Should you buy stocks during a recession?

Key takeaways

- While often uncomfortable and even painful, an economic downturn can also present opportunities for investors.

- You should avoid panic-selling your investments when the market turns sour.

- If you are financially able, you may even want to consider adding to your investments during a recession by increasing your retirement contributions or opening a brokerage account.

A recession or economic downturn can be an unsettling time for investors and their finances. Stock prices often fall just as the economy starts to slow and workers get anxious about potentially losing their jobs due to the slowdown. But recessions can actually be one of the best times to invest. Here’s what you should know about investing in stocks during a recession or market downturn.

Market downturns

Market downturns are inevitable for long-term investors, so they shouldn’t come as a surprise when they occur. Since 1929, investors have seen many bear markets, or declines of 20 percent or more from a recent high, with their severity varying greatly. Some downturns see prices fall and recover quite quickly, as they did during the first half of 2020 when investors were concerned about the impact of the COVID-19 pandemic. Other downturns take longer to recover from.

But these market downturns create opportunities for long-term investors. Stocks fall as investors anticipate lower earnings during a recession and concerns grow about the economic outlook. If people only bought stocks when the outlook was good, they’d likely end up with a mediocre investment record. As legendary investor Warren Buffett has said, “The future is never clear; you pay a very high price in the stock market for a cheery consensus.”

Preparing to take advantage of market downturns is one of the best things you can do as an investor and the impact can be substantial over time.

Need expert guidance when it comes to managing your investments or planning for retirement?

Bankrate’s AdvisorMatch can connect you to a CFP® professional to help you achieve your financial goals.

Impact of investing during a recession

Chris Davis, chairman of New York investment management firm Davis Advisors, often quotes his grandfather as saying, “You make most of your money in a bear market – you just don’t realize it at the time.”

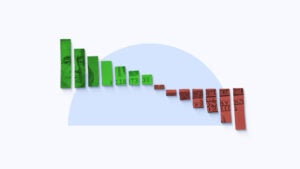

Davis Advisors conducted a study to illustrate this point. Consider three hypothetical investors who had invested $10,000 in an S&P 500 index fund at the 2007 market peak. When the global financial crisis hit in 2008 and 2009, sending stocks lower, the three investors had different reactions:

- Nervous investor: Sold all their stocks following the market downturn at the low on March 9, 2009, and invested in cash.

- Patient investor: Held their stocks throughout the market downturn, staying invested.

- Savvy investor: Viewed the downturn as an opportunity and invested an additional $10,000 in stocks at the low on March 9, 2009.

The three different reactions led to significantly different results. The nervous investor ended 2024 with $5,391, while the patient investor ended 2024 with $52,765. Incredibly, the savvy investor, who added to their investments at the market low, ended 2024 with $170,711.

It’s easy to look back with hindsight and see the savvy investor’s approach as rather obvious. But it probably didn’t feel like an obvious decision at the time. At the depth of a recession, the news is filled with stories about how bad the economy is and commentators opine on whether things will get even worse. But even if you don’t invest exactly at the market bottom, you can still boost your long-term returns by adding to investments during a downturn.

How to buy stocks during a downturn

There are a number of ways you can increase your investments in stocks during a downturn.

Bottom line

If you’re able to increase investments in the stock market during a downturn, it can be a great way to boost your long-term returns and achieve your investment goals. Buying stocks during a recession isn’t easy, as there’s often a lot of negative news to digest, but it can be rewarding if you can stomach the short-term noise. Consider boosting your contributions to retirement accounts, rebalancing your overall portfolio toward stocks or buying directly in a brokerage account to take advantage of low prices.

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.