Guide to dollar-cost averaging: Use this strategy to build wealth over time

Key takeaways

- Dollar-cost averaging is a popular investing strategy that entails buying new investments at regular intervals, such as once a month.

- If you have a 401(k), you’re already dollar-cost averaging with every paycheck. But you can also use the practice in a typical brokerage account, individual retirement account (IRA) or any other type of investing account.

- You can implement the strategy manually or set your brokerage account to automatically invest at regular intervals.

Dollar-cost averaging is one of the easiest techniques to boost your returns without taking on extra risk, and it’s a great way to practice buy-and-hold investing. Dollar-cost averaging can be especially beneficial for people who want to set up their investments and deal with them infrequently.

Here’s what dollar-cost averaging is and how to use it to maximize your investment gains.

What is dollar-cost averaging?

Dollar-cost averaging is the practice of putting a fixed amount of money into an investment on a regular basis, such as monthly or even bi-weekly.

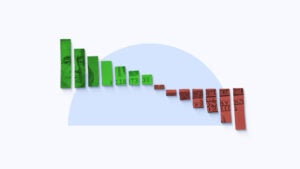

Over time, the strategy allows you to spread out when you buy — which means you’ll do so at market lows and highs — averaging your purchase prices. Because you’re always investing the same amount of money, when prices are lower, you’ll buy more shares, and when they’re higher, you’ll buy fewer shares. It’s the opposite of timing the market, which entails trying to predict in which direction prices are headed next risking losses if stock prices fall.

By setting up a regular buying plan when the markets (and you) are calm, you’ll avoid this psychological bias and take advantage of falling stock prices when everyone else becomes scared. If you have a 401(k) retirement account, you’re already practicing dollar-cost averaging, by adding to your investments with each paycheck. You’re also already using the strategy if you reinvest your dividends, since those payouts are invested back into the market at regular intervals, likely each quarter.

Example of dollar-cost averaging

Imagine an employee who earns $3,000 each month and contributes 10 percent of that to their 401(k) plan, choosing to invest in an S&P 500 index fund. Because the price of the fund moves around, the number of shares purchased isn’t always the same, but each month $300 is invested. The table below shows this example over a 10-month period.

| Month | Contribution | Price of fund | Shares bought | Shares held | Total value |

|---|---|---|---|---|---|

| 1 | $300.00 | $100.00 | 3 | 3 | $300.00 |

| 2 | $300.00 | $97.50 | 3.08 | 6.08 | $592.80 |

| 3 | $300.00 | $101.30 | 2.96 | 9.04 | $915.75 |

| 4 | $300.00 | $85.45 | 3.51 | 12.55 | $1,072.40 |

| 5 | $300.00 | $91.23 | 3.29 | 15.84 | $1,445.08 |

| 6 | $300.00 | $93.20 | 3.22 | 19.06 | $1,776.39 |

| 7 | $300.00 | $96.50 | 3.11 | 22.17 | $2,139.41 |

| 8 | $300.00 | $100.54 | 2.98 | 25.15 | $2,528.58 |

| 9 | $300.00 | $101.43 | 2.96 | 28.11 | $2,851.20 |

| 10 | $300.00 | $105.00 | 2.86 | 30.97 | $3,251.85 |

You can see that the value of the employee’s investments went up 8.4 percent on their $3,000 in total contributions, despite the fund only increasing 5 percent over the period. That’s because the employee was able to buy a greater number of shares when the price was lower, taking advantage of the market volatility.

Does dollar-cost averaging really work?

It can depend on your specific situation, but dollar-cost averaging has been a successful way for many people to invest over time. The question is about whether you should time your purchases based on market conditions or just buy consistently over time using the dollar-cost averaging method. Timing the market has proven to be very difficult and most people are better off with a consistent investment plan.

Another issue is that most people are investing money as they earn it, likely through a workplace retirement plan such as a 401(k). Dollar-cost averaging makes sense here because you’re investing what you can as soon as it’s available to be invested. However, if you inherited a large sum of money, say $100,000, you wouldn’t want to spread that out to be invested over years. In that scenario, it’s best to get it invested relatively quickly, but you could still spread out purchases over a few months to take advantage of potential volatility.

Disadvantages of dollar-cost averaging

Dollar-cost averaging can make sense for a lot of investors, but it does come with some downsides:

- Waiting to buy can mean missing opportunities. In a market that generally rises over time, you’ll likely be better off being fully invested as soon as possible. But because most people are saving and investing as they earn money, dollar-cost averaging is the next best option.

- Your investment choices determine performance. If you’re dollar-cost averaging into a poor investment, the strategy in which you bought in (dollar-cost averaging) won’t be able to boost your investment’s performance. The approach works best with broad-based funds such as an S&P 500 index fund, which has performed well over long time periods.

How to dollar-cost average

There are two ways that you can set up dollar-cost averaging for your account: manually and automatically. If you opt for the manual route, you’ll just pick a regular date (monthly, bi-weekly, etc.) and then go to your broker, buy the stock or fund and then you’re done until the next date.

If you opt to go the automatic route, it requires a little more time upfront, but it’s much easier later on. Plus, it will be easier to continue buying when the market declines, since you don’t have to act. While setting up your automatic buying may seem like a chore, it’s actually easy.

Almost any broker can set up an automatic buying plan, so use Bankrate’s reviews of the major players to find brokers that provide other features such as great customer service and educational tools.

Here are the steps to make dollar-cost averaging fully automatic.

1. Choose your investment

First, you’ll want to determine what you’re buying. Do you want to buy stock? Or will you go with an exchange-traded fund (ETF) or mutual fund?

- If you opt to buy an individual stock, it’s more likely to fluctuate significantly than a fund is. But it may be difficult to find a brokerage that allows you to buy stocks on autopilot.

- If you buy a fund, it should fluctuate less than an individual stock and it’s also more diversified, so your portfolio likely won’t drop as much if any single stock in the fund declines a lot as it would if you only invested in that stock.

Less-experienced investors usually opt for a fund, and some of the most diversified funds are based on the Standard & Poor’s 500 index. This index includes hundreds of companies across all major industries, and it’s the standard for a diversified portfolio of companies. If you want to buy an S&P index fund, here are some of the top choices.

In either case, you’ll need to note the ticker symbol for the security; that’s the short-hand code for the stock or fund.

2. Contact your broker

So, you’ve made your choice of investment. Now see if your broker will allow you to set up an automatic purchase plan for that investment. If so, then you’re ready to move on to the next step.

However, some brokers allow you to set up an automatic plan only with mutual funds. In that case, you might consider opening another brokerage account that allows you to do exactly what you want. There are other solid advantages to having multiple brokerage accounts, too, and you can usually get a lot of value by having multiple accounts.

3. Determine how much you can invest

Now that you’ve got a broker who can execute your automatic trading plan, it’s time to figure out how much you can regularly invest. With any kind of stock or fund, you want to be able to leave your money in the investment for at least three to five years.

Since stocks can fluctuate a lot over short periods, try to allow the investment some time to grow and get over any short-term declines in price. That means you’ll need to be able to live only on your uninvested money during that time.

So starting with your monthly budget, figure how much you can devote to investing. Once you have an emergency fund in place, how much can you invest and not need? Even if it’s not a lot at first, the most important point is to begin investing regularly.

Dollar-cost averaging is now cheaper than ever, since all major brokers now charge no commissions on stock and ETF trades and the best brokers for mutual funds allow you to skip the fees for thousands of mutual funds. That means you really can start with any amount of money and begin building your nest egg.

4. Schedule your automatic plan

You can set up the automatic trading plan at your broker using the ticker symbol for the stock or fund, how much you want to purchase on a regular basis and how often you want the trade to execute. The exact process for setting this up varies by broker, but these are the basics that you’ll need in any case. If you have further questions, your broker can help.

And if your stock or fund pays dividends, it can be a good time to set up automatic dividend reinvestment with your broker. Any cash dividend will be used to purchase new shares, and you can often even buy fractional shares — putting the whole value of the dividend to work, rather than having it sit for a long time in cash earning little or next to nothing. So even as soon as the next dividend, your dividend will be earning dividends.

Bottom line

Dollar-cost averaging is a simple way to help reduce your risk and increase your returns, and it takes advantage of a volatile stock market. If you set up your brokerage account to buy stocks or funds automatically and regularly, then you can sit back and do the things you love, rather than spend your time investing. In investing, you can often get better results with less effort.

Note: Bankrate’s Brian Baker and Mallika Mitra contributed to an update of this article.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.