What’s the value of your American Airlines miles?

Key takeaways

- American AAdvantage miles can be worth more or less depending on when you book, the timing of your flight and other factors.

- You can use loyalty points to boost your AAdvantage status.

- Miles can be earned from booking flights and other travel, as well as through shopping, dining and co-branded credit cards.

The American Airlines AAdvantage rewards program allows you to earn miles from flying, credit card spending, eligible shopping and more, which you can then redeem for rewards like free flights, flight upgrades, vacation packages and travel experiences.

Although you cannot redeem AAdvantage miles directly for cash, you may be wondering how much are American Airlines miles worth. Read on to learn more about the value of AAdvantage miles and how they compare to similar programs as well as what you can use these miles for.

How much are American Airlines miles worth?

According to Bankrate’s latest points and miles valuations, American AAdvantage miles are worth 1.0 cents apiece on average. That would break down into the following dollar amounts:

| AAdvantage miles | Value according to Bankrate valuations |

|---|---|

|

25,000 miles |

$250 |

|

50,000 miles |

$500 |

|

75,000 miles |

$750 |

|

100,000 miles |

$1,000 |

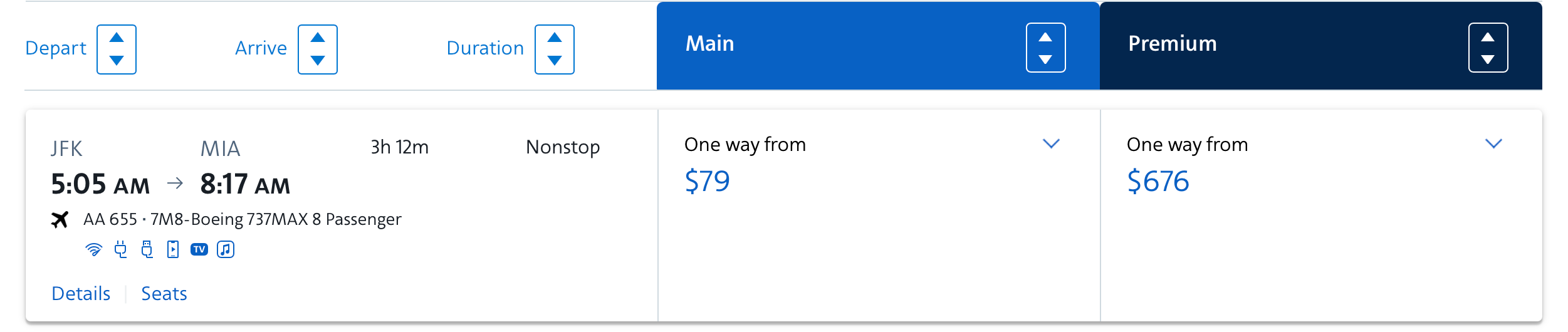

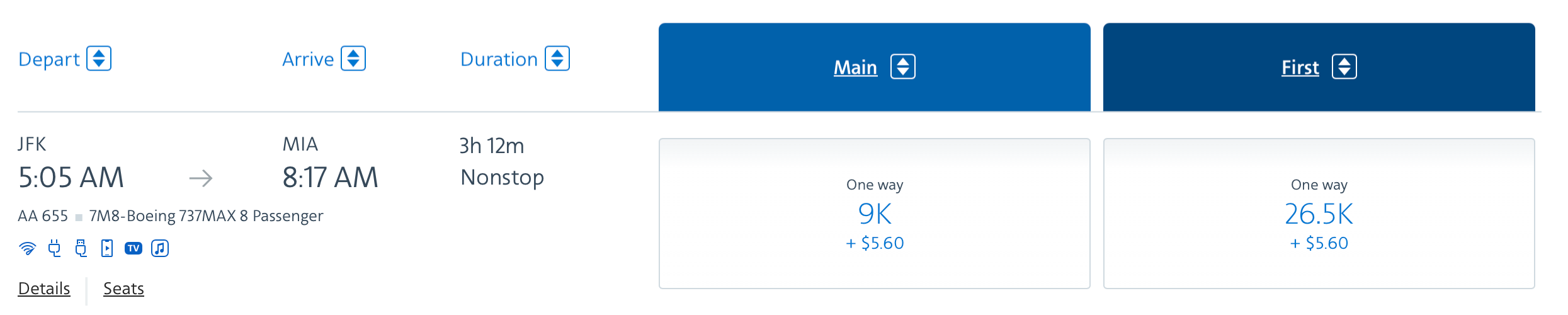

However, there are ways to gain additional value from American Airlines AAdvantage miles depending on how you use them. For example, we found a one-way, first-class flight from New York (JFK) to Miami (MIA) in April for $676 if you pay in cash.

If you pay in miles, however, that flight will cost only 26,500 miles, a savings compared to paying in cash for the fare at a 2.55 cents per mile ($676 / 26,500 = 0.0255).

However, a one-way, main cabin flight from Portland to New York in March might cost you $147 in cash and about 12,000 miles ($147 / 12,000 = $0.012). With this flight, each mile would be worth about 1.2 cents. Still not a bad value, but not the best either.

American Airlines miles vs. other airlines

Compared to other airline rewards programs, the average value of American Airlines miles is on the lower end. You may be able to get more value if you travel in a specific geographical area through a smaller carrier, but you will forgo the expansiveness that comes with a rewards program from one of the largest airlines in the world.

|

Airline rewards program |

Bankrate estimated value |

|---|---|

| American Airlines AAdvantage | 1.0 cents |

| Alaska Airlines Mileage Plan | 1.1 cents |

| Delta SkyMiles | 1.2 cents |

| Frontier Miles | 1.3 cents |

| Hawaiian Airlines HawaiianMiles | 0.7 cents |

| JetBlue TrueBlue | 1.3 cents |

| Southwest Rapid Rewards | 1.5 cents |

| Spirit Airlines Free Spirit | 1.0 cents |

| United MileagePlus | 0.9 cents |

| Virgin Atlantic Flying Club | 2.6 cents |

Source: Bankrate

What’s the value of AA Loyalty Points?

In 2022, American Airlines launched the Loyalty Point Rewards program. You earn one loyalty point for every eligible AAdvantage mile you earn.

The Loyalty Point Rewards program is how you earn AAdvantage status, and status is how you can boost your airline experience overall or earn more rewards with each trip. The loyalty points accumulate toward earning status — AAdvantage Gold at 40,000 points, Platinum at 75,000 points, Platinum Pro at 125,000 and Executive Platinum at 200,000 — and offer you a reward when you earn a certain amount.

Here’s what you can earn when you reach the required amount of points:

|

Loyalty points needed |

Reward earned |

|---|---|

|

15,000 |

1,000 loyalty points |

|

175,000 |

5,000 loyalty points |

|

250,000 |

15,000 loyalty points |

Keep in mind: By reaching the points threshold above, you’ll have the opportunity to earn more than just loyalty points. Some of the above thresholds allow you to choose a different reward other than or in addition to the points.

The higher your AAdvantage status, the more rewards you earn for each of your flights. That’s in addition, of course, to the other perks and benefits that come with airline status, ranging from priority boarding to free checked bags and more.

How to redeem American Airlines miles

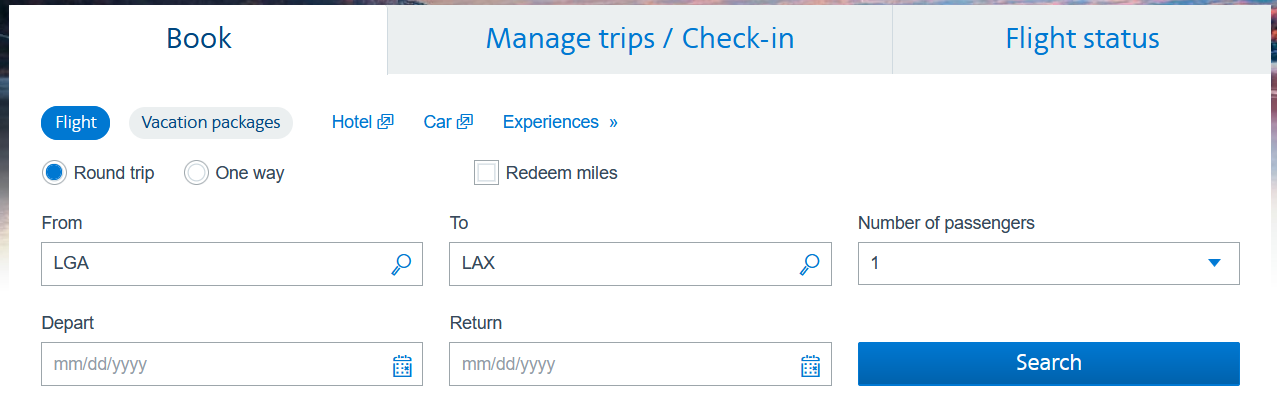

AAdvantage miles can be redeemed for American Airlines flights, flights on partner airlines, flight upgrades, an Admirals Club membership, travel experiences, rental cars, hotel bookings, vacation packages and charitable donations. To redeem your miles, head to the American Airlines website and conduct your search, being sure to select “Redeem miles.”

Once you’ve entered your desired destination and dates, American Airlines will present different flight options and the miles required for each.

When is the best time to redeem American Airlines miles?

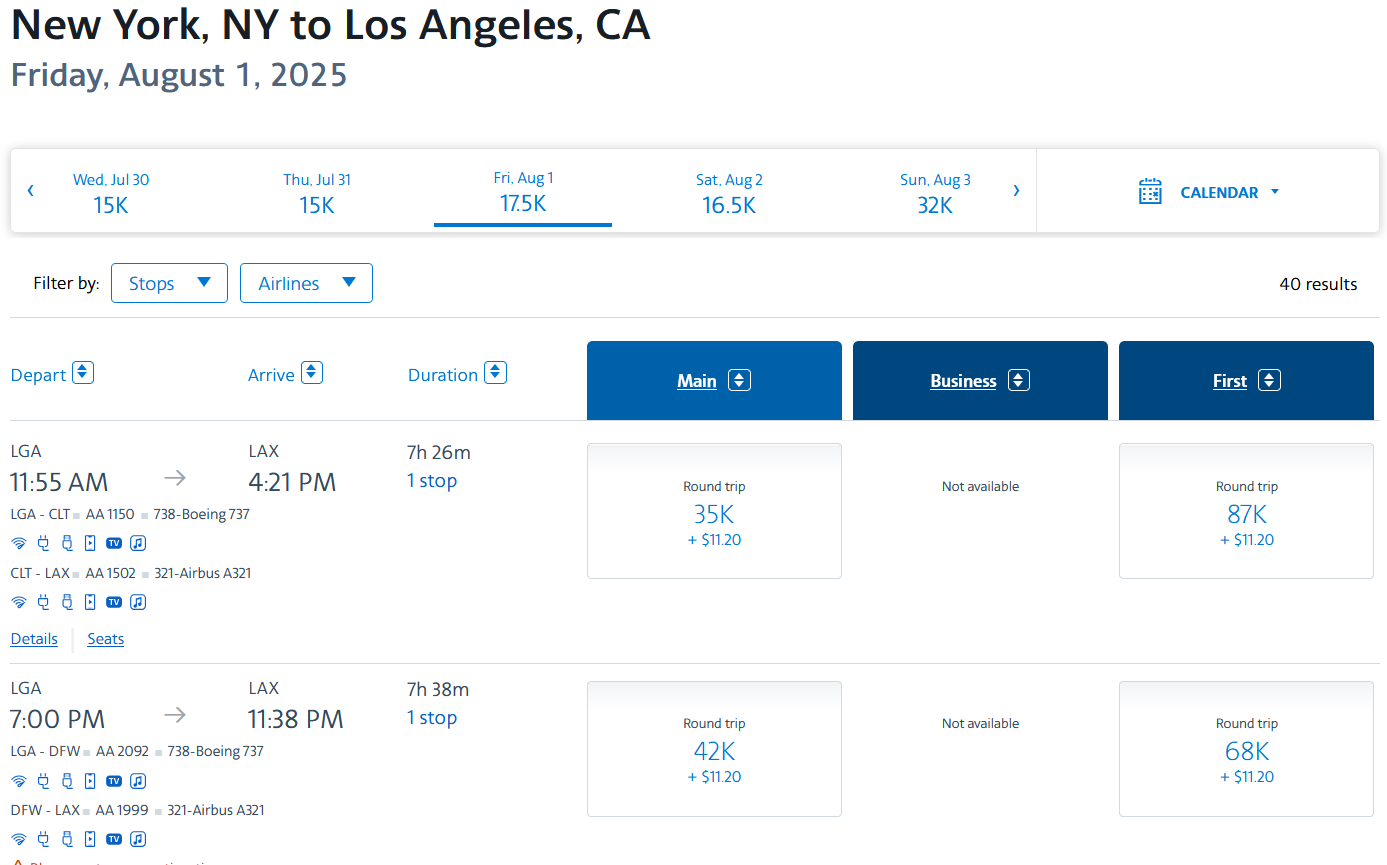

American Airlines’s AAdvantage program uses dynamic pricing, meaning the points required for a trip can vary depending on the flight and time of year you intend to travel. As a result, you may get more value from your miles if you book early, can be flexible with dates or fly during off-peak seasons instead. When searching on the American Airlines website, you can click on the calendar view to more easily see the required points for a route, including the lowest price in miles for the given month.

Although redemption values will vary no matter the method you choose, you may get more value from your miles when you redeem them for flights during off-peak seasons or to off-peak destinations. You may also get more value from your miles by redeeming them with American’s partner airlines.

For example, when we conducted our search, booking a round-trip from New York City (LGA) to Los Angeles (LAX), departing Aug. 1 and returning Aug 4. would cost 17,500 miles. However, if you instead booked Aug. 2 and return Aug. 5, a round-trip ticket would only cost 16,500 miles.

Best credit cards for earning American Airlines miles

If you want to boost your ability to earn miles with the airline, you should consider getting one of American Airlines’ rewards credit cards. The airline has several credit cards to choose from, issued by both Citi and Barclays. Here are a few options to consider:

American Airlines AAdvantage® MileUp® Card

-

The American Airlines AAdvantage MileUp* is the airline’s no-annual-fee credit card option. You’ll earn 2X miles per dollar on eligible American Airlines purchases and grocery store purchases, along with 1X miles on all other purchases. Plus, as a new cardholder, you can earn 15,000 bonus miles after spending $1,000 on purchases within the first three months of account opening.

Citi® / AAdvantage® Platinum Select® World Elite Mastercard®

-

The Citi / AAdvantage Platinum Select World Elite Mastercard* comes with a bonus of 80,000 miles after you spend $3,500 within the first four months of account opening. Additionally, the card earns:

- 2X miles on eligible American Airlines purchases

- 2X miles at restaurants and gas stations

- 1X miles on all other purchases

The annual fee is $99 per year, but it’s waived for the first 12 months.

Citi® / AAdvantage® Executive World Elite Mastercard®

-

If you have some big purchases on the horizon, you can score a lot of miles from the Citi® / AAdvantage® Executive World Elite Mastercard® welcome bonus. That bonus allows you to:

- For a limited time, earn 100,000 American Airlines AAdvantage® bonus miles after spending $10,000 within the first 3 months of account opening.

Cardholders also earn:

- 10X miles on eligible hotels booked through aa.com/hotels and eligible car rentals through aa.com/cars

- 4X miles on eligible American Airlines purchases

- 1X miles on other purchases

However, a card with impressive perks like this usually comes at a cost — in this case, you’re on the hook for a $595 annual fee.

AAdvantage® Aviator® Red World Elite Mastercard®

-

The AAdvantage® Aviator® Red World Elite Mastercard®* offers you just 2X miles per dollar on AAdvantage purchases and only 1X mile per dollar on other purchases, so it’s not ideal for everyday purchases. That said, it’s the simplest welcome bonus to earn. Earn 50,000 bonus miles after making your first purchase and paying the full $99 annual fee within the first 90 days.

Additional ways to earn American Airlines miles

You can earn frequent flyer miles through more than just booking flights or spending on a co-branded airline credit card. One of the most attractive components of the American AAdvantage program is that there are numerous ways to earn miles.

- Booking flights. Traveling with American Airlines, American Eagle, Fiji Airways, JetSMART, Oneworld airlines and partner airlines accrues miles.

- Other travel bookings. You can accumulate miles by booking cars, hotels, vacation packages, and cruises.

- Get creative with miles. Boost your mileage balance by buying or gifting miles. You can also take advantage of the Mileage Multiplier to increase your balance with bonus miles on eligible flights.

- Dining and partner offers. Earn miles through partner offers, AAdvantage eShopping at over 1,200 online stores, and personalized offers with SimplyMiles. You also earn when dining with linked cards through the American Airlines AAdvantage Dining program.

The bottom line

American Airlines miles provide multiple ways to redeem them for solid value. From earning miles through everyday spending and flights with the airlines or its partner to redeeming for your next trip, the possibilities are endless. Redemption rates for American Airlines miles can vary so be sure to evaluate when using them makes the most sense for you. Still, the program’s value, perks and rewards compare favorably to many other airlines’ offerings.

*Information about the American Airlines AAdvantage® MileUp®, Citi® / AAdvantage® Platinum Select® World Elite Mastercard® and AAdvantage® Aviator® Red World Elite Mastercard® has been collected independently by Bankrate. Card details have not been reviewed or approved by the card issuer.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.