Guide to American Express Pay It Plan It

Key takeaways

- The American Express Pay It and Plan It features offer alternative payment options for eligible cardholders.

- Pay It can be used for small purchases under $100, while Plan It can be utilized for single or combined purchases over $100 with a fixed monthly fee.

- Pay It Plan It is available for select American Express credit cards, but not all accounts may be eligible.

- Consider the fees and your financial situation before deciding to use Plan It for large purchases.

Pay It and Plan It from American Express are two features that offer eligible American Express cardholders alternative payment options. Pay It allows you to pay for small purchases throughout the month, while Plan It lets you pay off large purchases over time for a fixed monthly fee with no interest charges.

Plan It can be used for single purchases over $100 or a combination of purchases that add up to $100 or more, and you can have up to 10 different payment plans active at any given time. It can be used for airline tickets and prepaid hotel bookings purchased through American Express Travel too (terms apply).

If you have an American Express credit card and you want to get creative in terms of paying off your balance, this program is worth exploring. Keep reading to learn more about how American Express Pay It Plan It works and whether it’s right for you.

How does Amex Pay It Plan It work?

While it may seem as though Pay It Plan It is a program designed to help cardholders pay down pricey purchases, this program can also work for smaller purchases charged to your credit card.

According to American Express, here’s how to use Pay It Plan It:

Pay It

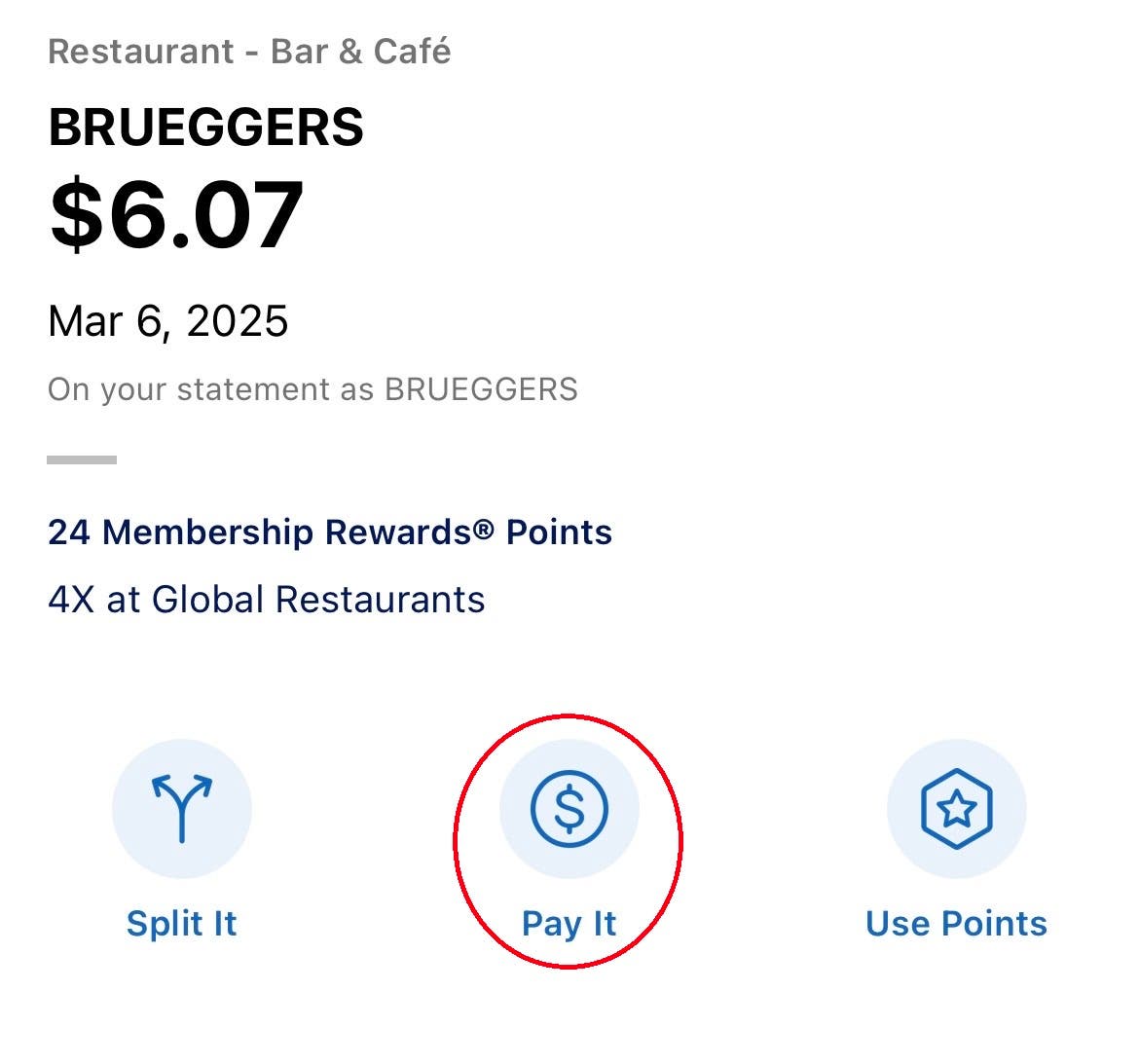

Use Pay It to pay off small purchases of under $100 throughout the month, reducing your total balance. Purchases eligible for Pay It will have a small icon next to them in your American Express account. Payments made with this feature are counted toward the minimum due on your credit card statement.

How does American Express’ Pay It work in practice? Here’s a basic rundown:

- In your Amex account, pay off small purchases that have the Pay It icon.

- You can pay off up to five purchases per day with this feature.

- Your payment counts toward your outstanding balance and monthly minimum payment due.

Plan It

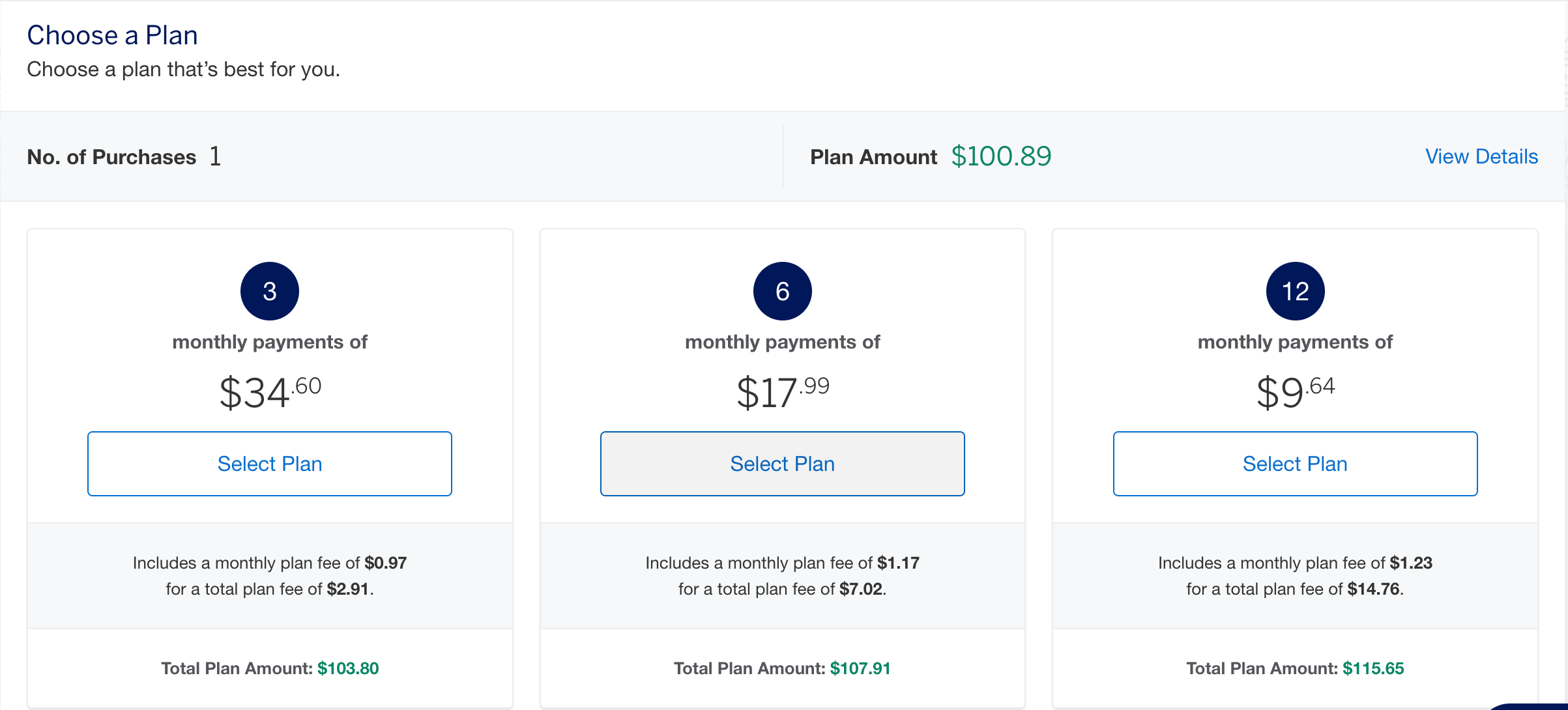

Use Plan It to combine up to 10 purchases into a payment plan, provided each purchase is at least $100 (or qualifying amounts of $100 or more). From there, you’ll pick a repayment plan option with an upfront fee. You can use the American Express Plan It Pre-Purchase calculator to get an idea of payment plan options and fees before making a large purchase.

How does American Express’ Plan It work in practice?

- Select a qualifying purchase of at least $100 (or eligible amounts of $100 or more), then combine them into a plan.

- Choose one of the payment options American Express offers, which will include information on the plan duration and plan fee.

- Pay off your purchases according to the plan and the repayment schedule required.

Keep in mind that the repayment plans and plan fees can vary and may change based on the purchases you select. Additionally, you’ll still earn rewards on purchases you pay off using the Pay It Plan It features.

Which cards are eligible for Pay It Plan It?

Pay It Plan It is available for eligible consumer credit cards issued by American Express. It also works for American Express credit cards that are co-branded with airline and hotel partners. This means you could use this benefit with co-branded Delta credit cards like the Delta SkyMiles® Platinum American Express Card.

Here are some top American Express credit cards to consider if you’re looking for Pay It Plan It access:

- Blue Cash Everyday® Card from American Express

- Blue Cash Preferred® Card from American Express

- American Express Cash Magnet® Card*

- American Express Platinum Card®

- American Express® Gold Card

- Amex EveryDay® Credit Card*

- The Amex EveryDay® Preferred Credit Card*

However, Pay It Plan It isn’t available for business credit cards from American Express, which rules out cards like The Blue Business® Plus Credit Card from American Express. Accounts that don’t have a credit limit or the Pay Over Time feature are also excluded.

Is your account eligible for Pay It Plan It?

According to American Express, Pay It Plan It eligibility isn’t guaranteed. You may be ineligible for this program due to your account status, creditworthiness, card type or date of account opening.

American Express also notes that you won’t be able to create plans if your account is canceled, or if one or more of your American Express accounts is enrolled in a debt management program or has a payment that is returned or delinquent.

Should you use Pay It Plan It?

If you like the idea of paying off small purchases immediately or paying off large purchases over time without accumulating high interest, then the Pay It Plan It feature from American Express could work in your favor.

You can use Pay It to pay off targeted smaller purchases throughout the month, which will help to keep your overall balance low. Utilizing this feature could be worth it if you’re utilizing too much credit in relation to your overall credit limit and you want to lower your credit utilization ratio.

It would be worth using Plan It if you want the option to pay for a large purchase over time and don’t want to pay expensive interest fees. Instead, the Plan It feature will let you pay an upfront fee, which will help you to avoid all the unknowns of paying a variable interest rate on your credit card.

Before you use Plan It, however, pay attention to the fees and only carry a balance when it makes sense. Even if the costs associated with this program work out to less than regular interest charges, you’re still paying money to borrow. Over time, even small fee plans and charges can add up in a big way.

The bottom line

Amex offers its cardmembers two useful alternatives to making monthly payments. For those who want to keep their credit utilization ratio below the recommended 30 percent, the Pay It feature offers a quick-and-easy way to pay off small purchases ahead of schedule. If you make a larger purchase and don’t want to risk accumulating interest over time, the Plan It feature allows you to schedule set payments with a fixed fee.

Being an American Express member comes with several notable benefits, including Pay It Plan It, but make sure your card qualifies for these perks before making any purchases.

*The information about the American Express Cash Magnet® Card, Amex EveryDay® Credit Card and The Amex EveryDay® Preferred Credit Card has been collected independently by Bankrate. The card details have not been reviewed or approved by the card issuer.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.