How to read your credit card statement

Key takeaways

- Your monthly credit card statement includes a variety of information pertaining to the current status of your credit card account.

- In addition to providing a record of your charges and payments, credit card statements also include information about fees, APRs, rewards and more.

- Learning how to read a credit card statement properly can help you keep better track of your spending while also helping you spot any irregularities or fraudulent transactions.

Whether you’re asking yourself “what is this charge on my credit card?” or analyzing your spending and rewards earning, credit card statements feature a wealth of information beyond a simple record of your expenses.

Making it a habit to review your statement can help you stay on track with your financial goals. Let’s take a look at what a typical card statement includes.

What is a credit card statement?

Your credit card statement is a monthly document that itemizes your spending over the past billing cycle. It displays applied charges as well as other information about your credit account. Once a month, your card issuer sends it by mail or through paperless methods via your credit card company’s online portal.

Reviewing your credit card statements each month could bring more awareness to your debt balances, alert you to any errors or fraudulent activity, inform you of account changes and help you notice spending trends. Federal law requires issuers to send your statement at least 21 days before your payment due date, but you should be able to find new and historical statements through your bank’s website or app regardless of whether you choose the paper or paperless option.

Still, to truly benefit from reviewing your credit card statement, you have to know how to read it. Let’s break down a real-life credit card statement so you can better understand your own.

Your credit card statement: An example

Credit card statements are made up of several different sections that help explain the current state of your account. Each section provides important information you can use to understand your account better. Let’s take a closer look at the different sections you may see on your next credit card statement.

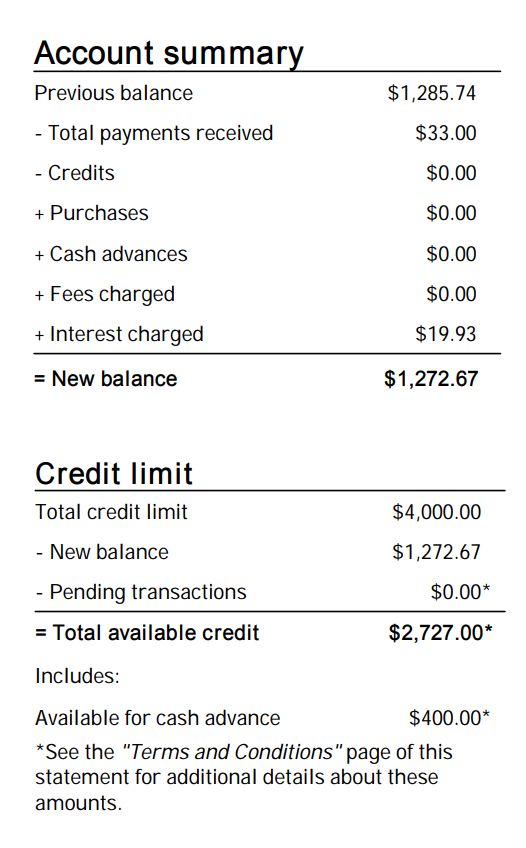

Account summary

Your account summary is one of the main sections on your credit card bill and provides a brief outline of where your account stands. Think of it like a recap of what’s happened over the past billing cycle. This section summarizes some of your account’s most important information, including:

- Previous statement balance

- Total payments received

- Any statement credits

- Applied fees

- Interest charges

- Total purchases

- Available credit

- Cash advances

Anything that affects your overall statement balance gets totaled up here. Simply put, your statement balance is the sum of all the charges, credits and payments made to your credit card account during that specific billing cycle. You’ll see any payments and statement credits (like reward redemptions or refunds) deducted from your balance. Purchases, interest charges, fees and cash advances get added to it.

This section will also show your credit limit and the available credit on your account. Not only does this help you understand how close you are to your credit limit, it also allows you to determine your credit utilization on the card.

Keep in mind: Your account summary includes only those transactions that came in before the close of your billing cycle, not those which happened after the statement was generated. Thus, your statement shows your statement balance, which is not necessarily the same as your current balance. Online banking, however, makes it more convenient to view your recent activity whenever you want — including your current balance information.

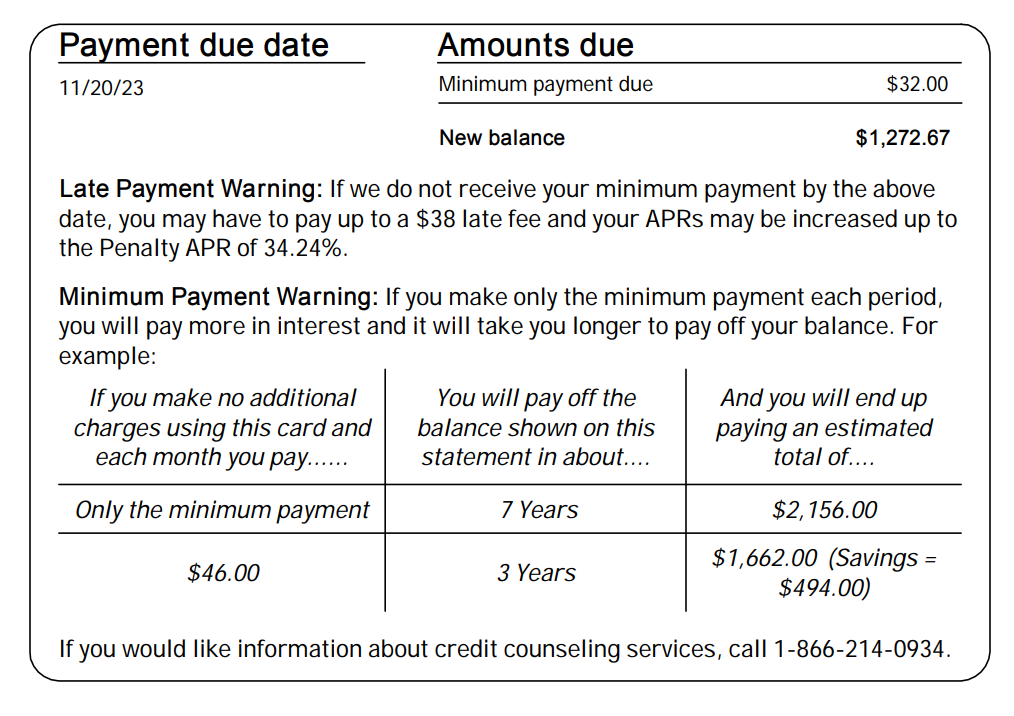

Payment information

Your payment information section provides your outstanding balance and the minimum payment required to avoid late fees or a penalty APR. You’ll also find the date your payment is due, so mark your calendar if you haven’t already set up automatic payments.

Minimum payment warning

In accordance with amendments to the Truth in Lending Act, you’ll see a minimum payment warning in the payment information section cautioning you about the consequences of only making minimum payments on your credit card balance. This is paired with calculations for how much time and money you would save if you increase your monthly payment.

Credit card providers are required by law to give you an idea of what you’d need to pay per month — with no additional purchases — to pay off the balance in 3 years, sometimes expressed as 36 months.

Included with the minimum payment warning may be a credit counseling notice, provided to help you connect with a nonprofit credit counseling agency. If you’re having trouble making your minimum payments, short-term issues can often be solved with a phone call or email to your credit issuer. However, some circumstances require additional help to start getting debt under control.

See Bankrate’s minimum payment calculator for a customized way to organize your budget. The calculator includes the ability to input your balance, rate, minimum payment amount and other figures to help determine your ideal payment plan.

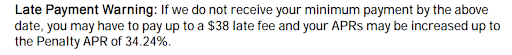

Late payment warning

Even if you’ve made every credit card payment on time, you’ll still see a late payment warning on each credit card statement. Paying less than the minimum requirement or missing the payment due date will lead to a late fee and potentially a spiked interest rate which are both outlined in the late payment warning.

If you miss a credit card payment, call your issuer and try to submit at least the minimum as soon as you can. If you’re 60 days overdue, that is typically when a penalty interest rate kicks in. Your delinquent payment might also be reported to the major credit bureaus — Equifax, Experian and TransUnion — resulting in a hit to your credit score.

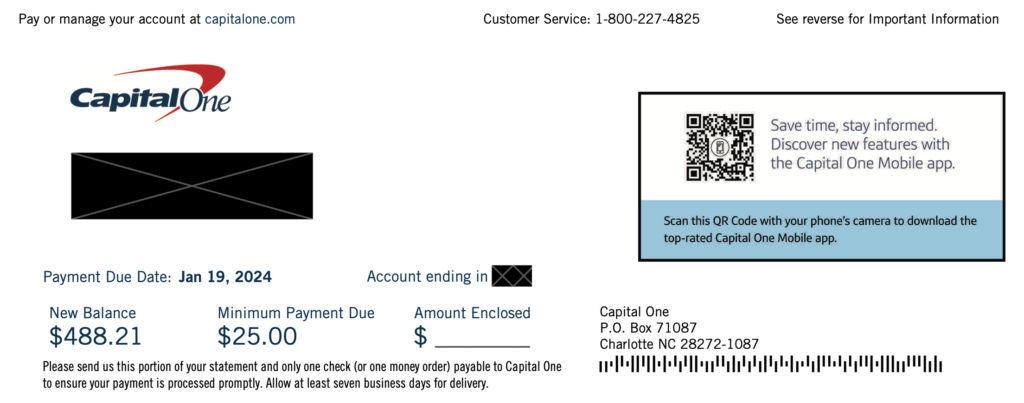

Payment coupon

If you receive your credit card statements in the mail, it includes a payment coupon for you to submit along with a check or money order. A handy way to avoid the mail while avoiding late payments is through your credit card’s autopay, which automates your payments each month. If autopay doesn’t work for your finances, you can always schedule a payment through the online platform or mobile banking app ahead of your due date.

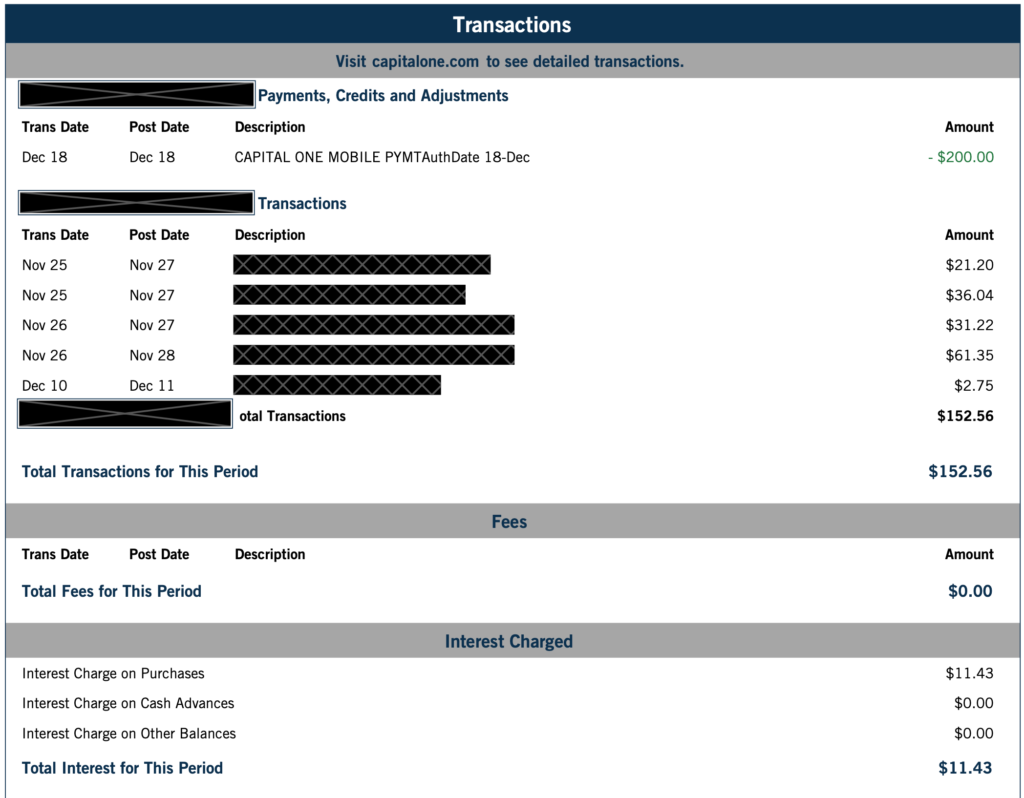

Transactions from the billing period

This is potentially the most useful section on your credit card statement. Your transactions section itemizes all of the purchases, charges, statement credits and payments you’ve made within the billing cycle. Each line shows the following information about the posted transactions:

- Transaction date

- Date the transaction was posted

- Location and name of the merchant

- Reference number

- Last four digits of the card used

- Amount charged or credited

If you have authorized users on your account, the last four digits of the card used could help you identify where or who the purchase stemmed from. If you use mobile wallets, you might see a note like “Virtual Card,” rather than your last four digits.

Most importantly, this breakdown shows the amount charged for every transaction made — which is a must when checking for discrepancies. Noticing trends in your monthly charges is also one of the quickest ways to discover where you can cut expenses. Plus, it gives insight into your highest or most frequent spending categories, which can help you analyze whether you’re using the right rewards card for your spending.

If you see a suspicious charge or one you did not authorize, call your issuer immediately. Keep in mind that many card issuers offer zero-liability fraud protection, which is a nice perk.

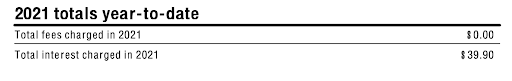

Total interest and fees year-to-date

Your statement includes a summary of the interest and other fees you paid in the current year, including annual fees. Most fees are avoidable if you know the ways around them. This can also be a helpful metric when deciding when it’s time to do a balance transfer, switch to a lower fee card or use a debt consolidation loan.

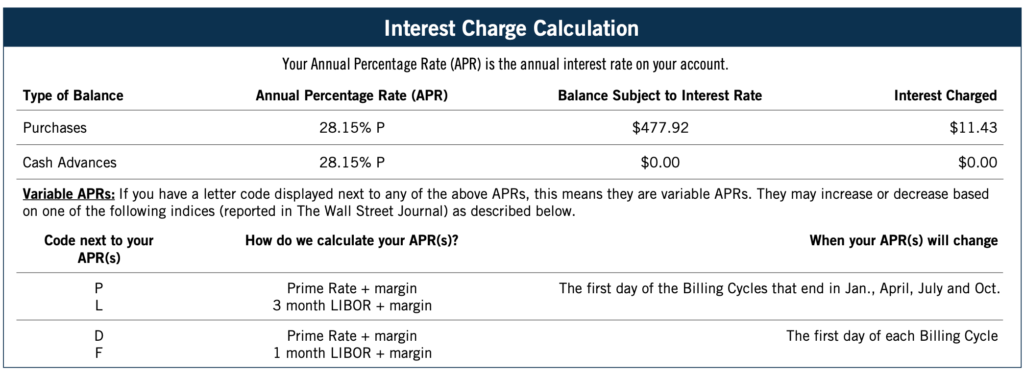

Interest charge calculation

Near the bottom of your statement you’ll see an interest charge calculation. This section includes the APR for purchases, cash advances and other transactions. The interest rate often varies by the type of transaction (e.g., cash advance APRs are typically higher than purchase APRs), but they can be the same depending on the credit card issuer. You’ll likely notice you have a variable interest rate, meaning it can change over time, which is standard for credit cards.

This interest charge calculation will also outline the specific times when the APR is set to change, depending on how your account is coded. It outlines how your APR is calculated, which is the sum of two or more of these factors:

Check this section when you want to know the status of any promotional or introductory APR period, if you’re considering a cash advance or when you’re interested in executing a balance transfer.

Important messages

Your credit card statement also may include an important messages section (or account notices section) that is meant to alert you to any changes made during the billing period. That might include any changes you requested, such as a credit limit increase or a switch to a different card type.

With some banks, changes to your account are depicted in different sections. Often, a shift in the annual fee or your interest rate may be found in an “Account Changes Notification” section rather than here. Your credit issuer is required by law to inform you of all of these changes, but it may take some extra scouring of the document to find it.

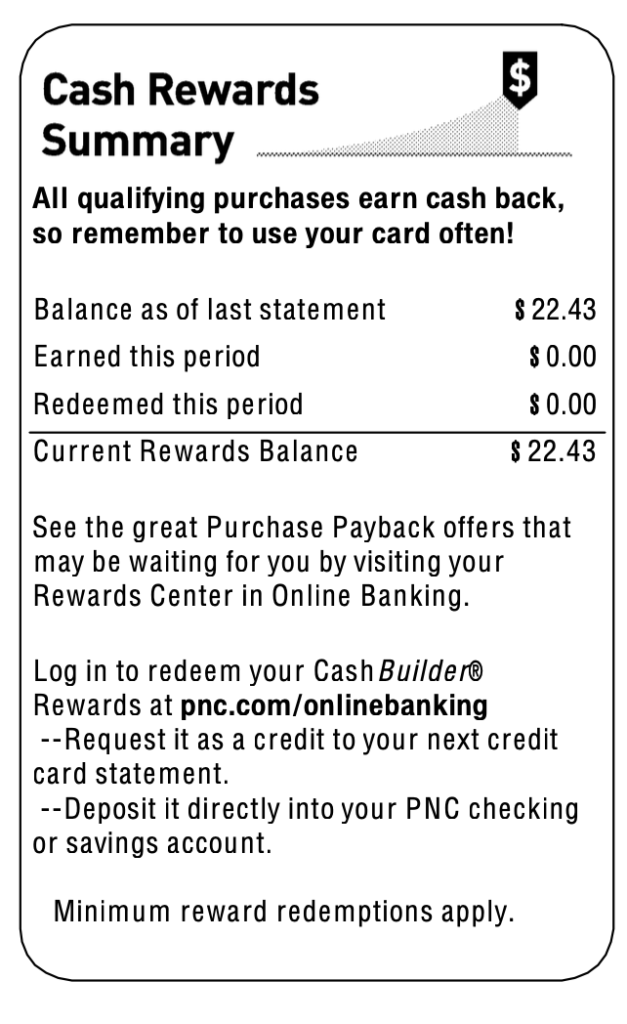

Rewards summary

If you’re enrolled in a rewards program, you’ll find an overview of where you stand at the end of your statement. Some statements are more inclusive than others, but generally you will find the points, cash or miles you’ve earned during the billing cycle and the total rewards amount available.

When you want to plan your next vacation, cover a big purchase or just pay off your statement balance with a statement credit, keeping track of these rewards could help you reach those goals faster.

How long should you keep credit card statements?

Most experts recommend keeping paper credit card statements for 60 days. That’s the typical window most credit card companies give customers to report errors on their statements, though some offer longer periods. However, it might be more advantageous to go paperless instead.

Most credit card companies allow you to keep and access your credit card statements through their online banking platform for at least a year. Capital One, for example, stores online statements for up to seven years.

There are three main ways you can get your current and past credit card statements:

- Checking your mailbox every month

- Logging in to your online credit card account

- Logging in to your credit card’s mobile app

You’ll typically get an email each month when your statement is ready, and you can access it securely by logging into your account. If you can’t manage to find one of your statements online, you could also call in to your card issuer’s customer service line and request a copy of the statement you need.

That’s particularly helpful if you need to keep track of your credit card activity for tax purposes — like owning a small-business or making charitable donations. In those cases, you might need access to your statements for up to seven years just in case you’re audited.

While you might enjoy the convenience of having paper statements on hand, online statements are just as accessible, have the same information, and could save you a few hours of sorting through stacks of documents.

The bottom line

Knowing how to read your credit card statement helps you maintain control over your finances. Whether you choose to keep a paper trail with mailed statements or access them online, you’ll find the statements useful in managing your credit card account.

Reviewing your credit card statement each month is one of the best ways to check for errors, see your rewards, analyze your spending and find out how much interest and fees you’re being charged. If a review of your statement reveals high interest charges or rewards that don’t match your spending habits, you may want to consider switching to one of today’s best credit cards instead.

Frequently asked questions about reading credit card statements

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.