What is a Schedule K-1?

Our writers and editors used an in-house natural language generation platform to assist with portions of this article, allowing them to focus on adding information that is uniquely helpful. The article was reviewed, fact-checked and edited by our editorial staff prior to publication.

What is a Schedule K-1?

A Schedule K-1 is a tax form that reports income, deductions, dividends and other financial information for partnerships, S corporations and trusts. These organizations are generally required to issue a K-1 to those with a financial interest in them, and recipients are required to report the information on tax returns.

Here’s what you need to know about a Schedule K-1 and who is required to receive and file one.

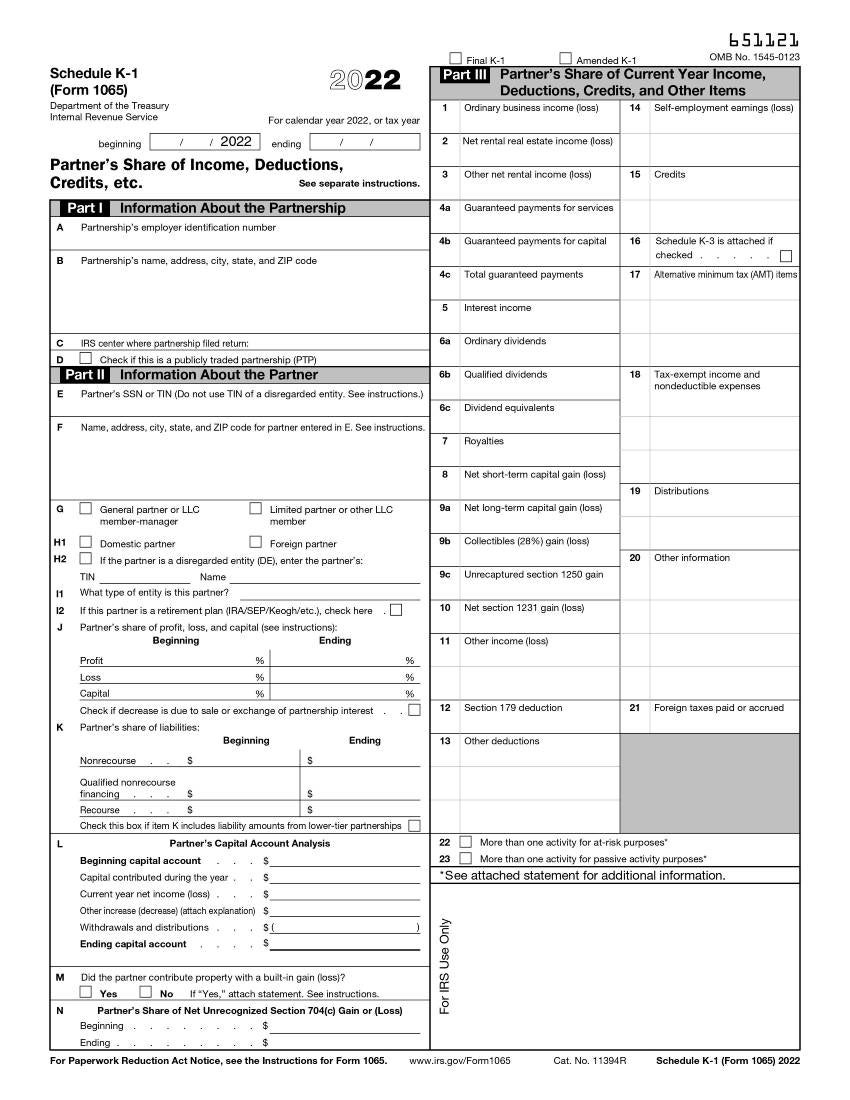

Source: IRS.

How does a Schedule K-1 work?

Schedule K-1 is a tax form that certain types of businesses, such as partnerships and other financial entities, use to report the dividends, gains and losses, invested capital and other moves made by those with a financial interest in them.

For example, companies must issue to their partners K-1s that provide details on their share of yearly earnings, their share of dividends and interest earned from the investment and other information.

When a partnership forms, the partnership must keep records of each partner’s initial investment on a K-1. Investors in publicly traded partnerships also have their investment, gain or loss and dividends reported on a K-1.

Similarly, S corporations report the income, losses and dividends paid to shareholders on a K-1. Trusts and estates also use K-1s to report income distributions to beneficiaries. ETFs also may issue K-1s if they are structured as partnerships, which is common.

Those who receive a K-1 must report the relevant financial information on their annual tax return or they risk running afoul of tax laws.

How are K-1s used?

Although individuals do not submit K-1 forms to the IRS, they should use the information from a K-1 to finalize their personal income tax returns.

The IRS receives different K-1 information from corporations, trusts, estates and partnerships. The responsibility for paying taxes on a business’s earnings usually falls on the partners in a partnership, rather than on the business itself. So the K-1 provides the individual’s share of the entity’s gains and losses, for example, allowing an individual to pay the correct amount of tax. This is in addition to any W-2 wages earned by the taxpayer from the corporation, which are reported separately.

Here’s what to expect on a K-1 form

A K-1 has three key sections:

- Part I: This section provides basic information about the business entity, such as employer identification number (EIN), address and filing location.

- Part II: This section provides specific information about the recipient, such as their Social Security number, address, position within the entity and the person’s share of profits and losses. It also shows how much the partner has invested in the business and how much was contributed or withdrawn during the year.

- Part III: This section shows the recipient’s share of the entity’s income, deductions, credits and other financial details. The information includes details on dividends and interest earned from the investment.

Who has to file a Schedule K-1?

Four main types of entities must file a K-1:

- Business partnerships: Partnerships need to file a K-1 form for every partner.

- S corporations: S corporations must submit a K-1 form for each shareholder.

- Trusts and estates: Trusts and estates must provide a K-1 to every benefactor.

Organizations and partnerships fill out K-1 forms and provide them to partners and shareholders.

When do you receive a Schedule K-1?

While individuals may receive some tax forms as early as January for the prior tax year, a K-1 may not arrive until relatively late in the tax season. Some experts say it’s typical to see them in the summer.

According to the IRS, “Schedule K-1 must be provided to each partner on or before the day on which the partnership return is required to be filed.” Timing is also dependent on the entity’s fiscal year.

Bottom line

A Schedule K-1 is a form that organizations use to report the proportional income, gain and loss, dividends and other financial information of those with a financial interest in the entity. For individuals, it’s important to receive a K-1 for the relevant financial interest and then report that information correctly on the individual’s tax return.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

What are stocks and how do they work?

SEP IRA vs SIMPLE IRA: How they compare