Cash back vs. travel points: How to choose credit card rewards

Key takeaways

- Cash back credit cards make sense when you want to earn simple rewards for each dollar you spend.

- A points or miles card may be a better option if you travel often and want to earn rewards for travel on your purchases.

- If neither option is the perfect fit, it may be worth trying out different credit card combinations and rewards structures to see what works.

Rewards credit cards come in many forms. Some offer cash back while others offer travel rewards in the form of points or miles, and there can be potential benefits and downsides to all these options. The type of rewards credit card and rewards structure that’s best for you depends on your spending habits, lifestyle and goals. Learn more about the differences between the two, the pros and cons of each and how you can choose the rewards style that’ll work for you.

Cash back rewards versus points and miles rewards

Cash back cards offer cash rewards as a percentage back on your purchases. These cards tend to be easy to use and primarily feature cash redemptions, though you may be able to choose additional options like gift cards or shop with points at specific retailers.

On cards that offer points and miles, you rack up a certain amount of points or miles on your purchases instead. On some cards, you earn points through a credit card issuer’s own rewards program — like Chase Ultimate Rewards or American Express Membership Rewards. These rewards programs typically offer flexible redemption options, including travel.

Other cards let you earn points and miles directly with a specific airline or hotel chain’s loyalty program, such as American Airlines AAdvantage or World of Hyatt. You’ll generally find this kind of rewards system on co-branded airline or hotel credit cards.

Used wisely, points and miles can go a long way to helping you save on a coveted vacation.

Cash back vs. points and miles credit cards comparison table

Before we dive into all the different ways you can utilize cash back and points and miles credit cards, the chart below provides an overview of how these cards work.

|

Cash back credit cards |

Points and miles credit cards |

|

|

Rewards currency |

Cash back |

Points or miles from general rewards, airline or hotel cards |

|

How much you can earn |

1% to 2% cash back on regular purchases; 3% or more cash back in bonus categories |

1X to 2X points on regular purchases; up to 10X points in bonus categories; potentially more with hotel credit cards |

|

Redemption options |

Cash back, statement credits, gift cards and merchandise |

Varies by card type but may include travel through a portal, transfers to airline and hotel partners, cash back, statement credits, gift cards and merchandise |

|

Redemption values |

Typically 1 cent per point in value |

Typically no more than one cent per point for non-travel options; flexible and much higher value possible per point for premium travel redemptions |

What to know about cash back rewards cards

In general, cash back is the better choice for simplicity seekers hoping to earn uncomplicated rewards on everyday purchases.

Cash back credit cards offer a percentage of cash back on each dollar you spend, with some cards offering a higher rate in select categories like groceries or gas. Some cash back cards offer a flat 1.5 percent to 2 percent cash back for every purchase you make, while others offer higher bonus rewards — ranging from 3 percent to 5 percent back — in fixed or rotating categories.

Redemption flexibility

A major benefit of cash back cards is their flexibility when it comes to redeeming rewards. Depending on the cash back card you use, you may be able to redeem your rewards for a check in the mail, a direct deposit or a statement credit to your account. Some of the best cash back cards let you cash in your rewards for gift cards, merchandise or travel rewards through your card’s travel portal, though the value for these options is often less.

Redemption value

Cash back credit cards tend to be a good value for people who rarely travel or prefer to use their rewards for everyday savings rather than premium experiences. Cash back rewards are generally worth 1 cent each, although this varies by program. When you’re getting 1 cent per point, a 2 percent cash back card yields $2 for every $100 you spend.

Pros and cons

Consider these advantages and disadvantages of choosing a cash back card instead of a points and miles card:

Pros

- Earning and redeeming cash rewards is simple and quick.

- Cash rewards value tends to be straightforward and can be easier to maximize.

- There are many no-annual-fee cash back cards to choose from.

- Cash back credit cards may offer hefty welcome bonuses.

Cons

- Most cash back credit cards don’t come with notable travel benefits (but you may be able to earn rewards on certain travel purchases).

- Maximum potential rewards value for cash back cards can be lower when compared to the best travel credit cards.

- You may have limited redemption options — or no redemption options other than statement credits — depending on the card you choose.

What to know about points and miles cards

A points or miles card is likely the better choice for people who travel often or want to save for an aspirational trip. Many types of rewards credit cards fall under the umbrella of “points and miles” cards or “travel” cards. These cards include airline credit cards that let you earn frequent flyer miles in a specific frequent flyer program, hotel credit cards that let you earn points towards free stays, and also flexible rewards cards that earn points in a credit card issuer’s own rewards currency and let you redeem point for travel in multiple ways.

Points and miles cards can also come with useful travel benefits like airport lounge access, travel credits, application fee credits for Global Entry or TSA PreCheck or built-in travel insurance benefits — although cards with the strongest benefits often charge high annual fees.

Redemption flexibility

Some of the best travel credit cards on the market today offer strong flexibility when it comes to redeeming your rewards. If you have a travel credit card that earns Chase Ultimate Rewards points, for example, you may be able to redeem your points for cash back, gift cards, statement credits, merchandise, travel through the Chase Ultimate Rewards portal or even 1:1 points transfers to Chase airline and hotel partners.

Redemption value

Travel rewards tend to be worth more than cash back if used strategically, and some of the best travel rewards currencies can be worth about 2 cents each or more depending on how you redeem your travel rewards based on Bankrate valuations.

While cash back redemptions typically give you a fixed value for your points – typically 1 cent per point – the value of travel rewards depends on how you redeem them.

Most points and miles experts use the “cents per point” equation when calculating value: take the cash value of the award flight or hotel stay you’re redeeming for (minus any taxes and fees you need to pay out of pocket) and divide that by the points cost, to find out how much each point is worth. For example, if you pay 10,000 points and $50 in taxes and fees to book a flight that retails for $250, you’d be getting a value of 2 cents per point.

Some credit card rewards programs, like Chase Ultimate Rewards, might also offer higher value when you redeem your points through the issuer’s own travel portal.

Outsized rewards through transfer partners

Finding the most valuable redemptions for points and miles can take some work, but the payoff is worth it. Typically, you’ll get the most bang for your buck with premium cabin flights or expensive hotel stays that retail for a high cash price but cost relatively less when paying with points.

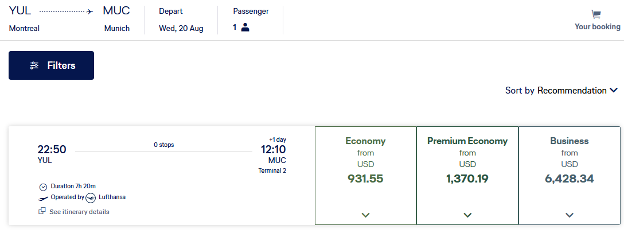

For example, consider this one-way Lufthansa business class flight from Montreal to Munich. It costs 88,000 miles (plus $59 in taxes and fees) when booked with United MileagePlus, but $6,428 when booked with cash through Lufthansa. Booking this flight with points and miles would net you a whopping 7.2 cents per point in value – a great deal if you’re looking to fly in luxury.

These kinds of high-value redemptions are known in the points and miles world as “sweet spots.” They take some work to find, but you can start your search by familiarizing yourself with the best frequent flyer programs and the best ways to use points and miles for travel.

Pros and cons

Here are some general advantages and disadvantages of choosing a points or miles card over a cash back card:

Pros

- Travel rewards can provide more value than cash back if you travel often and prioritize high-value redemptions.

- Perks like priority boarding, free checked baggage, airport lounge access or free nights at hotels help you travel in style.

- Many travel cards come with travel insurance and no foreign transaction fees.

- Travel cards, especially premium ones, can have higher rewards rates and higher welcome bonuses.

Cons

- Travel credit cards tend to have higher annual fees than cash back cards.

- Points and miles credit cards typically require more effort than cash back cards when it comes to tracking your rewards and making sure you’re getting the best value out of them.

- Airline credit cards and hotel credit cards often offer limited redemption options.

Cash back vs. points and miles credit card examples

If you’re reading over the pros and cons of either type of card and wondering which is best for you, consider the following scenarios.

In the first example, imagine you want to earn cash back rewards for each dollar you spend, then redeem the rewards for statement credits to your account. You decide to sign up for an American Express credit card as a result, but you can’t decide which one.

If you signed up for a points and miles credit card like the Platinum Card® from American Express or the American Express® Gold Card, these points would only be worth 0.6 cents each if redeemed for statement credits to your account.

In the meantime, paying with points at checkout would get you a slightly better value of 0.7 cents per point for most merchants.

The redemption values shown above also apply to the American Express Gold Card.

Instead of going with a points and miles credit card, however, you could sign up for a true cash back credit card from Amex and get 1 cent per point in value when redeeming for a statement credit. That’s how it would go if you chose the Blue Cash Preferred® Card from American Express, which would allow you to also earn a welcome bonus while enjoying exceptional rewards in a range of everyday categories along the way.

If you wanted to redeem your rewards for travel instead of cash back, however, you would probably want to opt for a points or miles credit card instead. If you did go with the Amex Platinum or the Amex Gold in this case, you would have the option to transfer your points to 20 different airline and hotel loyalty programs including Air France-KLM Flying Blue, Hilton Honors, Marriott Bonvoy and Virgin Atlantic Flying Club, which could net you 2.0 cents per point on average with the right redemption, according to Bankrate valuations.

Some types of points and miles credit cards also offer more value for rewards when redeeming points for travel through the issuer’s own travel portal, including the Chase Sapphire Preferred® Card and Chase Sapphire Reserve®. These cards let you transfer points to airline and hotel partners, but also offered a flat 25 percent or 50 percent boost in value, respectively, when you used points to book travel through Chase TravelSM. That old system is being phased out and replaced with Points Boost, which gives cardholders up to 1.75X (Chase Sapphire Preferred) or 2X (Chase Sapphire Reserve) value on specific airline and hotel redemptions through Chase Travel. However, existing cardholders will still be able to access the old rewards rates until October 2027.

Under the old system of the 25 percent or 50 percent extra value on all Chase Travel redemptions, 60,000 points would be worth $750 with the Sapphire Preferred and $900 with the Sapphire Reserve. Under the new Points Boost system, 60,000 points could be worth up to $1050 with the Sapphire Preferred and up to $1200 with the Sapphire Reserve, but only on select hotel stays or flights.

If you decide to use your Chase points for cash back or statement credits, on the other hand, you would get just 1 cent per point in value.

Bankrate writer Ryan Flanigan says he chooses a card for a specific reason. If he has a big trip in mind, he’ll focus his efforts on cards that help him earn the points or miles he needs to maximize those expenses. But if he has a significant upcoming expense that won’t fit nicely in a bonus category, he’ll look for a cash back card to “defray that cost as much as possible.”

Which rewards are best for you?

When it comes to cash back versus points, it comes down to your spending habits, goals and lifestyle. For instance, Bankrate managing editor Sarah Gage prefers points and miles. She says,

I optimize for travel points because without them, we wouldn’t travel to the extent we do.

— Sarah Gage Bankrate managing editor

And Bankrate lead writer Benét J. Wilson agrees. She says,

Nothing is more satisfying to me than using my travel points to book a great trip, like when I used Delta miles to take my family to visit Paris and London. It’s all about the experiences for me!

— Benét J. Wilson Bankrate lead writer

But if you don’t travel much or care about using your rewards strategically toward lofty travel goals, you’re best suited for cash rewards. Bankrate senior editor Harlan Vaughn is a fan of cash back cards:

Not everyone is ready for the potential complexity of travel rewards. Cash back is just that: a cash rebate for your spending. It’s a bonus for your spending you wouldn’t otherwise get. Don’t leave money on the table.

— Harlan Vaughn Bankrate senior editor

If cash back is your preferred choice, you may want to opt for a flat-rate cash back card so you don’t need to keep up with rotating bonus categories or activating your rewards. No matter which type of cash back card you choose, this move will benefit you due to the sheer simplicity of earning rewards. And you’ll still get something back from your credit card spending, even if you don’t get the most value for your rewards.

If you get a rush out of turning $500 worth of credit card rewards into $750 or $1,000 worth of travel, then you’re a perfect candidate for a card that offers rewards in the form of points or miles. You’d benefit from a travel card that gives you plenty of options for boosted points or miles values and travel upgrades. If you travel throughout the year and want access to benefits to make air travel more comfortable, then an elite travel card may be an even better fit.

The bottom line

To determine whether a cash back, points or miles card is better for you, you’ll need to know what kind of cardholder you are and what type of rewards structure most closely matches your spending habits and lifestyle.

But it doesn’t necessarily come down to choosing between cash back vs. rewards. It’s not uncommon for cardholders to pair a few different credit cards to maximize their rewards, so trying out different credit card combinations and rewards structures could also be an option.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.