How to convert Capital One cash back into miles

The legacy Capital One Savor Cash Rewards Credit Card* is no longer taking new applicants as of July 2024, although existing cardholders can still use the card. Those interested in the legacy Capital One Savor Cash Rewards Credit Card can check out the new Capital One Savor Cash Rewards Credit Card, formerly known as the SavorOne card, instead.

Key takeaways

- Capital One allows cardholders to convert cash back rewards into miles.

- The process is simple, quick and can be done through the Capital One website.

- Converting cash back into miles helps you earn free travel faster and can increase the value of your rewards.

I recently got the Capital One Savor Cash Rewards Credit Card so I could pool the rewards with my Capital One Venture X Rewards Credit Card and spend them on flights. That way, I could earn free travel faster through combined spending. Unlike some other issuers, Capital One lets you turn your cash back into miles, which I find to be a huge advantage.

Unfortunately, the experience wasn’t as intuitive as I hoped.

The conversion process itself is simple and quick. However, getting to it can be a bit of a quest. It definitely was for me, and I write about cards for a living. It took calling Capital One and searching Reddit to figure out the steps to take. Here’s how to move your Capital One rewards, which cards are eligible and why to do it in the first place.

How to transfer rewards between Capital One cards

First, be aware that you can only transfer cash back to another Capital One cash back card or travel card. The issuer doesn’t allow converting miles into cash back.

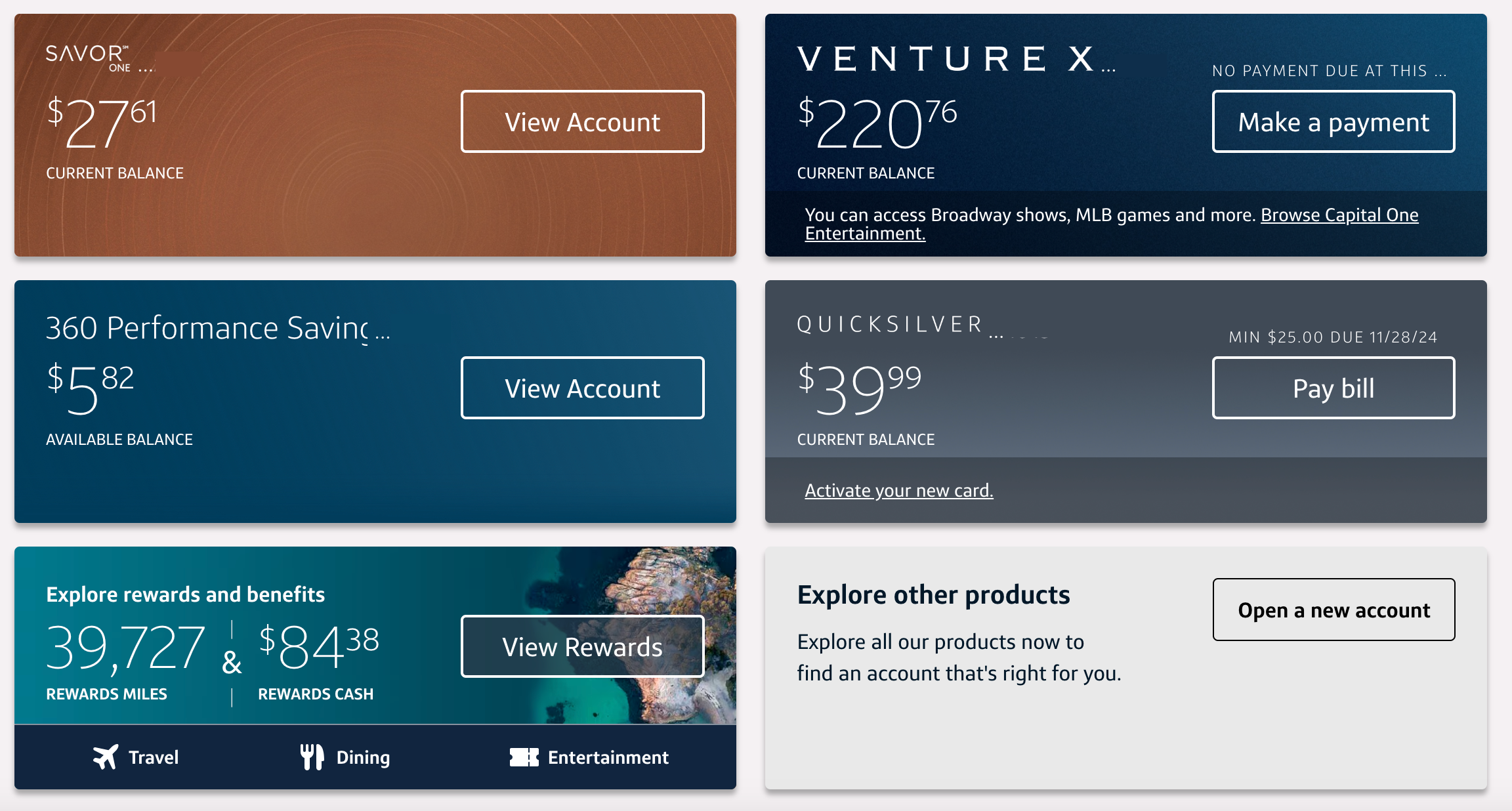

To set up a transfer, log in to your Capital One account through your browser. Note that you can’t complete a transfer through the app. Once you’re logged in, you’ll see tiles of all your Capital One accounts, as well as rewards. Click “View Rewards.”

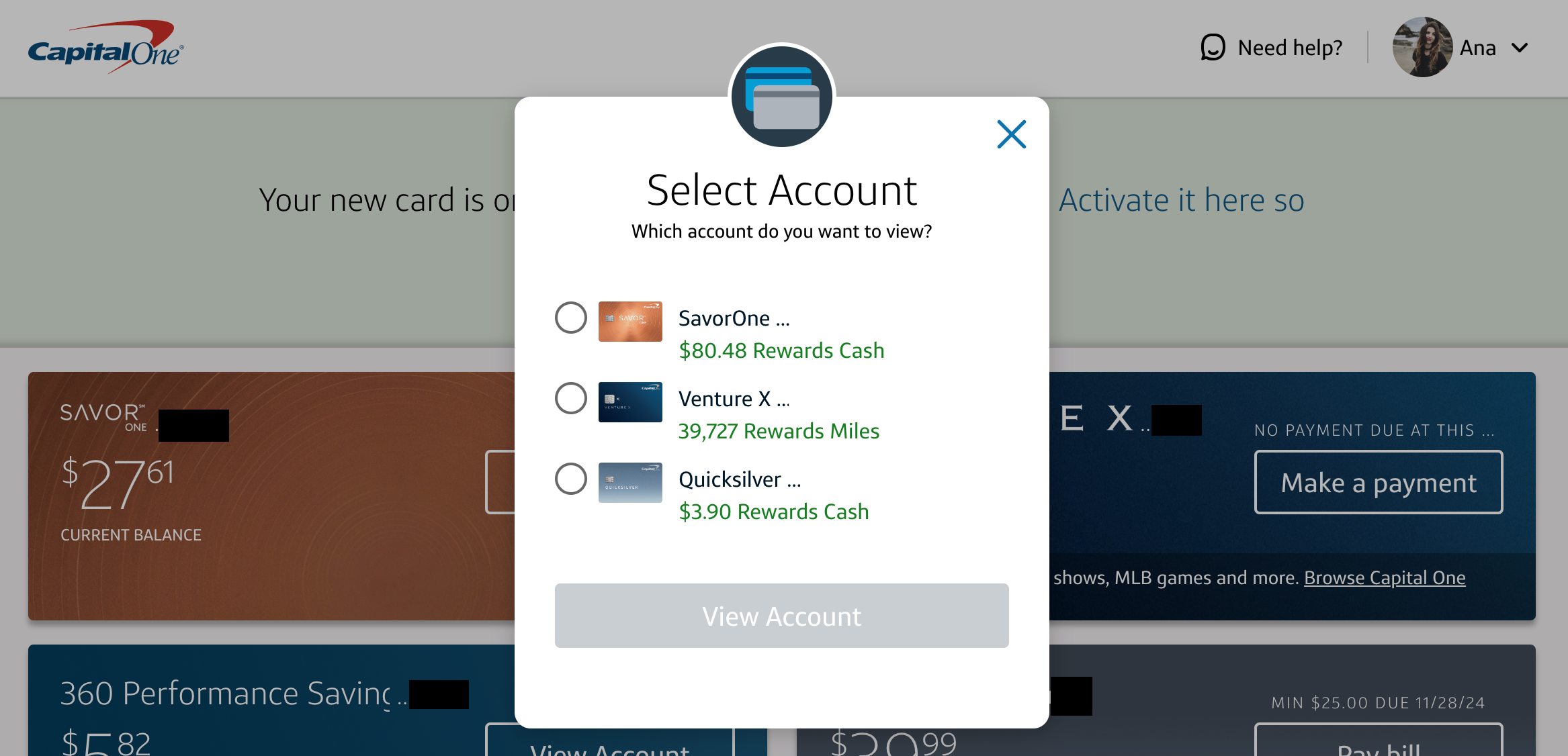

Next, choose the account you want to move the rewards from:

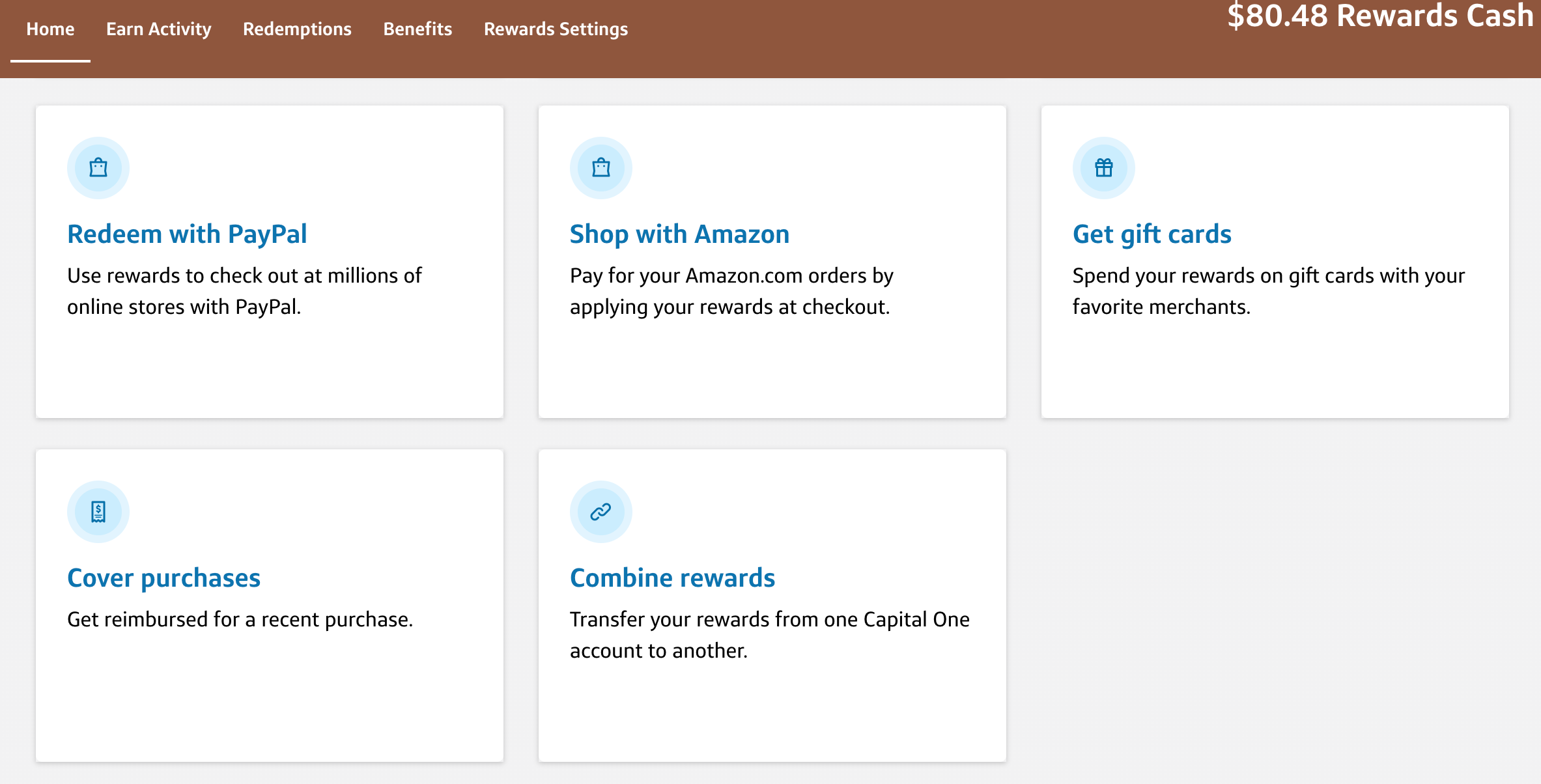

Now, scroll down until you see “Combine rewards” — which is what you want to do.

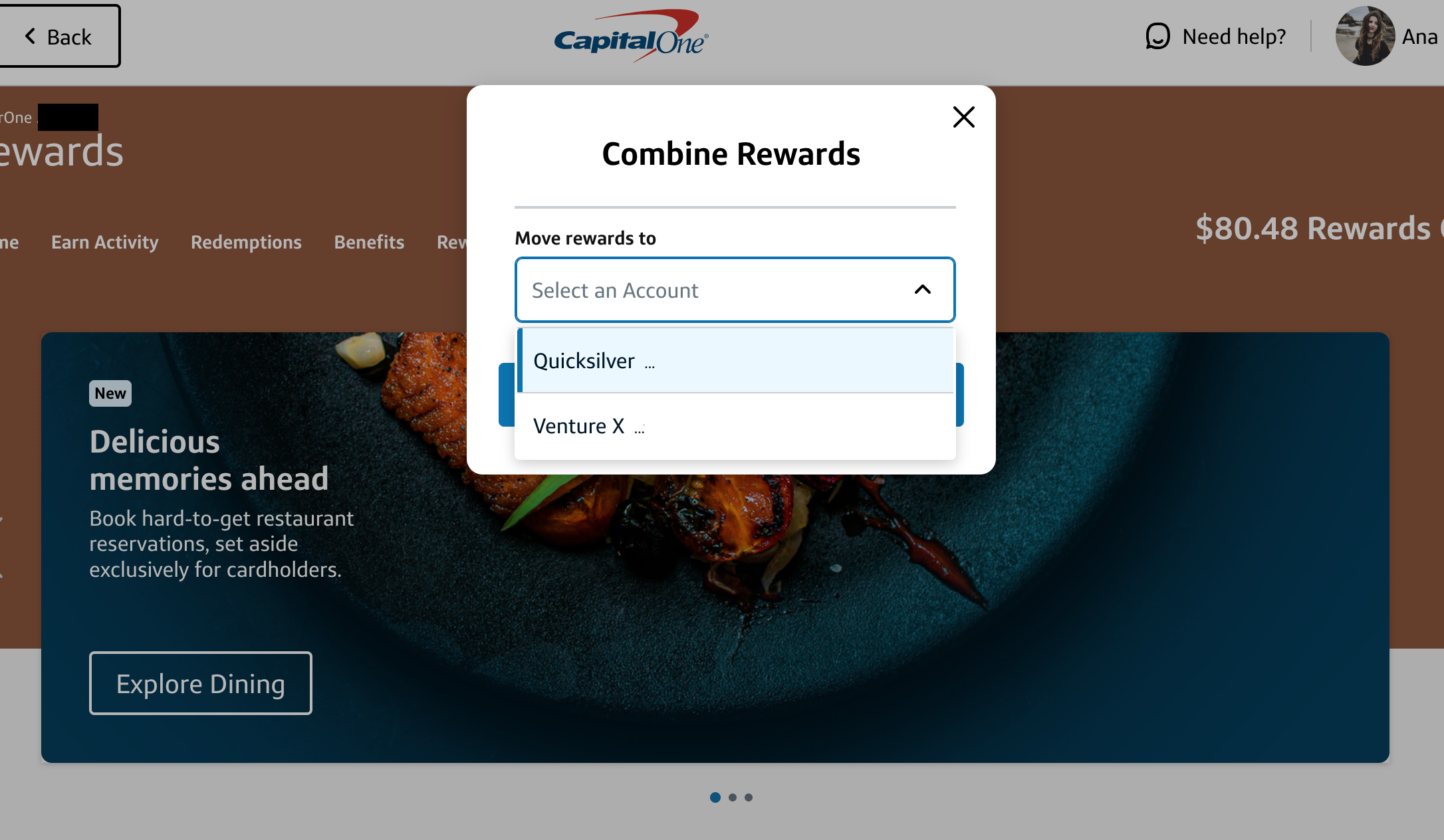

When you click the tile, pick the account you want to send the rewards to.

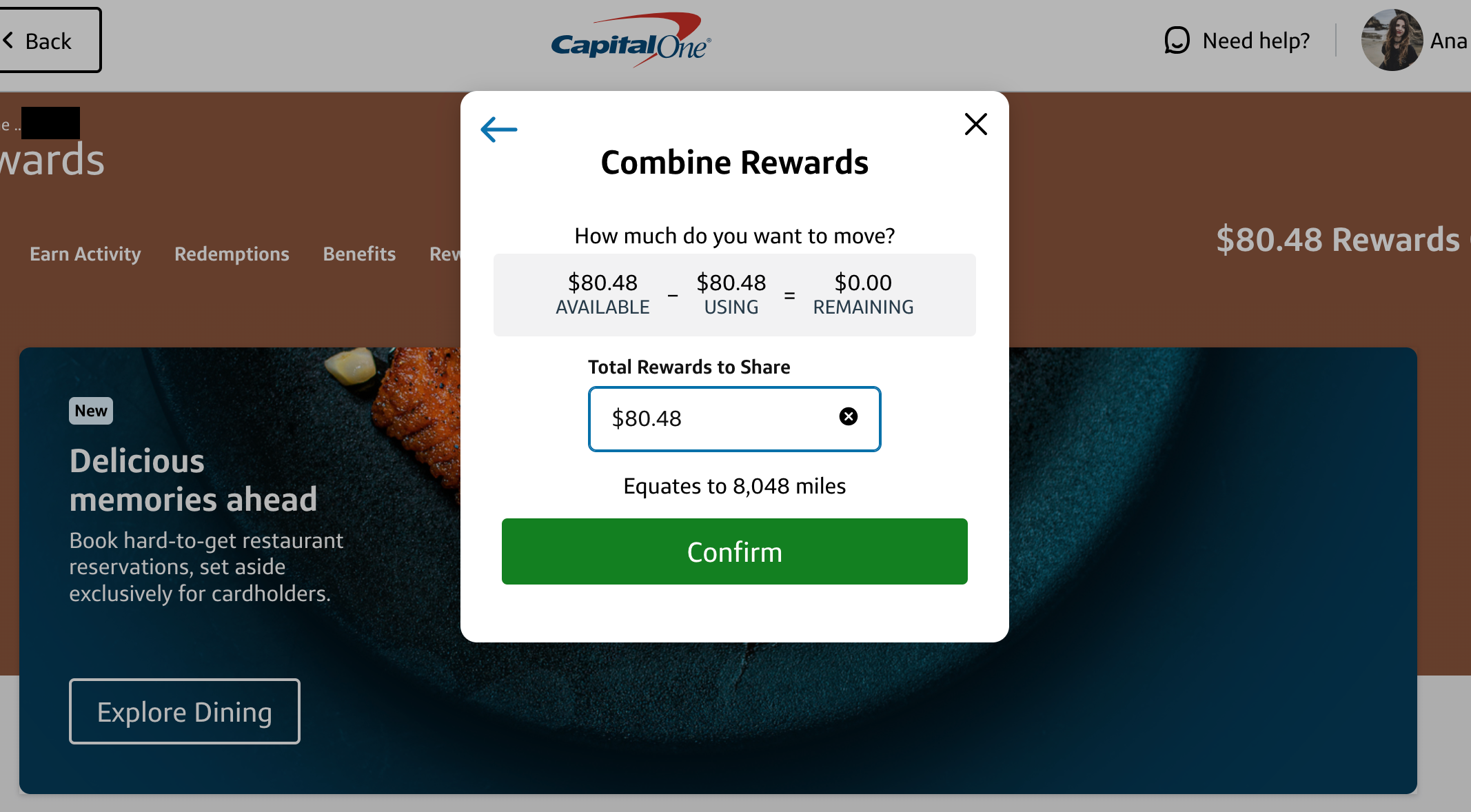

Next, you’ll be prompted to input how much cash back you want to move. The transfer ratio is 1 cent per mile, meaning you get 100 miles for each dollar transferred.

After indicating how much you want to transfer, click the “Confirm” button. The rewards will move to the designated account immediately.

Which Capital One cards are eligible?

To convert cash back into miles with Capital One, you’ll need a miles-earning card, such as:

- Capital One Venture X Rewards Credit Card

- Capital One Venture Rewards Credit Card

- Capital One VentureOne Rewards Credit Card

As for the cash back cards, you have many options, including:

- Legacy Capital One Savor Cash Rewards Credit Card* (unavailable for new applications)

- Capital One Savor Cash Rewards Credit Card

- Capital One Savor Student Cash Rewards Credit Card

- Capital One Quicksilver Cash Rewards Credit Card

- Capital One QuicksilverOne Cash Rewards Credit Card

- Capital One Quicksilver Student Cash Rewards Credit Card

- Capital One Quicksilver Secured Cash Rewards Credit Card

Such extensive lists provide plenty of opportunities to create a valuable card pairing. For example, if you have the Capital One Savor card and one of the Venture cards, you can earn generous cash back on food and entertainment and turn it into miles to book travel with.

Or, if you have the VentureOne and the Quicksilver, you can earn 1.5 percent on all purchases with the Quicksilver and transfer the rewards to the VentureOne. This way, you can take advantage of the issuer’s travel portal and transfer partners without complex rewards structures or annual fees.

Why convert cash back into miles

If you have multiple rewards credit cards, you might not be thinking about combining rewards. After all, it requires an extra step — and oftentimes, the best credit card strategy is the simplest.

Still, with Capital One, despite all the complexity, you can still complete this extra step in under a minute, which may allow you to:

Earn free travel faster

For most people, saving enough rewards for travel requires quite a bit of spending. And when you spread your spending across multiple cards, your rewards might exist in multiple currencies and programs. As a result, you might not be able to use all of your rewards earnings to book a trip — unless you pool them together.

I recently got the Capital One Savor just to convert cash back from it into miles on my Capital One Venture X. I spend around $500 on food monthly. The Savor earns unlimited 3 percent cash back on dining and grocery store purchases (excluding superstores like Walmart and Target), meaning I’ll get around $180 in cash back annually. That’s 18,000 miles I can move to my Venture X every year to redeem for travel.

Stretch your rewards value

When you turn your Capital One cash back into miles, you boost the value of your rewards. With cash back, 1 cent will always be 1 cent. According to Bankrate’s valuations, Capital One miles can be worth an average of 1.7 cents per mile when you transfer them to a high-value travel partner. That means that $100 of cash back you’ve earned with a cash back card can eventually become $170 — or more — to redeem for travel.

The bottom line

Capital One might not be known for its credit card combinations. Yet, having both a cash back card and travel card from the issuer can help you maximize rewards with little effort.

It’s easy and quick to convert your cash back into miles. Doing so can help you earn free travel quicker, as well as squeeze additional value out of your cash back. If the goal of your credit card strategy is to save on travel, you can’t go wrong with this move.

*Information about the legacy Capital One Savor Cash Rewards Credit Card has been collected independently by Bankrate. The card details have not been reviewed or approved by the issuer.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.