Alternative investments: What they are and popular types for making money

When it comes to investing, most people think of securities like stocks and bonds. These investments, along with cash, are considered traditional investments and make up the bulk of retirement portfolios for most investors. But another category known as alternative investments also exists and has grown significantly in recent years.

Here’s what you should know about alternative investments and how they can help diversify a portfolio.

What are alternative investments and how do they work?

Alternative investments fall outside the traditional investment classification of stocks, bonds and cash. Alternative investments include a broad range of assets but typically include real estate, commodities, private equity and hedge funds.

Alternative investments tend to have the following characteristics:

- Low liquidity – not as easy to sell or convert to cash.

- Higher fees – expenses tend to be higher than for traditional investments.

- Complex structure – some alternative investments can be complex and may only be available to accredited investors.

- Less regulation – alternative investments are subject to the same regulatory requirements as traditional investments, such as mutual funds or ETFs.

- Potentially low correlation – alternative investments may not be correlated with traditional assets, making them an attractive way to diversify portfolios.

Popular types of alternative investments

Real estate

Real estate is one of the largest asset classes and allows investors to profit from holding physical properties or securities such as real estate investment trusts (REITs). Real estate investments can generate income for investors from rental payments as well as capital gains if a property appreciates in value.

Individual investors can invest in real estate for relatively low costs through REITs or real estate focused ETFs. You might also own a home or rental property as an investment.

Commodities

Commodities are another type of alternative investment and include natural resources such as oil, natural gas, gold and various agricultural products. Commodity prices often respond to changes in supply and demand for the underlying commodity.

Investors may invest in commodities in a variety of ways. There are many ETFs that track the performance of various commodities, but you can also use derivatives or directly hold a commodity to profit off of price changes.

Private equity

Private equity involves putting money into a private company or a start-up, which is known as a venture capital investment. Private equity may sound similar to investing in stocks, but private companies aren’t publicly traded. A private equity fund may work closely with the companies it invests in, helping to form a strategy and influencing capital allocation decisions.

Private equity funds are typically only available to institutional investors and high-net-worth investors. The fees for these funds can be substantial, but some are able to outperform traditional stock market indexes by a wide margin.

Hedge funds

Hedge funds may invest in a combination of traditional and alternative investments and may use strategies such as shorting or derivatives in the management of their funds. Hedge fund fees can vary from one fund to another, but helped popularize the “2 and 20” fee structure, where investors paid a 2 percent management fee each year and 20 percent of the fund’s profits.

Hedge funds are only available to institutional investors and high-net-worth individuals.

Cryptocurrency

Digital currencies such as Bitcoin or Ethereum would also fall into the alternative investments category because they fall outside the scope of traditional investments. Crypto investors should be aware that this type of asset can be extremely volatile and its limited history makes it difficult to accurately assess whether it offers diversification benefits to a traditional portfolio.

Up until recently, crypto fans largely had to turn to crypto exchanges which often charged high fees for trading, but you can now buy Bitcoin and Ethereum in ETF form.

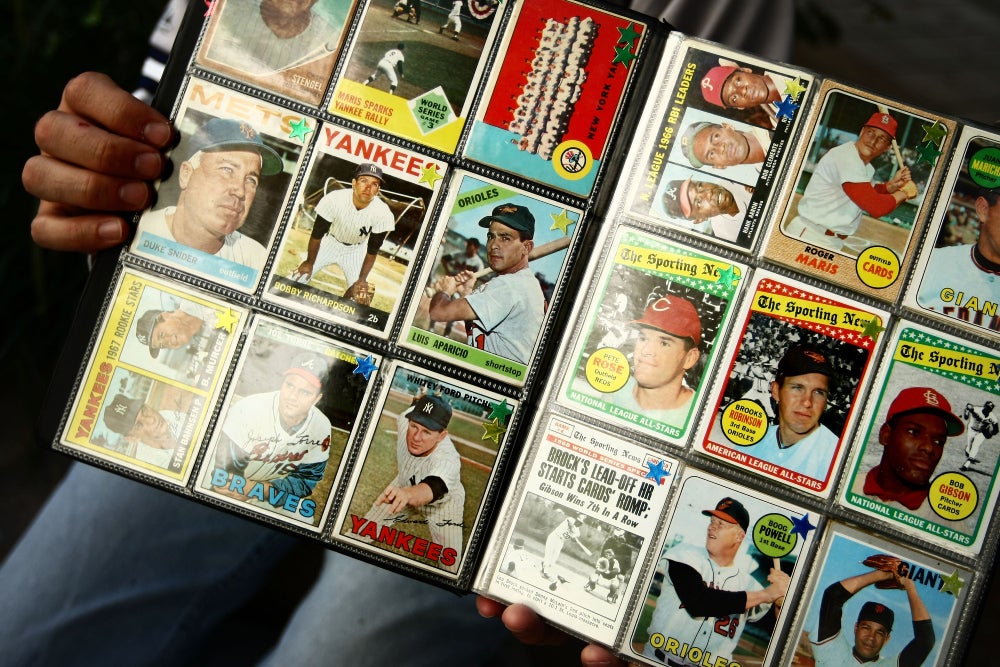

Sports memorabilia and collectibles

Credit: Chris McGrath/Staff/Getty Images

Sports memorabilia and collectibles are another type of alternative investment that could pay off if you choose the right items to invest in. Certain trading cards have increased enormously in value over the years if the featured athlete achieves greatness or the card is particularly unique and in pristine condition.

Other items such as signed jerseys or game-used sports equipment can also pay off nicely for some investors. If sports is an interesting area for you to consider investing in, here’s how to invest in a pro sports team.

Art

Investing in art has long been appealing to certain investors, particularly high-net-worth families. Buying the work of an up-and-coming artist could pay off handsomely down the road, while holding a historic painting of a well-known artist may hold its value over time.

Art, like many other collectible items, has no intrinsic value because it doesn’t generate cash flows for its owner. Its value is purely based on what someone else is willing to pay for it, which can fluctuate greatly depending on market conditions and opinions of the artist at a given moment in time.

Stamps

Stamps have been a favorite item among collectors for a long time and can be a potentially lucrative type of investment depending on what you hold. The more rare or unique a stamp is, the more likely it is to hold significant value for collectors.

Legendary bond investor Bill Gross has one of the greatest stamp collections in the world that he auctioned off in 2024 for $19.2 million. His collection included one of only two existing copies of the 1868 One-cent “Z” Grill stamp that was issued after the Civil War and sold for $4.3 million alone.

Coins

Coins are another favorite among collectors and can become quite valuable over time depending on how rare they are. The most valuable coins can sell for millions and often date back centuries to the early days of a new country.

The 1794 Flowing Hair Silver Dollar is believed to be the first silver dollar minted by the United States and one sold for $12 million in 2022.

Bottom line

Alternative investments can be a way to add diversification to your portfolio if the assets have a low correlation with traditional investments like stocks and bonds, meaning they tend to move in opposite directions. However, alternative investments often have low liquidity and high fees, so they probably shouldn’t make up a significant portion of your portfolio.

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like