Orlando housing market: Everything you need to know

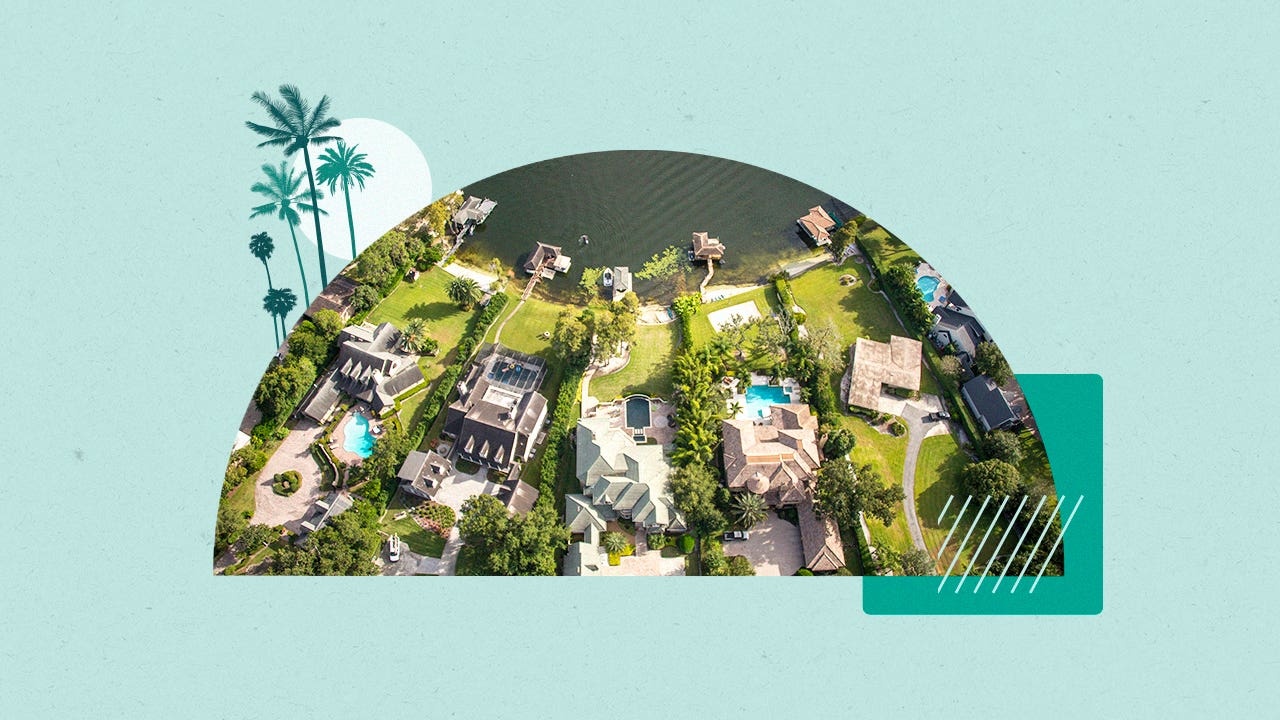

A beautiful view of the waterfront is a key characteristic that defines some of the best places to live in Florida. But in Orlando, which is inland from both coasts, one of the main selling points is the ability to build a beautiful career. The Walt Disney World Resort is the area’s biggest employer, but the Magic Kingdom — and the area’s massive overall leisure and hospitality industry, which also includes Universal Orlando and SeaWorld — isn’t the only job opportunity that beckons newcomers. AdventHealth, Lockheed Martin and Siemens Energy are just a few of the major names that call the area home.

So, while plenty of people love to vacation in Orlando (more than 59 million people visit each year), a lot of them find reasons to stay. If you’re one of them, or if you’re looking to sell a home in the area, read on for everything you need to know about the Orlando housing market.

Orlando housing market overview

Much like the Florida housing market overall, the pandemic was very kind to property values in Orlando. In February of 2020, just before COVID reshaped the world, the median price tag for a home here was $250,000, according to data from the Orlando Regional Realtor Association (ORRA). As people re-evaluated their lifestyles, chasing sunny weather and a relatively low cost of living in the Sunshine State, median prices soared to $387,000 by June 2022.

Higher mortgage rates seem to be dampening the market, though: As of February 2023, median prices stood at $358,000. ”Orlando’s housing market remains in correction mode as sales have been steadily slowing down over the past 12 months,” ORRA president Lisa Hill said at the beginning of the year. “The great news for buyers is that they have significantly more options compared to last year. For sellers, home values remain stable.”

Orlando housing trends and stats

- How much you’ll pay: The median sale price for homes in Orlando is $358,000, a 3.7 percent increase from February 2022, according to ORRA. Homes typically sell for 97 percent of their list price.

- How much more you’ll pay at closing: Closing costs in Florida average 2.3 percent of the purchase price, according to data from CoreLogic’s ClosingCorp. On a median-priced $358,000 Orlando home, that comes to $8,234.

- How many homes are out there: There were 5,555 Orlando homes on the market in February 2023 — more than double the amount from February 2022.

- How long it takes to sell one: The typical home in Orlando spends 62 days on the market before going to contract.

Should you buy or sell in the Orlando housing market?

While the market here is shifting, the numbers still reflect a seller’s market. Most real estate experts define a balanced market with 5 to 6 months of available housing inventory. Orlando’s supply is currently just 2.5 months, so the bulk of the power is still in the seller’s hands.

If you’re a home seller

It’s not going to be a seller’s market forever, and median prices dropped throughout the back half of 2022. If you’re gearing up to list your home in Orlando, keep these considerations in mind:

- Know your value: Orlando was one of the hottest housing markets of 2022, according to Zillow. So even if prices have lowered slightly, you’re still sitting on a very valuable piece of property. Figure out how much your home is worth by looking at comps in your neighborhood, and work with a real estate agent to develop a competitive pricing strategy.

- Know your timeline: If you’re in a crunch and need to relocate immediately, pricing to sell (i.e., listing the home for a below-market value) can speed up the typical 62-day timeline. You can also consider looking for offers from an iBuyer or a local “we buy houses” company.

- Be willing to negotiate: Nearly 50 percent of sellers in Orlando offered concessions in the final quarter of 2022, according to a Redfin report.

- Budget for closing costs: In addition to paying the real estate agent commissions, sellers have other closing costs to consider. In Florida, be ready to pay for documentary stamp taxes — commonly known as real estate transfer taxes elsewhere — which will run you $0.70 for every $100 of home value. It’s also typical to pay for a title insurance policy for the new owner.

If you’re a homebuyer

Buying in Orlando in 2023 is looking better than it has for the past two years, but that doesn’t mean it’s going to be easy. As you consider how much you can afford to spend on a house, be sure to think about these pieces of the homebuying puzzle:

- Calculate your total cost of living: Your mortgage payment is only one of your main financial obligations. Will you need to pay for childcare? How much is your car payment? Are you paying off student loans? Scrutinize your entire budget to make sure you aren’t stretching yourself too thin.

- Get preapproved: Once you have a budget in mind, it’s time to verify that a lender thinks it’s realistic. Getting preapproved for a mortgage helps solidify your budget and demonstrates that you’re a serious buyer.

- Look everywhere: The Orlando metro area is huge. While the $358,000 median price tag is a good starting point for your search, keep in mind that values look very different in different locales. In Edgewood/Pine Castle, for example, the average sale in January 2023 was just under $202,000, according to ORRA. Head to luxurious Windermere, though, and you’ll be in for some sticker shock: Average sales there were more than $1.16 million.

Orlando housing market predictions

Housing headlines can sound a bit ominous these days, which may make you wonder: Is the housing market about to crash? The answer is no. Orlando’s housing market seems poised to follow a similar trajectory of the rest of the country in 2023, with slower sales, but it remains fundamentally strong.

The entire state of Florida remains one of the top places where people want to move, and Orlando’s long-term population forecast means that a lot of them will be heading here. The metro region is on track to add 1,500 residents every week through 2030, and that kind of influx typically means good news for housing values.

Find an Orlando real estate agent

Whether you’re buying or selling a home in Orlando, don’t do it on your own. Real estate deals are complex, and the advice of a licensed agent is critical to helping you navigate one of the most expensive transactions you’ll ever make. Ask agents you’re considering plenty of questions to get a sense of how they will approach your business, and how they can help you get the best deal possible.

FAQs

-

Due to an increase in inventory, home prices in Orlando may slightly decrease this year. Following the basic economic principle of supply and demand, the surge in supply will translate to more bargaining power for buyers. In February, Redfin data showed that 29.8 percent of listings had price drops.

-

Yes. After being one of the hottest housing markets in the country throughout much of the pandemic, Orlando’s housing market is cooling off a bit. In February 2023, there were 2,240 home sales in the area, according to the Orlando Regional Realtor Association. That’s more than 550 less than one year earlier.

-

Florida real estate can certainly be expensive, and a study conducted by Florida Atlantic University showed that Orlando is in the top 20 of overpriced U.S. home markets. However, it’s important to look in the future to think about home values, too. With Orlando’s forecast for continued population growth throughout the rest of the decade, it seems unlikely that home values will decrease by a significant amount.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.