Does car insurance cover keyed cars?

Key takeaways

- Car insurance policies with comprehensive coverage often cover keyed car repairs, while collision coverage does not.

- Keyed car repair costs vary based on the extent of the damage, but you might pay anywhere from $500 to $1,500.

- You will have to pay a comprehensive deductible for insurance to cover repairs, so you should ask yourself if it makes financial sense to file a claim before proceeding.

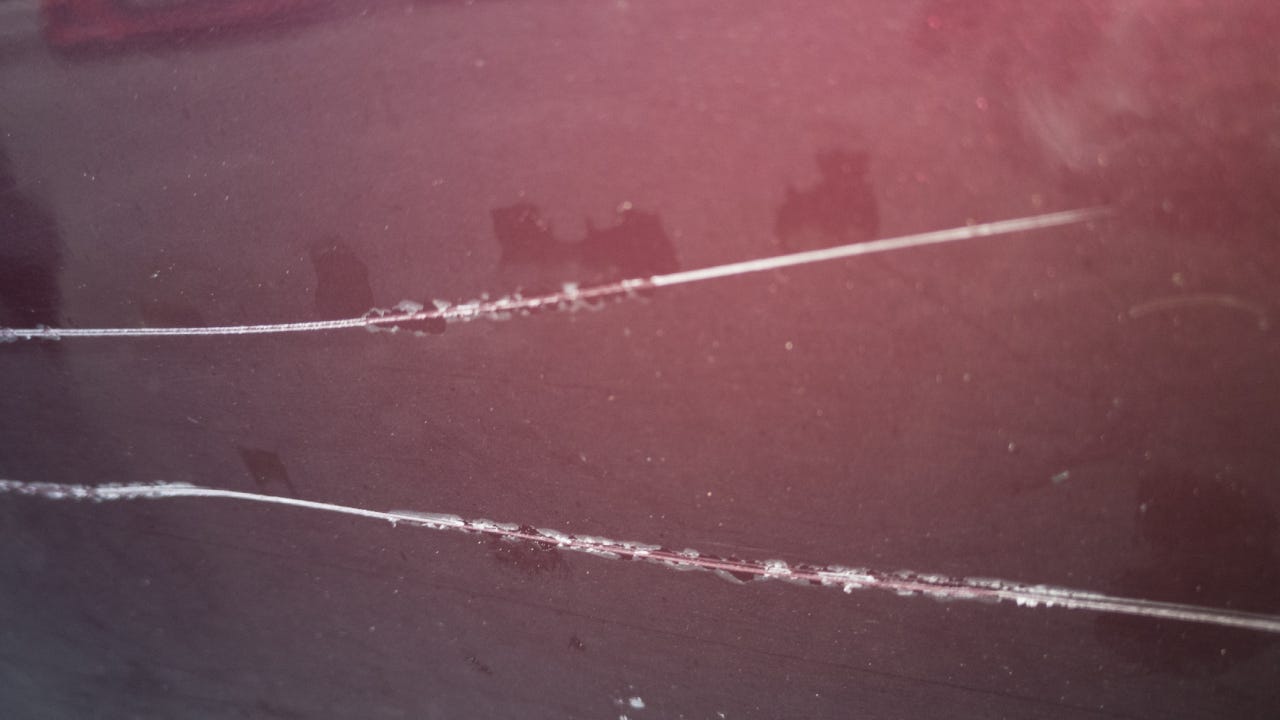

Keyed car damage can be more than cosmetic if the scratch is deep. To repair your keyed car, you might consider if it’s covered through your insurance policy before you head to the repair shop. Most full coverage policies will pay for keyed car repairs as long as you have comprehensive coverage, but you’ll have to file a claim and pay the deductible. Bankrate’s insurance editorial team explains your options, so you can decide whether or not to file a claim or pay out of pocket.

Will insurance cover a keyed car?

If you’re wondering whether insurance covers vandalism, realize that most car insurance does cover a keyed car if you have the right policy in place. If you have full coverage, then you likely have comprehensive coverage on your auto policy that provides coverage against theft, vandalism and weather-related damage. You can file a claim under your comprehensive coverage if your vehicle is keyed. However, if you only have liability insurance, your keyed car will not be covered by your auto insurer.

How much does it cost to repaint a keyed car?

The cost of repairing a scratch on a keyed car depends on how far and deep the damage has penetrated. If it has only scratched the top coat, the expenses will be the lowest. For instance, if it’s a superficial scratch that’s just near your door handle or a single panel, you might only have to pay for a touch-up paint job. According to Kelley Blue Book, you can expect to pay between $500 to $1,000 for a basic paint job, but an auto shop specializing in storm and damage repair puts estimates for minor touch-ups and scratch repair between $945 and $1,545.

If the scratch is deep and the damage extends from the clear or base coat to the bare metal, you might fall on the higher end of repair costs. You’ll also pay more if someone dragged the key across several body panels instead of just one, or if your vehicle has an unusual paint color that’s difficult to source. That said, labor costs in your area can greatly affect the price you pay to repaint the keyed car. Extensive keyed car repairs can run up to $1,000 or more. To help you save, request repair quotes from several shops before you agree to the work.

Will making a claim on my keyed car affect my premium?

An important consideration before filing a claim is how it may affect your premiums. Policyholders who file claims often see the price of their insurance go up, regardless of how minor the issue is. However, you probably won’t pay as much as someone who files a claim for an at-fault accident, for example. You’ll most likely see the change in your rate at renewal time.

Your annual rates are likely to rise more significantly if you file more than one claim within a short time. For instance, if you have one claim on record from within the last two years and file another one, you’re likely to notice a notable spike at renewal. Insurance companies make up for the cost paid in claims with an increased premium, even if the expenses were for minor cosmetic damage that you are not at fault for. Therefore, if you are trying to save money by getting your auto insurer to pay for the repair expenses of your keyed car, consider that you may end up paying a higher premium for the next few years to offset the insurance company’s out-of-pocket costs for the claim.

Is it worth making a claim to fix my keyed car?

Whether or not you should file a claim depends on your insurance policy, specifically your deductible, and the extent of damage to your car.

Example 1: Worth filing a claim

Example 2: Not worth filing a claim

What do I do if someone keys my car?

The process of filing a claim in the event of a keyed car is much the same as filing a claim for any other damage. Some of the steps to take include:

- Document the incident by time and place, and take photos and videos.

- File a police report.

- Inform your insurance company if you have comprehensive coverage.

- Take your vehicle to a repair shop for inspection.

If you decide to file a claim, your auto insurer will either reimburse you after you have paid the mechanic, or the insurer might pay its portion of the claim to the mechanic directly. Regardless, the payment from your insurer will have the comprehensive deductible taken from it. You would have to pay the difference between the amount owed to the repair shop and what was paid by your auto insurer out of pocket to cover your deductible. With a $500 comprehensive deductible and a $1,500 damage claim, you would pay the $500 deductible to the repair shop and the insurer would pay the remaining $1,000. In this example, the keyed car repair cost is $500, with insurance covering the rest.

Tips for protecting your car from vandalism

No one wants their vehicle to be the target of vandalism. Fortunately, there are a few things you can do to prevent your car from being keyed. While these might seem like straightforward suggestions, they might stop someone from causing damage altogether:

- Install a security system or alarm: If your car did not come with a security system, consider installing an alarm that could deter vandals. A system with a loud alarm or flashing light often makes people think twice before messing with your vehicle.

- Park in a garage or well-lit area: Keep your car safe by parking in a locked or secure garage — ideally one with video surveillance if you’re in public. If you can’t park in a garage, choose a well-lit space on a street that isn’t out-of-the-way or secluded. Vandals are less likely to target your car if they might be spotted.

- Keep your locked and free of valuables: People are more likely to vandalize or steal from your vehicle if it looks like an easy target. Don’t leave your personal belongings in the car where someone can see them, and always lock your doors when you leave the vehicle. If you have to leave items in your car, put them in discreet places like the trunk, under a seat or in the glove compartment.

- Mix up your parking routine: Vandals and thieves often pay attention to a target’s routine, making note of when they arrive, where they park and when they leave. Try to switch up your schedule so you’re not always parking in the same place and don’t follow a predictable schedule if you can avoid it.

If you’re someone who keeps up on your car maintenance and generally takes care of your vehicle, it can be really disheartening to find that your car has been keyed. Fortunately, if you have comprehensive insurance, the repairs are often covered. Once you’ve fixed the paint job, remember that there are things you can do to prevent your car from being vandalized again.

Frequently asked questions

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

Does car insurance cover windshield replacement?

Does car insurance cover theft?

If your car breaks down, will insurance cover a rental?

Does car insurance cover your parked car?