Take these important precautions now before key coronavirus relief programs expire

Millions of Americans are hurtling toward a major fiscal cliff when the calendar turns from 2020 to 2021.

Congress has so far failed to reach an agreement on another round of stimulus, and several of the sweeping CARES Act-backed legislative relief programs are coming up on their sunset date — from several unemployment insurance (UI) enhancements to a batch of other safety nets helping federal student loan and mortgage borrowers.

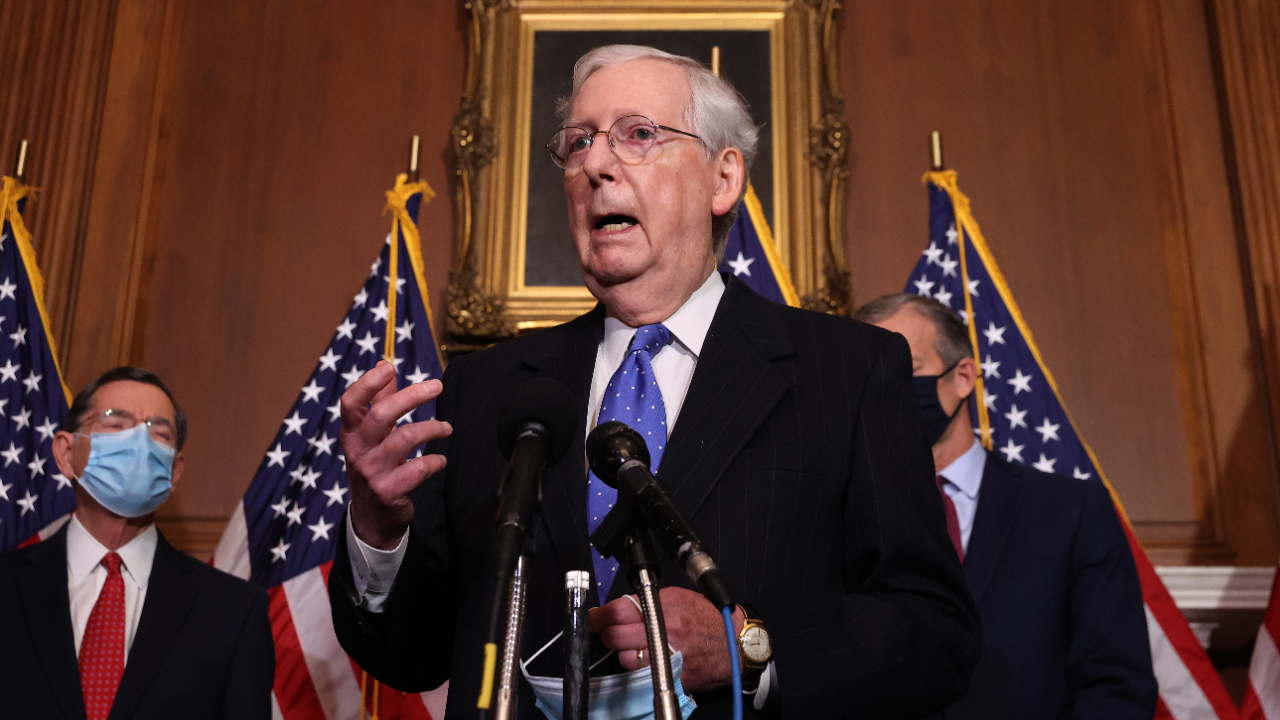

Legislators are reconvening this week, with negotiations for more aid on the agenda. A bipartisan group of senators unveiled a $908 billion relief bill on Tuesday that would send relief to state and local governments and boost weekly jobless checks by $300 a week. But that’s just one hoop in a long line of hurdles that lawmakers will need to clear to get out another round of aid. Most experts caution Americans to prepare their finances for no relief at all.

“This has been the time to break the glass — as in, ‘in case of fire, break glass’ — in that they need to take all reasonable and prudent steps possible to obtain help if facing a loss of employment or income,” says Mark Hamrick, Bankrate’s senior economic analyst and Washington bureau chief. “The proverbial jury is still out whether the House and Senate, along with the president, will approve another needed round of relief legislation.”

Here’s a list of seven federal relief programs expiring at the end of the year and how to prepare now if they aren’t extended.

1. Access to certain enhanced unemployment benefits

Deadlines: Dec. 31 (while others have already expired)

The CARES Act dramatically shored up UI benefits at a time when as many as 1 in 4 Americans were applying for the program to make ends meet, largely as a result of lockdowns and restrictions that shuttered retailers, offices, gyms, restaurants, bars and more.

Lawmakers created three new UI programs, which became entirely federally run and funded:

- Pandemic Emergency Unemployment Compensation (also known as PEUC): This program provided Americans an additional 13 weeks of benefits.

- Pandemic Unemployment Assistance (PUA): The creation of PUA allowed typically ineligible gig workers, independent contractors, freelancers and others to apply for jobless benefits if they were facing job loss or a reduction in hours.

- Federal Pandemic Unemployment Compensation (FPUC): As a result of this program, an additional $600 in weekly checks was provided to all Americans drawing unemployment benefits.

Both PEUC and PUA are set to expire on Dec. 31. According to The Century Foundation, a left-leaning research institution, those two expirations could leave almost 12 million Americans in the dust, with about 7.3 million individuals getting kicked off from PUA and another 4.6 million losing PEUC.

When it comes to the extra weekly payments of $600, or FPUC, those expired at the end of July. But according to a widely watched tracker you still might be seeing an increase in your weekly check if you live in these states (or jurisdictions):

- Alabama

- Alaska

- Washington, D.C.

- Idaho

- Iowa

- Kansas

- Louisiana

- New Mexico

- North Dakota

- Wisconsin

That’s because President Donald Trump in early August took executive action to temporarily boost those weekly payments after Congress couldn’t strike a deal to renew FPUC (Senate Republicans wanted to provide a smaller supplemental weekly amount so as not to deter Americans from getting back to work). In most cases, the memorandum boosted those weekly checks by $300 through what came to be known as the Lost Wages Assistance (LWA) program.

Most states were only allowed to make six weeks of those extra payments, most of which have already been depleted.

2. Student loan deferment

Deadline: Dec. 31

Lawmakers and the president essentially pressed the pause button on federal student loans: No interest is accruing and no payments are due. That’s all set to change after Dec. 31, with the clock starting again in January.

When it comes to your student loans, the Department of Education recommends pursuing an income-based repayment plan if you fear being unable to afford your payments come 2021. You might also be able to work out an individualized forbearance program if you find yourself unable to make payments.

3. For renters, an eviction moratorium

Deadline: Dec. 31

A Trump administration provision from September directed the Centers for Disease Control and Prevention (CDC) to halt evictions for most renters through the rest of 2020 on fears that it could spread the virus.

That program allowed renters (with an income threshold of $99,000 or less for single filers and $198,000 for married filers) to avoid eviction if they could certify that they were unable to pay their rent due to the pandemic and could become homeless if they’re forced to leave their home. Applicants seeking relief through the program had to also state that they made their “best effort” to obtain other government assistance to pay their rent and that they’re currently paying as much as they can afford.

Those protections are set to end when the calendar turns to 2021.

4. For homeowners, mortgage forbearance programs and foreclosure protections

Deadlines: Dec. 31, though it differs

More than two-thirds of all homeowners have a federally backed mortgage, according to independent research nonprofit, the Urban Institute. Through the CARES Act, they’ve been granted certain programs that protect against foreclosure and prevent hard-hit borrowers from having to make payments during coronavirus-related financial distress.

Homeowners with a federal or GSE-backed (meaning Fannie Mae or Freddie Mac) mortgage loan, lenders or loan servicers are legally protected from foreclosure until Dec. 31, according to the Consumer Financial Protection Bureau (CFPB).

Meanwhile, homeowners can also request a 180-day payment pause (with the option to renew it for another 180 days after that ends for a total of 360 days), during which interest and payments won’t be due. The deadline to request both the initial and secondary forbearance option varies, with some of those federally backed mortgages having a Dec. 31 deadline. Theoretically, however, Americans could still take advantage of the program well into 2021 if they want to request their second 180-day extension or if they’re working with a specific firm with a later deadline.

5. 401(k) hardship withdrawals

Deadlines: Dec. 30

The CARES Act allowed individuals with 401(k)s and IRAs to take out up to $100,000 — or 100 percent of their vested account balance if it’s less than that amount — without the typical 10 percent early withdrawal penalty, all through what’s known as “hardship distributions.”

Americans will still need to pay income taxes on that money, though they can stretch it out over a three-year period. They can also pay back all or a portion of what they owe without it being counted against the maximum annual contribution limit. Working with your employer and plan administrator, however, is a must.

Americans have up until Dec. 30 to take advantage of the program, as long as they can supply proof that they or someone in their household has faced hardship from the virus. That can be something like facing job loss or getting infected with the disease.

6. Most of the Fed’s emergency lending programs

Deadlines: Dec. 31

While the Fed has mostly remained independent from Congress with its coronavirus response, the CARES Act sent the Fed money to create 13 different special loan programs for various hard-hit firms, states and other corners of financial markets. But Treasury Secretary Steven Mnuchin has indicated that he wants most of those programs to expire at the end of this year, including a key program that provides five different loan options for mid-sized firms and nonprofits, as well as others that buy corporate and municipal debt.

Though the programs’ expiration might not have a direct impact on your wallet, experts say it might lead to market choppiness, with those programs seen as a key part of calming financial markets after severe dysfunction at the start of the pandemic in March. Mnuchin, however, argues that firms and states most need grants, not loans, meaning the money would be better served in a stimulus package than packaged in accounts at the Fed where it’s so far had minimal take up.

Four facilities were approved for a 90-day extension, one of which backstops money market funds and another supports financial firms in making Paycheck Protection Program (PPP) loans.

7. Other important relief programs, though their impact is often indirect

Deadlines: Dec. 31, though most vary

If you’re a state or local government employee or working for a firm utilizing some of the tax opportunities established through the CARES Act, you might want to take note of other special programs’ expiration dates — though the impact on your wallet won’t be as direct.

A refundable employer retention tax credit for firms that have been hit hard by the pandemic expires on Dec. 31. Meanwhile, one of Trump’s August executive actions to defer payroll taxes (6.2 percent for Social Security and 1.45 percent for Medicare) ends on Dec. 31.

Congress also allocated $150 billion in aid to state and local governments, but those funds can only go toward covering costs from 2020. Experts say budget constraints among state and local governments could weigh on the economic rebound from the pandemic for some time, similar to what happened during the Great Recession more than a decade ago. Many budget departments turn to cutbacks in education, public safety or health care when facing a budget deficit, which is typically where the most money in a municipal budget is allocated.

Important steps to take before the programs expire

Experts say both economic and financial consequences could arise when these programs expire. Americans unable to turn to federal relief programs for help might lose track of bills and be unable to afford basic necessities.

“If these programs are not extended, we could certainly see increased misery in terms of homelessness, hunger and suffering,” Hamrick says. “This is why some fear a double-dip early in the new year if further relief measures aren’t put in place.”

Federal relief programs, including the $600 unemployment boost and $1,200 stimulus payments (or more), helped prop up Americans’ wallets at the start of the pandemic, blunting the pain of mass job loss that prevented consumption from sharply dropping off. These expiration dates take away that safety net, while other businesses may resort to bankruptcy to get a fresh start in the new year and reduce debt, according to Joe Brusuelas, chief economist at RSM.

1. When it comes to your retirement account, evaluate your options and be ready to take action

When it comes to withdrawing funds from your retirement account, be sure to weigh the pros and cons of making those distributions. Doing so could set your retirement savings back by years, though you might find that borrowing from yourself is a better option than taking out a personal loan.

The CFPB suggests working with a financial adviser or expert who can help you weigh your options, repayment plans and tax implications. Keep in mind that no workplace plan is the same and it might also take several weeks before you receive a check.

2. Apply for unemployment benefits right away if you haven’t done so already

If you’ve faced job loss or even an income disruption, you’re likely eligible for unemployment benefits. When in doubt, most experts recommend applying. If you’re a gig worker in particular, consider applying as soon as possible considering you’ll no longer be eligible for benefits in the new year. And if you’re eligible to receive any benefit amount, consider pocketing as much into your emergency fund as you can.

3. Look into which UI program you’re utilizing

Aside from the CARES Act-backed new UI programs, many states have a permanent Extended Benefits (EB) program, though all of that depends on its unemployment rate and UI laws.

Potentially, that means if you’re drawing PEUC by the time the program expires and haven’t yet utilized EB, you could switch into that program and still receive jobless benefits.

Gig workers, however, won’t be eligible for that program. Meanwhile, only an estimated 2.9 million of those running out of PEUC will be able to collect EB and states will have to front the bill at a time when most trust funds are sorely depleted, the Century Foundation estimates.

“It’s important to remember that EB can be anywhere from an extra six weeks to 20 weeks,” says Michele Evermore, senior researcher and policy analyst at the National Employment Law Project who specializes in UI issues. “EB does not apply to PUA, just people who were eligible for regular UI. The PUA people all just go to $0.”

4. Have a plan for when forbearance ends

Working with your lender or servicer is going to be important for both student loan borrowers and homeowners currently utilizing a forbearance period. Particularly when it comes to mortgage forbearance, there’s no one-size-fits-all. Be in close communication with your lender or bank, documenting all exchanges for your records. Contact your servicer if you wish to work out a new payment plan.

Meanwhile, low interest rates across the board might make refinancing a smart option, though you’ll want to weigh any fees and costs associated with that switch. Federal educational borrowers might also be giving up more favorable provisions when they decide to refinance into a private loan for a lower interest rate.

5. Communicate with any lenders you regularly work with

In times of economic distress, many financial institutions will introduce what’s called “goodwill programs” that let individuals adjust their payment plans or monthly bills. Make a list of everyone you regularly pay a bill to, then reach out to see if they’re willing to work out any options.

Many state and local governments, meanwhile, issued local-specific orders that ensured utility companies keep electricity, gas and water on for those who’ve been hard hit by the crisis and thus fallen behind on payments. Even if those programs have expired, you might still be able to negotiate a specific program individually. Meanwhile, a resource from the National Association of Regulatory Utility Commissioners runs a list of companies still offering relief.

“The most important thing for someone to do if facing difficulty making payments is to initiate communication or remain in contact with these creditors or others to whom money is or has been owed,” Hamrick says. “That might be the last thing one wants to do in the sense of confronting the problem, but it can be the difference between generating a solution or creating a bigger problem.”

Learn more:

- Here’s what to do if you’re still jobless by the time your coronavirus unemployment benefits run out

- If you’re not paying student loans now, what other money moves should you be making?

- Greg McBride’s end-of-year financial checklist: 15 tasks to complete

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

How long does it take to get home insurance?