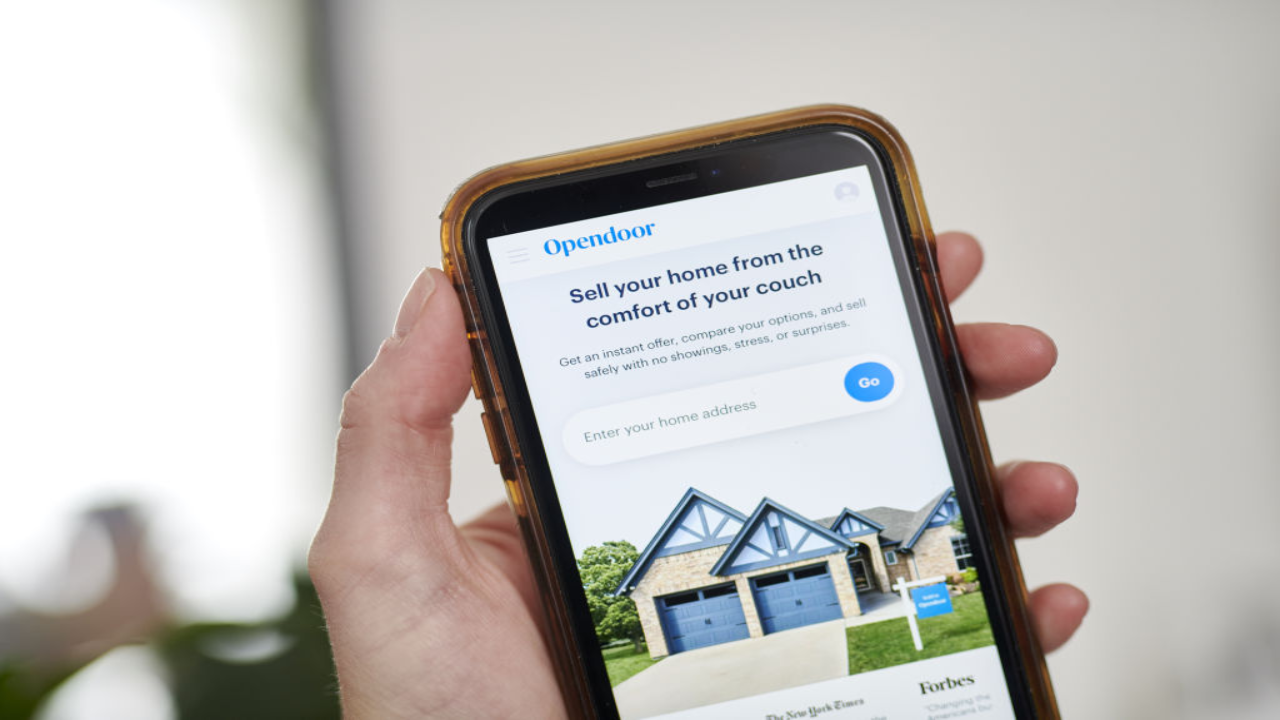

Opendoor review: What it is and how it works

Opendoor has operated in the real estate space for a decade, with a platform that offers to streamline the home selling and buying process. Like other iBuyers, the online enterprise makes cash offers on houses using an algorithm to determine their worth. You can buy a home from Opendoor, too, and even do both at the same time.

How does Opendoor work, exactly? That depends on which of its services you want to use. Here, we’ll explore the options for both buyers and sellers, as well as pros and cons.

What does Opendoor do?

Working with an iBuyer like Opendoor fast-tracks the real estate process, making selling or buying a house faster by eliminating traditional real estate agents and paying cash, which means home sellers don’t have to wait on a buyer’s financing to be approved.

They target their services mainly toward sellers, making all-cash offers in a matter of days with minimal hassle on your end. Services include:

- Opendoor Complete: This service bundles buying, selling and closing into one theoretically seamless transaction. If you want to buy a new home using the proceeds from the sale of your current home, it can help you avoid paying two mortgages or dealing with two moves.

- Opendoor Exclusives: For buyers, this service is available only in Austin, Houston and Dallas–Fort Worth, Texas, offering access to Opendoor-owned homes 14 days before Opendoor lists them on the market. For sellers, the Exclusives program lets them take 30 days to see if they get a higher offer from a prequalified buyer before accepting Opendoor’s cash offer.

- Partnerships: Title company OS National is a wholly owned subsidiary that allows Opendoor to wrap title and escrow services into their offerings to buyers and sellers. It also has a mortgage lending partnership with Lower.com. In addition, Opendoor has a partnership with Zillow for sellers in 45 markets around the country.

Opendoor for sellers

The ease of Opendoor’s process is a big selling point. You just enter your address into their site and provide some basic info about your home, and the company makes you a preliminary cash offer in minutes.

If you like the sound of it, the next step is a video walkthrough of your home. Once the company sees the video, they’ll send a representative to assess the home in person, both inside and out. You’ll receive a final offer within a few days of the in-person assessment — how close it is to the preliminary number depends on how many repairs will be needed, and closing costs are also deducted.

You’re not obligated to accept the offer, but if you do, the final steps are to set a closing date and move out. Unlike cash-homebuying companies that purchase properties as-is, with Opendoor you’ll need to clear out the home and leave it broom-clean.

One caveat: There is a relatively long list of property types that Opendoor does not buy, so there’s a chance that your home will not be eligible to be sold to them. With some exceptions, the company generally will not buy houses that are:

- Outside their operating areas

- Prefabricated or mobile homes

- Valued at more than $600,000

- On lots of two acres or more

- Built before 1930

- Located in a flood zone

- Equipped with a well or septic system

- Short sales or foreclosures

- Lender-owned

- Tenant-occupied

- Severely damaged (ie, foundation issues, flood or fire damage)

- Built with un-permitted additions or certain dated materials

Opendoor for buyers

Opendoor may be an iBuyer, but it also works in the home-selling space. Home shoppers can use them to buy any home, whether it’s one Opendoor owns or one on the local MLS.

Buying from Opendoor means getting paired with one of their own real estate agents, what they call a partner agent — you can’t bring your own hand-picked real estate pro to the table.

The main upside is that Opendoor can make the offer for you, using company cash, and then hold the home for you while you sort out your mortgage. If you’re in a competitive housing market, the ability to make what is essentially a cash offer can give you a leg up. You do, however, have to have preapproval from a mortgage lender to buy with them.

How does Opendoor make money?

Opendoor does need to turn a profit, of course, and to do so, it charges fees. If you sell your home to Opendoor, you’ll pay a 5 percent service fee. (So, if they’re offering to buy a home for $350,000, you’d automatically subtract $17,500, or 5 percent of that.) That’s pretty equivalent to what you’d pay in real estate agent commissions in a traditional sale — these usually average between 5 and 6 percent of the final sale price. You’ll also be responsible for paying about 1 percent in closing costs.

The company also typically charges for necessary repairs, a cost that can vary widely depending on each transaction and is relatively vague. Per their website, “Some examples of common repairs include paint, roofing, flooring, and HVAC.” It’s unclear exactly what they will deem necessary.

Opendoor coverage

Like most iBuyers, Opendoor does not operate everywhere in the country, so in order to sell your house to them, first you need to find out whether they buy homes in your area. They primarily service large metro areas, including Atlanta, Boston, Charlotte, Dallas–Fort Worth, Denver and Los Angeles.

The following 26 states contain at least one market where Opendoor is buying:

|

|

Opendoor competitors

Opendoor was one of the pioneers of the iBuying game, and it’s still one of the biggest players. It’s not the only player out there, though — Offerpad is another big-name iBuyer. Zillow and Redfin both used to operate in the space as well, though both have since shut down their iBuying arms.

There are also other companies out there who also aim to streamline the homebuying and selling process, such as Clever and HomeLight. A wide variety of cash-homebuyers also operate similarly, with cash offers and fast timelines, including large national players like We Buy Houses and HomeVestors. And just about every state and major metro area has smaller, locally owned options too.

Opendoor pros and cons

Working with Opendoor comes with advantages and disadvantages. Here are a few things to consider:

Pros

- Convenience: Selling your home through an online iBuying platform is an easy and streamlined process when compared to a traditional sale. Your transaction moves along with very little third-party involvement. There are also none of the hassles of open houses and viewings — you don’t need to open your home to strangers who tour through looking at every detail.

- Speed: A cash offer means no waiting on a buyer’s financing to be approved or fearing that it might fall through. You get the house off your hands and the money in your pocket faster. If you need to relocate quickly, selling your home to a company like Opendoor can get you the money you need to move ASAP.

Cons

- Lower offers: The major downside is that going through a company like Opendoor likely means you’ll pocket less than you would if you sold your home the traditional way, on the open market. These businesses need to turn a profit on each transaction and don’t offer top-of-the-market prices.

- Fees: Opendoor charges a flat 5 percent fee to buy your house, which is nearly as much as you’d pay in real estate commissions if you sold the traditional way. They also require you to pay a certain amount of closing costs and charge you for repairs.

Opendoor vs. traditional real estate agents

While Opendoor can take a lot of the hassle out of home selling, so can a good local real estate agent. A local agent will know the intricacies of your specific area’s market very well and be able to market your home effectively to get you the best price possible. Listing this way does take longer, and you do have to pay their commission fee. But the amount is only nominally more than Opendoor charges (agent commissions usually total between 5 and 6 percent, while Opendoor charges a flat 5 percent fee), and an agent-assisted sale will typically make up for the extra time by fetching you a higher price.

Bottom line

There are many instances in which selling your home through Opendoor might be a good idea. For example, if you need to sell your home fast so you can relocate for work, if you need the cash more quickly than you’d see it in a traditional transaction, or if you just want to get the property off your hands in the easiest way possible.

However, if bringing in the highest price possible for your home is more important to you than speed or convenience, you’re probably better off selling with a local real estate agent. It couldn’t hurt to look into both options, comparing Opendoor’s offer against a local agent’s listing price recommendation. But don’t take too long — you’re not obligated to accept an offer from Opendoor, but if you don’t accept it within seven days, it expires.

FAQs

-

It means your house meets the criteria for them to buy, based on the information the company has. It’s not, however, cash in your pocket just yet — if you want to move forward with the process after you see the preliminary offer, you must first send in a video walkthrough of the home and allow a representative to pay an in-person visit. Within a few days of this in-person assessment, you will receive a final offer, which will be revised to account for their service charge and repair fees.

-

No. Cash-homebuying companies and iBuyers need to make money on the transaction, so their offers will fall short of fair market value. Opendoor also charges a flat 5 percent fee for each transaction. If you want to bring in the highest price possible for your home, you’re better off working with a local real estate agent.

-

It might. The “instant” cash offer Opendoor provides online is strictly preliminary. If the information it’s based on turns out to be incomplete or inaccurate, or if they learn something problematic about your property during their in-person assessment (like an un-permitted addition or serious foundation damage), they might decline to make a final offer.

-

In most cases, no. However, if you think their offer is way off, you can always reach out to let them know and they might be willing to reassess.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.