Student loan legislation tracker: Bills that could reshape America’s student debt

“I’m just a bill. Yes, I’m only a bill. And I’m sitting here on Capitol Hill. Well, it’s a long, long journey to the capital city. It’s a long, long wait while I’m sitting in committee, but I know I’ll be a law someday. At least I hope and pray that I will. But today I am still just a bill.”

If you’re a student loan borrower, it wouldn’t hurt to remember these Schoolhouse Rock lyrics every time you see a headline about mass forgiveness, the disappearance of income-driven repayment (IDR) or the like.

So far in 2025, the Trump administration has repeatedly broken student loan news, worrying borrowers who have been working toward Public Service Loan Forgiveness or want to enroll in IDR.

Keep in mind: Sometimes it’s just bluster, and other times there’s an actual bill that could earn Congress’s support and the president’s signature, both of which are necessary to become a law.

As Rep. Mike Lawler (R-NY) reminded Bankrate in an exclusive interview, “Legislating takes time.” Lawler, who has introduced multiple higher education financing bills in the 2025-2026 session, added: “I do think we can build consensus around this because it impacts everybody across the country. And it’s something that, long-term, we need to have a solution.”

Student loan legislation under consideration

We’re focusing on new legislation — mostly what’s been introduced during the current congressional session — that would most impact families paying for college or repaying education debt.

1. Cap federal loan interest at 2 percent

Act name: Affordable Loans for Students Act (full text)

| Introduced | In committee | Passed the House | Passed the Senate | President’s desk | Signed into law |

This is the bill to watch if you’re among federal loan borrowers who feel as if accruing and capitalizing interest has kept your outstanding balance from shrinking despite years of repayment. Originally announced as a 1 percent cap on federal loan interest rates, this bill enjoys co-sponsors from both political parties. Lawler confirmed to Bankrate that the rate ceiling would “apply retroactively” to current loan-holders, not just future borrowers.

For context, student loan rates for federal loans currently range between 6.53 percent and 9.08 percent.

Everybody acknowledges that the issue of college affordability is a big one. And that you can set up a 529 account and start saving today and still [won't] be able to pay for college tuition for your children. So, this is a real challenge. And obviously, we want to make it so that people can have access to a student loan, but also be able to pay it off and do so in a timely manner rather than having compounding interest really preventing them from paying down the loan.— Rep. Mike Lawler (R-NY) to Bankrate on March 26

2. Shut down the Grad PLUS Loan program

Act name: Graduate Opportunity and Affordable Loans Act (full text)

| Introduced | In committee | Passed the House | Passed the Senate | President’s desk | Signed into law |

Sen. Tommy Tuberville (R-AL) introduced this bill in late January, aiming to limit federal student loan borrowing for graduate and professional students. Besides canceling the Grad PLUS Loan program (and ostensibly leaving Parent PLUS Loans intact), it also changes the total borrowing limits for Direct Unsubsidized Loans:

| Federal Direct Unsubsidized, Subsidized Loans | Current limit* | Proposed limit** |

| Graduate student | $138,500 | $65,000 |

| Professional student | $138,500 | $130,000 |

|

*Including undergraduate borrowing **In addition to undergraduate borrowing |

Even if Tuberville’s proposal doesn’t move forward, the PLUS Loan program could remain on the chopping block — it’s a reported target of congressional Republicans’ budget reconciliation process. Either way, future graduate- and professional-degree seekers may have to rely on private student loans for graduate students.

3. Offer income-driven repayment for Parent PLUS Loan borrowers

Act name: Affordable PLUS Repayment Options for Parents Act of 2025 (full text)

| Introduced | In committee | Passed the House | Passed the Senate | President’s desk | Signed into law |

At present, federal Parent PLUS Loans must be consolidated (with the Education Department, not privately refinanced) to be eligible for income-driven repayment plans. This bill, introduced by veteran lawmaker Maxine Waters (D-CA), would amend the Higher Education Act (HEA) of 1965 to make IDR an immediate option for parents who borrow on behalf of their child.

IDR access could help some of the 3.6 million Parent PLUS Loan borrowers lower the monthly dues on their combined $110 billion in outstanding debt, according to the Waters office’s math. It would undoubtedly help senior citizens struggling with this debt, too.

I try to pay attention and at the right time… to try and pursue a legislative response if that's warranted. And it's all about parents who are trying to put their kids through school, and they can't afford it.— Rep. Maxine Waters (D-CA) to Bankrate on April 3

4. Interest-free deferment for medical, dental residents, interns

Act names: Resident Education Deferred Interest (REDI) Act (full text)

| Introduced | In committee | Passed the House | Passed the Senate | President’s desk | Signed into law |

A joint Senate-House effort, the REDI Act caters to student loan borrowers who take on significant debt for medical and dental careers — then watch their balance balloon while they’re interning or in residency (and before earning their potential six-figure salary). REDI would amend the HEA to remove that possibility — if passed, this bill would defer repayment and pause interest accrual during internship and residency programs.

5. Extend the CARES Act’s student loan repayment reimbursements

Act name: Employer Participation in Repayment Act (full text)

| Introduced | In committee | Passed the House | Passed the Senate | President’s desk | Signed into law |

The CARES Act of March 2020, in part, allows companies to give up to $5,250 in tax-free reimbursements to employees for repaying student loans (or covering education costs) — but only through 2025. This new “employer participation” bill, introduced in both the House and the Senate, aims to make it permanent by rewriting the Internal Revenue code. With bipartisan support among co-sponsors, this bill is a decent bet to move forward.

Not to be confused: The SECURE 2.0 Act of 2022 allowed employers to match their workers’ student loan payments in the form of retirement account contributions.

6. Allow servicemembers to apply GI Bill benefits to federal loan repayment

Act name: Modern GI Bill Act (full text)

| Introduced | In committee | Passed the House | Passed the Senate | President’s desk | Signed into law |

Like the legislation directly above, the Modern GI Bill Act similarly makes an effort to fold student loan repayment into existing benefits. It would allow servicemembers who qualify for education assistance under the Post-9/11 GI Bill to apply their aid toward federal loan payments, for up to three years and to certain limits ($15,900 for 2026).

7. Lower the barrier to private student loan bankruptcy

Act name: Private Student Loan Bankruptcy Fairness Act of 2025 (full text)

| Introduced | In committee | Passed the House | Passed the Senate | President’s desk | Signed into law |

Discharging student loans in bankruptcy is easier said than done — you must prove that “undue hardship” keeps you from zeroing a balance without relief. This bill would remove that standard altogether, at least for private student loan debt.

But don’t get your hopes up. “That bill isn’t going anywhere,” says Vermont-based student loan lawyer Joshua Cohen, who has pursued full and partial discharges for many of his clients.

8. Penalize schools for their students’ debt loads

Act name: Preventing Financial Exploitation in Higher Education Act (full text)

| Introduced | In committee | Passed the House | Passed the Senate | President’s desk | Signed into law |

The Trump administration has frozen grant funds to major universities that it believes to be allowing antisemitism on its campuses. This bill would also dole out financial penalties to schools that allow a high percentage of students to become delinquent or in default (or “make insufficient payments”) on federal loans.

For example, in its first year of implementation, the bill calls for a school to pay 30 percent of the outstanding balance of its students who are in default (if at least 11 percent of the students are in default). The funds would go directly to the federal government.

If this idea gains steam, it could be combined with another recently introduced bill: The Higher Education Reform and Opportunity Act (full text), which also sits in committee and would more broadly hold colleges and universities to account for their students’ debt struggles.

For real-time updates on these and other bills, search Congress.gov for legislation you care about. Once you click onto a particular bill, select “Get alerts.” You’ll receive automatic updates when a bill is changed, co-sponsored or perhaps on its way to becoming law.

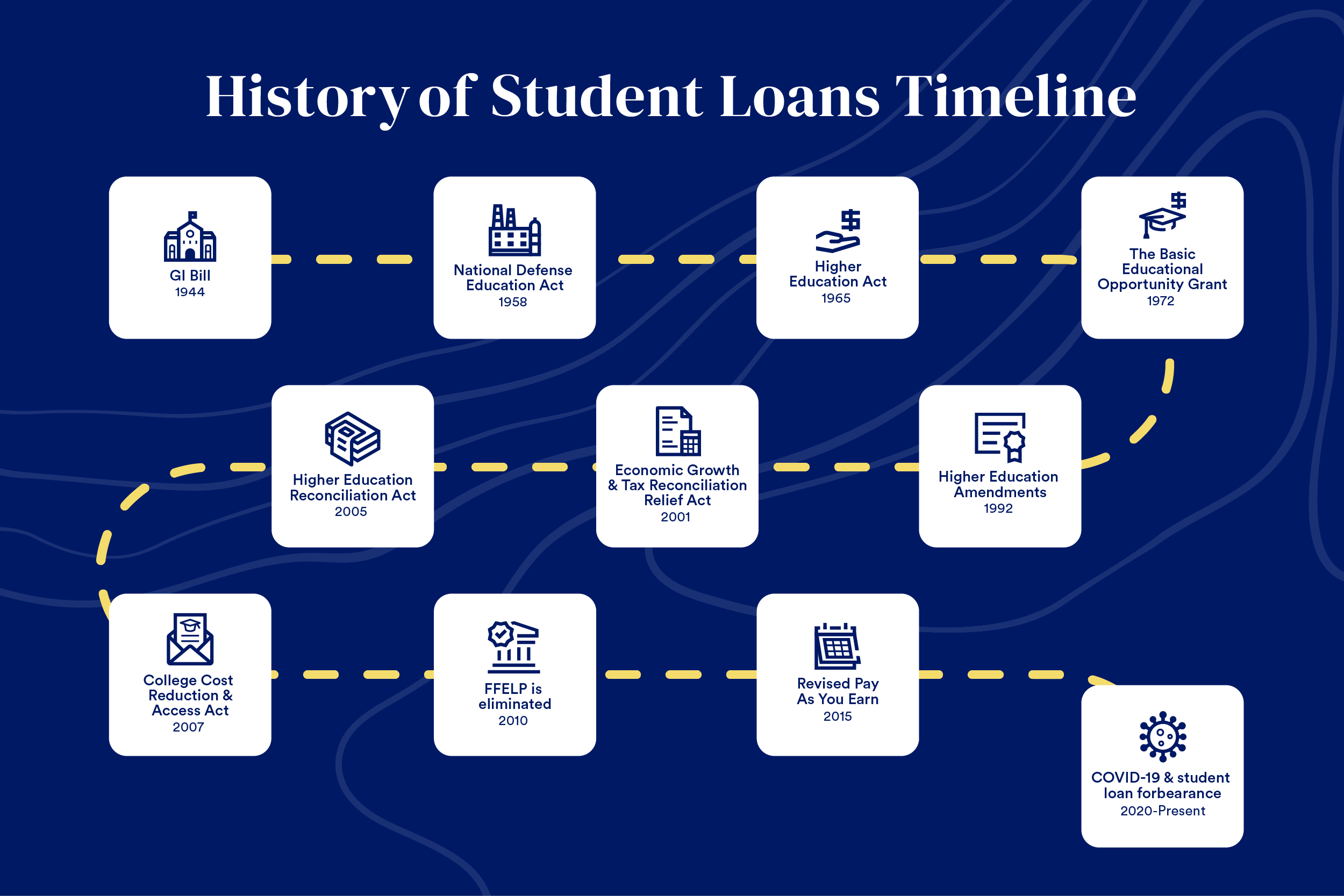

The history of federal student loans and financial aid

Not all federal student loan repayment changes originate from Congress. In 2015, for example, the Department of Education (DoED) created the Revised Pay As You Earn repayment plan. And more recently, Presidents Biden and Trump have used DoED powers and executive orders to award forgiveness and to threaten taking it away.

Still, with the power of the purse, Congress — and the signatures of many presidents — have most directly affected where we are today.

| Year | Legislation | President | Impact |

|---|---|---|---|

| 1944 | GI Bill | Franklin D. Roosevelt |

|

| 1958 | National Defense Education Act | Dwight D. Eisenhower |

|

| 1965 | Higher Education Act | Lyndon B. Johnson |

|

| 1972 | The Basic Educational Opportunity Grant | Richard Nixon |

|

| 1992 | Higher Education Amendments | George H. W. Bush |

|

| 2001 | Economic Growth and Tax Reconciliation Relief Act | George W. Bush |

|

| 2005 | Higher Education Reconciliation Act | George W. Bush |

|

| 2007 | College Cost Reduction and Access Act | George W. Bush |

|

| 2010 | Health Care and Education Reconciliation Act | Barack Obama |

|

| 2020 | The CARES Act | Donald Trump |

|

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.