How to rent a car with points and miles

Key takeaways

- Booking a car rental with points or miles can make sense if rental prices are high or if you find a good deal.

- If you have a card that is part of a flexible credit card rewards program, you can book a rental car through the travel portal just like you would book a flight or hotel.

- You can also typically use rewards earned in airline or hotel loyalty programs towards car rentals.

Planning a road trip or need a car for a quick weekend getaway? While air travel is typically what comes to mind when you think about credit card travel rewards, redeeming your points and miles for auto rentals is also an option for most cardholders.

Usually, I almost never recommend using rewards for rental car bookings since you can almost always find a rental car deal through AutoSlash, Hotwire, Kayak or Priceline if you don’t care what company you’re renting from. When these kinds of deals don’t exist, however, here’s what you need to know about booking a car rental with miles or points:

How to book a car rental with miles or points

Just like booking a flight or cruise with your travel credit card, renting a car with your existing points or miles is a mostly straightforward process. However, some credit card rewards programs make this option easier to navigate.

Airline miles and points

Nearly every airline has a frequent flyer program that has the option to redeem your points or miles for rental car bookings. The exchange value of airline miles for rental cars typically isn’t as good as using miles for booking flights, but it is a solid option in a pickle. It might also be worthwhile if you’re earning more miles than you can spend on flights through a co-branded airline credit card.

Flexible credit card rewards

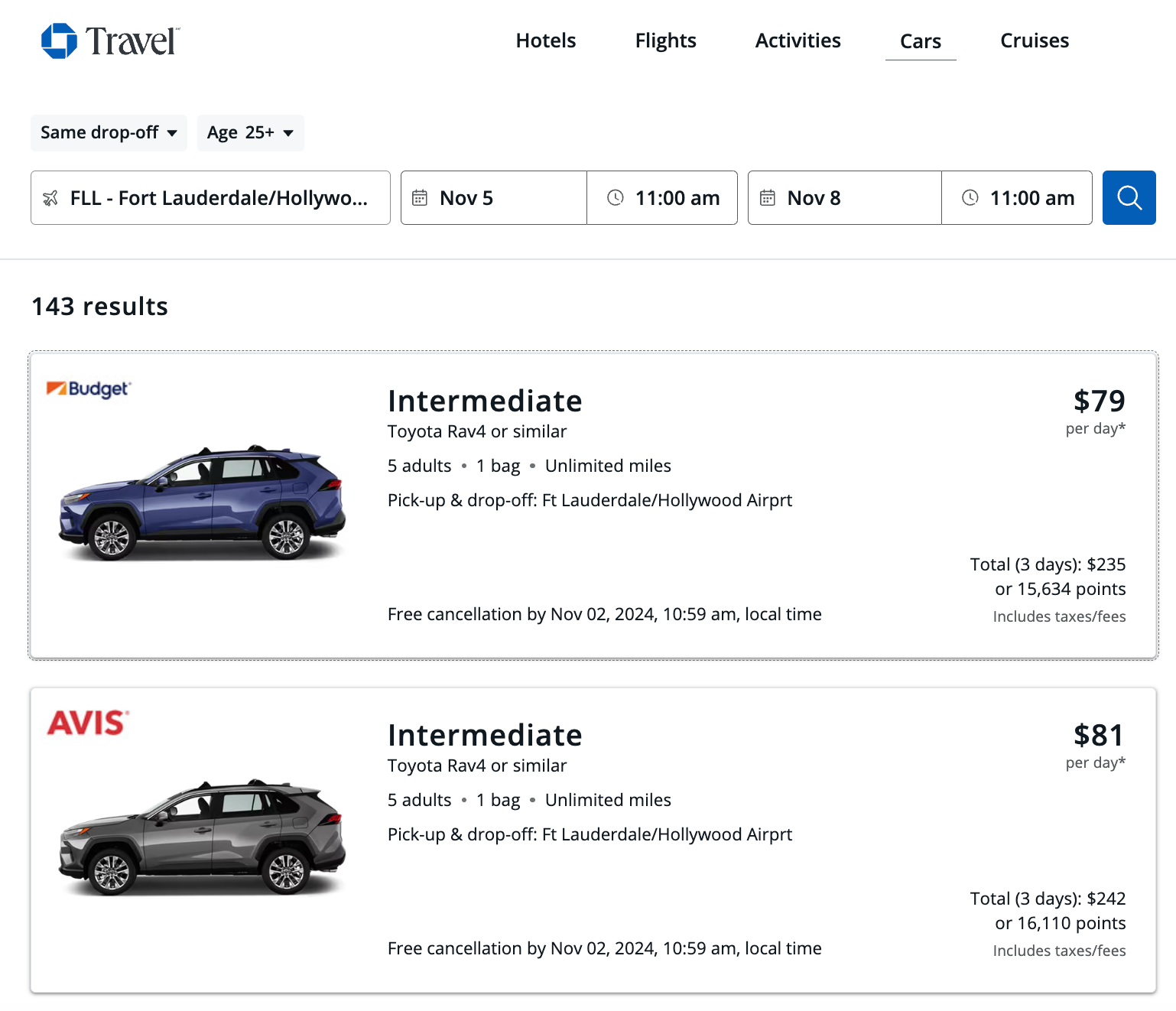

If you have a travel credit card that is part of a flexible credit card rewards program, like American Express Membership Rewards or Chase Ultimate Rewards, you can book a rental car through the travel portal just like you would for booking a flight or hotel. Redemptions are still tied to the cost of the rental but will vary based on the rewards redemption value of your particular credit card.

Car rental loyalty programs

If you frequently rent cars through any of the major car rental companies like Hertz, Avis or National, you should be earning rewards in the rental company’s own loyalty program. Just like airline or hotel loyalty programs, these programs are free to join.

For example, if you join the Avis Preferred® program, you’ll earn 1X points per dollar spent on rentals and 2X points per dollar spent on accessories (with a minimum of 100 points per booking), and you can redeem your points for free rental days starting at 700 points. Accessories can be redeemed starting at 250 points each, and additional points may be available through promotions — such as those that earn you an extra 100 points for booking within the first three months of joining — or through the company’s higher-tier Preferred Plus® and President’s Club programs.

If you happen to have a stash of car rental rewards, what better time to use them than the present? Likewise, if you don’t have a car rental loyalty account, it’s likely a good time to join since you’ll be earning lots of rewards if you wind up paying for a car rental.

When should you rent a car with points or miles?

If you’re the kind of rewards collector who likes to maximize the cents per mile you get when redeeming rewards, car rental redemptions might not be for you. Rental redemptions are almost always linked to rental prices, so if prices are high, you’ll have to pay a lot of rewards.

Sometimes it doesn’t make sense to rent a car with your points and miles, such as when the price of the rental is a better value than using your points. For example, say you want to rent a car for a day and the price will come out to $100. But if the same rental will cost you 12,000 points, then the value drops to 0.8 cents per point, which means you’ll earn more bang for your buck just spending the cash.

Value, however, isn’t always only about the numbers. If you really need a car rental and can’t afford to pay a higher rental rate, using points or miles for a car rental may still be good value for you.

Tips for booking a car rental with points and miles

- Alternatives like Turo or locally-owned rental companies may offer more favorable rates.

- Make your plans sooner rather than later — if you decide to pay for a car rental, most companies don’t require a deposit and have very liberal cancellation rules.

- Book a paid reservation as far in advance as possible, then cancel or change the booking as you get your flights and accommodations sorted.

- Make sure you know the company’s rules, as some rewards programs won’t reinstate your rewards if you have to cancel your rental.

- Double-check the rules of your credit card rental insurance if you’re planning on using the primary or secondary rental car coverage that’s offered with many credit cards.

Keep in mind: Most travel credit cards only provide an insurance benefit when you use the corresponding credit card to pay for the rental. Do some research in advance to see what your credit card offers.

The bottom line

Booking car rentals with your points or miles may be worth considering when rental rates are high. Though using credit card rewards for car rental bookings isn’t always the best way to maximize the redemption value of your points and miles, redeeming rewards for a rental may still be of great value to you if covering the cost of a car makes your trip possible.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.