Does car insurance cover scratches and dents?

Key takeaways

- If you have full coverage car insurance, which generally includes comprehensive and collision coverage, your scratches and dents are likely covered.

- Because comprehensive and collision coverage both come with deductibles, it may not always be worth it to file a claim to cover minor damage.

- If you intentionally cause the scratch or dent, or it it’s old or due to regular wear and tear, your car insurance may not cover it.

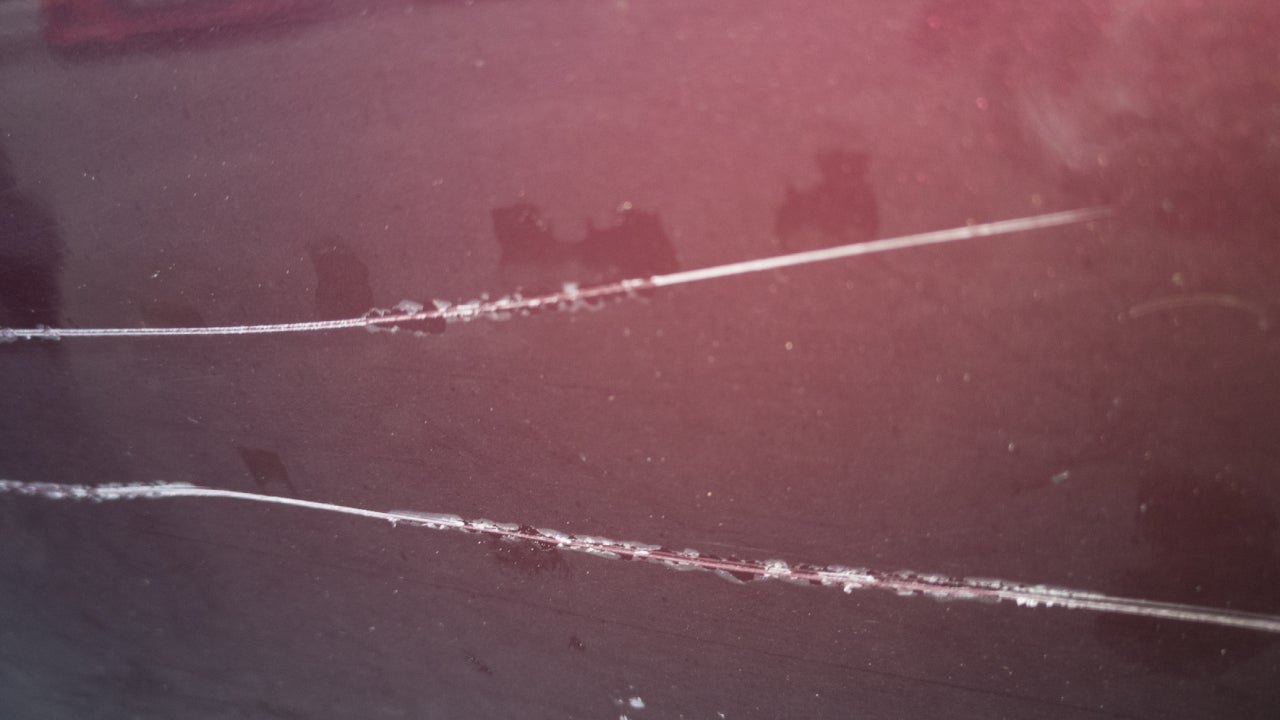

After releasing your frustration with your choice of swear word, you may start to wonder what you’re going to do about your car’s fresh scratch or dent. Minor car damage can come in many forms: an intentional door-ding from an ex, a deer with terrible timing or an overambitious parallel parking attempt. If you have a full coverage car insurance policy, which includes collision and comprehensive coverage, you’ll generally have protection from these malicious, random or accidental incidents. However, because these coverages have deductibles, we’re here to help you decide whether it makes more sense to file a claim, pay out of pocket or simply live with the damage.

Is minor damage covered by car insurance?

Minor damage can include scratches, dents or other imperfections that may be cosmetically unappealing but don’t technically impede operating the vehicle. Whether or not it’s covered by car insurance depends on the types of coverage you have on your insurance policy.

| Type of insurance | Does it cover scratches or dents? | Is there a deductible? |

|---|---|---|

| Minimum coverage liability | No; state-mandated minimum coverage insurance only covers liability for damage you do to other vehicles. | No. |

| Collision coverage | It might; this type of coverage pays for damages to your vehicle caused by you due to a collision with something, whether that’s another car or an innocent yellow parking lot bollard. | Yes; deductibles typically range from $1,00 – $2,000. If you have a high deductible and a small scratch, it may not be worth filing a claim. |

| Comprehensive coverage | It might; comprehensive coverage applies to damage to your vehicle caused by something other than a collision, such as a fallen tree limb or an animal that runs in front of your car. | Yes; deductibles typically range from $1,00 – $2,000. If you have a high deductible and a small scratch, it may not be worth filing a claim. |

When does car insurance cover scratches and dents?

Many of us do everything in our power to keep our vehicles looking as good as the day we drove them off the lot, but life often has other plans. In the table below, you’ll find some common scenarios where full coverage auto insurance does cover scratches, dents and other minor damage (but it’ll still be up to you to decide if filing a claim is worth it):

| Scenario | How coverage applies |

|---|---|

| A deer dents your car | Animal damages are typically covered under comprehensive coverage. Even a small animal incident can cause damage, but a deer can total a car under the right circumstances. |

| A squirrel chews on your car’s wires | This type of damage may cost more than a minor scratch and could render your car inoperable. Your comprehensive insurance could help cover damages. |

| You get into a fender bender | If you bump another vehicle in traffic and end up scratching your bumper, damage to your vehicle could be covered by collision coverage. Your property damage liability would pay for damage to the other driver’s vehicle. Conversely, if it’s the other driver’s fault, their property damage liability should cover the cost for repair. |

| Your car gets keyed | Vandalism is typically covered by comprehensive coverage. Other examples might include someone spray painting your car or damaging the doors or windows while trying to break in. |

| Road debris hits your car | If a rock or cargo flies off the truck in front of you and hits your car, it may be covered by comprehensive coverage. If, however, you hit an object lying in the road — such as a car bumper from an earlier accident — it could be considered a collision loss. If an object cracks your window or windshield, you could file a claim with comprehensive or, if you purchased it, through your glass coverage, which likely has a lower deductible. |

When does car insurance not cover scratches and dents?

There are some cases where insurance does not pay for scratches on cars, or for dents and other damage. In these scenarios, it wouldn’t make sense to file an insurance claim and you would have to pay for repairs out of pocket. Some examples include the following:

| Scenario | Why car insurance likely won’t cover it |

|---|---|

| You don’t have collision or comprehensive coverage. | Simply put, if you don’t have collision or comprehensive coverage (what’s typically known as full coverage), you don’t have insurance covers damage to your car. The only way damage to you car will be covered is if someone else causes it. And if they don’t have insurance, or even if they don’t have enough insurance, it still might not be covered. |

| Your car gets scratched or dented through normal wear and tear. | If you live in a busy area and have had your car for any length of time, for instance, chances are, it will pick up the occasional scratch or dent. If you can’t prove the damage was caused recently by a known (and covered) cause, it’s unlikely your insurance will cover it. |

| You purposely caused the damage. | Throwing a fit and kicking your car after you find a parking ticket on it when you ‘just ran inside for a moment’ is not a scenario that most insurance companies will cover. Neither is any other type of vandalism perpetrated by you. If someone else vandalizes or kicks your car in a fit of rage, though, your full coverage policy should take care of it. |

| The damage happened ages ago. | Most insurers (and states) set limits on how far back you can file a claim. Even though you may not notice a scratch or dent the moment it happens, you should be prepared to give as specific a time frame as possible if you want it to be covered. |

| You violated any of the terms of your insurance policy. | Say you and some friends drove across the border to Mexico for a fun night out and your car got dented by a falling tree branch. Because most policies don’t allow for coverage if you’re driving in Mexico, you’re most likely out of luck. Make sure to review your policy in full (your agent can help) so you understand the terms and conditions. |

When to file a claim for a scratch or dent — and when to not

Just because you can file a claim on a scratch or dent doesn’t mean you should. Filing a claim may lead to an increase in your premium unless you have accident forgiveness. And if the damage is truly minor, it may not make sense to file because it could cost less to fix than the amount of your deductible.

For example, if a shopping cart bumps your car and leaves a scratch with a $100 estimate to fix, filing a claim wouldn’t make sense if your deductible is $500. However, if damage from an incident amounts to a more significant repair cost, like $1,000, you may want to file a claim because it is more than your deductible. Just keep in mind that filing claims can also affect your car insurance rates.

If there are any injuries in an accident, even if they seem minor at the time, you should get a police report and let your insurer know about the accident. Sometimes, an injury that seems minor may become something more serious after the fact and unless you let your insurance company know in a timely manner, they could refuse to pay out on a claim.

Frequently asked questions

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

Does home insurance cover roof replacement

Does car insurance cover engine failure?

What is full coverage car insurance?

Does car insurance cover keyed cars?