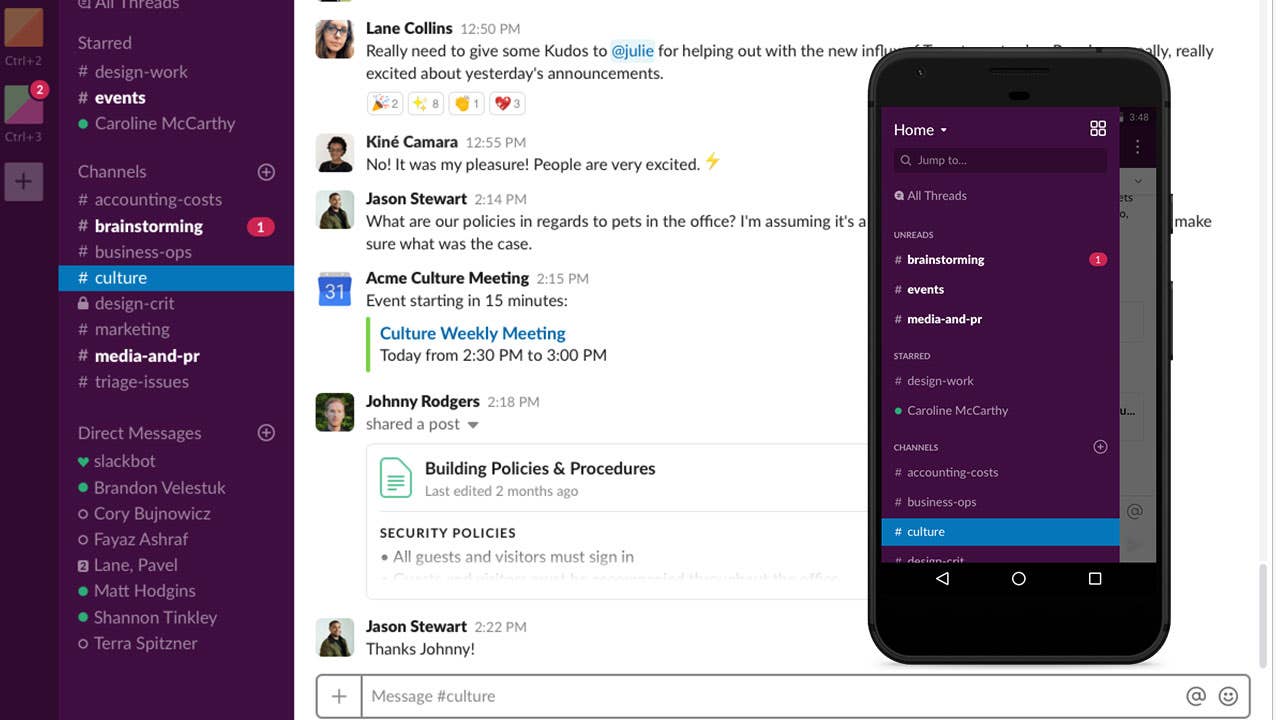

Slack’s offbeat IPO: 4 things to watch out for

Slack Technologies is going public, but with a twist. The company behind the popular workplace communication app has filed confidentially with the Securities and Exchange Commission to list its stock on an American exchange.

The strange bit? It’s doing a direct listing on the exchange. This listing poses several risks for investors, especially if they’re looking to buy right away.

Slack’s weird debut raises the risk for investors

Slack is bypassing the usual method of going public – an initial public offering (IPO) – in favor of a direct listing. In an IPO, a company hires an investment bank to sell stock to the public. Typically the company raises capital for itself, and some insiders cash out a portion of their stock.

However, in a direct listing, the company’s shareholders, such as early investors or employees, just begin selling their stock on the exchange, cutting out the Wall Street banks. Public investors buy stock directly from these insiders at first. And that’s what Slack is doing. It’s not looking to raise money for itself, and it’s only these insiders who are initially selling stock.

The direct listing route is rare. Usually it’s been used for smaller, less-publicized companies, but Swedish music streaming company Spotify – then valued at about $20 billion – used the method in early 2018. Slack’s valuation is estimated at $7 billion, and it’s one of the more anticipated market debuts in a while. The company reported that it had more than 10 million daily active users in 150 countries.

Slack has projected sales of $389 million for the year ending January, good for growth of 76 percent year over year. It’s projecting sales growth of 64 percent this year, when it should generate free cash flow, management says. Those are heady figures, but the valuation looks pricey at more than 11 times sales. But if it sales growth can remain high, it may not look so expensive for long.

The direct listing exposes investors to certain risks that they wouldn’t otherwise face with an IPO. Here’s what makes Slack’s listing different:

1. There’s no guaranteed market

In a conventional IPO, there’s always trading on day one, as the stock is officially sold to the public and it’s readily available for purchase and sale. Investors know how many shares will be sold, and even if they can’t buy in the pre-IPO market, they can buy in the public market along with anyone else, though they may have to pay a premium to buy on the first day.

That’s not necessarily true in a direct listing, because the number of shares available for sale depends on whether insiders want to sell. Even if they do sell, there is no guarantee that the stock will meet the demand from investors. While investors might demand millions of shares, there might be far fewer or even none at all that insiders want to sell. So supply will trickle onto the market only as insiders decide to let go of it.

So that could mean investors won’t predictably be able to trade the stock.

2. The stock may be volatile

With a conventional IPO, the banks leading the process actually support the stock price. Before it’s officially sold, they help market the stock to large institutional investors and drum up interest. Then when the stock actually debuts, they have technical means to keep the price up in the short term. The bank’s efforts help establish what is a fair price for the stock, and that’s important psychologically for maintaining the price and investor confidence over time.

However, in a direct listing, the market for the stock may be thin – that is, with few shares trading, and a bank doesn’t support it. So the stock’s price may be volatile. One large investor might want a lot of shares and push the stock very high, even though supply is low. Conversely, one or more sellers might be willing to sell at a price well below market. Or maybe traders can’t even find a price that they can agree on, and no shares trade.

In the short term, the stock price may be driven more by these technical factors than the company’s fundamental performance. And this kind of volatility can scare investors into selling exactly when they shouldn’t, hurting their long-term returns.

3. Dual-share class structure not popular with investors

The initial filing reportedly says that Slack will have a dual-class share structure. This structure gives certain insiders, usually company officials, voting control beyond their share ownership. For example, insiders with one share class may get 10 votes, while normal shares receive only one vote. In the case of Slack, co-founder and CEO Stewart Butterfield and others are slated to receive privileged shares that allow them greater latitude in how the company is operated.

Outside shareholders typically dislike a dual-class structure because the structure disempowers them. A dual-share class makes it difficult for outsiders to have a substantive say on how the company is run, and makes it easier for privileged insiders to run the company as they see fit.

Investors’ dislike for the structure hasn’t kept well-regarded companies such as Alphabet from establishing it, however.

4. Murky optics on insiders unloading shares

Here’s one final concern that’s relevant to any sale of stock by an insider. Why does the insider – who knows the company best – want to sell? That’s an important question that investors should always be asking themselves. In the case of Slack, the company is not raising cash from the listing, so it’s only insiders who are looking to sell stock. They may be doing this for any number of reasons, including having the vast majority of their worth tied up in the stock.

In a traditional IPO, the restrictions on insiders selling and when are relatively high. Those restrictions prevent knowledgeable insiders from fleecing unsuspecting outsiders, providing time for investors to analyze the company before insiders can fully cash out. However, restrictions are lower in a direct listing, because insiders are the sole source of the stock’s supply.

Now recall, insiders are looking to sell stock, perhaps a lot. They’re also setting up a dual-share class so that their own stock has more rights than what they’re selling to the public. And they have fewer restrictions on cashing out. All of this muddies the optics of the listing.

To be clear, there need not be anything nefarious in the intentions of sellers, but responsible investors should examine all angles of Slack’s position and consider the ramifications.

Bottom line: Don’t bet the farm on shares like these

While investors need to examine the risks associated with Slack’s listing – as they would for any stock – this debut poses special areas of risk that investors don’t typically encounter. That said, Spotify’s direct listing last year came off without any major issues, so a direct listing can work.

Slack may well turn out to be a great investment. It’s certainly one of the most anticipated stocks of 2019, which may include even more darlings such as ride apps Uber and Lyft and home-sharing app Airbnb. But investors looking to buy them will need a sensible long-term strategy and will want to understand how to invest smartly before plunging in. Regardless of how great Slack or any company looks, savvy investors diversify their holdings, so they’re not exposed to too much risk in any one investment.

Learn more:

- What is an initial public offering?

- Penny stock basics

- Best online brokers for stocks 2019