How to request a credit line increase with Capital One

Key takeaways

- While some credit card issuers will automatically increase your credit limit over time if you qualify, you can also request a higher limit.

- Capital One lets you request a higher credit limit through your online account management page, or you can call in to inquire.

- It’s easier to qualify for a higher credit limit on a Capital One card if you have a history of using your card responsibly, your income has increased or you have other reasons to think you’ll be eligible for more available credit.

A higher credit limit could give you more flexibility in your budget and benefit your credit score by decreasing your credit utilization ratio. This is true when it comes to Capital One credit cards, as well as cards from other issuers, although individual companies all have their own processes when it comes to granting more available credit.

If you have a Capital One card specifically, requesting a higher credit line should be a breeze. Here’s what you need to know about increasing your credit limit with Capital One, either by showing your creditworthiness so your limit is increased automatically or by taking the initiative to request more credit instead.

Before you apply for a credit increase

Before you apply for a higher credit line with Capital One, you’ll want to think about your current credit limit and how you’re using it, along with how much credit you want to have. You should also consider your current financial standing and how likely you are to get approved for more credit if you request it.

Questions to ask yourself include:

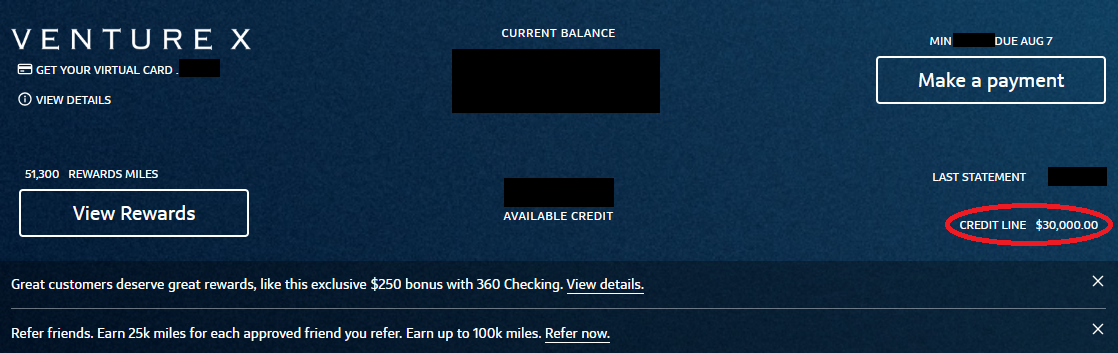

What is your current credit limit?

Before you decide how big of an increase to ask for, make sure you know the current limit on your Capital One credit card. You can easily find this information by logging into your account.

Fortunately, asking for a credit limit increase with Capital One won’t negatively impact your credit score. This is because the card issuer only performs a soft inquiry for credit limit increase requests, and soft credit inquiries do not impact your credit in any way.

How much credit do you want?

While it could be tempting to ask Capital One to double the amount of available credit you have right now, asking for 10 percent to 20 percent more credit may be more reasonable and present a higher chance the request will be accepted.

Also, think about how your card issuer determined your original credit limit. Considering what factors have changed in your credit report can give you an idea of what you may be approved for now.

Are you eligible for an increase?

Capital One evaluates various criteria when determining whether to grant a credit limit increase. Here are a few factors that can help you get approved:

- You’ve been using your Capital One card responsibly. A positive payment history demonstrates that you can manage debt well, so the issuer might be more inclined to extend more credit to you.

- You’ve had your Capital One account open for several months at a minimum. The longer you’ve had your card, the more time you’ve had to show the issuer you’re a responsible borrower.

- It’s been several months or longer since your last credit limit increase. If you ask for more credit too often, the issuer might interpret it as a red flag signaling that you might be in dire need of cash.

- You have an unsecured Capital One credit card. Capital One doesn’t grant higher credit limits on its secured credit cards unless you increase the amount of your security deposit.

Three ways to increase your credit limit with Capital One

There are a few ways you can get a credit limit increase with Capital One — and sometimes you don’t even have to ask.

1. Receive an automatic credit limit increase

Capital One may automatically increase your credit limit if you use your credit card responsibly. Some Capital One cards, especially those geared toward consumers establishing or building credit, offer the opportunity for an increase after six months of on-time payments.

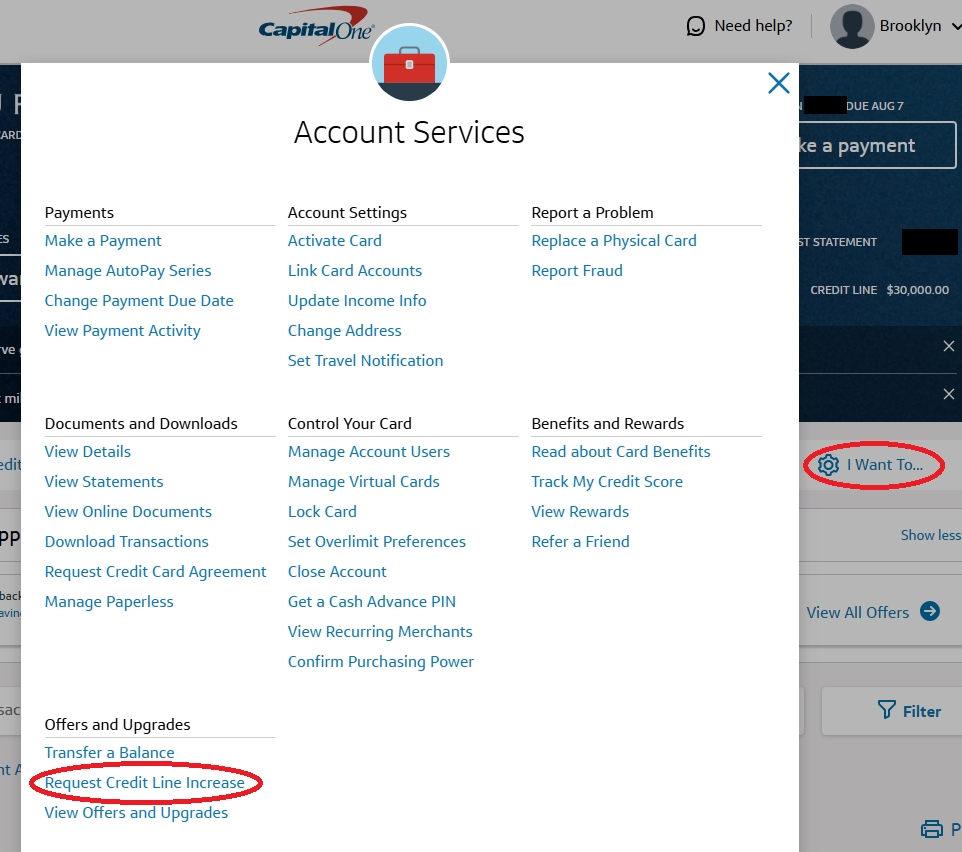

2. Request a credit limit increase online

The easiest way to ask for a higher credit line is through your online account. Log in to your account in a web browser and click “Request Credit Line Increase” in the “I want to” section of settings. You can do this on the web version of the Capital One website or in the Capital One mobile app via your profile page.

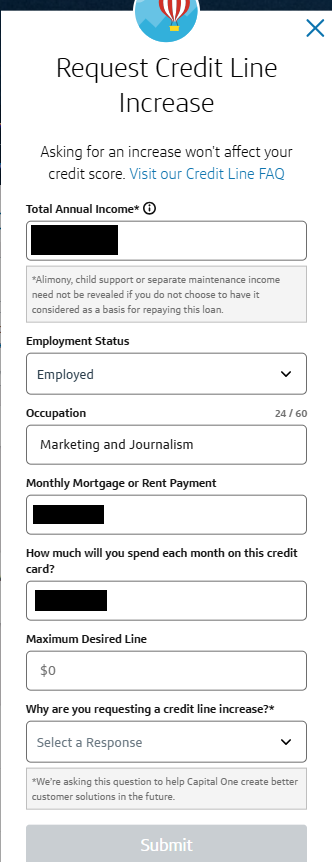

This will bring you to another page where you can update your income information (recommended if your income has increased), ask for a higher credit limit or set overlimit preferences.

3. Call Capital One customer service

Another option is to call the number on the back of your card. Be prepared to answer some questions and have all the required information handy. You might need to explain why you’re requesting more credit, so think of that in advance. Has your income increased? Are you planning a large purchase? What warrants a higher credit line in your situation?

This may seem like a hassle compared to making the request online, but talking to a representative offers an opportunity to personally present your case for the credit limit increase. Mention your positive payment history and how long you’ve been a cardholder to improve your approval odds.

How long does a credit line increase take?

If you’re requesting the increase online, your credit limit increase may be approved immediately after you provide some information, such as your employment status and annual income. In other cases, it might take a few days to get a response from the issuer.

Similarly, if you call to request an increase, a Capital One representative might give you the decision right away or take a few days to review your account.

What to do if your request is denied

Requesting a higher credit line is a simple process with Capital One, but approval isn’t guaranteed. If you’ve been denied, don’t worry. There are alternative solutions and steps you can take to improve your chances the next time you inquire.

Work on your credit

Pay down debt, make on-time payments and use your credit cards responsibly. A higher credit score and clean credit report improves your odds of getting more available credit, whether you’re seeking more credit on your existing cards or applying for a new one.

Apply for a different credit card

Speaking of new credit cards, applying for a different offer can also lead to getting access to more credit. If Capital One denied your credit limit increase request, it might make sense to apply for a credit card from a different issuer.

If your credit score isn’t in the best shape, look into credit cards for bad credit or credit cards for fair credit to avoid another denial. To those with good or excellent credit, another credit card can offer more purchasing power as well as a chance to continue improving credit.

Try a balance transfer

If you are considering a credit limit increase because you’ve gotten too close to the credit limit on your card, you might want to look into a balance transfer.

With a balance transfer credit card, you can transfer balances from existing cards and not pay anything in interest for a few months. The best 0 percent APR credit cards offer zero interest for 21 months, so make sure to compare your options.

A credit card application will trigger a hard inquiry that can knock a few points off your credit score. To see if you prequalify without affecting your credit score, check out Bankrate’s CardMatch feature which uses a soft pull to match you with a card that best fits your needs.

The bottom line

Numerous benefits can arise from increasing your credit limit. You may be able to improve your credit utilization ratio, increase your credit score, improve your chances of being approved for other top credit cards down the road and more.

To take advantage of these benefits, make sure you are handling your debt responsibly so your card issuer will want to give you access to more credit. Even if Capital One rejects your request, you can take steps to increase your chances for next time and try again in a few months.

Why we ask for feedback Your feedback helps us improve our content and services. It takes less than a minute to complete.

Your responses are anonymous and will only be used for improving our website.