Capital One mobile app review: Everything to know as a cardholder

Key takeaways

- The Capital One mobile app allows banking and credit card customers to access and manage their accounts in a secure way.

- The Capital One mobile app supports two-factor authentication, as well as multiple sign-in options.

- Once logged into the app, you can use it to view and manage account details, alerts, payments, credit card rewards, credit monitoring and more.

Sometimes it’s hard to imagine how we ever got by without a powerful, mobile computer in our pockets. And while many still use desktop and laptop computers throughout the day, mobile apps have become the dominant way of interfacing with the financial institutions where we have our accounts, especially credit card accounts. Capital One offers a full-featured mobile app that allows customers to quickly perform most of the functions they need for their account management.

Here’s our review of the app and our breakdown of its features:

What is the Capital One mobile app?

The Capital One mobile app is available for download on Apple and Android devices, which allows customers to manage their Capital One credit card and deposit accounts. It also allows anyone to access Capital One’s CreditWise tool, which helps consumers understand and learn how to improve their credit scores.

The Capital One mobile app is available on both the Apple App Store and Google Play Store and has been well-received by users. Here are the app’s scores at the time of writing:

- Apple App Store: 4.9 stars from over 9.5 million ratings.

- Google Play Store: 4.5 stars from over 1.6 million ratings.

What the Capital One mobile app isn’t

The Capital One mobile app isn’t the same as the Capital One Digital Wallet and Mobile Payments. These are a set of services that allow you to make payments online or at retailers using several partners.

Capital One credit cards are compatible with PayPal, Apple Pay, Google Pay, Samsung Pay, Paze, and Fitbit Pay. These services use their respective apps to allow you to make payments with your Capital One credit card, but this is not the same method as using your Capital One mobile app for payments. However, you can manage some of your digital wallet settings through the mobile app.

Capital One mobile app features for credit cardholders

The Capital One app is a great place to manage your credit card account quickly. Here are all of the features you can expect as a credit cardholder:

For those who have only a deposit account with Capital One, the app still offers the ability to view your statements and transaction history. You can also use the app to deposit a check by taking a photo of it. Additionally, the app allows account holders to send money securely to almost anyone in the U.S. by using the Zelle service.

And if you don’t bank with Capital One at all? You can surprisingly still find value in the app — at least for credit monitoring. Capital One’s CreditWise service is available to everyone, including those without a banking account.

How to download and navigate the Capital One mobile app

To download and access the Capital One mobile app, follow these steps:

- Find the app in your respective app store: Go to Apple’s App Store or Google Play, depending on the mobile device you have. You can even text “GET” to 80101 to download the app.

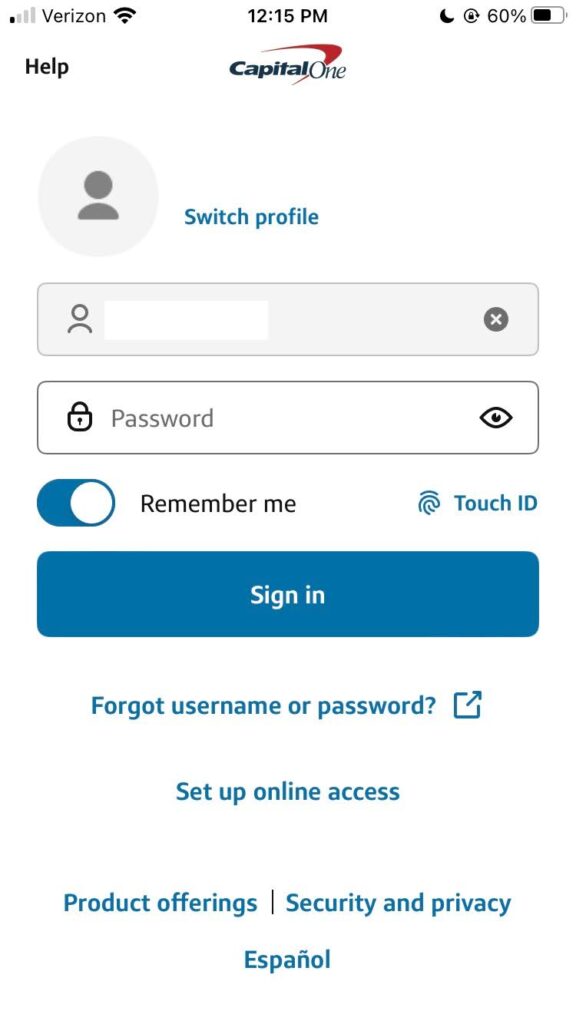

- Log in to your account: After downloading the app, sign in with your username and password. If you’re new, set up access by verifying your phone number via a texted code. You can also enable fingerprint login (if supported) and opt in for notifications.

- Familiarize yourself with the home screen: After logging in, you’ll see clickable account tiles showing your available credit and payment due. If you have one account, only that tile will appear. You can also view rewards, CreditWise, shopping offers and nearby ATMs or branches if you have a bank account.

- Choose the account you want to manage: Tap an account tile to view information such as minimum payment, statement balance and last payment date. You’ll also find card terms like fees and interest rates, expected and recent transactions, statements, account users and options to lock or replace your card.

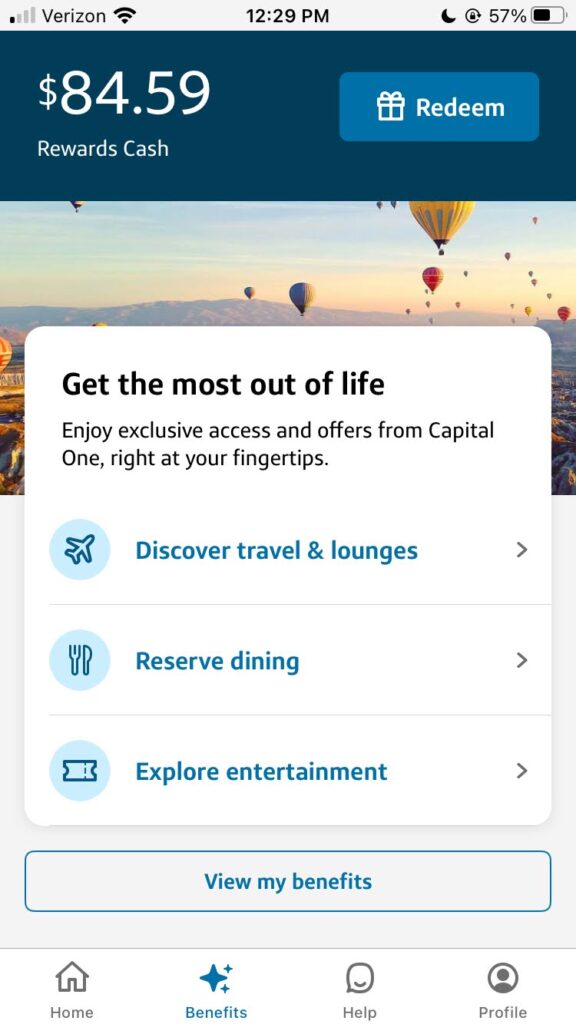

- View your benefits: By clicking the “Benefits” tab at the bottom of the app screen, you can view your card’s available benefits, as well as your available rewards.

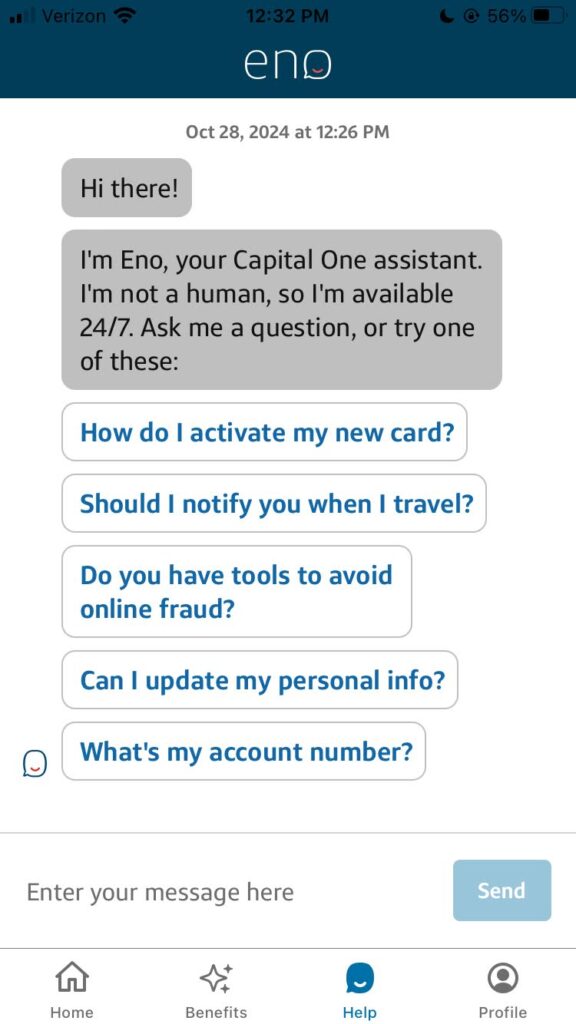

Get help: After the “Benefits” tab, you’ll see the “Help” tab with an icon of Eno, Capital One’s virtual assistant. Clicking this tab will open Eno’s chat window, where you can ask it questions about your account

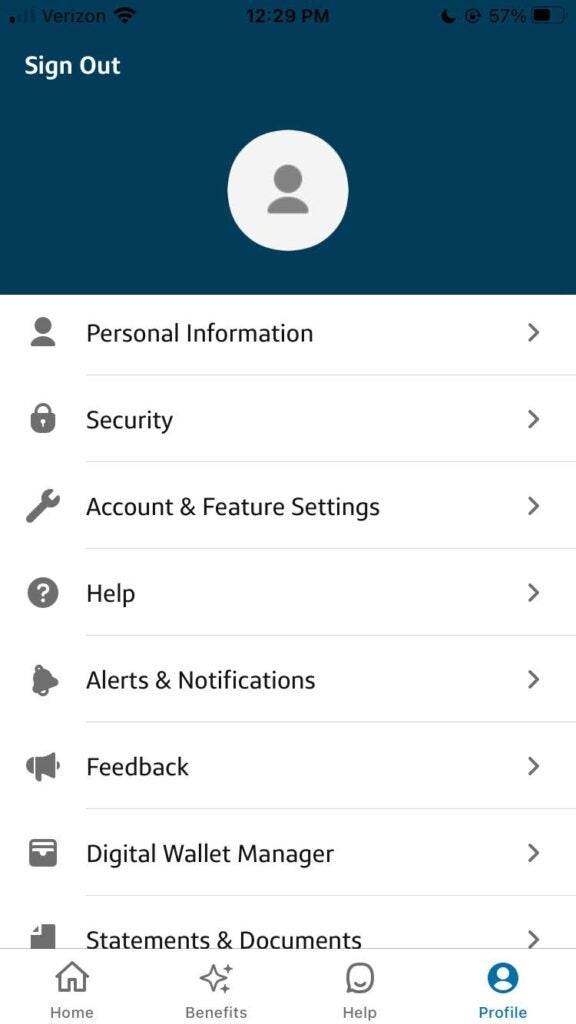

View your profile: Lastly, you can navigate to the “Profile” tab and manage the app overall. Here, you can change your password, set up alerts, manage your digital wallet and more.

Capital One mobile app security

Digital security should be the highest priority for any financial app, so where does Capital One stand? Capital One offers similar security measures to other financial apps, including two-step authentication and various sign-in options, such as fingerprint and facial recognition. The app also offers the SureSwipe method of logging in, which replaces passwords with a pattern users trace with a finger.

Within the app, Capital One offers additional security measures, allowing you to set up fraud and purchase alerts, as well as lock your card in case it is lost or stolen.

You can access the Capital One mobile app’s security features through the Profile screen. Here, you can edit your username, change your password and update your sign-in options.

Bankrate’s take: Pros and cons of the Capital One mobile app

When using the Capital One app, it’s important to understand its strengths and weaknesses, including the features it excels in and those it lacks. Here are some of Bankrate’s takes on how the Capital One mobile app stacks up against competitors:

Pros

- Capital One’s app is easy to use and has a largely intuitive interface. It allows customers to access credit card accounts, deposit accounts and its CreditWise service, all from the same app.

- Capital One also eliminates a common pain point of mobile apps by offering numerous ways to log in, including fingerprints, facial recognition and the SureSwipe feature (which is great for those who have mobile devices that don’t support fingerprint identification).

- You can also use the app to verify your identity in person rather than relying on physical identification forms.

- Basic questions and tasks can be done by chatting with Eno, Capital One’s mobile app assistant, which is pretty responsive overall.

Cons

- The Capital One app lacks the ability to communicate with a representative via chat or secure messaging, and it doesn’t give you a phone number to call directly from the app when prompted by Eno, either. Instead, Eno will give you an option to visit Capital One’s contact page, where you can find the phone number you need yourself. This can be frustrating if you’re trying to connect with a representative quickly.

- The app also lacks the ability to plan out multiple payments to your account. You can set up a single autopay plan, but you can’t schedule payments for multiple dates.

The bottom line

Capital One’s app offers a solid suite of tools, plus good security features. It’s essential for those with Capital One credit cards who want to make their banking journey easier — and for the most part, the app will help you do just that. However, it falls a little short in terms of customer service accessibility, as it does not allow you to chat or call a live representative directly through the app.

By understanding all the app’s capabilities and recognizing its limitations, you can use it to efficiently manage your accounts while also keeping track of your credit score.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.