5 reasons why you should go cashless in 2023

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict , this post may contain references to products from our partners. Here's an explanation for . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

Cash is king, as the saying goes, but is its crown beginning to slip in favor of digital payments? Cashless payment providers like Venmo and Zelle have grown by millions of users in the last few years as more retailers and banks also now accept cashless payment methods.

Over 40% of Americans say they never pay with cash during a typical week of spending, according to a recent survey by the Pew Research Center. That figure has continued to climb over the last decade, up from 24% in 2015. Such shifts can impact currency circulation and even contribute to cash shortages like the one we saw during the early days of the pandemic.

While short-term cash shortages can be disruptive, going cashless offers plenty of benefits for day-to-day money matters. For starters, cashless transactions make it easier to track spending and stay on top of your finances. When dining out in a group, payment apps help to simplify a split check and instantly pay back friends. Better still, cashless credit card transactions allow you to rack up valuable rewards that you can later put toward travel and other frills.

Ready to quit searching for the nearest ATM? Here’s what going cashless can do for you.

1. Earn bonuses on everyday purchases

Credit card rewards can be a great way to earn bonuses from shopping. Cashless payment methods can garner rewards such as airline miles and money back in your wallet.

Depending on your spending habits, some credit cards may be easier than others to maximize your reward potential. While airline miles might seem appealing for a future vacation, if you’re not spending enough in the card’s travel reward category, you might not get enough bonus miles to justify owning the card or paying for its fees.

Cash back can be an appealing all-around credit card bonus since it often comes with a wide variety of reward categories and can be used nearly anywhere.

Different credit cards offer different ways to earn cash back. For example, many cards come with a flat cash back percentage for all purchases, offering a higher percentage for specific categories such as dining or purchases with certain retailers.

Whichever type of credit card you choose, taking advantage of card rewards can often help you save money and earn perks you wouldn’t by paying with bills out of your wallet.

2. Split costs with your friends and family

Whether you’re out on the town with a friend, giving your sister a lift to the airport or grabbing groceries with a roommate, splitting the bill can quickly become awkward if you don’t have exact change on hand.

While keeping a running tab with your friends and family is tempting, it’s not a great idea to rack up a personal loan with your peers – especially since being in debt with your peers has the potential to go sour.

Using a cashless payment app lets you settle your split bills quickly. Since payment apps can be linked directly to your bank account and cards, you can pull directly from your pool of funds and pay exactly what you owe.

3. Bulk up your digital wallet

Online shopping can be a convenient way to order groceries, gifts and everyday essentials, letting you skip the store line and snag some sweet discounts while you’re at it.

Setting up your payment method with your favorite online shop can be just as easy. However, juggling multiple cards over different sites or digging out your wallet every time you pay can put a damper on the speed and ease of digital retail.

Many retailers are making checkout easier by allowing users to pay through their digital wallet, a suite of payment services and information the user keeps on their device. When online shopping, simply log into your digital wallet at checkout and your options are immediately loaded into the site’s payment form.

Some digital wallets allow you to combine different payment methods, letting you bundle your credit cards, debit cards, peer-to-peer payment apps and even your cryptocurrency wallet into one application. You can take your digital wallet from site to site, making payment as easy as one click wherever it’s accepted.

You can also take your digital wallet with you when you go offline. At many physical stores, you can now load your digital wallet onto your phone and pay with a tap of your device.

4. Track your spending with a click

When it comes to budgeting, staying on top of your expenses is key to financial freedom. However, it can be hard to follow every dollar when you’re on the go.

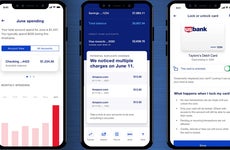

Short of holding onto every coffee, grocery and taco-run receipt, there’s an easier way to track your expenses. Cashless payment providers digitally track every transaction you make and can give you access to your purchase history with the click of a button.

Depending on the cashless provider, you can request everything from a simple list of transactions to an organized, bucketed breakdown of your spending habits. You can see if you’re spending too much on takeout and merchandise at a glance. This means no more spreadsheets created from scratch or trying to figure out what happened to the extra $20 you had in your jeans pocket.

5. Keep your cash safe

Shopping online or offline has risks. A lost wallet, a hacked credit card account and even check fraud can quickly cause financial disaster without the proper precautions.

If you’re carrying cash, there’s no way to track where it went or who might be spending it, making it risky to carry money around. However, cashless payment methods allow you and the proper authorities to quickly track, dispute and freeze fraudulent transactions or stop them from even occurring.

Most credit and debit cards now come with EMV chip technology, protecting your transactions from being hacked. Online transactions are encrypted and have to be accessed through your unique password.

Many credit card providers can also detect the likelihood of a fraudulent transaction based on geolocation data, transaction history and other factors. This means if someone outside of your area steals your card and tries to make a large purchase, the card provider can decline the payment. It’s a much safer and more straightforward solution than trying to track down the thief who ran off with your cash.

The bottom line

Cashless payments are only going to get more popular in the years ahead. Going cashless can be safer, more convenient and more rewarding. As fewer people use cash in everyday purchases, it’s a good idea to start thinking about how cashless payments can work for you and how to maximize those benefits.

Whether you’re trying to bulk out your cash rewards, make paying back your friends easier, track expenses or make your virtual shopping experience simpler and more secure, cashless spending is the way to go.

Related Articles