How to sell a house by owner in Florida

Key takeaways

- You don’t need a Realtor to sell your home in Florida, but they provide valuable expertise that could save you time and money.

- If you sell without an agent, you won’t need to pay a listing agent’s fee. However, you may still need to cover the buyer’s agent’s commission.

- In these situations, it’s smart to hire an attorney to make sure your deal is solid and your interests are protected.

Florida has long been an attractive destination for retirees and out-of-state transplants, thanks to its beaches, warm weather and relatively affordable cost of living. But with the recent high mortgage rates and a tricky homeowners insurance market, the state’s housing market has started to slow.

The most recent data from Florida Realtors reveals that the median sale price for a single-family home across the state in August 2024 was $411,638 — a slight decrease (0.8 percent) year-over-year. And homes are taking much longer to sell, spending a median of 39 days on the market before contract — a 44.4 percent increase from last year.

These trends may seem concerning to homeowners thinking of selling in the Sunshine State. To maximize your profits and avoid paying a hefty commission fee, you might consider foregoing a real estate agent in favor of a for sale by owner or FSBO sale. Here’s what you need to know about how to sell your house by owner in Florida.

Selling a house without a Realtor in Florida

Before you decide to go the FSBO route, it’s helpful to understand what’s involved in this type of sale — acting as your own agent is a lot of work. Here’s a rundown of the process.

Get your home market-ready

No matter where in Florida you live, there are some important steps you’ll need to take before your home is ready to list.

- A pre-listing inspection isn’t mandatory, but it can be a great place to start: A professional will examine your home and identify any issues with the property before it hits the market. This gives you a better idea about the condition of your house, which can help you decide how much to list it for — or how much you want to sink into repairs.

- What is necessary, though, is cleaning and decluttering to get the home ready for viewings. You want it to look its best for potential buyers. Some sellers even choose to have their home professionally staged by a design expert.

- Boosting your home’s curb appeal can be another critical part of getting it market-ready. Make a strong first impression with buyers by making it inviting right from the start: Tidy your landscaping, add some bright flowers, clean your windows, maybe even refresh the paint job.

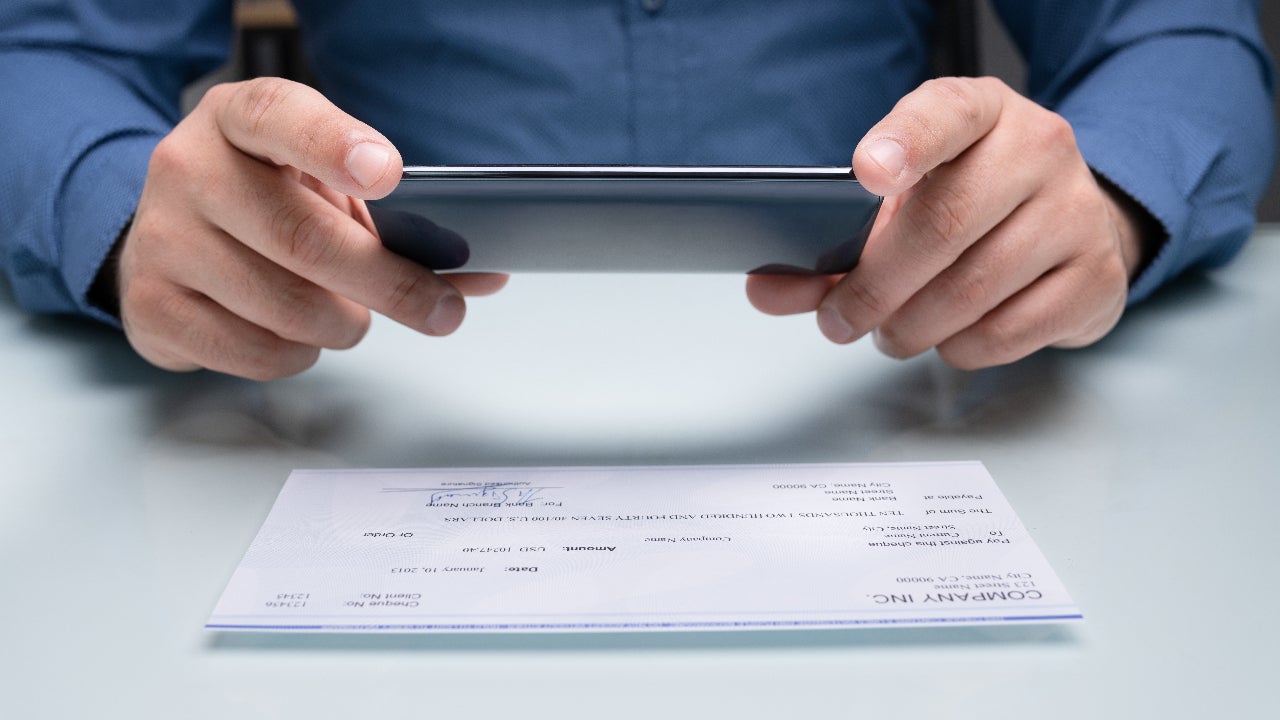

- Once this prep work is complete, it’s smart to hire a photographer to snap some professional-quality photos of your property, inside and out. These shots are crucial, since most buyers browse listings online before deciding which ones to go see in person.

Set a realistic price

You might already have an idea of how much your home is worth, but you should still do some research before setting a sale price. After all, if you price your house too high, it could deter some buyers immediately. But you don’t want to go too low and potentially lose money, either.

Start by looking at real estate comps in your area. This means searching for recently sold houses in your neighborhood that are similar to yours (think square footage, number of bedrooms/bathrooms, amenities) to see how much they went for. This exercise will give you some insight into how properties like yours are performing in your local market.

If you’re still not sure, it might be worth scheduling a professional home appraisal. An appraiser will both review comps and perform a walk-through of your property, giving you an independent assessment of its value. This will likely cost a few hundred dollars.

Besides an asking price and photos, your listing will also need a written description that details all of its features, including Florida specifics like distance to the nearest beach and whether or not there’s a swimming pool.

Promote, promote, promote

To get the word out about your house, you’ll have to put some effort into marketing. The best way to get your property seen by buyers is to put it on your local multiple listing service (MLS), a database that real estate agents use to list and view available properties. Without an agent, you’ll likely need to hire a company to list the home on your behalf — many will do it for a one-time flat fee, so search online for options in your area.

You’ll also want to add a yard sign to let locals know that your home is on the market. On it, mention that the property is FSBO and include a phone number or email address. You can promote the sale on social media as well; just be cognizant of what kind of information you’re putting out there, especially if you and your family still live in the home.

Without an agent to coordinate showings, keep in mind that you’ll be doing all the scheduling, showing and open-house hosting yourself. Use caution, again, when letting strangers into your home.

Negotiate and close the deal

With any luck, you’ll wind up with an offer or two. Be ready to negotiate with the buyer’s agent about everything from pricing to contract terms and closing date, and stay organized with all the paperwork (there’s a lot!).

The legal end of things is probably the trickiest part to manage without a Realtor. That’s why, even though the state of Florida does not require you to hire a real estate attorney to sell your home, it makes sense for FSBO sellers to hire one. Real estate contracts are complicated, and you want to be completely sure that you’re both following the law and looking after your best interests.

Required disclosures for Florida home sellers

Florida home sellers must complete a property disclosure form, which lays out any potential issues or problems with the property, including its potential for erosion (if it’s a coastal property) and the presence of environmental hazards like radon gas or lead-based paint. This is standard procedure in most states.

For properties that are part of a homeowners association, you’ll also have to provide the buyer with information about the HOA rules, financials and fees.

Pros and cons of selling a house by owner in Florida

Selling your house without a real estate agent’s help has both benefits and drawbacks.

Pros

- Not having an agent means you don’t have to pay a listing agent’s commission. This will save you the equivalent of about 2.5 to 3 percent of your home’s sale price. So, if you sell your home for $400,000, that’s $10,000 to $12,000 you don’t have to pay to a Realtor.

- Selling your home on your own means you have complete oversight of every decision, including pricing, marketing and negotiating: You call the shots.

- When an agent shows your home, they will typically ask you and your family to clear out. This can be tricky, especially for families with kids and pets. But with FSBO, you’re showing your own home, and you never have strangers in the house without you being there.

Cons

- FSBO sales require a lot of work and a big time commitment. From setting a price to coordinating showings to negotiating with buyers, it’s all your responsibility.

- You might earn less money. Significantly less: According to data from the National Association of Realtors, in 2023, FSBO homes typically sold for almost $100,000 less than agent-listed houses.

- Real estate agents are licensed pros who know their local markets incredibly well. Without one, you lose out on their expertise, guidance and industry connections.

FAQs

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.