What is ESG investing? A guide to socially responsible investing

Key takeaways

- ESG investors analyze public companies based on the impact the business has on the environment, society and corporate governance.

- Benefits go beyond the “feel good” factor. Some research suggests that ESG investing may even help boost returns.

- Screening tools make it easier to evaluate companies based on key criteria and identify stocks that align with your values.

- ESG funds are an easy way to invest in a diversified collection of ESG stocks without having to do the legwork.

The principles behind values-based investing have been around since the 1960s. But it wasn’t until the last decade or so that the term ESG — which stands for environmental, social and governance — entered the popular lexicon and was put into widespread use by mainstream investors to screen investments based on those factors.

ESG investing may also be called social responsibility investing or social impact investing because of its emphasis on trying to do good with your investments. At the other end of the investing spectrum are sin stocks, or vice stocks, which are companies that operate in industries that some investors consider morally or ethically questionable.

In recent years consumers have steadily poured more money into investments that align with their values. In 2022 global ESG assets were valued at more than $30 trillion, according to Bloomberg Intelligence. That figure is projected to rise to $40 trillion by 2030.

Here’s what ESG investing is, how it works and the benefits and drawbacks of the approach.

What is ESG investing?

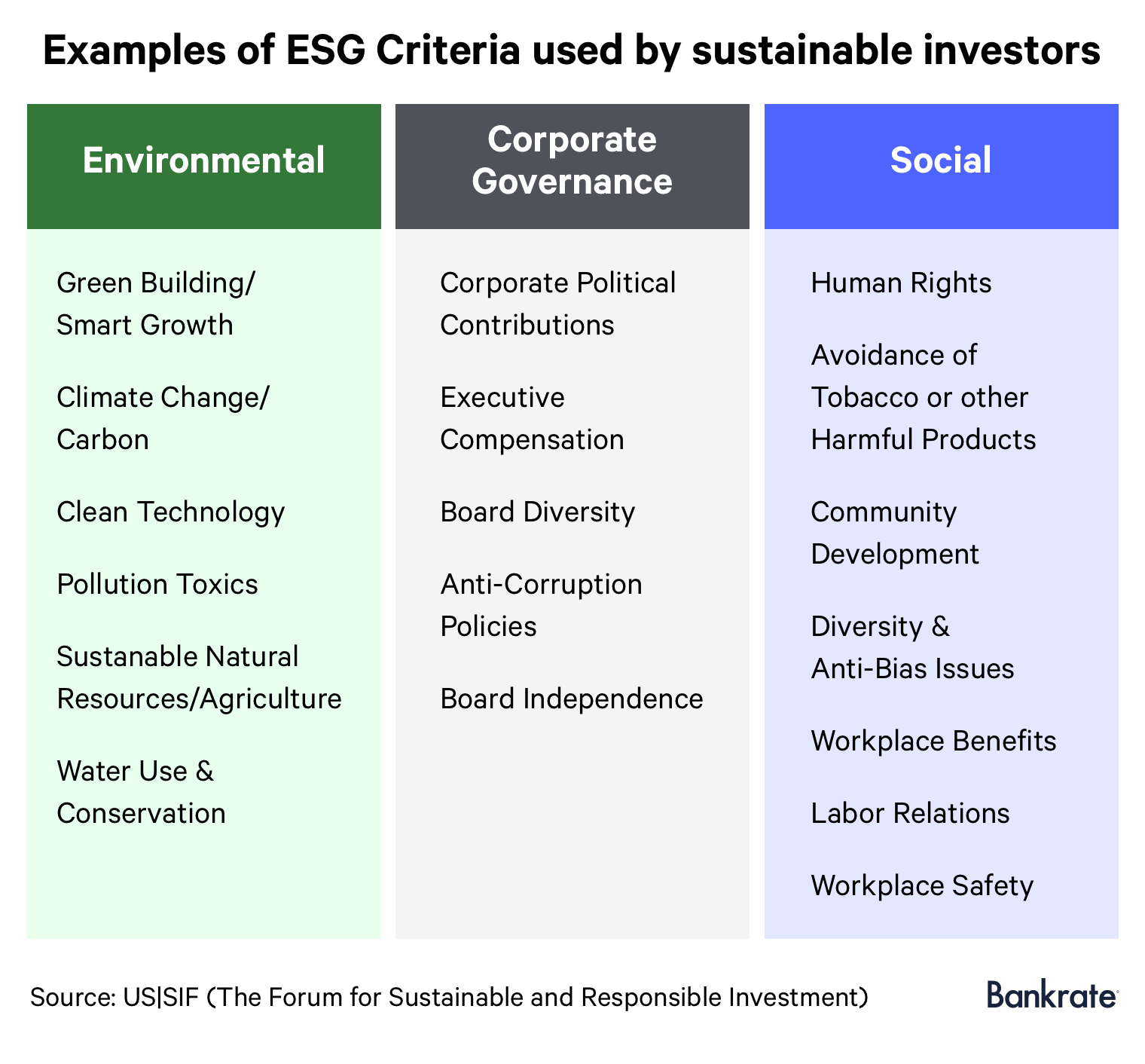

Proponents of ESG investing focus on three key features of companies to guide their investment decisions. They then invest in companies that demonstrate these values and divest, or sell, companies that don’t meet these criteria. These three areas are:

- Environmental – These companies focus on environmentally friendly technologies or mitigating their impact on the environment by investing in green infrastructure. These companies may also emphasize how humanely they treat animals and use natural resources.

- Social – These companies emphasize healthy social dynamics, respecting racial, gender and sexual diversity, and take care of human stakeholders through fair pay, for example. They also work with other people and companies that respect these values.

- Governance – These companies emphasize how they are governed, including the structure of executive compensation, objective reporting to their shareholders and other stakeholders, and how they organize the board of directors fairly.

How ESG scores are calculated

Which companies are considered ESG companies? Both investors and third-party analysts evaluate companies on the three criteria and provide ESG ratings on the companies. Even individual investors can now evaluate companies with the help of open-source ESG tools.

Fund management firms, including those that create mutual funds and exchange-traded funds (ETFs), may analyze public companies on ESG criteria and construct their funds using them. Other firms use the work of third-party analysts to evaluate publicly traded companies, which need to meet certain criteria to be included in the funds.

Research firm MSCI offers one model of ESG ratings, grading firms on an AAA – CCC scale. Firms with the highest ratings (AAA, AA) comprise just 20 percent of all companies evaluated, and lead their industry “in managing the most significant ESG risks and opportunities.”

MSCI evaluates 35 ESG issues across these three key dimensions:

- Environmental, including carbon emissions, water stress, raw material sourcing, toxic emissions and waste, cleantech and renewable energy.

- Social, including labor management, health and safety, product safety and quality, consumer financial protection and community relations.

- Governance, including issues surrounding the board of directors, pay, business ethics and tax transparency.

Even individual investors can evaluate a publicly traded company’s ESG cred with the help of analysis tools. For example, Interactive Brokers offers a sophisticated third-party ratings system that scores companies along granular areas that you choose, such as reducing emissions or engaging with human rights.

Benefits of ESG investing

ESG can offer some potential benefits to investors who are looking to use it to screen for investment opportunities.

Returns are generally strong

Some research suggests that investing in socially responsible companies may actually help your returns, not hurt them. But other research suggests the opposite: that investors must give up at least some level of returns to invest in ESG-friendly companies. Either way, the research suggests that ESG returns can still be attractive.

For example, the iShares ESG Aware MSCI USA ETF returned an average of 14.63 percent annually in the five years to January 2025. The iShares MSCI USA ESG Select ETF similarly delivered 14.65 percent annualized returns over the same five-year period.

It’s not especially expensive to invest in

If you’re buying an ESG fund, the expense ratio on the fund – the cost to invest in it – can be relatively low, depending on exactly which fund you buy. The funds mentioned above have expense ratios of 0.15 percent and 0.25 percent, respectively, making those funds low costs. In practical terms, investors would pay $15 annually and $25 annually for every $10,000 invested.

While even cheaper funds than these exist and deliver strong returns with similar investments, ESG investors aren’t paying a huge premium either.

Investor support can help a company thrive

Part of the value for ESG investing is the “feel good” factor in investing in companies that may be helping improve the world, treating their employees well, focused on social justice or simply considering all stakeholders. By investing in ESG stocks or funds then, investors make it cheaper for these companies to finance themselves and therefore thrive.

4 key concerns with ESG investing

The promises that ESG can help change the world are big, and unfortunately those promises are probably bigger than what socially responsible investing can actually deliver. Here are four major concerns with ESG investing and why it may not be the cure-all that’s been promised.

1. You may be paying more to own the same companies

One of the most obvious problems with ESG funds is that they charge a higher expense ratio for what may end up being the same companies in other major indexes or funds. Take the iShares ESG Aware MSCI USA ETF (ESGU) from BlackRock. This popular ETF has about $14 billion under management, as of February 2025. Its largest positions include Apple, Nvidia, Microsoft, Amazon, Alphabet, Meta, Broadcom and Tesla, with these comprising about 32 percent of the fund.

Now, look at what’s in the Vanguard S&P 500 ETF (VOO), which is based on the Standard & Poor’s 500 index and includes hundreds of top American companies. The top eight companies include Apple, Nvidia, Microsoft, Amazon, Meta, Tesla, Alphabet and Broadcom. The stakes in these companies total more than 30 percent of the whole fund.

These funds have huge overlap in their top positions, where a huge portion of the fund is held. But ESGU charges an expense ratio of 0.15 percent, while VOO asks 0.03 percent. For every $10,000 invested, that amounts to a difference of $12 annually. It’s not huge in absolute terms, but it adds up and other fund companies may charge more for their variation on the ESG theme.

The backstory: The fund industry has seen shrinking fees for years, as competition has heated up. ESG is an attractive marketing hook because fund managers can boost their fees.

2. Are these companies really doing “good”?

Do the firms among the top holdings in the ESGU fund surprise you? Do Amazon, Microsoft and Nvidia tout themselves as socially responsible investments?

And it might be a similar issue with stocks in other funds. Take another BlackRock fund, the iShares ESG Aware MSCI EM ETF (ESGE), which invests in emerging markets companies. It includes shares of oil and mining companies. These don’t sound like what people think of when they’re investing in environmental companies.

So yes, while a fund’s investments may not have specific characteristics such as being engaged in controversial weapons or thermal coal, they may not be all that green-friendly, either.

3. Not all ESG funds are the same

While many funds say they include ESG stocks, you won’t be able to judge at all unless you look closely under the hood. Even then, it’s tough to know which businesses a firm is actually involved in, since they’re often large and diverse.

Some funds may own certain kinds of companies that they think are consistent with an ESG mandate. For example, tobacco stocks that may be excluded from some ESG funds may score well on sustainability metrics and be included in other types of ESG funds.

4. Divestment from non-ESG stocks doesn’t solve the problem

ESG proponents suggest that divesting their portfolios from companies that don’t meet the mandate will help, ultimately, put those companies out of business. They see it as a kind of shareholder activism, where investors vote with their dollars. The reality is more complex.

Divesting non-ESG stocks from a portfolio or not lending to them may raise their cost of capital, making it more costly for them to do business. But if the divestment puts downward pressure on the stock, it actually increases the potential return to those who don’t invest according to ESG principles. So, perversely, ESG investing principles may be raising the prospective future returns of non-ESG stocks.

More effective solutions include outlawing or regulating the product, or making it cost-prohibitive to produce.

Getting started with ESG investing

Investors looking to get started with ESG investing have a number of options, including buying individual stocks and ESG funds, as well as working with a robo-advisor that offers ESG options.

ESG stocks

If you want to buy ESG stocks, you can invest in exactly the companies that you want, and you can filter out those that don’t meet your criteria. But you’ll need to do the research to find the companies that have ESG cred.

One great option here is Interactive Brokers, which provides a detailed ratings system that can help you sort through thousands of publicly traded companies. Its IMPACT mobile app allows you to screen your existing and potential holdings from an ESG perspective and trade in or out, among other features.

Another place to poke around for investment ideas is among the holdings in ESG funds. For example, Morningstar analysts identified a handful of large-cap stocks that are uniquely owned by ESG funds — and not commonly held in non-ESG funds — that may be worth further research:

- Ecolab Inc. (ECL) provides cleaning and sanitation products and technologies for the food, health care, hospitality, utility and manufacturing industries.

- Agilent Technologies Inc. (A) supports life science research with instruments and services for laboratories and clinical diagnostic markets across several industries.

- Xylem Inc. (XYL), a water technology company, focuses on the transport, treatment and testing of water for residential, commercial, industrial and agricultural applications.

However, it’s important to note that you’ll need to do everything yourself, including following your investments over time. You’ll also want to own at least 10 or so stocks so that you’re properly diversified and have reduced your risk.

ESG funds

If you don’t want to screen individual stocks for ESG criteria, a good alternative is an ESG mutual fund or ETF. ESG funds include only companies that fit the fund’s criteria for inclusion, so you’ll know that whatever is in the fund passes muster there. Funds are also a great fit for those looking for an easy way to have a diversified collection of ESG stocks without having to do all the legwork.

However, it’s worth noting that not all ESG funds have the same criteria, and some may focus on specific aspects over others (environmental over governance issues, for example). So, you’ll want to understand exactly what you’re buying.

Popular ESG funds include:

- Vanguard ESG U.S. Stock ETF (ESGV) is a broad index fund that excludes companies in industries such as adult entertainment, alcohol, fossil fuels, gambling, nuclear power, tobacco and weapons.

- iShares Global Clean Energy ETF (ICLN) tracks the performance of stocks from the clean energy sector.

- iShares ESG MSCI USA Leaders ETF (SUSL) focuses on large- and mid-cap stocks that score higher than their sector peers on ESG issues.

See our list of the best ESG ETFs for more socially responsible investment options.

Robo-advisors offering ESG options

If you really want to take a hands-off approach, you can have a robo-advisor manage your portfolio and invest your money. First, you’ll need to find a robo-advisor that offers ESG investing choices — Wealthfront and Betterment are two good options — and then you’ll need to indicate to the robo-advisor that you’re interested in these funds.

From there, the robo-advisor handles pretty much everything else. Just deposit money regularly, and the automated advisor will continue to invest your money according to your preset plan.

FAQs

— Bankrate’s Dayana Yochim contributed to an update.

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.