Socially responsible investing 2024: How to get started in 6 steps

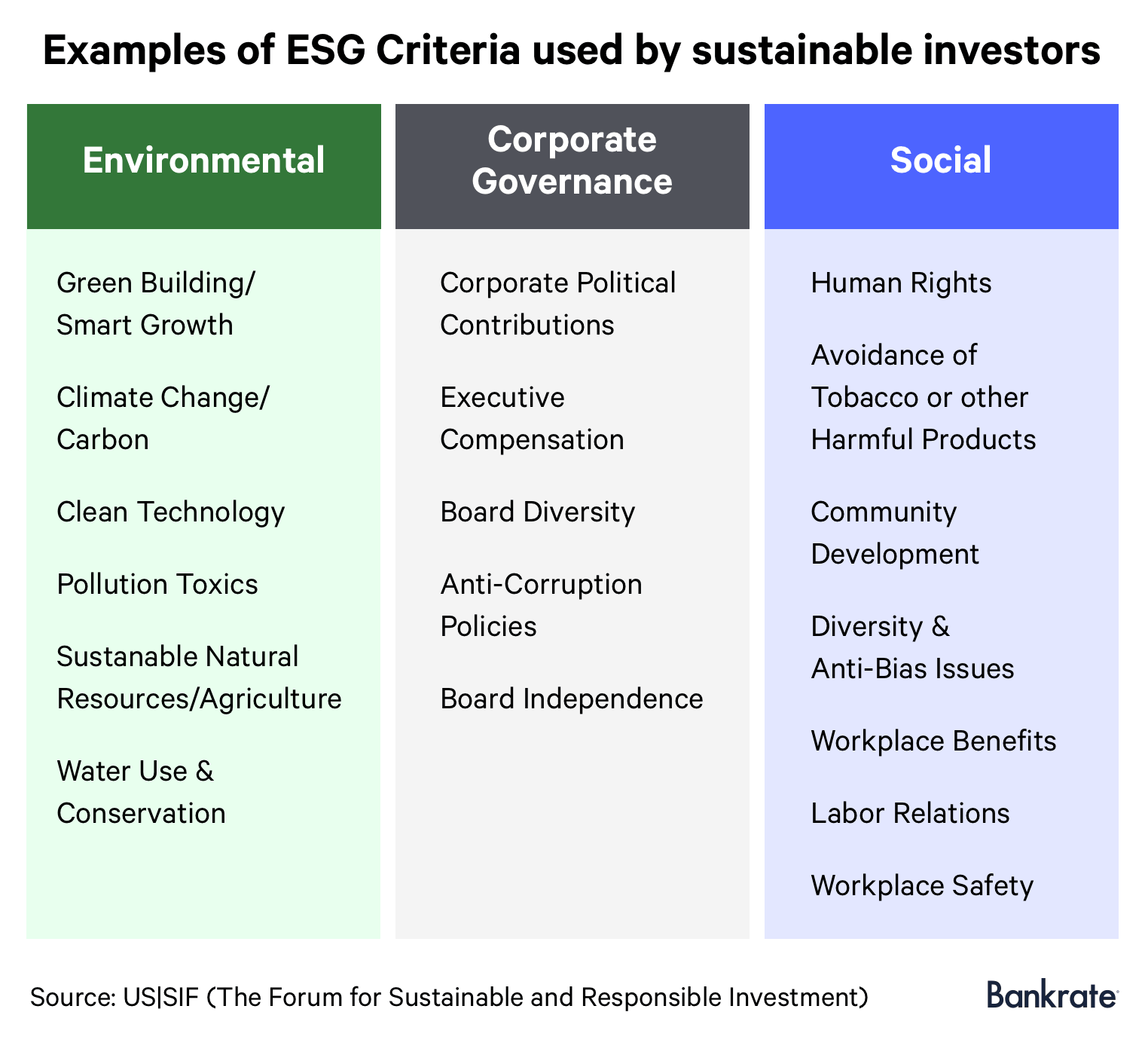

If you want to put your dollars into causes you care about, one of the easiest ways to get started is through socially responsible investing. The strategy prioritizes financial return with the caveat that the money is invested to fuel positive change in three key areas: environmental, social and corporate governance (ESG). Perhaps you’re looking to help reduce pollution, address gun violence, promote animal welfare or advocate for employee rights. Whatever your cause, socially responsible investing allows you to earn a return while making an impact.

Socially responsible investing by the numbers

- Assets invested based on sustainability are expected to reach $400 trillion by 2030, up from more than $30 trillion in 2022, according to Bloomberg Intelligence.

- Money invested in sustainable mutual funds and ESG-focused ETFs rose slightly in the first quarter of 2024 and sat at about $3.0 trillion, according to Morningstar.

- The $3.0 trillion level was a 1.8 percent quarterly increase from the level at the end of 2023.

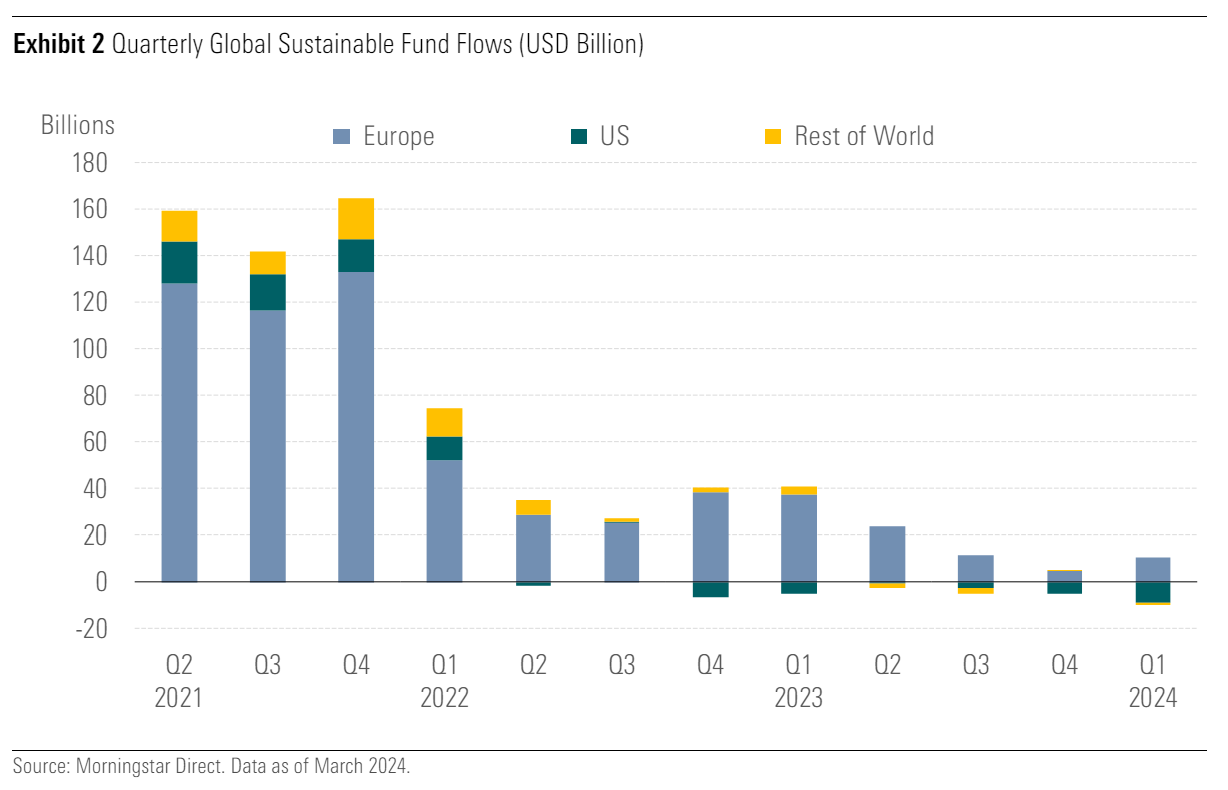

- Global sustainable funds added $900 million in net new money during the first quarter of 2024, according to Morningstar, with inflows in Europe being offset by outflows in the U.S. and Japan.

- U.S. sustainable funds lost $8.8 billion in assets during the first quarter of 2024, a record level of outflows.

- Most sustainable funds earned better total and risk-adjusted returns than their category indexes in 2021, according to Morningstar, but underperformed in 2022 due to their underweight positions in the energy sector and large tech holdings.

What is socially responsible investing (SRI)?

Socially responsible investing is an investment approach that considers the social impact and moral values of an investment as well as the expected financial return. The impact of the investment is considered before the potential profit. An investor who focuses on the social impact of their investments will likely consider ESG factors as they’re evaluating potential investment opportunities.

For example, these investors typically avoid investments in fossil fuels or in the tobacco and firearms industries because of their negative impact on consumers and society.

According to the US SIF Foundation’s Report on U.S. Sustainable and Impact Investing Trends 2022, the three letters of ESG have been attracting some big numbers. Total assets in sustainable investments grew from $12.0 trillion at the start of 2018 to $17.1 trillion at the start of 2020. That figure fell to $8.4 trillion in 2022, in part due to a change in how assets are calculated, according to the report.

“Money managers and institutional investors are using ESG criteria and shareholder engagement to address a plethora of issues, including climate change, conflict risk and anti-corruption as well as labor and equal employment opportunity, corporate political activity and human rights,” said Lisa Woll, US SIF Foundation CEO.

The growth of socially responsible investing

The focus on socially responsible investing has been steadily increasing for several years and the pandemic only fueled it further. Assets are expected to rise to $40 trillion by 2030 from about $30 trillion in 2022, according to Bloomberg Intelligence.

Money invested in sustainable mutual funds and ESG-focused ETFs reached nearly $3.0 trillion in the first quarter of 2024, according to Morningstar. The funds added net new assets of about $900 million during the first quarter of 2024, with Europe seeing $11 billion in fund inflows, while the U.S. saw record outflows of $8.8 billion and Japan recorded outflows of $1.7 billion.

Socially responsible investment performance

Many investors have questions about whether a socially responsible investment strategy means sacrificing investment returns. In 2021, most sustainable funds earned better total and risk-adjusted returns than their category indexes, according to Morningstar. Sustainable U.S. large-blend funds beat their traditional fund peers in 2021 as well as over the trailing 3- and 5-year periods.

However, sustainable funds underperformed in 2022 due to their underweight position in traditional energy and large tech holdings. Renewable energy companies have also underperformed recently.

Investment performance relies on many factors outside the scope of ESG, but performance suggests investors shouldn’t let subpar investment return concerns keep them from pursuing a socially responsible investment strategy.

6 important questions to ask as you get started with SRI

Are you looking to earn cash while making change? The best way to start is to do some in-depth research. There are plenty of complexities to the world of social investing, and it’s good to educate yourself so you understand where you might be putting your money. A good place to start is the US SIF Foundation’s free 30-minute online course.

As you think about making your portfolio sustainable, consider these key questions.

1. When will you need the money?

One of the most important pieces of sustainable investing is the same as traditional investing: You need to know your timing. Do you need money in five years? Ten or more? Understanding your timeline is a critical piece of determining what should be in your portfolio.

2. How much risk are you willing to take?

The next question is also a consideration no matter where you’re putting your money: How do you feel about knowing you might not get it back? Here’s a simple rule to follow: The more diversified your investments are, the less volatile your portfolio will be.

If these investments are meant to be retirement assets, be sure they match your risk tolerance as you age. If you’re younger, you might want to consider a riskier mix of assets. If you’re nearing retirement age, you’ll want to consider more conservative investments.

“Investors still should really think through if a strategy [focused on sustainable investing] is right for them,” says Casey T. Smith, president of Georgia-based Wiser Wealth Management. “Many ESG funds are heavily tilted toward growth stocks, specifically tech funds.”

3. Which brokerages look like your best bet?

You’ll need a broker or an individual who executes trades and is paid a commission when you buy or sell securities. You can pick from well-established names like Charles Schwab or Fidelity. If you’re okay with less of a human touch, robo-advisors like Betterment, Earthfolio and Impact Labs use algorithms to automate your investments.

There are quite a few more options. In fact, the US SIF Foundation identifies 497 institutional investors, 349 money managers and 1,359 community investing financial institutions in its latest Trends report. With so many options, make sure you spend time researching the brokerage that best caters to your timeline and needs. Be sure to pay attention to fees, too. There may be another brokerage that offers the fund you want at a lower price.

4. What’s your moral code?

Make a list of what’s important to you. For example, BlackRock offers products that explicitly exclude firearms manufacturers. Meanwhile, State Street and others offer funds focused on addressing climate concerns. Whatever you’re passionate about, look for mutual funds or other securities that are connected to those causes.

Here is a breakdown of some of the causes your investments can tackle.

5. Do you want to avoid too much additional research?

In addition to what you want to invest in, you can also explore exclusionary funds, which are focused on leaving certain kinds of companies out of the mix. For example, consider Vanguard’s ESG U.S. stock fund. Your investment is indexed across approximately 1,400 stocks. Sifting through each of those companies would be far too much work, so Vanguard’s fund leaves out companies that:

- Produce alcohol, tobacco, gambling and adult entertainment

- Produce civilian, controversial and conventional weapons

- Produce nuclear power

- Do not meet certain diversity criteria

- Have violations of labor rights, human rights, anti-corruption and environmental standards defined by U.N. Global Compact Principles

- Own proved or probable reserves in fossil fuels such as coal, oil or gas

Rather than having to pick individual stocks and research individual companies, you can sleep easy knowing that your money isn’t going to benefit any business you don’t believe in.

6. Should you divest some of your assets?

Take a look at your current portfolio, and consider divesting from any assets that don’t fit your objectives. Divesting, the opposite of investing, is the process of selling an asset in order to meet your financial, social or political goals. Often, you can sell your assets and reinvest them into your new sustainable funds. That’s especially easy to do if your divested funds are in the same brokerage firm as your new sustainable-focused funds.

— Note: Bankrate’s Brian Baker contributed to a recent update of this story.

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.