What is collision insurance?

Collision insurance is an optional coverage that helps pay for repairs to your vehicle when you are to blame for a car accident or other damage-causing incident, like hitting a tree or mailbox. Even the safest drivers can lose focus or react poorly when a split-second decision must be made, and collision insurance can be a financial buffer for errors on the road. Learn how collision coverage fits into your insurance policy, what it covers, when it is required and what types of vehicles may be better off without it.

How collision insurance works

If you cause an accident or damage your vehicle another way (like running into your garage door before it fully opens), you can file an insurance claim under the collision portion of your policy — so long as you carry this type of coverage. Assuming your claim is approved, you will be responsible for covering an agreed-upon amount of damage out of pocket. This is called your deductible. The remaining cost of repairs will be paid for by your collision coverage, up to your policy limit.

Auto collision insurance is usually part of a full coverage car insurance policy, which also includes comprehensive and liability coverage. Collision and comprehensive coverage provide financial protection if your car is damaged or if you or your passengers are hurt in an accident. Liability coverage, on the other hand, helps pay for damage or injuries others face when you’re responsible for a crash.

What does collision insurance cover?

Collision covers damage to your vehicle caused by colliding with something. This includes damage caused by:

- Hitting another vehicle

- Striking a stationary object like a tree, pole or mailbox

- Colliding with a building

- Another vehicle colliding with your car while parked (like in a hit-and-run)

One caveat is colliding with an animal, such as a deer. That type of damage is covered by comprehensive coverage.

If you are not at fault for an accident, the other driver’s property damage liability should take care of the damage to your car. Sometimes car insurance claims are lengthy, though, and you might want your car fixed more quickly. You could choose to pay your collision deductible and use your coverage to fix your vehicle. Your company will then pursue the other party’s insurance company to receive a payout from their property damage liability. This is a process called subrogation. While collision claims often cause premiums to rise, if your insurer successfully recovers the costs through subrogation, your deductible should be refunded and any premium increase may be waived, since you were not at fault.

What doesn’t collision insurance cover?

Collision auto insurance does not cover everything. For instance, any damage you cause to other vehicles or injuries you inflict on the other driver or their passengers as a result of an accident you cause will fall under your liability coverage.

Here are a few other things that are excluded under collision insurance:

- Damage caused by theft or vandalism

- Animal damage

- Fire or water damage

- Damage from a natural disaster or bad weather like hail

- Intentional damage

With the exception of intentional damage, which is never covered by insurance, damage from instances like those listed above is typically covered by comprehensive coverage.

Do I need collision car coverage?

You might. If you have a loan or lease on your car, collision insurance is likely mandated as part of your financing terms. Since a lender has a vested interest in your vehicle, they often require that you buy a policy that includes both comprehensive and collision coverage.

If you own your vehicle outright, the decision to carry collision insurance is up to you. Insurance experts generally recommend it if you can afford it — especially for newer or higher-value vehicles — to protect the investment you’ve made in your vehicle. Without it, you would be required to cover repairing or replacing your vehicle out of pocket if you cause an accident.

Keep in mind that, in the event of an approved claim, collision insurance only pays out the vehicle’s actual cash value (ACV) — not the amount you paid to purchase the car. ACV factors in depreciation. If paying off your loan or purchasing a new car in the event yours is totaled is a concern, adding gap insurance or new car replacement coverage to your policy could help.

As your car ages and loses value, it’s a good idea to compare the cost of your premium and deductible amount to the potential insurance payout to determine if collision coverage is worth keeping. If you have questions about this, you can talk to an insurance agent to gain clarity.

While adding collision coverage will increase your overall insurance costs, the benefits are certainly worth it for some policyholders:

- You receive compensation to repair or replace your vehicle after an accident.

- You feel peace of mind on the road knowing your vehicle is covered.

- You gain financial stability since you know how much you’ll owe if your car is damaged (your deductible amount).

How much does collision coverage cost?

Collision cost varies based on multiple factors, including the kind of car you drive, where you are located and the amount of coverage you want. The average cost of a full coverage policy in the U.S., which includes collision and comprehensive, is $2,679, compared to the average cost of a minimum coverage policy (which does not include collision), which is $808. You may be able to pay less for your full coverage policy based on the amount of coverage you choose and other factors.

It’s worth noting that providers have different rules for itemizing additional insurance products on top of your state-mandated liability insurance. Some allow you to purchase collision as an individual product, while others require you to have a full coverage policy to get access to collision. However, you can usually buy comprehensive without collision coverage.

Once you have collision coverage or a full coverage policy, remember that filing a claim could result in your premium going up — which brings up a common dilemma in the cost of car insurance. Let’s say your collision coverage has a $500 deductible and the repairs to fix your vehicle following a minor fender bender are only $650. In that case, you might consider paying out of pocket rather than filing a claim, since you’d only be reimbursed $150 and your premiums could go up as a result.

What should I consider when purchasing collision coverage?

Now that you know what collision coverage is, you may want to consider a few things before adding it to your policy to ensure this coverage fits your needs:

- Your overall financial health: If your vehicle is paid off and you aren’t required by a financial institution to buy collision insurance, think about your overall financial situation. If you can handle the financial burden of repairing or replacing your vehicle out of pocket, you might opt to go without collision. But if you would need the insurance coverage to fix or replace your vehicle after a claim, it’s probably a good idea to buy collision insurance.

- Your premium: Having collision on your policy is likely to increase your overall cost for car insurance because the more coverage you buy, the more you’re likely to pay. If your budget is especially tight but you need or want collision, you might want to compare car insurance rates from several companies to find the most competitive price.

- Your deductible: Both collision and comprehensive coverage have a deductible, which is the amount you’ll pay out of pocket if you file a claim for those coverage types. A higher deductible will generally lower your rate since you are willing to pay more in the event of a claim. Be sure to choose a deductible level that you can afford to pay.

- Your vehicle: If your vehicle is only worth a few thousand dollars, you could end up paying that much in premiums to maintain full coverage over just a couple of years. As your vehicle depreciates, dropping collision coverage could save you money without exposing you to significant risk. Insurance experts recommend re-evaluating your policy bi-annually or annually to make sure it still makes sense for your situation.

- Your risk: While car accidents can happen to anyone, evaluating your personal risk factors can help you decide if collision coverage is worth the cost. If you have a strong driving record and live in a low-traffic area, your likelihood of causing a collision may be lower. However, even safe drivers face unexpected situations, so it’s important to weigh the potential savings against the risk of having to pay out of pocket for repairs.

When setting your deductible, it can help to think about the threshold under which you’d be willing to pay for repairs out of pocket. For example, if dealing with up to $1,000 in damage without help from your insurance company feels manageable, you may be able to select that higher deductible and reserve your coverage for more extreme crashes. But if you’d like your coverage to kick in at a lower level — say, $500 or more of damage — check to see if the higher premium will fit into your monthly budget.

— R.E. Hawley Insurance analyst, Bankrate

Frequently asked questions

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

Understanding your insurance offer after an accident

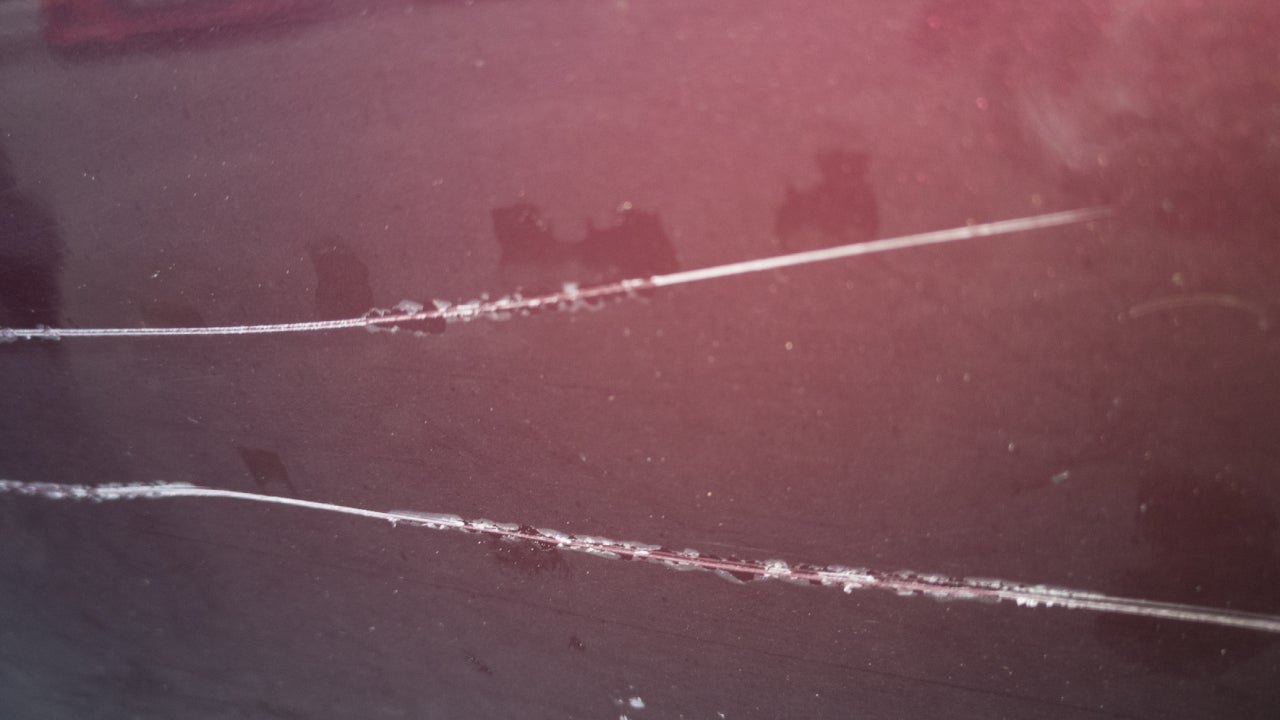

Does car insurance cover keyed cars?

Does car insurance cover scratches and dents?