Southwest Rapid Rewards guide

Key takeaways

- While Southwest Airlines made sweeping changes in the last year, including ending its free checked bags stance, the company’s loyalty program is still impressive with its lack of blackout dates and flexible rebooking policy.

- Southwest Airlines is also known for its popular Companion Pass, which lets users add a companion to flights they take for the cost of airline taxes and fees.

- Members can earn points in the program through flights with the airline, spending on Southwest credit cards and other qualifying activities.

Southwest Rapid Rewards has long been a popular frequent flyer program, but Southwest Airlines announced dramatic policy changes in 2025 that fundamentally altered some of the most visible features of the airline. Not only did Southwest announce it would start charging for checked bags, but it updated how many miles you can earn for flights. The airline also unveiled a plan for new cabin offerings with extra legroom seating and is letting customers choose an assigned seat ahead of their flight.

Still, some aspects of Southwest’s frequent flyer program aren’t changing at all. Rapid Rewards is remains unique in that it comes with unlimited rewards seats, no blackout dates and points that never expire. Southwest Airlines also continues to offer its famous Companion Pass as well, which allows users to book a companion to fly with them for just the cost of taxes and fees each time they book airfare with points or cash.

Southwest Rapid Rewards points can be redeemed for flights, other types of travel, gift cards and more, so they’re slightly more flexible than other airline-based rewards. Better yet, Southwest is a Chase transfer partner, so you can rack up rewards with Chase travel credit cards and transfer them to your Southwest Rapid Rewards account later.

If you’re curious about how this program works, read on to learn about the best ways to earn and redeem Southwest points, the program’s elite status tiers and more.

Southwest Rapid Rewards basics

Southwest Airlines flies to over 100 destinations across the United States, Central America, the Caribbean and Mexico. That said, Southwest does not belong to an airline alliance, so you can’t use points to book with other airline partners.

How many points you’ll earn when you fly with the airline depends on your elite status level (if you’re an elite flyer) as well as the type of fare you book. Also, note that Southwest changed some of its fare types in 2025, including the replacement of its old Wanna Get Away fares with a basic fare.

Points you’ll earn for flying, by fare type and status tier

Here’s a breakdown of how many points you’ll earn for flying, by elite status and by fare type:

| Basic Fare |

Wanna Get Away Plus fare |

Anytime fare |

Business Select fare |

|

|---|---|---|---|---|

| Base | 2X points | 6X points | 10X points | 14X points |

| A-List tier | 2.5X points | 7.5X points | 12.5X points | 17.5X points |

| A-List Preferred tier | 4X points | 12X points | 20X points | 28X points |

Southwest has different earning rules for non-elites as well as those who have A-List or A-List Preferred status with the airline. We’ll go over the types of Southwest elite status and how you can earn them later in this guide.

How to earn Southwest Rapid Rewards points

While you can earn Southwest Rapid Rewards points by booking paid airfare through the program, there are other ways to earn rewards. Consider the following strategies to increase your Southwest points haul:

Earn points through Southwest partners

Flying Southwest may be one of the best ways to earn Rapid Rewards points, but it isn’t the only way. The Southwest Rapid Rewards program partners with popular brands like Marriott Bonvoy, Alamo, Hertz and many more. The number of points you’ll earn will vary depending on the partner, but you can earn points when you book an eligible hotel or rental car or make an eligible retail purchase.

Earn points through Southwest’s shopping portal

Southwest Rapid Rewards has its own shopping portal that lets you rack up points when you make purchases online. How many points you can earn varies by retailer and current promotions, but you can typically earn 2X to 5X points per dollar spent on eligible purchases when you click through the portal before you shop.

Earn points through Southwest’s dining program

You can also join the Rapid Rewards Dining program to earn points when you eat out. Rapid Rewards Dining members can earn 3X points per dollar spent at participating restaurants when they opt in to receive email communications and pay with their linked card.

For a limited time, new members can even earn 500 bonus points within the first 30 days of joining the program. To achieve this bonus, you have to create a new account and spend $25 or more at a participating restaurant and complete an online review within the 30-day period.

Earn points through credit card spending

Chase offers a handful of co-branded credit cards with Southwest. These cards let you earn points for every purchase you make while enjoying perks like early boarding and discounts on in-flight purchases. With that in mind, signing up for a Southwest card could be well worth it.

Additionally, Southwest is a partner of the Chase Ultimate Rewards program; as such, you can use an eligible Chase credit card to rack up Ultimate Rewards points and then transfer them to Southwest Rapid Rewards.

How to redeem Southwest Rapid Rewards points

Once you have Southwest Rapid Rewards points to spend, there are plenty of ways to use them. Consider the following strategies to get the most value from your rewards.

Redeem for flights

The number of points required to book a flight varies based on the dollar value of the flight. This means when a Southwest flight drops in price, so does the number of points required to book the flight using your rewards. Also, note that the fare type will dictate how many points you need for a flight award. For example, Basic and Wanna Get Away Plus flights cost less than Business Select flights.

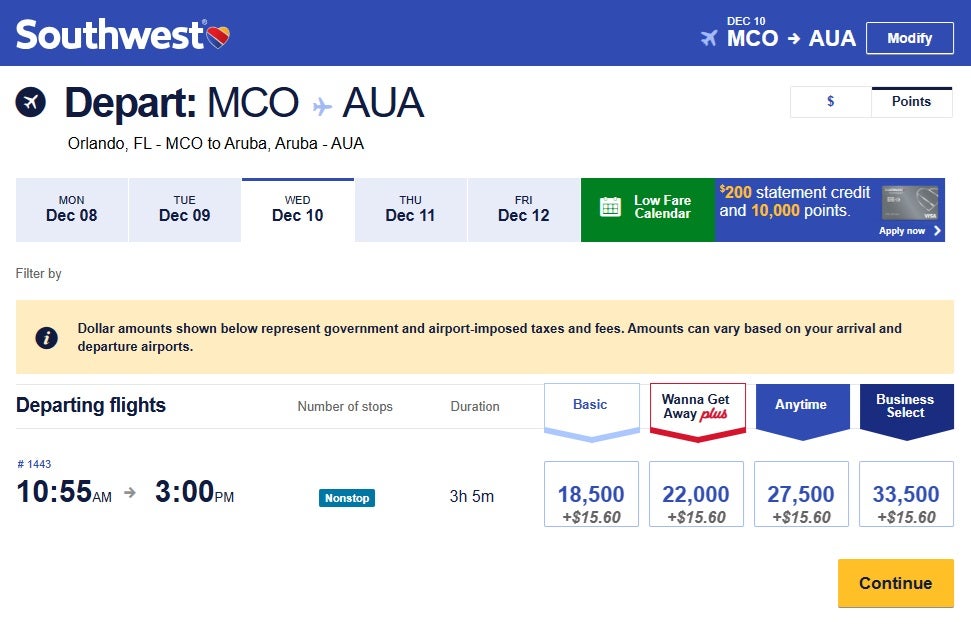

Here’s an example of the cost of a Southwest flight in points. Imagine you want to fly from Orlando, Florida (MCO) to the Caribbean island of Aruba (AUA) in December of this year. In this scenario, a non-stop, one-way flight would set you back 18,500 to 33,500 points (plus $15.60 taxes and fees) depending on the fare type you book.

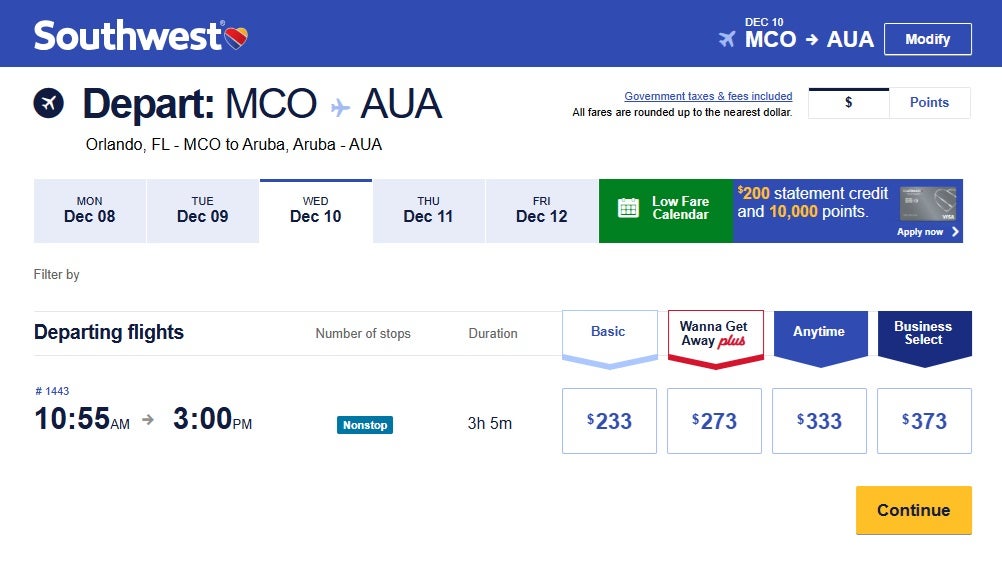

Meanwhile, checking the cash price for the flight shows that the same one-way would set you back between $233 and $373 depending on the fare type you book.

When you do the math on these potential redemptions, you can see this particular Basic fare comes with a value of just under 1.2 cents per point and Business Select redemptions clock in just under 1.1 cents per point in value. This is less than our estimated value for Southwest Rapid Rewards points, which is 1.5 cents each.

Southwest also introduced a Cash + Points redemption option for airfare in April 2024. This option lets users pay for a flight with a combination of cash and points, which can come in handy if you’re short the points you need for a redemption.

Redeem for other travel

Southwest lets you redeem points for stays at more than 400,000 properties around the world. Redemption options and available properties vary, as do the number of points you’ll need to cash in for a free night.

Redeem for gift cards or merchandise

You can also cash in Southwest points for gift cards with retailers like the Cheesecake Factory, Panera or Lowe’s. Alternatively, you can redeem rewards for select merchandise available through Southwest.

Redeem for experiences and events

Some experiences are also bookable with points, including spa packages and outdoor adventure tours. If you’re a Southwest credit card member, you can also use points to book exclusive events through Rapid Rewards Access Events.

How much are Southwest Rapid Rewards points worth?

According to our internal points and miles valuations, Southwest Rapid Rewards points are worth about 1.5 cents each. This means that 50,000 Southwest Rapid Rewards points could be worth around $750 if used for airfare.

However, changes to the program show that many redemptions from the airline come with lower point values overall. Make sure you run the numbers to know how much value you’re getting for each point you redeem before you book a flight.

How do Southwest Rapid Rewards points compare to other programs?

While some frequent flyer miles are worth more than Southwest points, rewards earned in the majority of programs are less valuable on average. The chart below shows how Southwest points compare in value to rewards from several other popular programs.

| Airline loyalty program | Bankrate value |

|---|---|

| Southwest Rapid Rewards | 1.5 cents |

| Hawaiian Airlines HawaiianMiles | 0.7 cents |

| Cathay Pacific Asia Miles | 2.9 cents |

| American AAdvantage | 1.0 cents |

| Delta SkyMiles | 1.2 cents |

| JetBlue TrueBlue | 1.3 cents |

| Virgin Atlantic Flying Club | 2.6 cents |

Southwest Rapid Rewards elite status tiers and benefits

Southwest Rapid Rewards offers two main status tiers: A-List and A-List Preferred. It also offers a highly-celebrated Companion Pass that’s considered the best in the industry.

Having elite status with Southwest helps you earn more rewards each time you pay for a flight, and it qualifies you for a free checked bag benefit even though other passengers now have to pay. The chart below shows how you can achieve each status tier, along with the Companion Pass, and the perks you’ll get when you do:

| Elite status tiers and benefits | A-List | A-List Preferred | Companion Pass |

| How to earn it | Fly 20 qualifying one-way flights or earn 35,000 tier qualifying points in a calendar year | Fly 40 qualifying one-way flights or earn 70,000 tier qualifying points in a calendar year | Fly 100 qualifying one-way flights or earn 135,000 qualifying points in a calendar year |

| Earning bonus | 25% | 100% |

N/A |

| Benefits |

|

|

|

Southwest Rapid Rewards partners

Southwest Airlines doesn’t have any airline partners because it’s not a part of an airline alliance. However, the program does partner with other travel brands to help Rapid Rewards members earn more rewards. Here’s a rundown of major Southwest partners you should be aware of:

- Hotel partners

- Best Western

- Choice Hotels

- Marriott Bonvoy

- MGM Rewards

- Southwest Hotels

- World of Hyatt

- Rental car partners

- Alamo

- Avis

- Budget

- Dollar

- Hertz

- National

- Payless

- Thrifty

- Other partners

- Emergency Assistance Plus

- eRewards

- NRG

- Reliant

- Bilt

- Rewards for Opinions

Best cards for Southwest Airlines points

Check out the best cards for your next Southwest Airlines booking

Compare nowThe bottom line

Frequent flyer programs are free to join, so you can earn rewards with every airline you fly. However, if you’re looking for one program to stick with, the best program for you will depend on which airline you fly with most often.

The Southwest Rapid Rewards program offers a lot of flexibility and value, especially for people who can earn and use a Companion Pass. If you aren’t ready to commit to an airline, though, you can still get a lot of mileage for your travel buck with a top travel rewards card, perhaps even one that allows you to transfer miles to your favorite airline, Southwest or otherwise.

Frequently asked questions about Southwest Rapid Rewards

*Information about the Southwest Rapid Rewards® Premier Credit Card has been collected independently by Bankrate. Card details have not been approved or reviewed by the issuer.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.