Where is the account number and routing number on a check?

Key takeaways

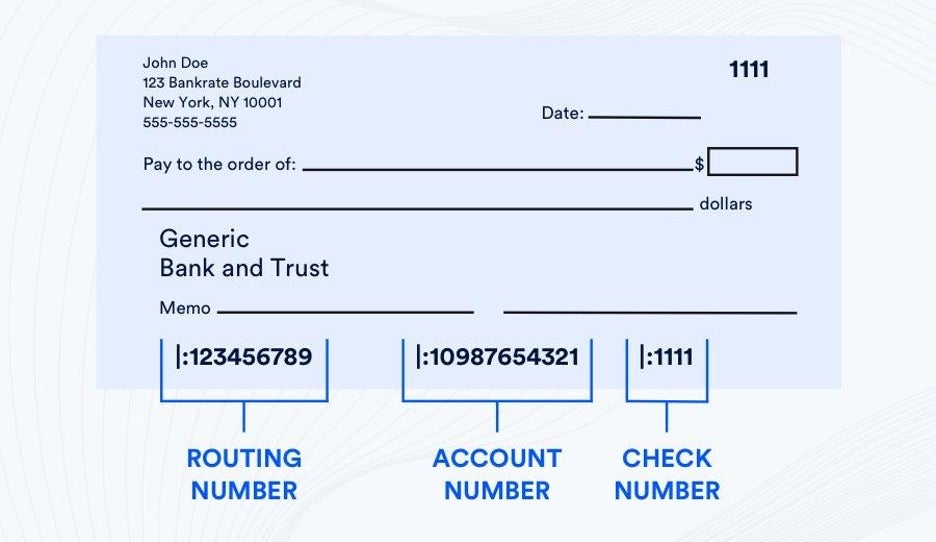

- Your account number is located at the bottom of a check — it’s the second set of numbers, between the nine-digit routing number and the check number.

- The routing number comes first — it’s the nine-digit number on the left that identifies your bank or credit union.

- Account numbers are unique to your specific account while routing numbers are shared by all customers at the same financial institution.

- You’ll need both numbers for direct deposits, electronic transfers, bill payments and other banking transactions.

Your account number is found at the bottom of a check. It’s the second set of numbers, between the nine-digit routing number and the check number.

Whether you’re setting up direct deposit for your paycheck or paying bills online, knowing where to find your account and routing numbers on a check is essential. These numbers work together to identify both your bank and your specific account, ensuring your money goes to the right place every time.

What is the account number on a check?

The account number on a check identifies the unique bank account that money is coming from or going to. Your account number is a unique set of numbers assigned specifically to your individual bank account when you opened it.

On a check, your account number appears as the longer set of numbers at the bottom, positioned between the bank’s routing number and the check number. Account numbers typically range from 8 to 12 digits long.

An account number is private and specific to your bank account, while the routing number is the bank’s public identification number. Each account has its own unique account number, so if you have multiple checking accounts — such as personal and business accounts — they each have different account numbers.

Without the correct account number, paychecks can get delayed, bills may go unpaid and you could face fees for transactions that don’t go through properly.

Always verify your account number before sharing it for financial transactions. A single wrong digit can send your money to the wrong account or cause payment delays that could result in late fees.

What is the routing number on a check?

While the bank account number indicates your specific account, the routing number identifies the bank itself. Routing numbers are required for many types of financial transactions, including check processing and wire transfers.

The routing number appears as the first set of numbers at the bottom left of a check. It’s always exactly nine digits long and is the same for all customers at your bank or credit union. Routing numbers help financial institutions process transactions by identifying which bank should receive or send money. Think of it as your bank’s postal code in the banking system.

Unlike account numbers, routing numbers are public information. You can find your bank’s routing number on their website or by calling customer service. One of Bankrate’s best money market accounts that offers check-writing privileges may display routing and account numbers in the same locations.

Other ways to find your routing number and account number

If you don’t have a check handy, several other methods can help you locate these important numbers.

1. Bank statements

Your account number appears prominently on both paper and electronic bank statements, usually at the top of the document. Look for “Account Number” followed by your unique digits. The routing number may also be listed, often in the account details section.

2. Online and mobile banking

Sign into your bank’s online banking portal or mobile app to find your account information. The numbers may be displayed in the account summary section, though some banks partially hide account numbers for security. Look for a “show” or “reveal” button to display all digits.

Savings accounts don’t typically come with checks, but they have account numbers that you can find through online banking.

3. Contact your bank directly

Customer service representatives can provide your routing and account numbers after verifying your identity with security questions. This method works well if you need the information immediately and can’t access other sources.

4. Bank’s website or app

Many banks list their routing numbers publicly on their websites. While this won’t give you your account number, it’s a quick way to confirm your bank’s routing number.

Keep in mind: Never share your account number via unsecured methods like email or text messages. Only provide these numbers through secure, verified channels when setting up legitimate banking transactions.

When do you need your account and routing numbers?

Understanding when you’ll need these numbers helps you prepare for various banking situations and financial transactions.

- Setting up direct deposits: Whether it’s your paycheck, government benefits or tax refunds, employers and agencies need both numbers to deposit money directly into your account.

- Paying bills electronically: Online bill pay services use these numbers to withdraw payments from your account automatically.

- Electronic transfers: Moving money between accounts at different banks requires both your routing and account numbers.

- Tax payments and refunds: The IRS needs these numbers for electronic tax payments and direct deposit of refunds.

- Automatic savings transfers: Setting up recurring transfers to savings accounts or investment accounts requires both numbers.

These numbers work together to identify your bank and specific account, making sure your money moves securely and accurately. Always verify these numbers before providing them to avoid transaction errors.

Bottom line

Your account number serves as a unique identifier for your bank account, telling financial institutions exactly which account to access for transactions. Found at the bottom of checks alongside the routing number, these numbers are essential for modern banking activities like direct deposit and electronic bill payments.

Understanding where to locate your account and routing numbers — and when you’ll need them — helps you handle banking tasks efficiently and avoid costly delays.

Next steps: Need to open a new checking account or compare your current account features? Explore Bankrate’s best checking accounts to find options that meet your banking needs, or learn more about how to write a check for additional guidance.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.