How to know what a “good” interest rate is today

When the Federal Reserve lowered its benchmark federal funds rate in September by half a percentage point (50 basis points), some depositors may have learned a lesson: A 5.50 percent annual percentage yield (APY) on a deposit account – be it a high-yield savings account or callable certificate of deposit (CD) – can vanish quickly. There was nothing unfair or deceptive about it; institutions managed their accounts to their best interest. Now you should, too.

You can, and should, make the most profitable decisions for managing your money. The hard part is figuring out how. Fortunately, whether you’re looking to reinvest funds that just exited a callable CD – which is closed by the issuer, not you, the depositor, before its maturity date – or for a new home for funds in a savings account or money market account, there are public information sources you can use to assess your options and develop a financial plan.

It comes down to knowing what you think rates will do in the future and applying your perspective to make the best deposit choices today. Financial institutions do this year in and year out. Here’s how you can adopt that mentality after two rate cuts in late 2024.

How banks develop their perspective

Banking institutions weren’t reading tea leaves when they created their deposit offering in 2023. Rather, they were watching the federal funds rate and economic data, specifically employment and inflation.

High inflation and high interest rates were likely to cool growth in the U.S. economy, if they did not cause a full-on recession. The resulting rise in unemployment and easing of inflation would put the Fed in a stimulative mode, causing it to lower its target rate again. Banking institutions in 2023 positioned their deposit offering for declining rates in 2024 and 2025.

When a bank or credit union expects rates to move downward, it wants depositors in products that reprice. They certainly didn’t want current depositors moving en masse into CDs that would lock them in at 2023’s historically high rates from a 15-year perspective. So what did they pursue generally? Savings accounts and money markets with high, but not fixed, rates. They also partnered with CD brokers to obtain callable CDs. It was just good financial management.

In hindsight, depositors’ best interest in 2023 was to lock in a CD at 5.50 percent APY – purely from the perspective of maintaining a high rate. What can depositors learn from repricing in 2024, and how can they apply it to their best interest now? Let’s look at the economic data to outline a general process.

Watching the economic data

U.S. economic data doesn’t indicate drastic rate changes during the next 12 months.

Inflation

We have historical precedence for high inflation and high interest rates in the U.S. economy, but never with the current combination of government debt, money supply, quantitative tightening, demographics, inflation and interest rates.

No one knows what the future holds for the economy; a surprise event could send it into recession tomorrow. But we do know inflation has yet to be defeated conclusively. In November, the Consumer Price Index and the Personal Consumption Expenditures Index, monitored by the Fed, show inflation bouncing higher after steep declines between May and July 2024.

Inflation trends don’t indicate an acceleration in declining rates, though the Fed may continue reducing its target rate by a quarter percentage point, or 25 basis points, after each Federal Open Market Committee meeting.

Source: Federal Reserve Economic Data (FRED), Federal Reserve Bank of St. Louis

Unemployment

Initial jobless claims dropped in mid-November to 217,000, below last week’s 221,000 and the lowest since May 2024.

Source: Federal Reserve Economic Data (FRED), Federal Reserve Bank of St. Louis

According to the U.S. Bureau of Labor Statistics, national unemployment was unchanged at 4.1 percent in October. In September, however, 4.1 percent was the lowest unemployment rate the economy had seen in three months, down from 4.2 percent in the previous month and surprising market expectations.

Source: Federal Reserve Economic Data (FRED), Federal Reserve Bank of St. Louis

Unemployment trends also don’t indicate an acceleration in declining rates.

Probability of changes in the fed funds rate

Want to learn what professional investors think about the probability of changes to the Fed rate?

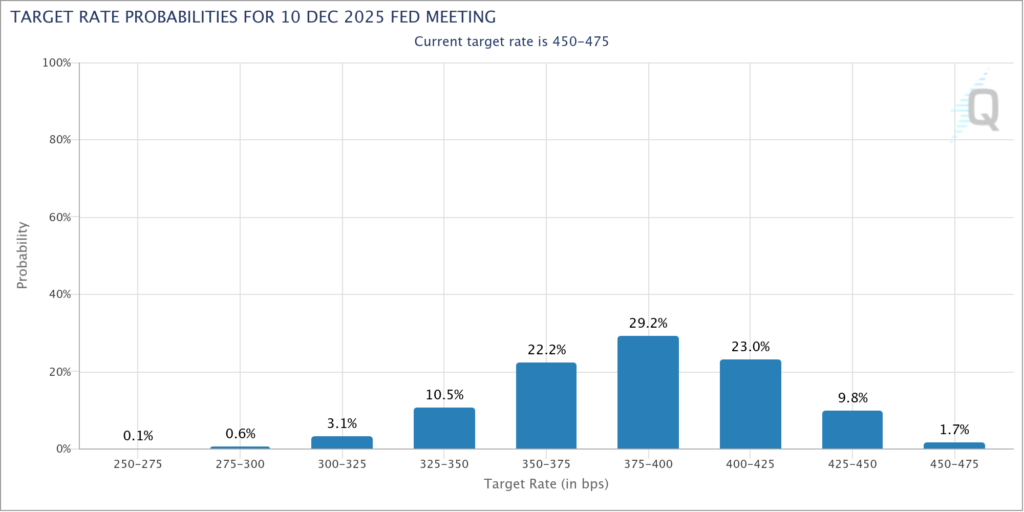

You can use the CME Group’s FedWatch to check where interest rates will likely go for up to a year into the future. Unlike the Fed’s “dot plot,” which shows each Fed official’s quarterly rate opinion, FedWatch shows where rates will be based on actual dollars invested.

Source: CME Group

Most professional investors have Fed Funds above 375 basis points, or 3.75 percent, through December 2025, and most have it below 425 basis points (4.25 percent). Translation? Rates will likely stay within that range during the next 12 months, at least according to investors putting real money on the line.

Translating economics into decisions

No one can advise someone else on which banking products are best for them. No deposit product is “bad” or “good” on its own. Generally, a callable CD can be useful in an environment where rates will likely rise or remain flat. The same applies to money markets and savings accounts. Traditional CDs can be better for economic environments where rates likely will remain flat or trend downwards.

Examples help illustrate how different banking products help you manage your returns.

Take a 1-year CD from Marcus by Goldman Sachs, yielding 4.10 percent APY as an example. Given the current economic conditions, you are unlikely to miss out on significant returns by locking in an APY at 4.10 percent. And a traditional CD will protect you from major and unexpected rates-down movement from the Fed. Where you miss out is that unanticipated scenario in which the Fed fights inflation with rates once again.

If you believe the economy may overheat within the next year, your most significant risk to high returns would be missing the high point in that rising rate environment. If you’re in this camp and are happy with your money market account, you may want to sit tight. Otherwise, consider a CD with a shorter duration.

This is the nature of most markets: If you want to maximize returns, you’ll have to take more risk by positioning your deposits for significant rate declines or increases. Otherwise, economic data suggest a CD of around 4 percent APY will be a well-performing investment between now and the end of 2025. Taking risks can push that return higher, as can finding outlier banking institutions with special offers.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.