Cash out refi vs. home equity loan: What you need to know

Key takeaways

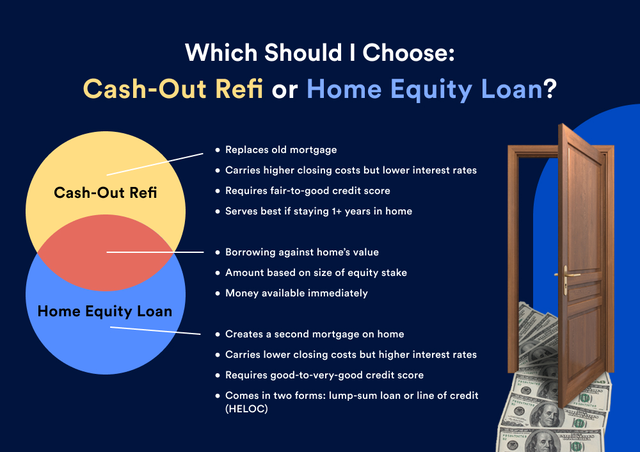

- A cash-out refinance replaces your existing mortgage with a new one; a home equity loan is a second mortgage on top of your primary one.

- A home equity loan works well if you have a big ownership stake and need a large, fixed lump sum.

- A cash-out refinance may be the smarter option if you want a lower interest rate and to deal with just one big debt.

If you need money and have a sizable amount of home equity built up, you may want to tap into that equity for the funds. Both a cash-out refinance and a home equity loan allow you to borrow against your ownership stake, using your home as collateral.

They work differently, though. A cash-out refinance involves replacing your existing mortgage with a new one, while a home equity loan is a second mortgage you take out in addition to your primary one.

If you’re weighing a cash out refinance vs. a home equity loan, how do you decide which is the better option? Here are the benefits and risks to consider for each.

Cash-out refinance vs. home equity loan

Cash-out refinance |

Home equity loan |

|---|---|

| Fixed or adjustable interest rate | Fixed interest rate |

| Interest rates comparable to purchase mortgages | Interest rates 2-3% above mortgage rates |

| Must maintain 20% equity stake in home | Must maintain 15%– 20% equity stake in home |

| Tax-deductible interest on mortgage principal; cash-out portion deductible if used on the home | Tax-deductible interest, if funds used to “buy, build, or substantially improve” the home |

| Closing costs of 2-6% of loan principal | Closing costs of 1-5% of loan principal |

| Debt-to-income ratio maximum of 43% | Debt-to-income ratio maximum of 43% |

| Loan-to-value limit of 80% | Loan-to-value limit of 80-85% |

| Minimum 620 credit score | Minimum 640 credit score |

What is a cash-out refinance?

A cash-out refinance pays off the remaining balance on your first home loan and replaces it with a new mortgage. The newly refinanced loan amount is for the remaining debt owed on the first mortgage, plus the amount you’re “cashing out” — that is, borrowing — from the equity. The loan term can be up to 30 years, and the interest rate — which can be fixed or variable — will reflect prevailing market rates. Cash-out refi rates tend to be a bit higher than traditional rate-and-term refinance rates, but overall, they’re comparable to purchase mortgages.

Some lenders and federal programs may set lower credit score requirements for cash-out refinancing. Because the refinancing lender assumes the first mortgage during a cash-out refi, that lender becomes the primary lien-holder in the event you default. With easier access to your home as collateral, lenders might be willing to offer lower rates compared to what you’ll get with a home equity loan.

Pros

- Lower credit requirements

- One loan rather than multiple loans

- May boost credit score

- Lower interest rates than other types of debt

- Can be used for any purpose

Cons

- Risk of foreclosure

- Long application process

- At least 20% home equity stake required

- Closing costs can be high

- Low debt-to-income ratio required

Cash-out refinance fees

Closing costs for cash-out refis typically range from 2 percent to 6 percent of the loan’s amount. Cash-out refis usually cost less than primary mortgages, as they don’t require certain expenses, like title searches and title insurance, that are common when buying a home. But you can expect to see certain familiar fees: The lender will likely charge you for an appraisal of the property, for example.

What is a home equity loan?

A home equity loan is a second mortgage against your home with its own terms and interest rate that are separate from your first mortgage. By refinancing using a home equity loan, you’re borrowing against the home’s equity — the difference between the appraised value of your home and what you owe on your mortgage. You can typically borrow up to 85 percent of your home’s equity. However, your loan size depends on other financial factors, like your income and credit history, and the outstanding balance on your first mortgage.

Home equity loans typically have a repayment period of up to 30 years, just like mortgages. Home equity loan rates may be higher than those of refis. The differences, however, vary significantly from lender to lender and over time.

Pros

- Fixed rates offer certainty

- Lower rates than unsecured debt

- Long repayment terms/low monthly payments

- Interest can be tax-deductible

- Use the cash for almost any purpose

Cons

- Foreclosure risk: home is collateral

- Higher credit requirements

- 15%-20% home equity required

- Must be paid off when home is sold

- Easy to overborrow due to lump sum distribution

Home equity loan fees

Home equity loan fees vary a good deal among lenders, highlighting the importance of comparing offers. While some lenders waive origination fees — often a big chunk of total closing costs — they may implement a slightly higher interest rate as compensation. And it’s likely that, as with the refi, you’ll have to pay for an appraisal and various administrative fees. In general, though, home equity loan closing costs tend to be lower than those for a refi: While they could be as much as 5 percent of the loan principal, they often are as low as 1 percent. That’s partly because you may incur fewer costs, but also because you’re likely borrowing a smaller amount, so percentage-based expenses — like origination fees — will be less.

When does a cash-out refinance make sense?

Cash-out refis generally have lower interest rates and are easier to qualify for, making them appealing to people who have less-than-perfect credit scores. They offer an option for homeowners to borrow a lump sum for planned expenses, with only a single repayment to track.

However, they replace your existing mortgage with a new one, meaning a new payment term and interest rate. You’ll have to pay new closing costs, too. If you got a great deal on your initial mortgage, you might not want to give it up if rates are now substantially higher. Or, if you’ve had your mortgage a long time, and your payments are now primarily going towards principal (not interest), you might not want to reset the amortization clock with a new loan.

A cash-out refi also tends to make sense if you were thinking of swapping out your current mortgage anyway — perhaps because of a big drop in interest rates. Also if you can get a better rate on a new mortgage than you have on your existing one or, you want to adjust the repayment term of your loan.

When does a home equity loan make sense?

Home equity loans let you keep your existing mortgage. That can be helpful if you got a good deal on your original loan and want to keep it for as long as possible. Or just don’t want to mess with it, in general.

A home equity loan is a good option for those who’ve paid down a solid chunk of their mortgage and built up a lot of equity in their homes, and who have a strong credit history and score. The overall process of taking out a home equity loan can be simpler and quicker than that of a cash-out refinance, too.

If your financials ensure you’ll get a good rate on the loan — one that’s competitive with refi rates — and you’re able to find a lender that waives most closing costs, a home equity loan could be the right choice.

Another way to borrow against your home equity is a home equity line of credit (HELOC). HELOCs give you more flexible access, letting you draw funds multiple times whenever you need to over a multi-year period. However, they usually have variable interest rates, which means your payments can be unpredictable. Just as with a home equity loan or a cash-out refi, your home is collateral, and you risk losing it if you can’t make payments.

Cost comparison: 15-year cash-out refi vs. 15-year home equity loan

The table below compares the costs of a cash-out refinance with that of a home equity loan, as of June 17, 2025. In this scenario, the refi comes out cheaper, despite its higher closing costs — because its interest rate is significantly lower than the home equity loan’s.

15-year cash-out refi |

15-year home equity loan |

|

|---|---|---|

| Loan amount | $150,000 | $150,000 |

| Closing costs | $2,400 | $600 |

| Interest rate | 6.16% | 8.33% |

| Monthly principal and interest | $1,279 | $1,462 |

| Total cost in first 24 months | $33,091 | $35,693 |

| Total cost in first 48 months | $63,782 | $70,786 |

| Total cost in first 120 months | $155,855 | $176,064 |

| Total loan cost | $232,620 | $263,760 |

Bottom line on cash-out refi vs. home equity loan

In the cash-out refinancing vs. home equity loan contest, remember that both are strategic ways to access the equity you’ve built in your home. However, you have to consider your financial situation, goals and how you plan to use the funds to determine the best approach. It’s equally important to consider the qualification criteria for both options to gauge which you’re most likely to get approved for.

Regardless of which path you choose, always shop around and compare offers from several lenders. Also, make sure you get an itemized list of fees from your lender before committing, so you can calculate how much the loan will cost.

FAQ

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.