How to prevent your home from flooding

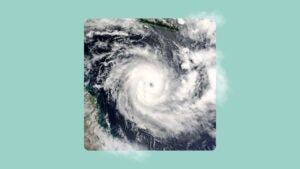

Flooding is the most frequent and costly natural disaster impacting the U.S.— also one of the most misunderstood. Homeowners living in high-risk flood zones know the importance of purchasing separate flood insurance policies and may even be required to by their mortgage company. However, many owners in moderate to low-risk zones are unaware that flooding can happen anywhere and anytime. Climate change puts weather patterns into overdrive, transforming average storms into severe weather threats. Increased flooding is starting to occur in areas where the population has not had to deal with these hazards before and is ill-prepared. While you can’t stop a flood from happening, Bankrate’s insurance editorial team has put together this guide that may help you mitigate some physical and financial loss by taking action and safeguarding your home.

How to prevent your home from flooding

For most of us, our homes are one of our most significant assets. The financial and emotional toll homeowners experience when a catastrophic loss occurs can last a lifetime. Can you stop a flood from happening? Unfortunately, no. But you can take preventative measures to reduce the damage your dwelling and personal property sustains.

With climate change shifting flood zones and increasing rainfall, flooding can happen anywhere. Homeowners insurance may provide some coverage for water damage resulting from overflowing appliances, but flooding from rains or overflows from bodies of water is not included in a standard homeowners insurance policy. Insurance professionals state that flood insurance is a good idea for most homeowners even if they don’t live in a flood zone, although it could seem cost-prohibitive for some. However, there are preventative steps that can help any homeowner reduce the risk of loss from flooding, from high-end storm resistance building materials to simply rearranging the furniture in your home.

Steps you can take to prepare for flooding

A single inch of water can cause $25,000 worth of damage to your home according to the Federal Emergency Management Agency (FEMA). Although some areas are at higher risk of flooding than others, flooding events have become unpredictable. Having storm supplies on hand and preventative measures in place may help reduce your risk of loss.

Here are some of the precautions experts recommend to make your home flood resistant.

Evaluate your home’s flood risk

According to FEMA, even homes with low to moderate flood risk are five times more likely to experience a flood in the next 30 years than they are a fire. Whether you are considering buying a home or are already a homeowner, evaluating your current and future flood risk is the best way to safeguard your financial investment.

To accurately price flood insurance and make premiums more equitable, FEMA created Risk Rating 2.0. As of April 2023, all flood policies have been renewed under this plan. To learn what zone your home is currently classified in, look at FEMA’s Flood Map Service Center and search for your address. When you pull up your address, the map may be shaded a specific color (you may need to zoom in and out to get the colors to load). If your home is in an area shaded by any of the flood hazard color keys, note the preparation recommended by FEMA for that zone. FEMA offers even more tools to support flood mitigation efforts through its Risk Mapping, Assessment and Planning (RISK MAP) process, also available online to the public.

FEMA is constantly revising the Flood Rate Insurance Map (FIRM) based on information from the Letters of Map Change (LOMC). When an area is reevaluated, these letters are attached to the map so the public can view changes in flooding conditions.

Consider flood insurance

Homeowners living near coastal waters usually know flood insurance is a good idea. But what about homes that are far from water or urban areas? Most homeowners insurance companies do not cover damage from flood events. First Street, a non-profit research and technology group, recently reported in its The 8th National Risk Assessment: The Precipitation Problem, stated that 17.7 million properties across the nation are at risk for significant flooding and that about 9.8 million of these properties are not included in FEMA’s risk map.

Due to the increased levels of precipitation caused by climate change, you may live in a high-risk flood area and be unaware. Using an online resource like Risk Factor, which shows 30-year projections of flooding and other natural hazard risks based on your address, can help you decide if purchasing a flood insurance policy is right for you. Flood insurance is a proactive step towards being financially protected if your home floods in the near future — even if it hasn’t in the past.

Your homeowners insurance provider may facilitate the process of obtaining flood insurance through a government program or private insurer. Be sure to account for the cost of flood insurance along with the cost of your home’s policy when determining coverage limits and the value of your home and belongings.

Keep in mind that flood insurance typically has a 30-day waiting period to become active (which means you can’t purchase it last minute and have it go into effect when a storm is forecast) and that flood insurance premiums are due up-front and in full at the time of purchase.

Evaluate your home’s drainage

Maintaining the ground around your home is one way to protect your house from flooding. Improper drainage causes excess water to accumulate around the home and increases soil erosion. Over time, soil erosion causes your home to sink, lowering its elevation and increasing the risk of flooding.

The grade around your home should slope away from your foundation. The next time it rains, observe to confirm that water moves away from your home and is not pooling in any areas on your property. Some signs of poor drainage are overflowing gutters, soggy land, drifting mulch or a leaking basement. A general contractor may provide suggestions for ways to resolve problems with drainage. To make your home more flood-resistant, you can install backwater valves to prevent flood water from backing up into your home.

Consider raising or sealing your foundation

Elevating your home about three feet above your community’s base flood elevation (BFE) can prevent your home from flooding and drastically lower the cost of your flood insurance policy. There are several ways to elevate your home. Whatever method you select must be NFIP-compliant and will require permits and city approval. During this process, your home is detached from the foundation and raised by hydraulic jacks. The existing foundation may be replaced or extended. Ultimately, the result is to have the floor of your home higher than the BFE.

As you can imagine, elevating a home’s foundation is not a cheap or easy solution — another option is to seal your foundation. This can be done by excavating around the home down to the bottom of the foundation. Fill and repair foundation cracks and then paint the foundation with sealant. In addition, you can also wrap the foundation in a waterproof membrane for an extra layer of protection.

Homeowners with basements can apply a sealant to the walls and floors of your basement. It will help limit flooding and the moldy mildew smell basements are known for.

Temporary flood barriers

As an alternative to structural changes, temporary flood barriers can help protect your home from flooding by diverting water away from your home. Sandbags are a popular option, but here are a few others:

- Coffered dams

- Inflatable dams

- Metal flood barriers

- Rubber dams

Use flood-resistant materials

When purchasing a home located in a high-risk flood area or rebuilding your home, consider using flood-resistance materials. Building materials are considered flood-resistant if they hold up to flood waters for at least 72 hours without major damage. Use FEMA’s guide to determine the right material quality for your home.

While concrete and other materials work well on the home’s exterior, don’t forget the interior. Many homeowners in high-risk areas opt for ceramic, clay or travertine tile floors over wood and carpet. Not only are they flood-resistant, but they are also attractive and could possibly increase the home’s market value.

Elevate utilities and appliances

Determine your area’s BFE and, whenever possible, elevate appliances and utilities above that level.This can help prevent costly damage and keep your home functioning after a flood. If you live in a single-story home or understandably don’t want to move your refrigerator to the second floor, consider using makeshift platforms from cinder blocks and wood. They are easy to assemble and can be taken down and stored when the flood threat is over. Here are some items you may want to have on hand in case you need to move your appliances:

- Hand truck dolly

- Lifting straps

- Cinder blocks

- Plywood

If flood waters rise in your area, be sure to turn off your home’s power before electrical systems can become compromised and to reduce the risk of electrical shocks (water and electricity are a hazardous combination).

Invest in a generator

Electricity can take weeks to months to return after a catastrophic flood. Lack of electricity can cause food spoilage and sump pump failure, which results in basement floods. Since you can not charge your phone or connect to Wi-Fi, you will also be unable to contact emergency services once your phone dies.

A whole-house generator is ideal but not an option that is affordable to everyone. Instead, consider a portable generator. Depending on cost and what you need connected, you can have enough electricity to run your refrigerator, sump pump, portable air conditioner and lights in a few rooms of your home.

Why you need a portable air conditioner

According to the Centers for Disease Control, the U.S. averages 702 heat-related deaths each year. The states with the hottest average temperature in the summer are Florida, Louisiana, Texas, Georgia, Mississippi, and Alabama — all states with the highest flooding risk. Many people stay in their homes to wait out hurricanes, and when the power goes out, it adds another level of danger to an already perilous situation.

Having a portable air conditioner along with a portable generator could save your life. The elderly, children and people with conditions that require electric and battery-dependent assistive technology and medical devices, are more prone to excessive mortality. Even young and healthy adults can succumb to heat stroke and while disaster recovery is underway, emergency services have limited availability.

Relocate your furniture and valuables

Some items are not salvageable after a flood. Furniture with upholstery, leather goods, mattresses and clothing fall into this category. According to the CDC, flood waters are not just rain. It can contain chemicals, human and livestock waste, carcinogenic compounds and other hazardous materials. If possible, move upholstered furniture to the second floor or elevate it about the BFE. Vital documents and jewelry can be moved to a water-tight safe and stored somewhere high, like a closet shelf.

While it can feel like you are playing large-scale Tetris, safely pack and stack what you can in storage containers. Remember small electronics, power cords, chargers and sentimental objects like family photo albums. This is especially important if you are evacuating. You may not have access to your home for several days and mold can develop on walls and personal property within 24 hours.

Inquire about mitigation assistance

FEMA’s Flood Mitigation Assistance (FMA) is a grant program that provides funding to states and local communities. Residents who have flood policies with the NFIP may be eligible for grants to upgrade their homes with flood and hurricane-resistant modifications. Modifications like hurricane shutters and elevated foundations are common options and grants may pay for part or all of the update.

Have a contractor contact on file

When floods occur, contractors and builders are in high demand and it can cause a delay in getting your home repaired. If you already have the information for a contractor you trust on file, start the claims process immediately. As soon as it is safe to do so, take pictures of the damage and text them to your contractor and then make an appointment for them to evaluate the property. If you don’t already have a contractor in mind, ask your friends and neighbors for recommendations, or see if your insurance carrier can recommend a reputable professional ahead of time.

Preventive steps to take when flooding starts

If you’re already experiencing a flood, it’s important to mitigate the damage as much as you safely can. The following steps may help you avoid more catastrophic damage.

- Turn off water at its source. If you’re experiencing a flood from a pipe break, overflowing toilet or another internal appliance, turn off your water immediately. This will allow you to begin triage of your belongings without the water rising even more.

- Use sandbags for rain flooding. For floods that are originating outside during a storm, placing sandbags near basement windows and other entry points can prevent more water from entering your home.

- Shut off circuit breakers. Water and electricity don’t mix. If — and only if — you can access your electrical box without walking through water, turn off all the breakers and/or fuses. In the event that your electrical box is located in a flooded room, stand back until a professional can turn it off.

- Wear protective gear. The water you wade through to assess damage, bail water and remove belongings may be contaminated with bacteria. Wear gloves and rubber boots. You may also want to wear a face mask.

- Evacuate as necessary. If you are in danger from rising water or electricity, evacuate the home as quickly as possible.

Frequently asked questions

-

-

The average cost for flood insurance for a single-family home with NFIP is $888. After implementing Risk Factor 2.0, FEMA created a glide path for premiums. The full risk-based cost average is $1,808, which is the amount homeowners should pay based on risk and rebuild costs. Due to laws enacted by Congress, premiums for most private residences can not increase more than 18 percent annually. Flood rates will increase or “glide” towards each homeowner’s unique risk-base cost until the annual premium matches the risk-based cost.

-

FEMA’s safety guidelines for flood cleanup emphasize that safety is paramount. Before entering your home, make sure the structure is safe and all power and gas are off until an electrician completes an inspection. While wearing protective gear, clean out standing water and remove saturated materials. Mold can develop quickly, so follow the United States Environmental Protection Agency’s (EPS) mold clean-up tips.

-

For both indoor drainage like bathroom pipes and outdoor drainage like gutters, eliminating obstructions is a crucial part of regular maintenance. Using drain guards in your home keeps hair and dirt from clogging your pipes and creating an overflow. For outdoor drainage systems, you’ll want to clear leaves, twigs and other debris on a regular basis. If you have a slope drainage system, make sure it doesn’t get overgrown with grass and remains at the proper incline.

-

You may also like

12 ways to avoid hurricane damage

How to protect your home from wildfire

How to prepare your home for a natural disaster

How to prepare your home for hurricane season