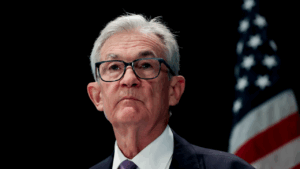

Fed’s latest interest rate hike further burdens credit card debtors

Earlier this week, the Federal Reserve announced its 10th interest rate hike since March 2022, bringing the cumulative increase to five percentage points. These increases are meant to combat the highest inflation readings in decades, so they are well-intentioned, but there are significant consequences for borrowers.

For example, the average credit card rate has risen to a record-high 20.24 percent. Someone with the average credit card balance ($5,805, according to TransUnion) who only makes minimum payments at 20.24 percent will be in debt for 208 months and owe $8,340 in interest. Those are staggering totals. The total interest bill has surged about $2,000 higher as a result of the rate increases. New and existing balances are affected, which adds insult to injury, considering that six in 10 people with credit card debt have been in debt for at least a year.

Of course, if you pay your credit card bills in full each month, your interest rate doesn’t really matter — but 46 percent of credit cardholders carry debt from month to month. And almost half of them don’t even know their interest rates.

How to tackle your credit card debt

It can be uncomfortable to face your debt, but it’s crucial to come up with a plan. Credit card debt is so pricey that you can’t afford to ignore it. My top tip is to sign up for a balance transfer card with a 0 percent intro APR. These allow you to move your existing high-cost credit card debt over to a new card with an interest-free term lasting as long as 21 months.

Remember that brutal minimum payment math I mentioned earlier? Those minimum payments start at $156 per month and decline along with the balance. Ideally, of course, you’d pay way more than the minimum each month. But that’s not always feasible. Balance transfer cards are compelling because you don’t need to pay all that much more, on a monthly basis, in order to knock out your entire balance within the allotted time. It would take 21 equal payments of about $276.

Balance transfer cards tend to charge balance transfer fees ranging from 3 to 5 percent, which amounts to a couple hundred bucks on the average balance. But if you stick to this payment plan, you could save more than $8,000 in interest, compared with only making minimum payments.

What comes next

Even if the Fed is done hiking for now, which is a distinct possibility, credit card rates should remain high for the foreseeable future. Honestly, even if rates were to fall a bit, it wouldn’t provide credit card debtors with a whole lot of relief. Whether we’re talking about 20 percent or 19 percent or 18 percent, these rates are all high.

If you can’t qualify for a balance transfer card — lenders are generally looking for good to excellent credit — then nonprofit credit counseling might be your best option. Reputable agencies such as Money Management International offer debt management plans along the lines of a 7 or 8 percent interest rate over four or five years. They negotiate better terms with your creditors and walk you through the process. I think this approach is especially advantageous if you have a lower credit score, have a lot of debt (especially if it’s more than $5,000) or just want some extra help.

The bottom line

Credit card debt tends to be the priciest mainstream consumer debt (only something truly egregious like a payday loan is typically more costly). Credit card rates can easily be three, four or five times higher than other common financial products such as mortgages and car loans.

In addition to the aforementioned strategies, you might consider taking on a side hustle, selling stuff you don’t need or cutting your expenses in order to raise some additional cash to put toward your credit card debt. It’s hard to build wealth when you’re lugging around credit card debt with a 20 percent interest rate.

Have a question about credit cards? E-mail me at ted.rossman@bankrate.com and I’d be happy to help.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.

You may also like

Fed holds interest rates steady, resisting pressure from Trump