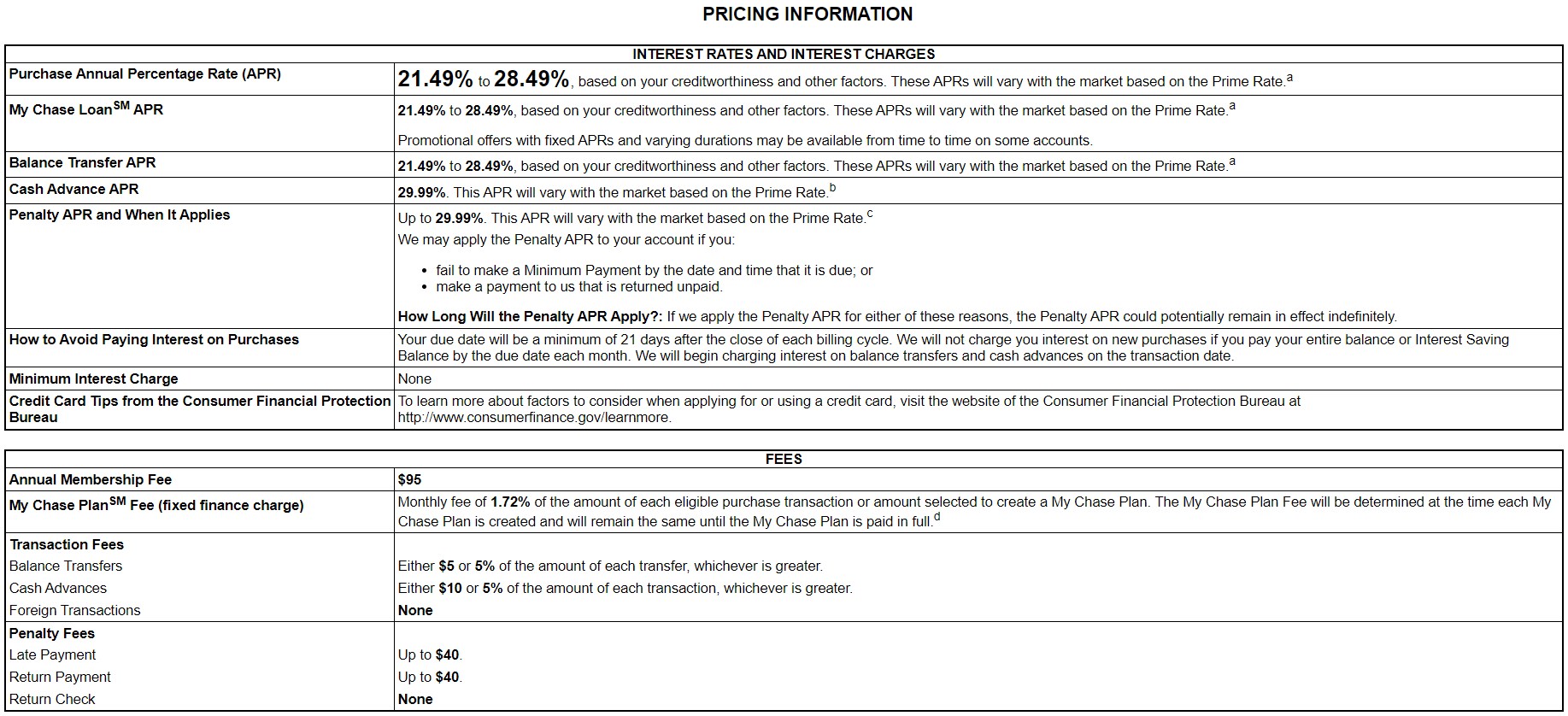

One of the best ways to understand the costs associated with a credit card you’re interested in is to read the terms and conditions document. This might also be titled “rates and fees” or “pricing and terms.” Although some of it might look intimidating there’s a specific section you should pay close attention to that outlines the costs in plain terms. It’s called the Schumer box.

Some of the terms used may look unfamiliar if this is your first time seeing it, but here’s a quick look at the fees you’ll find there.

Key terms

- Purchase annual percentage rate

- More commonly called your APR, this is another name for your credit card’s interest rate. An APR represents the total cost of financing a loan, including fees associated with borrowing the money. In the case of credit card financing, there’s little difference between your APR and your interest rate. APR is often broken out into purchase, balance transfer, cash advance and intro rates.

- Balance Transfer APR

- Some credit cards allow you to transfer the balance of one card to another. The Schumer box will display the APR for this type of transaction. Some cards offer you a 0 percent APR on balance transfers for a limited time, which will also be disclosed in the Schumer box if it applies.

- Cash advance APR

- A cash advance is when you use your credit card to withdraw cash via an ATM or bank transaction. Cash advances are usually subject to additional fees and a higher APR and often have no grace period — meaning, they accrue interest immediately. They’re best used for emergencies only.

- Annual membership fee

- An annual fee is the yearly cost associated with certain credit cards. It's usually charged at account opening and is billed to your account each year you keep the card open. Credit cards with an annual fee typically come with purchase rewards, a welcome offer or other benefits which could offset the cost.

- Balance transfer fee

- This is the amount you'll pay if you do a balance transfer to your card. It's expressed as a percentage of the amount transferred.

- Foreign transaction fee

- Your card issuer may charge a fee for processing transactions in a foreign country. This can apply when purchasing foreign goods online as well.

- Cash advance fee

- Your issuer will charge you a percentage of your withdrawal when you make a cash advance.

- Late fee

- Miss a payment and you could be charged this fee.

- Penalty APR

- If your monthly payment is late by 60 days, the interest rate on your credit account could increase. Depending on the card issuer, this could be temporary for up to six months or indefinitely.

To avoid these fees, make every effort to pay your credit card on time, every time and avoid spending more than you can afford to repay. You’ll also want to get accustomed with the pricing terms and conditions for your credit card so you’re aware of what fees you might be responsible for before applying.

How do credit card issuers make money?

All of those fees, charges and interest we mentioned — that’s a key way credit card issuers make money. A 2022 report from the CFPB, found that credit card issuers charged Americans $130 billion in credit card fees and interest that year alone.

The other revenue card issuers collect comes from fees they charge to merchants and stores where you swipe your card. So even if you take advantage of the grace period to avoid paying interest on your no-annual-fee card, they’re still making money — just not from you.

What can you buy with a credit card?

Credit cards are versatile so you can use them to buy almost anything. Dinner with a friend? Sure. Plane tickets to Thailand? Yup. Repairs on your car? Can do.

As long as the merchant accepts your card, you can use it. But just because you can doesn’t mean you should. Rather than swiping for any and everything, a smart credit card user makes their purchases based on their goals.

- Building credit? Make small regular purchases you can afford to pay off each billing cycle.

- Earning a sign-up bonus? Make purchases that fit the spending requirements and meet the deadline. As long as you can quickly pay it off, one or two large lump-sum purchases are an excellent way to quickly meet a sign-up bonus requirement.

- Saving up points or miles for travel? Focus spending on your card’s highest rewards categories. Otherwise, use the card as often as possible, but stay within your budget.

- Transferring a balance to save on interest? Avoid making purchases on the card. Calculate the monthly payment you’ll need to finish paying it before the zero interest period ends.

By using your credit card to achieve your goals rather than spending irresponsibly, it becomes a tool instead of a hindrance.

How to choose a credit card

You don’t have to choose the card everyone else has or the one with the most attractive benefits. To choose the best credit card for you, follow these tips to find one that fits your needs and lifestyle.

- Know your credit score. You should only apply for cards for which you have a reasonable expectation of approval. If you’re just starting your credit building journey, skip premium rewards cards and focus instead on the top cards for people with no credit.

- Analyze your spending habits. Determine what category most of your spending already falls into. If you spend most of your budget on gas and groceries, find a card with high rewards for those purchases.

- Determine your goals. How can a credit card help you? Are you using it to build your credit, earn rewards, protect from fraud or transfer a balance? Focus on one or two goals your next credit card can help you achieve.

- Review sign-up bonuses. If you’re deciding between multiple credit cards, it wouldn’t hurt to earn extra rewards or a statement credit from buying what you already planned to. Just make sure you’d still find the card useful after you get the welcome offer.

- What is the fee structure? A credit card may have excellent rewards, but if you know you’re going to carry a balance, the interest rate could make it costly. Costs like an annual fee could make it unaffordable or inconvenient.

- Use Bankrate’s CardMatch™ tool. When you want to find the right credit card without spending hours on research, use Bankrate’s free CardMatch™ tool to find one that fits your finances. Answer a few quick questions and get the best matches delivered straight to you.

Who should get a credit card?

Credit cards are a useful and versatile financial tool that can benefit nearly everybody — regardless of age, income or credit history.

Using a credit card is among the best ways to begin building credit. Many types of credit cards are relatively easy to obtain, which makes them a great option for young adults and college students who are ready to begin building their financial futures. There are credit cards designed to help those with a bad credit history rebuild it or those with no history to start building it.

For those who already have good or excellent credit, credit cards can provide several additional benefits. Cash back credit cards, for example, provide cardmembers a percentage of cash back on purchases, while the best travel rewards credit cards offer members hundreds of dollars in travel rewards and benefits.

There are credit cards designed for business owners, too. Like with personal cards, business credit cards often provide rewards and cash back on purchases used to build or run a business. They offer many of the same benefits and fraud prevention features as personal cards, and you can often get additional cards for employees at no extra cost. And any cash back or rewards earned can be used by the business.

The bottom line

Used responsibly, a credit card can be a powerful financial tool. Once you understand the basics of how they work and how they can help build credit, you can begin exploring what various types of credit cards can offer customers.

After that, compare multiple brands and issuers to choose the best credit card to fit your budget, spending habits and financial needs. Armed with the best card for your personal situation, you’ll be on the path to building and using credit to help achieve your long-term goals.

Related Articles