3 of the most expensive music memorabilia items ever sold

Music memorabilia has always been popular with collectors, and there have been several items with truly extraordinary price tags. According to Guitar World, a 1954 Fender Stratocaster owned by David Gilmour of Pink Floyd sold for $1.8 million at a 2019 Christie’s auction, while one owned by Jerry Garcia of the Grateful Dead sold for $1.9 million in 2017.

Does this mean memorabilia associated with the Grateful Dead will be more valuable than that of Pink Floyd? No. One of the reasons Garcia’s guitar fetched the high price was because it was custom-built for him, not because anything associated with the Grateful Dead would automatically be worth a lot of money. A deeper knowledge of what you’re purchasing is necessary to make a good investment decision, especially when it comes to alternative investments.

(The same goes for other types of investments, too. Working with a financial advisor can help you understand what’s in your portfolio and whether you’re on track to meet your financial goals.)

With this in mind, here are three instances in which music memorabilia was sold for large amounts at auctions and the “why” behind the price tag.

Kurt Cobain’s acoustic guitar

Jeff Kravitz / Contributor / Getty Images

Famous guitars associated with a single iconic musical performance have fetched huge prices at auction houses. The biggest by far is the Martin D-18E acoustic played by Nirvana’s Kurt Cobain at the band’s “MTV Unplugged” performance, which sold in 2020 for more than $6 million, making it the most expensive guitar ever sold.

By contrast, the electric guitar Jimi Hendrix played at the 1969 Woodstock Music and Art Fair was sold in 1990 to Italian collector Richard Pugliese for $324,000, equivalent to $793,446 in 2024. Hendrix’s guitar was from a more culturally significant moment, but ultimately, that didn’t add up to more value — it’s all about what the market will bear.

This gives investors who are considering buying famous musical instruments something to consider. A performance’s perceived historical significance may not necessarily translate to a more valuable item. If you’re an investor, do your due diligence beforehand, and don’t assume that historical significance will make an instrument worth more money. Take your personal inklings out of it and base your bidding on an understanding of the marketplace, not your grasp of history.

Need expert guidance when it comes to managing your investments or planning for retirement?

Bankrate’s AdvisorMatch can connect you to a CFP® professional to help you achieve your financial goals.

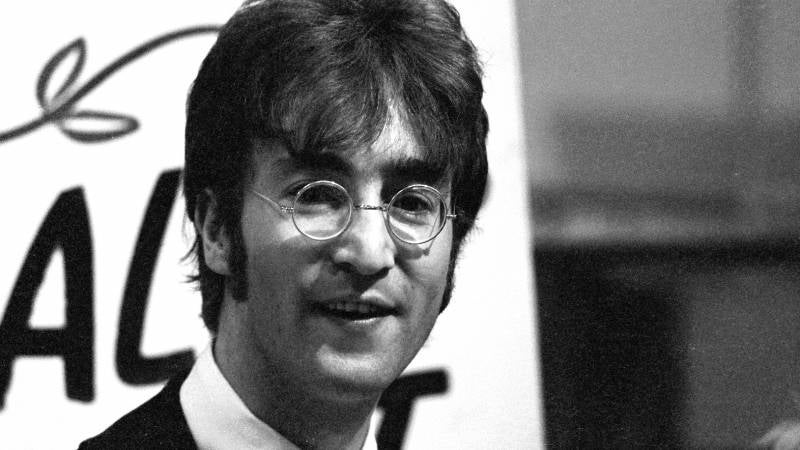

John Lennon’s ‘Imagine’ piano

Ivan Keeman / Contributor / Getty Images

The piano that John Lennon used to compose the song “Imagine” was sold for $2.1 million in October 2000 to singer George Michael. The Steinway Model Z upright piano was built in Hamburg, Germany, in 1970 and purchased by the former Beatle in the same year. With such an eye-popping sale price, you might think it’s the famous white piano one seen in the “Imagine” music video, but it’s a different, much more modest one. George Michael even called it “a funny-looking thing.”

Despite its modest appearance, there’s no disputing that this piano is an indelible part of music history. Furthermore, Michael felt that rather than keep the instrument to himself in a darkened attic, it would be better to donate it to the Beatles Story Museum in Liverpool, England.

“It’s not the type of thing that should be in storage somewhere or being protected,” Michael said. “It should be seen by people.”

While Lennon’s piano is potentially a good investment opportunity that could gain value over time, this particular venture is about more than that. If you’re the type of investor with a philanthropic streak, consider an investment that can pad your bank account and also be appreciated by others as a part of our shared history.

Learn more: How to invest in the music industry

Michael Jackson’s ‘Thriller’ jacket

Barry King / Contributor / Getty Images

Unless you were around in the 1980s, it’s difficult to imagine just how popular singer Michael Jackson was at the time of his 1982 album “Thriller.” Produced by the late Quincy Jones, the album took the top spot on the U.S. Billboard chart, and seven of the album’s nine songs became top 10 hits.

According to Rolling Stone, the album sold 66 million copies, making it the highest-selling album of all time. To put it in perspective, Rolling Stone said that it was the equivalent of every single citizen of France owning a copy of the record, including infants. In other words, he was insanely popular. In 2011, the jacket that he wore in the music video of the song “Thriller” was sold for $1.8 million at a Julien’s auction.

Despite these eye-popping figures, investors should not assume that anything Michael Jackson was ever associated with can fetch millions of dollars at auction. His career had more than its fair share of ups and downs, and while his other albums sold well, none captured lightning in a bottle the way the 1982 release did.

This means that while investors can reasonably expect memorabilia associated with him to fetch a high price, the highest will always go to memorabilia related to his “Thriller” era. In other words, investors should still do their research when considering what to buy, but every so often, there will be a no-brainer like this one.

Learn more: Take these 3 essential steps to build your ultimate investing plan

Bottom line

Collecting music memorabilia is a great pastime, and serious investors can make a good return on their investments in many cases. However, it’s important to keep in mind that as much as you may love a given artist’s music, that doesn’t necessarily mean the auction market feels the same way about it that you do.

Whether you’re considering investing in Keith Moon’s drum kit or a Southern Comfort bottle emptied by Janis Joplin, talk to an auction broker with experience in this area. They will help you adjust your expectations and help you figure out whether a given piece of memorabilia has a high market value or simply high emotional value for you.

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.

You may also like

Cost of selling a house in Ohio

7 best scholarships for children of veterans