Card locks: What they are and how they work

Key takeaways

- Most major credit card issuers offer the option to easily lock and unlock cards through their online accounts or mobile apps.

- Locking a credit card can prevent impulse purchases and keep the account safe from fraud.

- Recurring transactions will still go through while a credit card is locked.

You can lock your credit card any time to prevent new charges, which is helpful if you’ve misplaced your card, want to avoid impulse spending or limit access for others. Luckily, locked cards still allow recurring payments, such as subscription payments or scheduled bill payments, to go through without any interruption.

Most credit card issuers let you manage locks easily through your online account or mobile app.

What does locking your card do?

Locking your credit card temporarily disables new transactions without canceling the card entirely. When your card is locked, new purchases, cash advances and balance transfers are typically declined, but recurring charges like subscriptions or scheduled bill payments will still go through.

Most issuers let you lock or unlock your card instantly through your online account or mobile app.

What transactions are allowed while locked?

Recurring charges that have already been set up will continue to process per usual, such as:

- Utility bills

- Monthly subscriptions, such as streaming services, gym memberships, magazines or cable TV

- Any other automatic payments already in place

These types of charges often have an indicator set up by the merchant that signals the charge is recurring and will likely happen again. If you have monthly payments already set in place, they will likely not be affected when you lock your credit card.

Reasons to lock your credit card

- You accidentally misplaced your credit card. Consider locking your card if you think you’ll be able to find your credit card in a day or two. In some cases, you should deal with a lost credit card by contacting your credit issuer and requesting a replacement. A card lock can protect your account until you decide whether your credit card is gone for good.

- You want to protect your credit card account from fraud. If you have reason to suspect that your credit card number has been compromised, a card lock is one way to keep third parties from making purchases on your account — though you’ll probably also want to contact your issuer to report credit card fraud and request a new card.

- You want to prevent yourself from making new purchases on the card. If you’re trying to curb impulse shopping or stay out of credit card debt, locking your credit card can help you refrain from making purchases you might later regret.

- You still want to keep an old credit card account active. Closing an old credit card can hurt your credit score, so consider putting one or two subscriptions on the card, setting up auto-pay to ensure that you don’t fall behind on your payments and locking your card to prevent yourself (or anyone else) from making new purchases on the account.

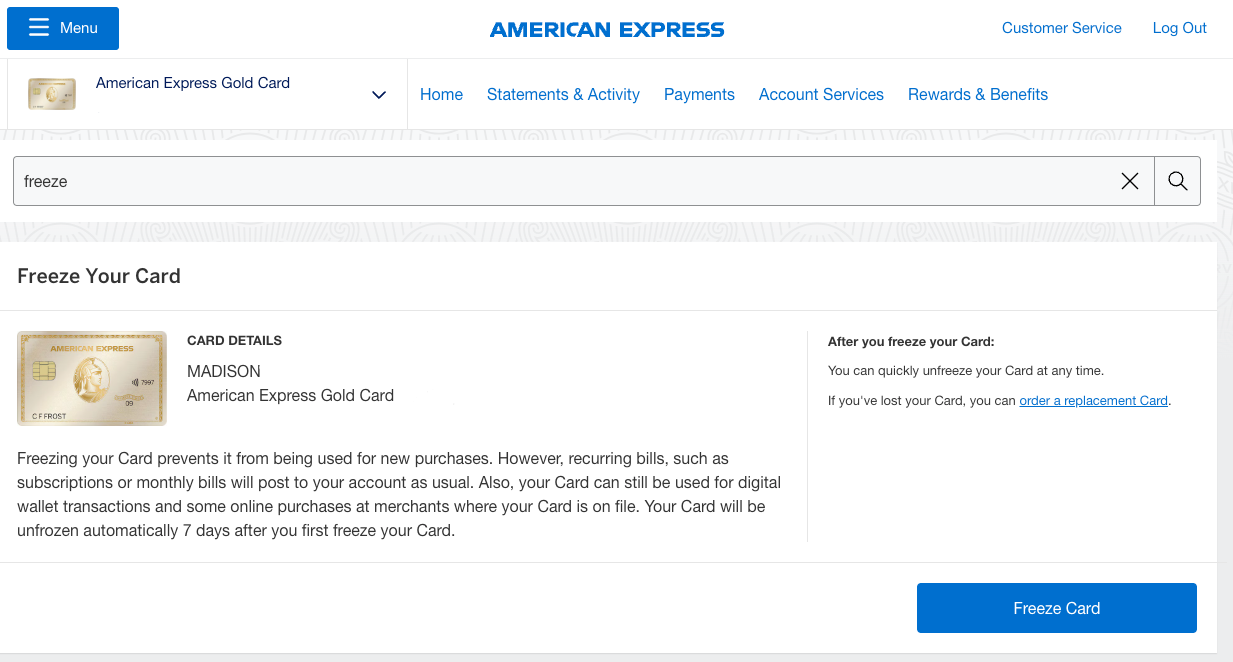

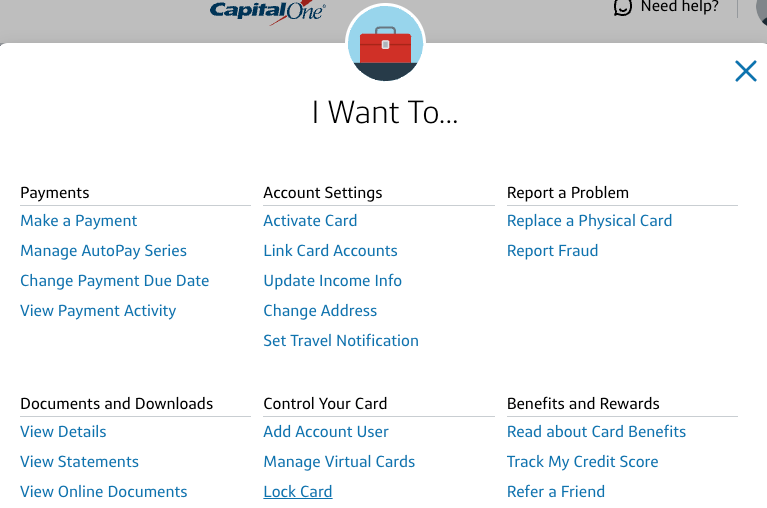

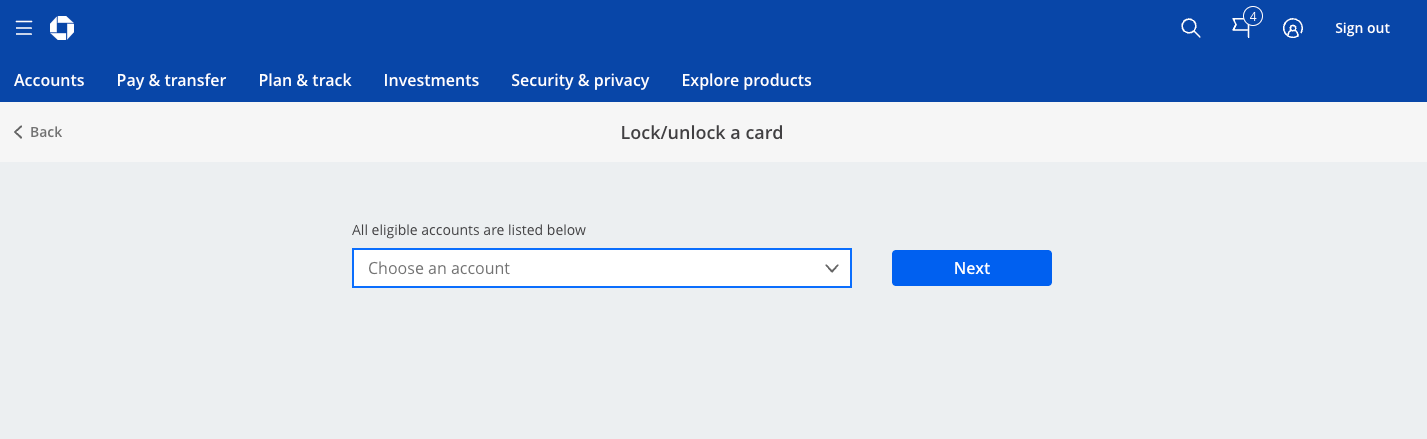

Credit card issuers that offer card locks

Most credit card issuers offer some type of card lock or credit card freeze. Here’s how to get a card lock or set up a credit card freeze with some of the biggest credit card issuers:

The bottom line

Locking your credit card blocks new purchases, helping you protect your account, avoid impulse spending or stay on budget. However, it doesn’t stop recurring charges like subscriptions or monthly bills. You can easily set or remove a lock through your issuer’s website or mobile app.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.