United MileagePlus Dining guide

Key takeaways

- United MileagePlus Dining allows you to earn United miles on everyday purchases at eligible restaurants in the program.

- Signing up for the program is free, but requires having a United MileagePlus account.

- The program does not require using a United credit card, but using one can help you earn more miles more quickly.

When saving up for your next award redemption, sometimes you wish there were easier ways to accrue miles without flying. If you’re saving for a flight on United or one of its partner airlines, the United MileagePlus Dining program can be a great option.

Once you link your credit card to a dining account, you can start earning United miles whenever you order from a participating restaurant in the program. MileagePlus Dining can help you earn more United miles without applying for a new credit card and by making everyday purchases at restaurants. If you do choose to enroll using a United MileagePlus credit card, you’ll earn additional miles when you use the United MileagePlus Dining program (on top of the miles you’ll earn with your United credit card). This guide will help you learn more about MileagePlus Dining and get started on your enrollment.

What is United MileagePlus Dining?

The United MileagePlus Dining program allows you to earn United miles when you make a purchase at participating restaurants. The program includes thousands of local and national restaurants and bars, meaning you likely have an eligible location close to you. This opportunity lets you do so easily once you set up your account and connect your credit cards. All you have to do is sign up and register your credit or debit card on the website. After that, any time you pay your bill at a participating restaurant, bar or club with the registered card, you’ll earn miles for every dollar you spend.

Keep in mind: The United MileagePlus Dining program is operated by the Rewards Network dining program. As part of the network’s rules, each credit or debit card can only be registered with one Rewards Network dining program at a time. If you’ve already registered a card with the American AAdvantage Dining program, you won’t be able to use that same card with the MileagePlus Dining program unless you remove it from the AAdvantage Dining program.

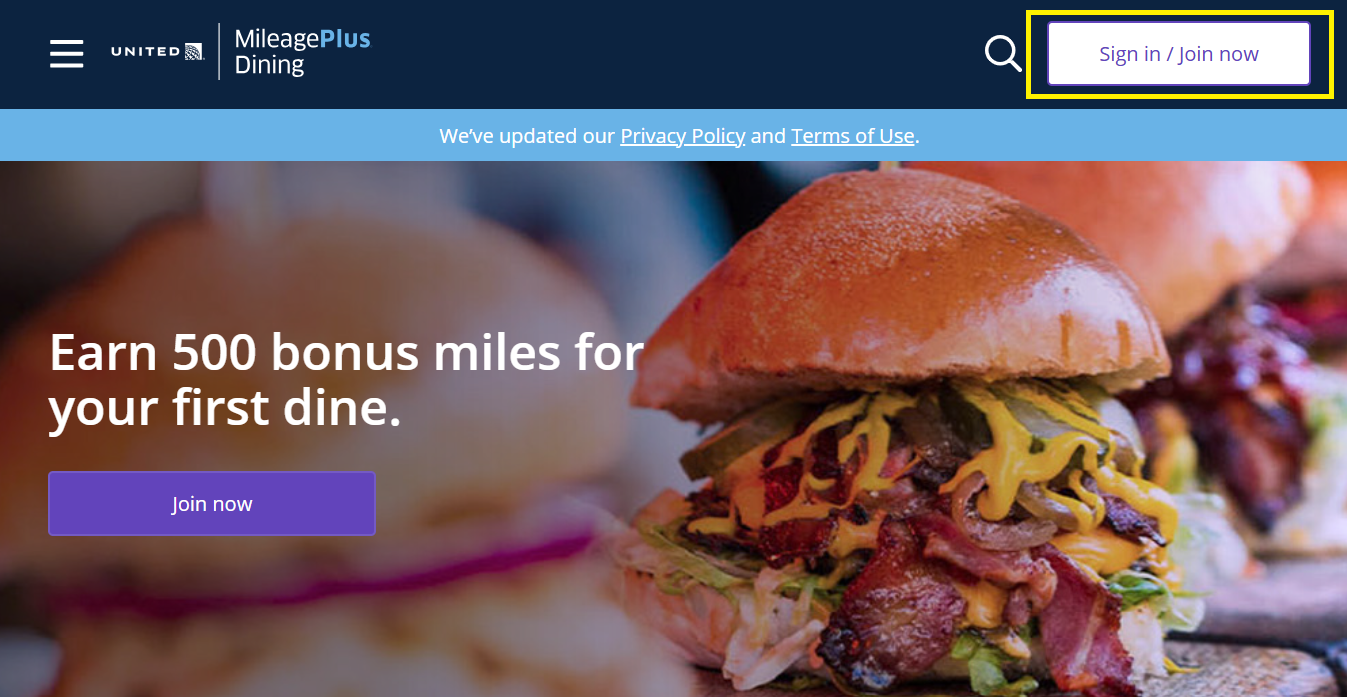

How to sign up for United MileagePlus Dining

Signing up for the program is simple and free:

- If you are not already a United MileagePlus member, visit United’s website in order to join the frequent flyer program. You need to have an active United MileagePlus account before you can sign up for the dining program.

- Visit the dining program’s website and sign up with your MileagePlus account.

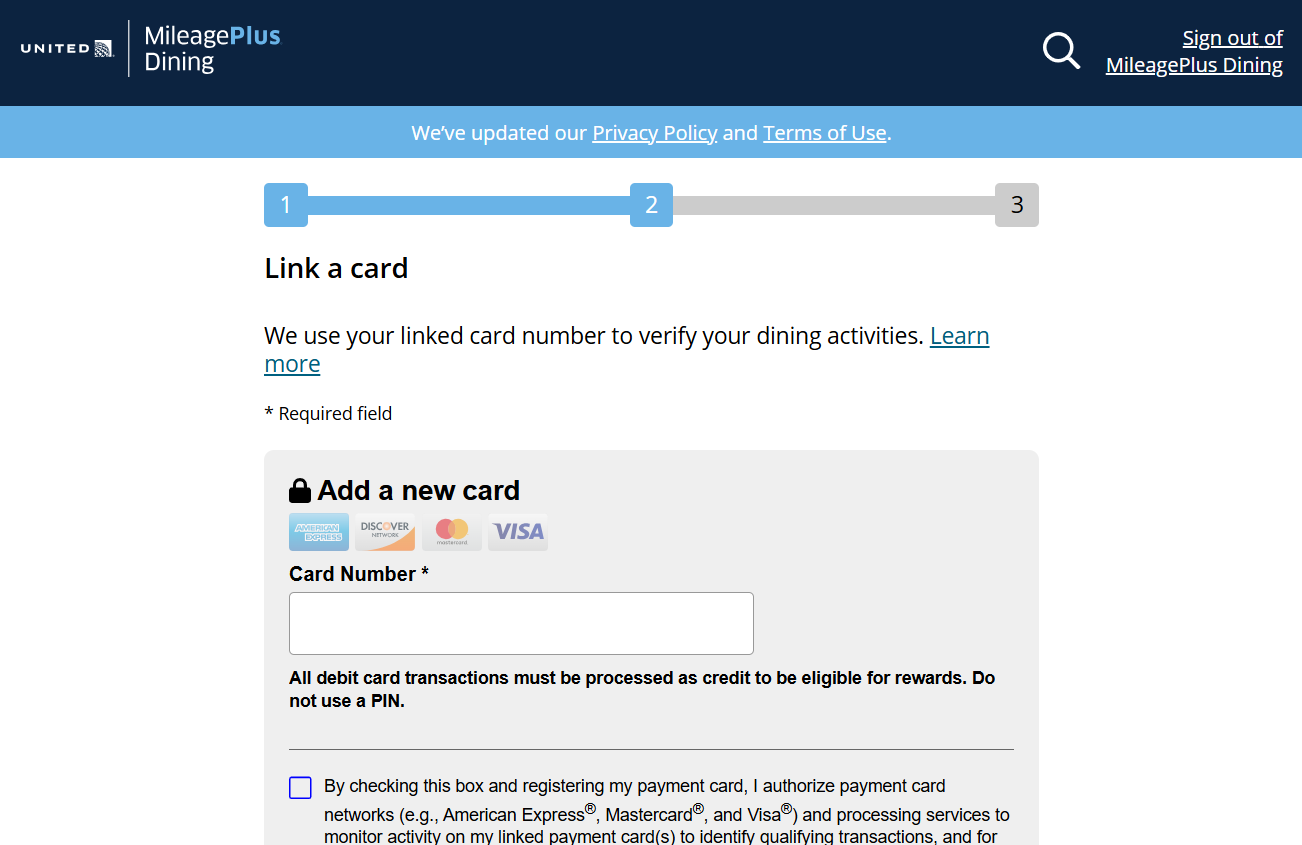

- Once you sign up, link the credit or debit cards you plan to use. Be sure to register any cards that you might use to pay your bill at a restaurant. The program will automatically award you miles whenever you use a registered card at a participating restaurant. Adding your card is done securely to keep your information safe.

- Use your linked credit or debit card at a participating restaurant and earn miles.

Signing up takes only a few minutes, but once you have enrolled and set up your cards for the program, you are on your way to earning miles just from your regular visits to participating restaurants and bars in the program.

How to earn miles with United MileagePlus Dining

Once you’ve set up your account and registered your cards, earning miles is easy. Every time you pay with your registered card at one of the 10,000-plus participating restaurants, bars and clubs, miles will be automatically credited to your MileagePlus account.

Here are a few tips for maximizing the program:

Sign up for emails to earn more miles

The United MileagePlus Dining program offers three earning tiers:

| Membership level |

|

|

|---|---|---|

| Basic |

|

|

| Select |

|

|

| VIP |

|

|

If you’re going to join United MileagePlus Dining, make sure to allow email communications, since you’ll earn at least three miles per dollar — instead of just one mile for every $2 spent — every time you dine out. And if you’re able to dine out at qualifying restaurants at least 11 times per year, you’ll start earning five miles per dollar with your 12th transaction.

Search for restaurants and dine out as usual

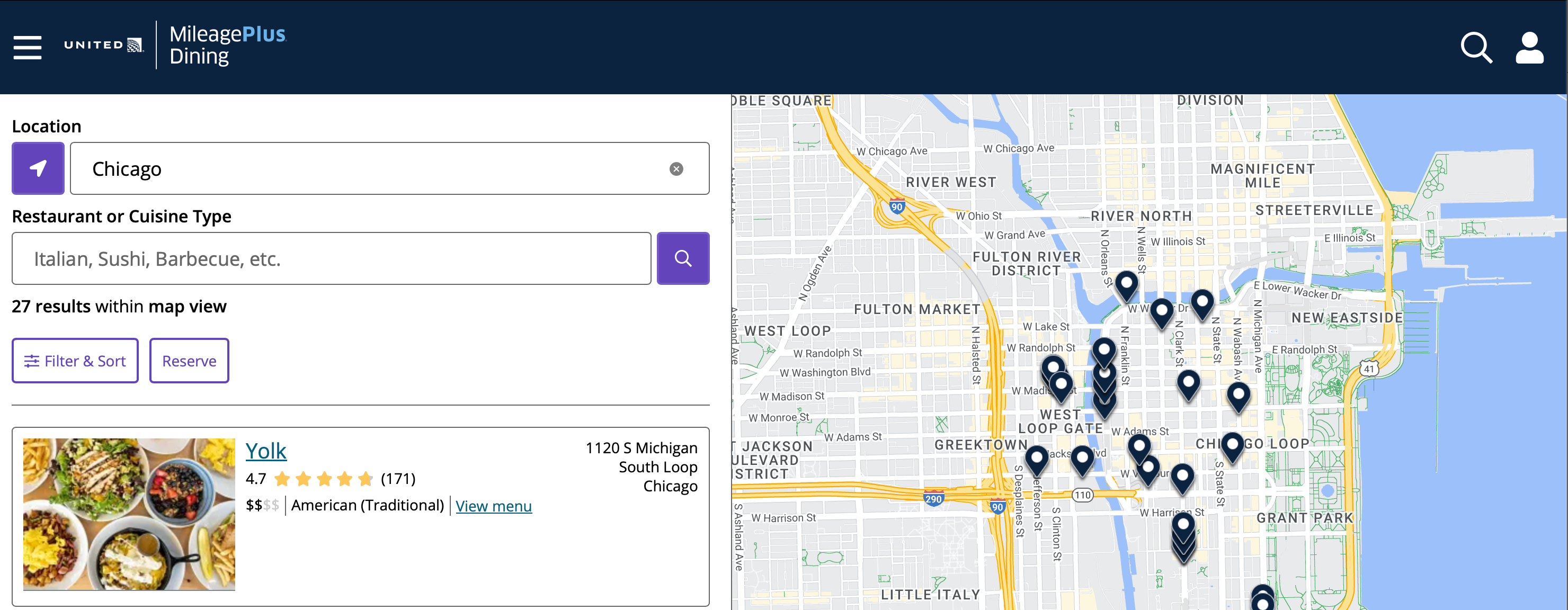

Browsing the MileagePlus Dining restaurant list is a great way to discover new eateries near your home or while traveling.

Finding participating restaurants and bars is easy with the MileagePlus Dining search tool.

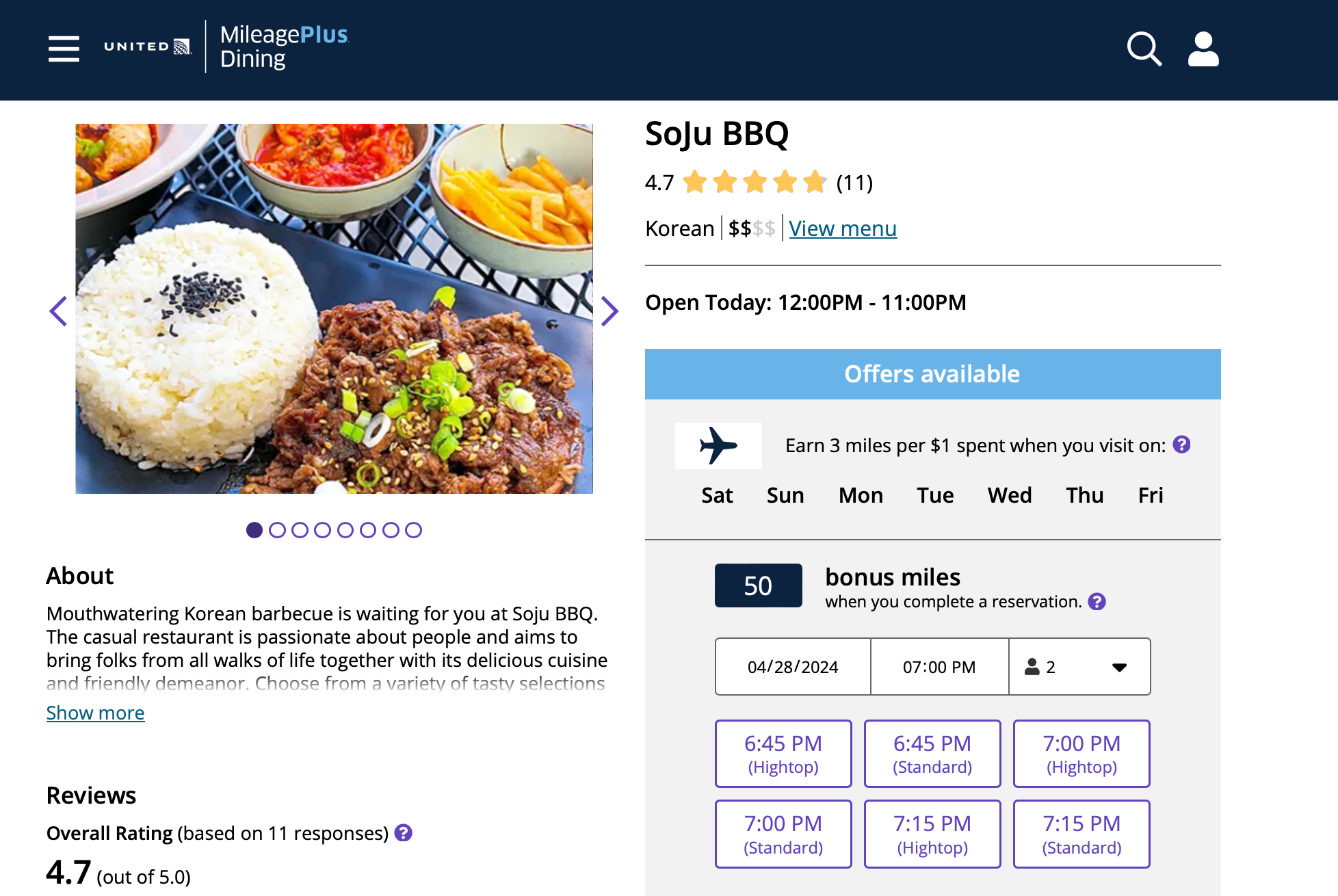

When you make a search, the results will include photos, descriptions, reviews and average prices for each restaurant, as well as MileagePlus benefit guidelines. You can search by city or ZIP code, explore a map view of restaurants around you or search for specific foods or cuisines. For select locations, you may see additional offers if you make a reservation with the restaurant.

When you click on a participating restaurant or bar, you can learn more about the restaurant, read reviews and get a sense of the price range. The site will also provide you insights into the mileage earning per dollar spent at the establishment. In addition, select restaurants let you reserve a table quickly and easily on the site.

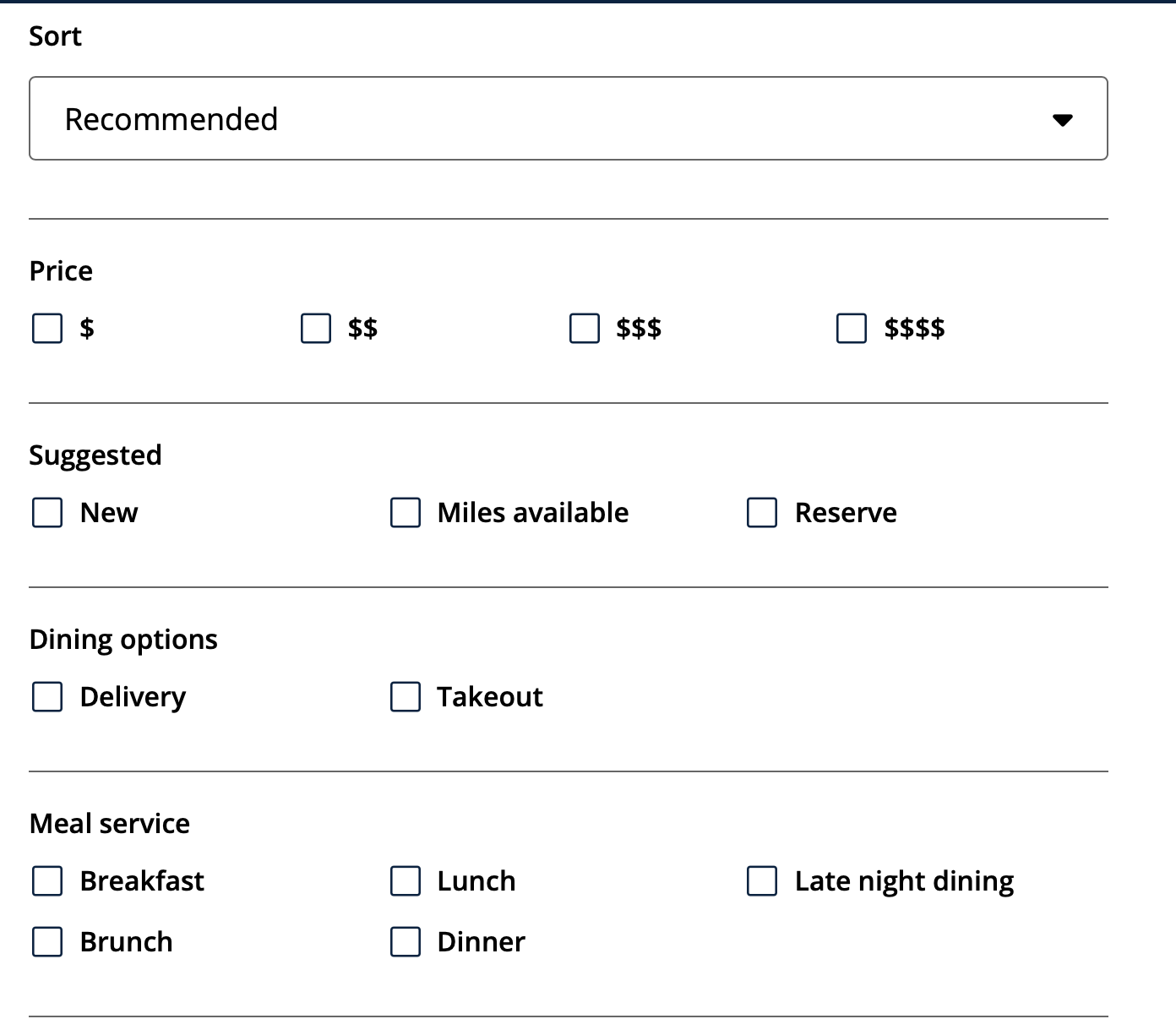

You can also filter results by distance or price and other helpful attributes for finding the right spot.

Of course, you don’t have to visit the website to earn miles, but it can help to know which restaurants offer rewards before you go. As long as you link your preferred cards to the United MileagePlus Dining program, you’ll automatically earn miles any time you pay for a meal at a participating restaurant.

Keep in mind: This differs from offers in credit card shopping portals in which you have to load the offer on your card in order to benefit. With United MileagePlus Dining, you’ll earn with any restaurant in the program as long as you use a card you registered in the program.

Earn bonus miles through promotional offers

MileagePlus Dining frequently offers new and existing members the chance to earn bonus miles. Bonus offers are usually sent via email, and may require small tasks such as completing a survey, signing up for text notifications, adding a new card or spending a specific amount each visit.

For instance, new members can currently earn 500 bonus miles when they join MileagePlus Dining and spend $25 or more with their linked card at an eligible restaurant within their first 30 days of membership. New members will then need to review the restaurant to earn their bonus miles. Note that MileagePlus members with Premier status can earn a total of 1,000 bonus miles through this offer.

Best credit cards for United MileagePlus Dining

You can use any credit or debit card with the program, but you can also rack up more rewards if you choose strategically. For instance, Chase Ultimate Rewards can be transferred to United MileagePlus, which means you could use the Chase Sapphire Preferred® Card to earn 3X Ultimate Rewards points on your dining while also racking up United Miles through the MileagePlus Dining program. Use those Ultimate Rewards for any number of travel redemptions or transfer them to United Airlines to pool them in your MileagePlus account.

Alternatively, you may want to consider getting a United credit card. Here are the most popular:

The bottom line

The United MileagePlus Dining program offers you the chance to earn United miles without changing your spending habits or applying for a new credit card. Just register your cards, enjoy your favorite restaurants in the program and watch the miles pile up.

Frequently asked questions about United MileagePlus Dining

*The information about the United℠ Explorer Card, United Quest℠ Card and United Club℠ Infinite Card has been collected independently by Bankrate. The card details have not been reviewed or approved by the card issuer.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.