How to do a balance transfer with Capital One

Key takeaways

- Capital One allows balance transfers from other credit card issuers but not between Capital One cards.

- You can complete a Capital One balance transfer online, over the phone or via the Capital One mobile app.

- When managed responsibly, a balance transfer can positively impact your credit score — however, taking on additional debt before paying off your transferred balance may harm your credit score.

If you’re looking for a simple way to pay off credit card debt without paying interest, signing up for a balance transfer credit card is often a good idea. When you complete a balance transfer, you move debt from one source to a new balance transfer card, usually one with a low or 0 percent introductory annual percentage rate (APR) offer. This can help you consolidate your debt and pay it down more quickly.

Does Capital One allow balance transfers?

Yes! Capital One allows cardholders to transfer a balance to and from their cards. It doesn’t have a card specifically designated for balance transfers like some other issuers. Instead, Capital One allows balance transfers on a variety of credit cards, including rewards credit cards. This means that the Capital One credit card you choose for your balance transfer could have more long-term value for you than a more traditional balance transfer card might have.

If you’re interested in completing a balance transfer with Capital One, here’s how you can get started:

3 ways to do a Capital One balance transfer

You can perform a Capital One balance transfer using an existing card or using a new card with a 0 percent introductory APR offer. The process is similar for both. You just have to make sure that your total balance on your new card won’t exceed the card limit once your transfer is complete — meaning that you’ll have to factor in any applicable balance transfer fees to your calculations.

1. Online balance transfer

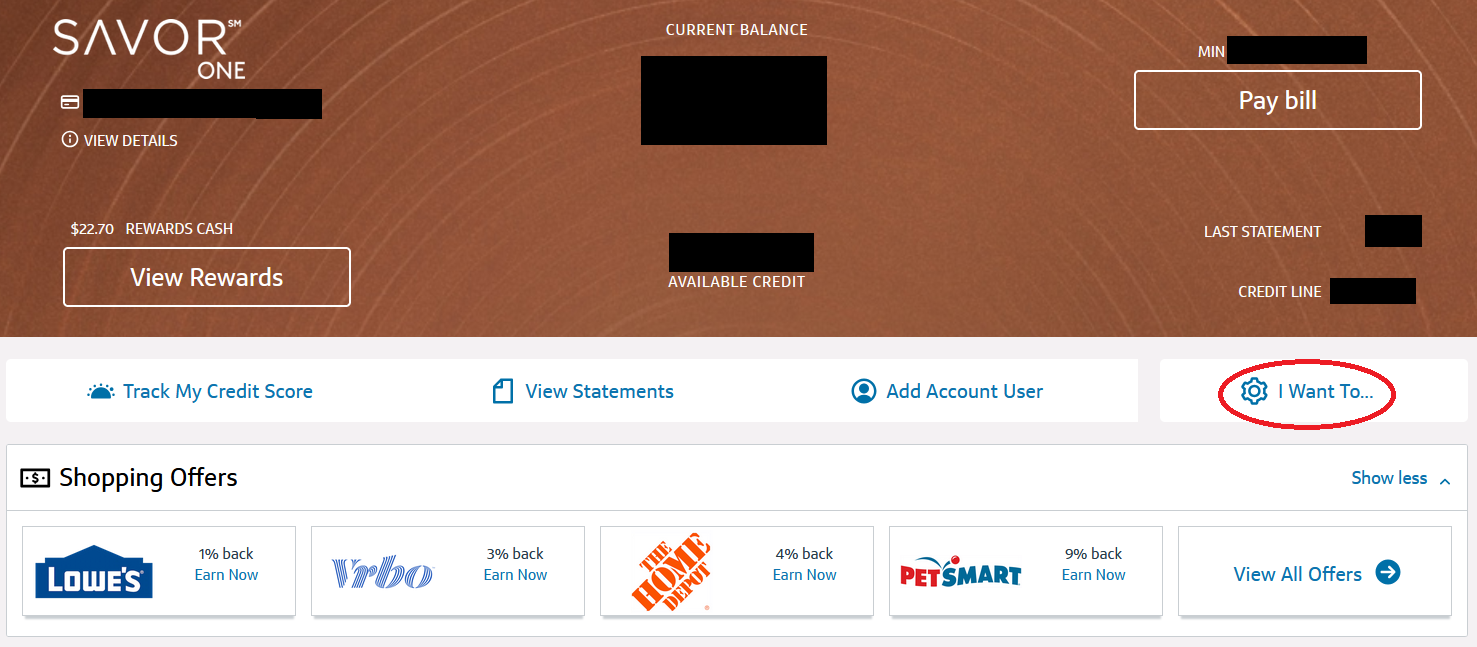

For an online balance transfer using a web browser, follow these steps:

-

Log in to your Capital One account. From there, choose the credit card account you plan on using for your balance transfer.

-

Go to the drop-down menu with a gear icon that says “I want to….” This will open a list of several options.

-

Scroll to the “Offers and Upgrades” section and click “Transfer a balance.” You’ll then be taken to a screen that outlines your current balance transfer offer, including how much you’ll pay in interest (if any), whether you’ll be charged a balance transfer fee and any associated time limitations.

-

Click the “Select Offer” button next to the balance transfer offer you’re accepting. After selecting an offer, you’ll be asked for your balance transfer details.

-

Enter your balance transfer details. You’ll be prompted to enter the name, account number and payment address of the other issuer, along with the amount of the transfer. Note that the amount of your transfer cannot exceed the amount you’re approved for in the offer.

-

Complete your balance transfer. Once you confirm the details, your balance transfer will begin processing. Your balance transfer fee, if applicable, will be added to your total balance once the transfer is complete.

For new credit cards, you can go through this process after completing your application and being approved for your card. After your approval, Capital One might prompt you to complete your balance transfer immediately, meaning you’d go through slightly different steps.

2. Mobile app balance transfer

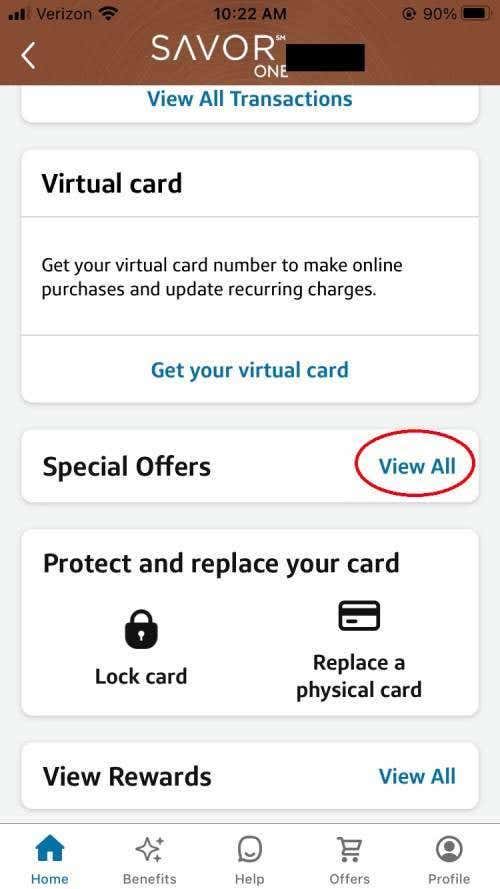

The process for a mobile app balance transfer is similar to that of an online balance transfer. Here are the basic steps:

-

Log into the Capital One mobile app. Once logged in, you’ll have to click on the credit card account you plan on using for your balance transfer.

-

Scroll to “Special Offers.” This option is below the transaction section. You’ll be taken to an “Offers and Upgrades” screen that details your current card offers.

-

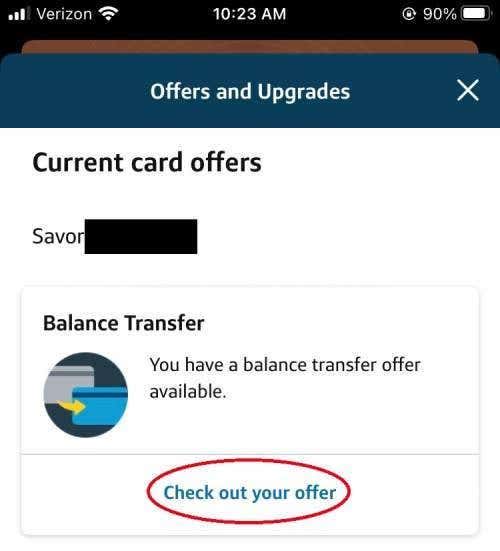

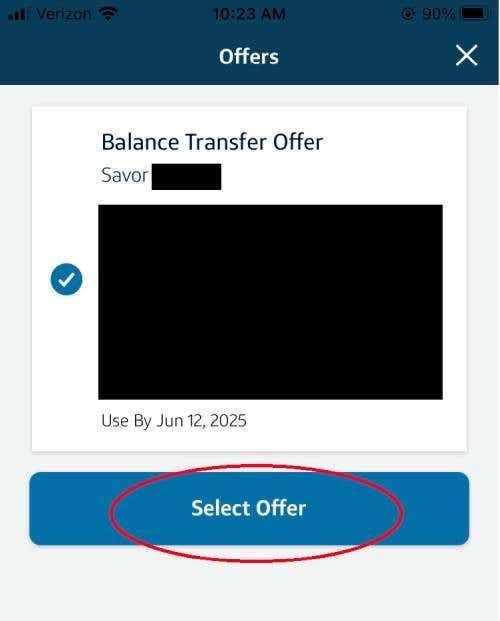

Choose your available balance transfer offer. You’ll be brought to another screen that shows you the details of your balance transfer offer or offers, if applicable.

-

Choose “Select Offer.” Once selected, you’ll be asked to verify your phone number via a security code. After that, you’ll be able to move forward with the transfer.

-

Enter your balance transfer details and complete your balance transfer. You’ll see similar prompts as you would for an online balance transfer.

3. Over-the-phone balance transfer

If you’d prefer to skip the internet and perform your balance transfer over the phone, you can do that by simply calling the number on the back of your credit card. You can also call customer service at 1-877-383-4802.

Before you call, however, make sure you have all the information you’ll need to complete the balance transfer, such as the account number for the account that you’re transferring the balance from, and the amount you want to transfer.

How long does it take to process a balance transfer with Capital One?

Balance transfers will be processed immediately once they’re approved, but it can take about 15 business days to process with the other issuer, according to Capital One.

The balance on your original credit card will continue to accrue interest until the requested balance transfer is processed. So check the account from which you transferred the balance to see if any outstanding interest needs to be paid off once your balance transfer is finished. Note that it could take up to 30 days for the interest to appear on your account.

Likewise, unless the balance transfer process is completed before your next credit card payment is due, the card issuer will still expect payment from you — and it can penalize you with late fees if you miss it.

Will a Capital One balance transfer hurt your credit score?

There are a few ways a balance transfer may hurt your credit score. Applying for a new credit card often results in a hard credit check, which can temporarily drop your credit score. Once you open a new account, the average age of your accounts will drop, which can also have a negative impact. If you decide to close your old credit card, that can also cause a drop in your credit score.

But adding a top balance transfer credit card to your wallet and keeping your old account open can have a positive impact on your credit score. That’s because the addition of a new account could help to increase the amount of credit you have while decreasing your credit utilization ratio — which is the amount of credit you have available to use compared to the amount of credit you’re actually using. Most experts suggest keeping a ratio of 30 percent or less.

By opening a new card, you’re adding to your available credit. Further, transferring a balance and paying it down over time will also improve your credit utilization. But if you open a balance transfer credit card, transfer a balance and charge new debt to your credit cards before paying that transferred balance off, your credit utilization ratio could get worse. This could cause your credit score to go down.

Likewise, your credit score is unlikely to improve if you never pay off your balance and keep transferring it from card to card.

The bottom line

If you’re ready to pay down high-interest credit card debt, a balance transfer may be the answer. A balance transfer with a Capital One credit card that offers a 0 percent introductory period can help you get a handle on your debt and begin paying it down — all while avoiding interest. You could also see improvements to your credit score as your credit utilization ratio rises.

But a balance transfer will only be helpful if used responsibly — and in some situations, a different debt management plan might be preferable. If you’ve already considered the pros and cons of balance transfers and are ready for a new Capital One credit card, don’t forget to come up with a strong debt payoff plan once you apply.

Frequently asked questions about Capital One balance transfers

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.